What's Coming

Regulatory updates and enhancements are frequently needed between releases, the most important releases to be delivered are highlighted here.

Costpoint Calendar Year End Support

As we approach the end of the year, Deltek is working diligently to provide you with flexibility and support when applying monthly releases. Please use the below as guidance on which releases will support calendar year end updates.

Costpoint 7.1.1 Customers

In order to receive 2020 calendar year end updates, Costpoint on-premise customers will have two options. You MUST be on one of the two below monthly releases in order to receive these CYE updates:

- 7.1.7 (released on 6/30/2020)

- 7.1.12 (scheduled for release around 12/10/2020)

If you are currently on 7.1.7, you can stay on 7.1.7 for the remainder of the year and apply the year end hotfix when released in early December. However, staying on 7.1.7 means you will not get any bug fixes released in subsequent releases that may impact your business.

It is very important to note that if you upgrade to 7.1.8, 7.1.9, 7.1.10, or 7.1.11 later this year, you will be forced to upgrade to 7.1.12 in December to receive calendar year end updates. There is no ability to move back to 7.1.7 once you upgrade to 7.1.8 or later.

Note that there will also likely be an additional 7.1.7 hot fix & 7.1.12 hot fix in January for additional regulatory changes for calendar year end. This will include any late updates from the government that did not make it in time for December's 7.1.7 hot fix or 7.1.12 MR respectively. Our target deployment for these January updates will be January 10, 2021.

In order to maintain version 7.1.7's compliance with federal and state payroll-related regulations, any payroll regulatory updates implemented in MR 7.1.8, MR 7.1.9, MR 7.1.10 and MR 7.1.11 will also be implemented in version 7.1.7 via a hot fix. This is a current list of the regulatory updates that will be implemented in version 7.1.7 via hot fix:

| Hot Fix/Date | Regulatory Update |

|---|---|

| Hot Fix 7.1.7.2

Release Date: September 22, 2020 |

Texas SUTA Electronic Filing Update |

| New Jersey SUTA Electronic Filing Update | |

| Idaho Tax Withholding Update | |

| Colorado State Filing Status Update | |

| Guam Filing Status Update | |

| Employee Social Security Tax Withholding

Deferred from 9/1 to 12/31 |

|

| Maryland SUTA Electronic Filing Update | |

| Quarterly Federal Payroll Tax Report | |

|

Hot Fix 7.1.7.3 Target Date: October 23, 2020 (subject to change) |

Truncation of Social Security Numbers on W-2s Furnished to Employees |

| 2021 W-4 Deductions Worksheet (updates based on IRS draft) | |

| 2021 SUTA Wage Base Updates for Oklahoma, Wyoming, Missouri, Iowa, Nevada, Washington, and Montana | |

|

Hot Fix 7.1.7.4 Target Date: November 20, 2020 (subject to change) |

2020 W-2 Updates - Add 2019 USERRA Make-Up Options to the Box 12 Lookup List |

| 2020 W-2 - Reporting COVID-19 Sick Leave and Family Leave Wages | |

| 2020 New Jersey Tax Withholding Updates | |

| 2021 Social Security Wage Limit Update | |

| Q3 2020 Form 941 - Worksheet 1 Updates | |

|

Hot Fix 7.1.7.5 Target Date: December 16, 2020 (subject to change) |

Repayment of Deferred Social Security Withholding |

| 2020 Affordable Care Act (ACA) Updates Based on Draft 1095-C | |

| 2020 Affordable Care Act (ACA) - Electronic Filing Updates |

Costpoint 8.0 Customers

Once Costpoint 8.0 is released in September, Deltek will support calendar year updates only in the 8.0.3 release. This release will be made available on DSM between 11/30/2020 and 12/15/2020. Costpoint 8.0 customers must plan to upgrade to 8.0.3 in December to get the calendar year end updates; and there will likely be another update (Costpoint 8.0.4) in January for additional regulatory changes.

We will continue to release information throughout the remainder of 2020. Please check back periodically for continued updates.

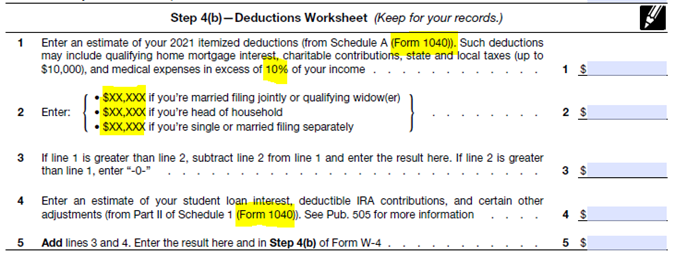

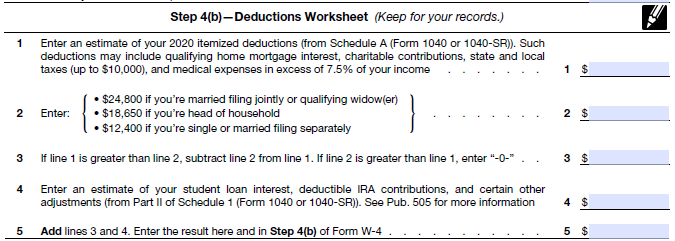

2021 W-4 Deductions Worksheet (Updates Based on IRS Draft)

On July 27, 2020, the Internal Revenue Service (IRS) supplied a draft version of the 2021 W-4 and introduced changes to Step 4(b)-Deductions Worksheet.

2021 Form W-4 Draft (July 2020)

2020 Form W-4

Costpoint will update the following screens to comply with the draft version of the worksheet, which may be further updated if the IRS releases additional changes:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (On-Premise): MR 7.1.10 (September 30, 2020)

- 8.0.1 (On-Premise): MR 8.0.2 (October 12, 2020)

Target Dates

- 7.1.7 Hot Fix (On-Premise): MR 7.1.7.3 (October 23, 2020)

2020 New Jersey Tax Withholding

Description

New legislation enacted September 29, 2020, made several changes to the New Jersey Gross Income Tax Act as part of New Jersey's Fiscal Year 2021 budget. The new law increases the Gross Income Tax rate for income between $1 million and $5 million and provides a new withholding rate for the remainder of 2020.

Effective January 1, 2020, the tax rate on that income bracket increases from 8.97% to 10.75%, regardless of filing status.

Effective immediately, employers must withhold Income Tax at the rate of 21.3% from salaries, wages and other remuneration in excess of $1 million, but not in excess of $5 million, during the taxable year. This higher withholding rate allows taxpayers affected by the rate increase to "catch up" on their withholdings for the year since the new tax rate is retroactive to January 1, 2020.

The Division of Taxation will not impose interest or penalties for insufficient payment of estimated tax and/or withholdings that may be due before September 29, 2020, if the underpayment is a result of the new tax rate.

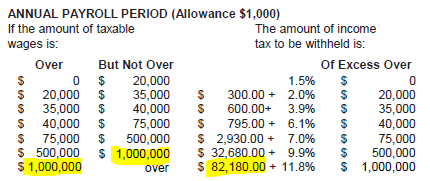

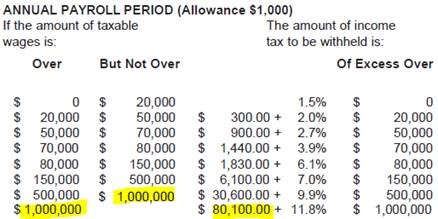

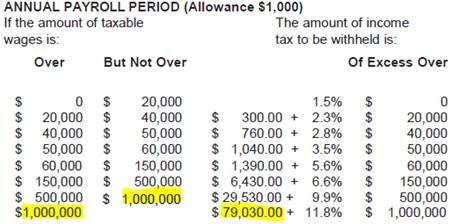

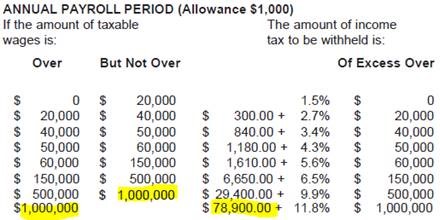

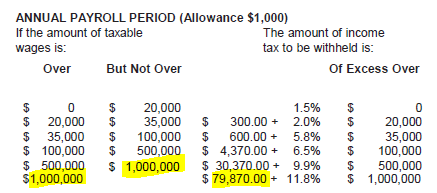

The following rates published by New Jersey represented withholdings for a full tax year and do not reflect the "catch up" rate of 21.3%.

RATE A

RATE B

RATE C

RATE D

RATE E

Costpoint Solution

In order to comply with the mandated "catch-up" withholding, the New Jersey tax tables will be updated with the 21.3% "catch-up" tax rate for annualized taxable wages between 1,000,000 and 5,000,000 from September 29, 2020 through December 31, 2020. Also, new tax tables with an Effective Date of January 1, 2021 will be implemented to revert back to the 11.8% tax rate for those with annualized taxable wages greater than 1,000,000.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

Important Information

If you do not download the Costpoint updates in MR 7.1.11, MR 8.0.3, or MR 7.1.7.4 by November 1, 2020, you will need to manually update your New Jersey tax tables as follows:

Effective September 29, 2020

In the Manage State Tax Tables screen, add new records for New Jersey with an effective date of 09/29/2020 to reflect the transitional withholding rate of 21.3% from September 29, 2020 to December 31, 2020.

State : NJ

Effective Date : 09/29/2020

Filing Status : RATE TABLE A

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.0000% |

|

35,000.00 |

600.00 |

3.9000% |

|

40,000.00 |

795.00 |

6.1000% |

|

75,000.00 |

2,930.00 |

7.0000% |

|

500,000.00 |

32,680.00 |

9.9000% |

|

1,000,000.00 |

82,180.00 |

21.3000% |

|

5,000,000.00 |

478,180.00 |

11.8000% |

State : NJ

Effective Date : 09/29/2020

Filing Status : RATE TABLE B

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.0000% |

|

50,000.00 |

900.00 |

2.7000% |

|

70,000.00 |

1,440.00 |

3.9000% |

|

80,000.00 |

1,830.00 |

6.1000% |

|

150,000.00 |

6,100.00 |

7.0000% |

|

500,000.00 |

30,600.00 |

9.9000% |

|

1,000,000.00 |

80,100.00 |

21.3000% |

|

5,000,000.00 |

476,100.00 |

11.8000% |

State : NJ

Effective Date : 09/29/2020

Filing Status : RATE TABLE C

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.3000% |

|

40,000.00 |

760.00 |

2.8000% |

|

50,000.00 |

1,040.00 |

3.5000% |

|

60,000.00 |

1,390.00 |

5.6000% |

|

150,000.00 |

6,430.00 |

6.6000% |

|

500,000.00 |

29,530.00 |

9.9000% |

|

1 ,000,000.00 |

79,030.00 |

21.3000% |

|

5,000,000.00 |

475,030.00 |

11.8000% |

State : NJ

Effective Date : 09/29/2020

Filing Status : RATE TABLE D

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.7000% |

|

40,000.00 |

840.00 |

3.4000% |

|

50,000.00 |

1,180.00 |

4.3000% |

|

60,000.00 |

1,610.00 |

5.6000% |

|

150,000.00 |

6,650.00 |

6.5000% |

|

500,000.00 |

29,400.00 |

9.9000% |

|

1 ,000,000.00 |

78,900.00 |

21.3000% |

|

5,000,000.00 |

474,900.00 |

11.8000% |

State : NJ

Effective Date : 09/29/2020

Filing Status : RATE TABLE E

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.0000% |

|

35,000.00 |

600.00 |

5.8000% |

|

100,000.00 |

4,370.00 |

6.5000% |

|

500,000.00 |

30,370.00 |

9.9000% |

|

1 ,000,000.00 |

79,870.00 |

21.3000% |

|

5,000,000.00 |

475,870.00 |

11.8000% |

Effective January 1, 2021

In the Manage State Tax Tables screen, add new records for New Jersey with an effective date of 01/01/2021 to reflect the new withholding tables that do not include the transitional withholding rate of 21.3%.

State : NJ

Effective Date : 01/01/2021

Filing Status : RATE TABLE A

| For Taxable Income Over | Base Tax | Percent of Excess |

| 0.00 | 0.00 | 1.5000% |

| 20,000.00 | 300.00 | 2.0000% |

| 35,000.00 | 600.00 | 3.9000% |

| 40,000.00 | 795.00 | 6.1000% |

| 75,000.00 | 2,930.00 | 7.0000% |

| 500,000.00 | 32,680.00 | 9.9000% |

| 1,000,000.00 | 82,180.00 | 11.8000% |

State : NJ

Effective Date : 01/01/2021

Filing Status : RATE TABLE B

|

For Taxable Income Over |

Base Tax |

Percent of Excess |

|

0.00 |

0.00 |

1.5000% |

|

20,000.00 |

300.00 |

2.0000% |

|

50,000.00 |

900.00 |

2.7000% |

|

70,000.00 |

1,440.00 |

3.9000% |

|

80,000.00 |

1,830.00 |

6.1000% |

|

150,000.00 |

6,100.00 |

7.0000% |

|

500,000.00 |

30,600.00 |

9.9000% |

|

1 ,000,000.00 |

80,100.00 |

11.8000% |

State : NJ

Effective Date : 01/01/2021

Filing Status : RATE TABLE C

| For Taxable Income Over | Base Tax | Percent of Excess |

| 0.00 | 0.00 | 1.5000% |

| 20,000.00 | 300.00 | 2.3000% |

| 40,000.00 | 760.00 | 2.8000% |

| 50,000.00 | 1,040.00 | 3.5000% |

| 60,000.00 | 1,390.00 | 5.6000% |

| 150,000.00 | 6,430.00 | 6.6000% |

| 500,000.00 | 29,530.00 | 9.9000% |

| 1 ,000,000.00 | 79,030.00 | 11.8000% |

State : NJ

Effective Date : 01/01/2021

Filing Status : RATE TABLE D

| For Taxable Income Over | Base Tax | Percent of Excess |

| 0.00 | 0.00 | 1.5000% |

| 20,000.00 | 300.00 | 2.7000% |

| 40,000.00 | 840.00 | 3.4000% |

| 50,000.00 | 1,180.00 | 4.3000% |

| 60,000.00 | 1,610.00 | 5.6000% |

| 150,000.00 | 6,650.00 | 6.5000% |

| 500,000.00 | 29,400.00 | 9.9000% |

| 1 ,000,000.00 | 79,030.00 | 11.8000% |

State : NJ

Effective Date : 01/01/2021

Filing Status : RATE TABLE E

| For Taxable Income Over | Base Tax | Percent of Excess |

| 0.00 | 0.00 | 1.5000% |

| 20,000.00 | 300.00 | 2.0000% |

| 35,000.00 | 600.00 | 5.8000% |

| 100,000.00 | 4,370.00 | 6.5000% |

| 500,000.00 | 30,370.00 | 9.9000% |

| 1 ,000,000.00 | 79,870.00 | 11.8000% |

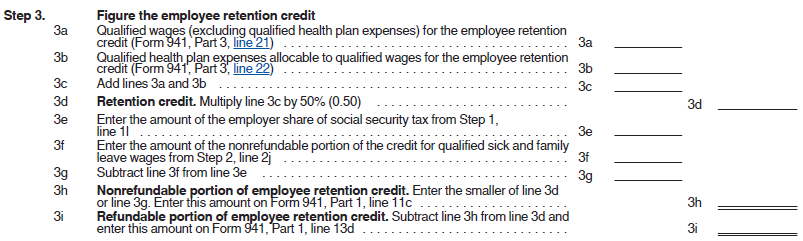

Q3 2020 Form 941 Instructions - Worksheet 1 Updates

Description

The Internal Revenue Service (IRS) released revised instructions for Form 941, which include changes to Step 3 of Worksheet 1 (Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit). Employers will need to use the new worksheet to complete their 2020 third quarter 941 reporting.

Worksheet 1. Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit (July 2020 Revision) https://www.irs.gov/pub/irs-prior/i941--2020.pdf

Costpoint Solution

Print Quarter Federal Payroll Tax Report

To comply with the revised Form 941, Costpoint will update the numbering and text in the Employee Retention Credit section of the Federal 941 Data and Tax Credit Report in MR 7.1.7.4, MR 7.1.11 and MR 8.0.3. The following chart provides a mapping of the new IRS worksheet to Costpoint's updated report.

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3cq2 on the updated report.) | 3cq2 Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3dq2 on the updated report) | 3dq2 Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3c Total qualified wages for employee retention credit (3a + 3b + 3cq2 + 3dq2): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3d Retention credit (3c x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3g Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3h Nonrefundable portion of employee retention credit (the smaller of 3d or 3g): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3i Refundable portion of employee retention credit (3d - 3h): |

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

Important Information

If you do not download the Costpoint updates in MR 7.1.11, MR 8.0.3, or MR 7.1.7.4 before completing your 941 for Q3 2020 and are therefore using an old version of Costpoint's Federal 941 Data and Tax Credit Report, please use the following mapping to help you complete your report:

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (Pre-MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below.) | 3c Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below.) | 3d Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3e Total qualified wages for employee retention credit (3a + 3b + 3c + 3d): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3f Retention credit (3e x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3i Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3j Nonrefundable portion of employee retention credit (the smaller of 3f or 3i): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3k Refundable portion of employee retention credit (3f - 3j): |

2020 W-2 Updates - Add 2019 USERRA Make-Up Options to the Box 12 Lookup List

Description

The following options will be added to the lookup list for Box 12 in the Manage W-2s (PRMW2) screen:

- D 19 (USERRA 2019 make up elective deferrals to a section 401(k) cash or deferred arrangement)

- E 19 (USERRA 2019 make up elective deferrals to a section 403(b) salary reduction agreement)

- F 19 (USERRA 2019 make up elective deferrals to a section 408(k)(6) salary reduction agreement)

- G 19 (USERRA 2019 make up elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred comp plan)

- H 19 (USERRA 2019 make up elective deferrals under a section 501(c)(18)(D) tax-exempt organization plan)

- S 19 (USERRA 2019 make up employee salary reduction contributions under a section 408(p) SIMPLE)

- Y 19 (USERRA 2019 make up deferrals under section 409A nonqualified deferred compensation plan)

- AA 19 (USERRA 2019 make up designated Roth contributions to a section 401(k) plan)

- BB 19 (USERRA 2019 make up designated Roth contributions under a section 403(b) salary reduction agreement)

- EE 19 (USERRA 2019 make up designated Roth contributions under a section 457(b) plan)

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

2020 W-2 - Reporting COVID-19 Sick Leave and Family Leave Wages

Description

IRS Notice 2020-54 (Guidance on Reporting Qualified Sick Leave Wages and Qualified Family Leave Wages Paid Pursuant to the Families First Coronavirus Response Act)

Source: https://www.irs.gov/pub/irs-drop/n-20-54.pdf

Reporting Qualified Sick Leave Wages

In addition to including qualified sick leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the social security wage base), and 5 of Form W-2, employers must report to the employee the following type and amount of the wages that were paid, with each amount separately reported either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified sick leave wages paid to the quarantined employee under the EPSLA; in labeling this amount, the employer must use the following, or similar, language: "sick leave wages subject to the $511 per day limit."

- the total amount of qualified sick leave wages paid to the employee caring for quarantined individuals and others under the EPSLA; in labeling this amount, the employer must use the following or similar language: "sick leave wages subject to the $200 per day limit."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 provided to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Reporting Qualified Family Leave Wages

In addition to including qualified family leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the social security wage base), and 5 of Form W-, employers must separately report to the employee the following type and amount of the wages that were paid in either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified family leave wages paid to the employee under the EFMLEA; in labeling this amount, the employer must use the following, or similar, language: "emergency family leave wages."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 sent to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Model Language for Employee Instructions

As part of the Instructions for Employee, under the instructions for Box 14, for the Forms W-2, or in a separate statement sent to the employee, the employer may provide additional information about qualified sick leave wages and qualified family leave wages and explain that these wages may limit the amount of the qualified sick leave equivalent or qualified family leave equivalent credits to which the employee may be entitled with 9 respect to any self-employment income. The following model language (modified as necessary) may be used:

"Included in Box 14, if applicable, are amounts paid to you as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act. Specifically, up to three types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:

- Sick leave wages subject to the $511 per day limit because of care you required;

- Sick leave wages subject to the $200 per day limit because of care you provided to another; and

- Emergency family leave wages.

If you have self-employment income in addition to wages paid by your employer, and you intend to claim any qualified sick leave or qualified family leave equivalent credits, you must report the qualified sick leave or qualified family leave wages on Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, included with your income tax return and reduce (but not below zero) any qualified sick leave or qualified family leave equivalent credits by the amount of these qualified leave wages. If you have self employment income, you should refer to the instructions for your individual income tax return for more information."

Costpoint Solution

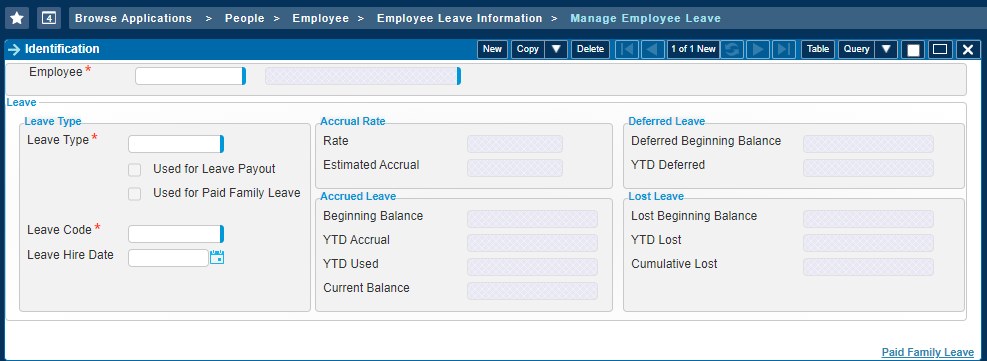

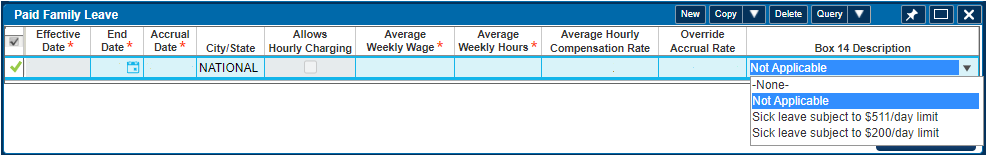

Manage Employee Leave (LDMELV)

When you report the COVID-19 sick leave wages in Box 14 of Form W-2, the sick leave wages must be reported based on the daily limit that was applied:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

A new drop-down box titled Box 14 Description will be added to the Paid Family Leave subtask in the Manage Employee Leave screen so you can specify which daily limit was utilized. This will allow the Create W-2s application to appropriately allocate wages to the correct category. The Box 14 Description drop-down box will only be enabled and required if the City/State is "NATIONAL PAID SICK LEAVE COVID19."

A new value "EMERGENCY FAMILY MEDICAL LEAVE COVID19" will also be added in City/State for the FFCRA's EFMLEA provision. The purpose of adding this value is to distinguish it from the existing value "NATIONAL PAID SICK LEAVE COVID19," which is for the FFCRA's EPSLA provision.

¶

¶

Create W-2s (PRPCW2)

The application will be updated to generate Box 14 records for any employees with the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Manage W-2s (PRMW2)

A new subtask titled COVID-19 Box 14 will be added to the screen, allowing you to view and edit Box 14 information for the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Print W-2s (PRRW2)

If an employee has COVID-19 sick leave of family leave wages in 2020, the information will print in Box 14 on a separate W-2 for the employee.

PRRW2: Print W-2s

W-2 Box 14 COVID-19 sick and family leave wages will be added to the report.

ESS W-2s (ESMELECW2)

In order to accommodate the Box 14 COVID-19 reporting, the existing Box 14 (Other) fields on the main screen have been replaced with a Box 14 subtask.

Export Payroll Taxes (PRPEXTAX)

The application will be updated to include the three types of COVID-19 leave wages in the W-2 File.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

2021 SUTA Wage Base Updates for Oklahoma, Wyoming, and Missouri

Description

The states of Oklahoma, Wyoming, and Missouri have released their SUTA taxable wage base limits for 2021. Costpoint will be updated to support these new limits with an effective date of 01/01/2021.

SUTA Wage Base Update Effective 01/01/2021

- Oklahoma - $24,000

- Wyoming - $27,300

- Missouri - $11,000

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.3 (October 23, 2020)

2021 SUTA Wage Base Updates for Montana

Description

The state of Montana has released its SUTA taxable wage base limits for 2021. Costpoint will be updated to support this new limits with an effective date of 01/01/2021.

SUTA Wage Base Update Effective 01/01/2021

- Montana - $35,300

Target Dates

- 7.1.1 (On-Premise): MR 7.1.11 (October 29, 2020)

- 8.0 (On-Premise): MR 8.0.2 (October 12, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.3 (October 23, 2020)

2021 SUTA Wage Base Updates for Vermont and Arkansas

Description

The states of Vermont and Arkansas have released their SUTA taxable wage base limits for 2021. Costpoint will be updated to support these new limits with an effective date of 01/01/2021.

SUTA Wage Base Update Effective 01/01/2021

1. Vermont- $14,100

2. Arkansas - $10,000

Target Dates

- 7.1.1 (On-Premise): MR 7.1.12 (December 4, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

2021 Social Security Wage Limit Update

Description

The IRS has released its Social Security taxable wage base limit for 2021 from $137,700 to $142,800. Costpoint will be updated to support this new limit with an effective date of 01/01/2021.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.12 (December 4, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.4 (November 20, 2020)

2021 Repayment of Deferred Social Security Withholding

Description

On August 8, 2020, the President signed an executive order which allowed employers to defer Social Security tax withholding for certain employees from September 1, 2020 through December 31, 2020. In late August, the Internal Revenue Service (IRS) announced that employers that opted to defer the withholding must pay the money back by April 2021.

Costpoint Solution

For those employers that opted to defer employee Social Security tax withholding in 2020, Costpoint has provided the following new functionality to track and process the repayments.

A. The ability to establish the total deferred amount and the rules for repayment

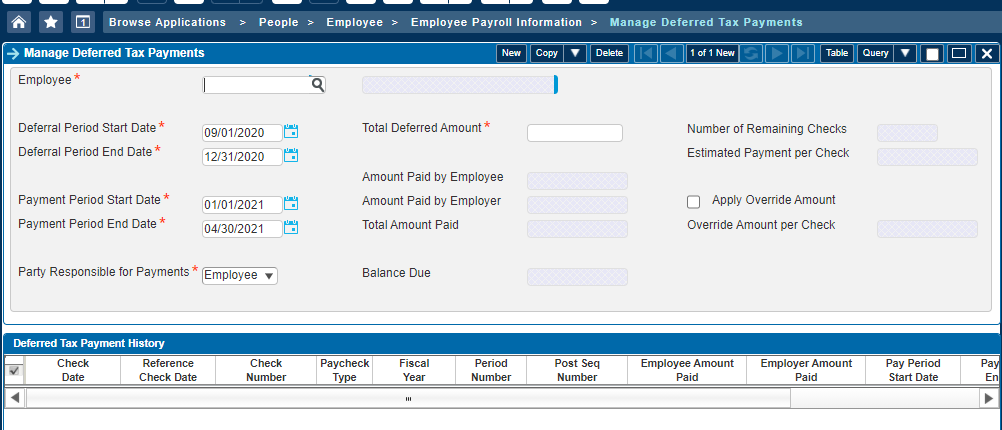

A new screen, titled Manage Deferred Tax Payments (EMMDFRDTAXPAY), will be added to Costpoint. This new screen will allow you to manage an employee's deferred Social Security amount and set up the rules for repayment of the deferral.

In this screen, you will be able to specify the deferral dates, the repayment date range, whether the employee or the employer is responsible for repaying the deferred amount, and, if necessary, an override amount to be withheld for any upcoming paychecks. Once the repayments have started, you will also be able to view the check detail for each repayment in the Deferred Tax Payment History subtask. The subtask will be populated with any pertinent data when an existing record is queried.

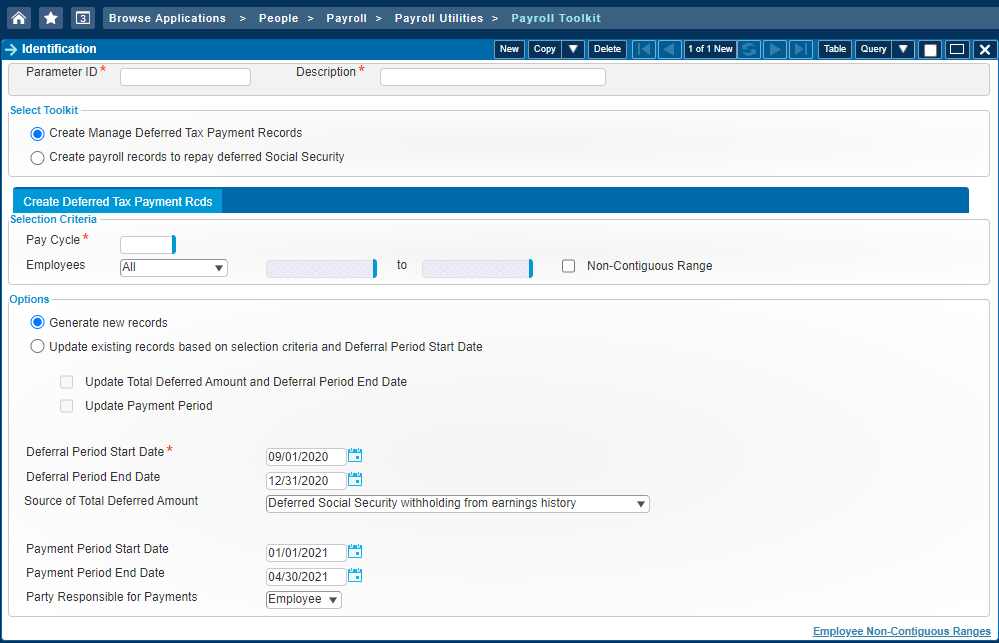

There are two ways of populating this new screen:

- If you used Deltek's recommended method of deferring the employee Social Security withholding (see " Employee Social Security Tax Withholding Deferred from 9/1 to 12/31" in the

Regulatory - Latest News section), you may populate this screen using the new

Create Manage Deferred Tax Payment Records toolkit in the Payroll Toolkits application. To determine the

Total Deferred Amount, the toolkit will sum the

Deferred Employee Withholding amounts from Manage Employee Earnings History, where the check date is between the specified deferral dates.

-

Timing: If this is the method you choose to create the Deferred Tax Payment records, you should run this toolkit after your final paycheck of 2020 and before computing payroll for the first paycheck in 2021.

-

B. The ability to process the repayment

Whether you used the new Create Manage Deferred Tax Payment records toolkit to generate the Manage Deferred Tax Payments (EMMDFRDTAXPAY) or manually enter the records, you may use either one of the following methods to process the deferred Social Security withholding repayments:

- A new toolkit, titled Create payroll records to repay deferred Social Security , has been added to the Payroll Toolkits screen. This toolkit can be used to generate X or Y type records to repay the deferral. In order to determine the repayment amount, the toolkit will prorate the employee's balance due over the remaining number of checks within the repayment period or, if you specified an Override Amount per Check, the toolkit will use that value as the repayment amount . The X or Y records generated by this toolkit cannot be edited and will only include the repayment amount. If the Manage Deferred Tax Payments (EMMDFRDTAXPAY) record specifies the employee as the party responsible for the repayments, the amount will be withheld from the employee. Otherwise, if the employer is the responsible party, the repayment amount will be recorded as the employer's Social Security liability.

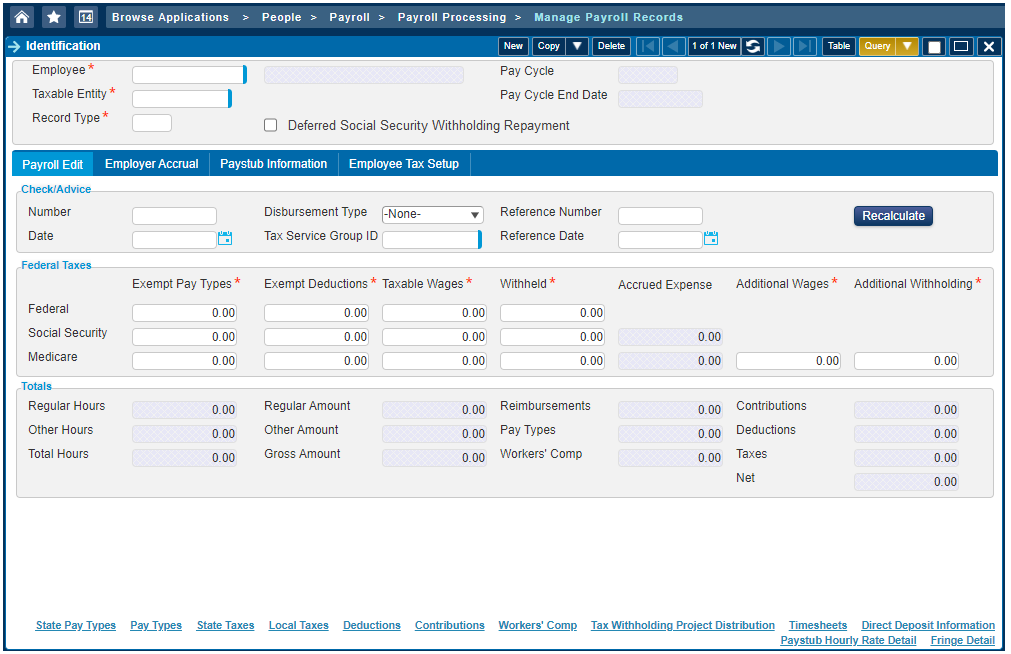

- You may manually enter an X or Y record in the Manage Payroll Records screen. In order to identify the record as a deferred Social Security repayment record, you must select the Deferred Social Security Withholding Repayment check box. By selecting this box, you will have limited access to fields in the screen and you will only be able to either enter an employee Social Security withholding amount or an employer Social Security accrual amount. You must also have at least one row in the Pay Types subtask or the State Pay Types subtask (for multi-state users) with zero hours and amounts.

Timing: It is important to perform the correct steps in order to process the repayment correctly:

- If you are using the new Create payroll records to repay deferred Social Security toolkit to generate the repayment records, ensure you have Check Dates assigned to your pay periods in the Manage Pay Periods screen. Each pay period with a check dated within the deferred Social Security withholding repayment period must have a Check Date assigned to it in order for the repayment amounts to be calculated correctly.

- If the employee is responsible for repaying the deferred Social Security withholding, compute a Regular or Bonus payroll for the affected employee in the Compute Payroll screen. If the employer (not the employee) is responsible for repayment of the deferral, this step is not necessary.

- Run the Create payroll records to repay deferred Social Security toolkit or manually enter the repayment record in the Manage Payroll Records screen.

- Print paychecks or payment advices.

- Post payroll.

C. The ability to export the deferred Social Security repayment amounts to a third party tax-reporting software

Costpoint's Export Payroll Taxes application will be updated to include the following:

- Add CHECK Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 70)

- Add QTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 71)

- Add YTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 72)

- Add CHECK Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 76)

- Add QTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 77)

- Add YTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 78)

Target Dates

- 7.1.1 (On-Premise): MR 7.1.12 (December 4, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.5 (December 2020)

2020 Affordable Care Act (ACA) Updates Based on Draft 1095-C

The IRS released a draft of Form 1095-C, which included the following updates:

- "Employee's Age on January 1" has been added in Part II

- "Zip Code" has been added in Part II, #17

- Line 17 is for reporting the applicable ZIP code that the employer used for determining affordability if the employee was offered an individual coverage health-reimbursement arrangement.

- If Code 1L, 1M, or 1N were used on Line 14, this will be the employee's primary residence location.

- If Code 1O, 1P, or 1Q were used on Line 14, this will be the employee's primary work location.

- Part III starts at #18 (instead of #17 in 2019)

- Part III ends at #30 (instead of #34 in 2019)

- New codes related to Health Reimbursement Arrangements (HRA) have been added for use in Line 14 (1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S).

These updates will be implemented into Costpoint and we will update as the IRS provides the finalized 1095-C and 1094-C requirements and instructions.

Important

As of mid-October, the IRS has not yet provided guidance on the spacing in the 1095-C and 1094-C forms. Until that is provided, Deltek will not be able to update the Costpoint 1095-C and 1094-C reports. When the IRS publishes the final spacing of these forms, we will update the Costpoint reports accordingly. Please continue to check this site for announcements to changes in the report spacing.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.12 (December 4, 2020)

- 8.0 (On-Premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.5 (December 16, 2020)

2020 Affordable Care Act (ACA) - Electronic Filing Updates

The IRS released their E-file instructions for ACA electronic filing, which included the following updates:

- Update 'ty19' to 'ty20' in the namespaces of both manifest and data files

- Update Software ID for 2020 to '20A0010933'

- Add element AgeNum

- Add elements for the ZIP Code, Line 17

- AnnualICHRAZipCd

- MonthlyICHRAZipCdGrp

- JanICHRAZipCd

- FebICHRAZipCd

- MarICHRAZipCd

- AprICHRAZipCd

- MayICHRAZipCd

- JunICHRAZipCd

- JulICHRAZipCd

- AugICHRAZipCd

- SepICHRAZipCd

- OctICHRAZipCd

- NovICHRAZipCd

- DecICHRAZipCd

These updates will be implemented into Costpoint's Create 1094-C and 1095-C Electronic File application.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.12 (December 4, 2020)

- 8.0 (On-Premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.5 (December 16, 2020)