Latest Regulatory News

Regulatory updates and enhancements are frequently needed between releases, the most important recent releases are highlighted here.

Reminder

Costpoint 7.0.1 Support Policy Update

Costpoint 7.0.1 is currently in Maintenance Support. Maintenance Support is a period where you will continue to receive hot fixes for severity 1 issues, and tax, legal, and regulatory updates.

Costpoint 7.0.1 will enter Sustaining Support on July 1, 2020. Sustaining Support is a period where you will continue to have access to all fixes that existed prior the beginning of the Sustaining Support life cycle phase. There will be no new software enhancements, hot fixes, service packs, or regulatory updates of any kind for versions in this phase. Sustaining Support lasts indefinitely.

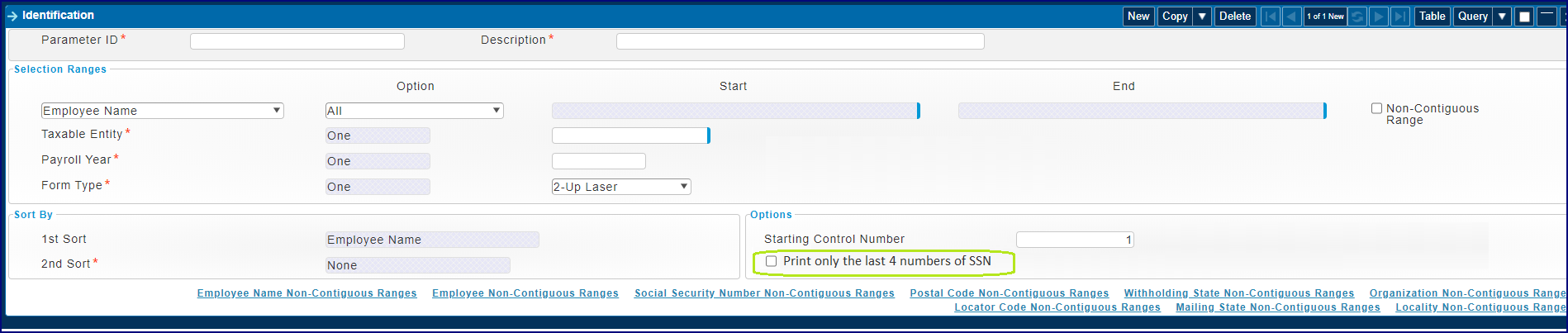

Truncation of Social Security Numbers on W-2s Furnished to Employees

To aid employer efforts to protect employees from identity theft, recent IRS regulations permit employers to voluntarily truncate employee social security numbers (SSN) on the employee copy of the W-2. According to IRS guidelines, when truncating, the first five digits of the employee's nine-digit SSN can be replaced by an asterisk (*) or X.

Costpoint's Print W-2s application will be updated to allow for truncation of the employee SSNs when printing W-2s. If opting to truncate, the first five digits of the SSN will be replaced with X. Example: XXX-XX-1234.

Please see the following IRS site for additional information: https://www.federalregister.gov/documents/2019/07/03/2019-11500/use-of-truncated-taxpayer-identification-numbers-on-forms-w-2-wage-and-tax-statement-furnished-to

Target Dates

- 7.1.1 (On-Premise): To be determined

- 7.1.7 Hot Fix (On-Premise): To be determined

- 8.0.2 (On-Premise):To be determined

2021 SUTA Wage Base Updates for Iowa, Nevada, Washington

The states of Iowa, Nevada, and Washington have released their SUTA taxable wage base limits for 2021. Costpoint will be updated to support these new limits with an effective date of 01/01/2021.

SUTA Wage Base Updates Effective 01/01/2021

1. Iowa - $32,400

2. Nevada - $33,400

3. Washington - $56,500

Target Dates

- 7.1.1 (On-Premise): MR 7.1.9 (September 8, 2020)

- 8.0.1 (On-Premise): MR 8.0.1 (September 14, 20200

Quarterly Federal Payroll Tax Report

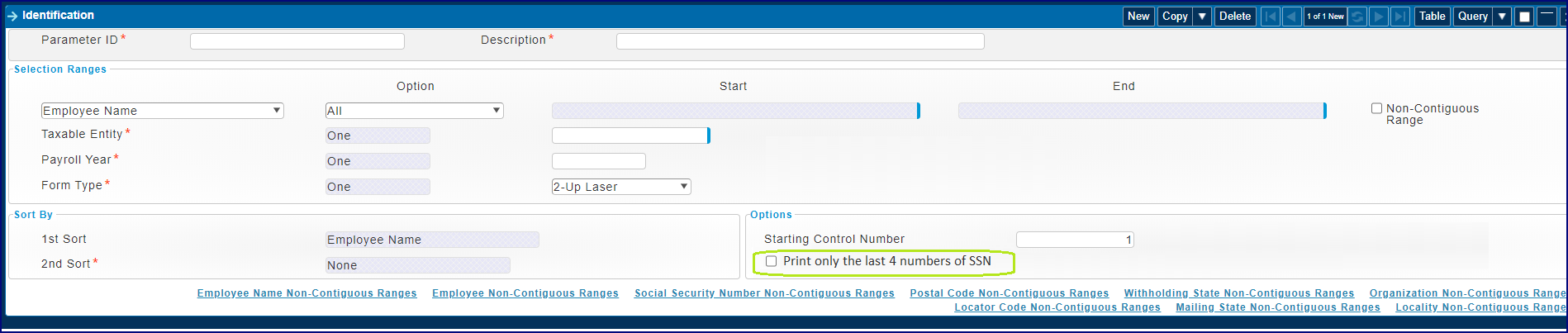

The U.S. Department of Treasury has not yet announced how the recent Social Security withholding deferral (CARES Act Memorandum) will affect the federal quarterly reporting. However, to help provide critical information, the Quarterly Federal Payroll Tax Report will be updated to provide the following information:

- Since it currently reports the expected Social Security Employee Withholding without adjusting for the amount of employee Social Security withholding that was deferred from September 1, 2020 to December 31, 2020, a new Actual Deferred Social Security Employee Withholding row will be added to the FICA Summary section of the Quarterly Federal Payroll Tax Report. This value will be a sum of the Social Security employee withholding that was deferred during the reporting period. This amount will only be included on the report if at least one employee's Social Security withholding was deferred. An Adjusted Total FICA Liability row will also be added to show the difference between the calculated amount and the deferred Social Security withholding.

- To provide additional information, a new Deferred Employee Social Security Withholding section will be added to the Quarterly Federal Payroll Tax Report. This report will provide a detailed list of the employees whose Social Security withholding was deferred during the reporting period as a result of the CARES Act memorandum.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.10 (September 30, 2020)

- 7.1.7 Hot Fix (On-Premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.1 (On-Premise): MR 8.0.2 (October 12, 2020)

Employee Social Security Tax Withholding Deferred from 9/1 to 12/31

Source: Bloomberg Tax

Employee Social Security Tax Deferred from Sept. 1 to Dec. 31

- The relief is in addition to the deferral of the employer portion of Social Security tax with respect to March 27 to Dec. 31

- Employees generally must have biweekly pay of less than $4,000 to be eligible for the new deferral

Withholding, deposits, and payments of the employee portion of Social Security tax are to be deferred with respect to the period from Sept. 1 to Dec. 31, 2020, under a presidential memorandum signed Aug. 8 by President Donald Trump.

This relief for employees is separate from, and in addition to, the deferral of deposits and payments of the employer portion of Social Security tax with respect to the period from March 27 to Dec. 31, 2020, which was authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The deferral provisions pertaining to the employee portion of Social Security tax are to apply only to compensation paid to employees whose biweekly pretax compensation generally is less than $4,000. The employee portion of Medicare tax is not affected by the memorandum, as the memorandum specifies its applicability to the employee portion of Social Security tax imposed by Internal Revenue Code Section 3101(a) without also identifying applicability to the employee portion of Medicare tax imposed by IRC Section 3101(b).

Although the memorandum indicates that deferrals of the employee portion of Social Security tax are available with regard to compensation paid during the period from Sept. 1 to Dec. 31, the memorandum does not indicate that the employee relief would extend to deposit deadlines from Sept. 1 to Dec. 31 for assessments on compensation paid before that period. By contrast, deferrals of the employer portion of Social Security tax are available both with respect to deposit deadlines that occur within the period from March 27 to Dec. 31, even if those deposit deadlines are for assessments on compensation paid before that period, and deposit deadlines after that period but that are based on compensation paid during that period.

While the CARES Act did not require employers to defer their portion of Social Security tax and instead merely provided them with the option to do so, Sections 1 and 2 of the memorandum appear to have the combined effect of requiring the deferral of the employee portion of Social Security tax for eligible employees. It is likely that Treasury Department guidance issued pursuant to Section 3 of the memorandum will clarify whether deferral of the employee portion of Social Security tax indeed is required.

Although the CARES Act specified that half of the deferred employer portion of Social Security tax would be due Dec. 31, 2021, with the other half due Dec. 31, 2022, the memorandum does not specify when the deferred employee portion of Social Security tax would be due. Instead, Section 3 of the memorandum authorizes the Treasury Department to issue guidance that would clarify when the deferred employee portion would be due.

However, the memorandum identified that there is a possibility that the deferral of the employee portion of Social Security tax with respect to the period from Sept. 1 to Dec. 31 will be transformed into an elimination of the liability to pay that amount. Section 4 of the memorandum specifies in this regard that the Treasury Department "shall explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum."

As it is uncertain whether the liability to pay the deferred amounts of the employee portion of Social Security is to eventually be eliminated, the deferrals of the employee portion of Social Security tax are for now, like the deferrals of the employer portion of Social Security tax, not to be treated as deferrals of liability.

Therefore, for now, the employee portion of Social Security tax, even with deferrals, that normally would be due with respect to the period from Sept. 1 to Dec. 31 would need to continue to be included in Lines 12 and 16 of Form 941, Employer's Quarterly Federal Tax Return, and in applicable boxes for Form 941's Schedule B for semiweekly depositors, with respect to the returns reporting data for the period from Sept. 1 to Dec. 31. Amounts of the employee portion of Social Security tax, regardless of deferral, also would continue to be factored into determinations during the period from Sept. 1 to Dec. 31 of whether an employer must perform a next-day deposit because it accumulated employment tax liability of at least $100,000.

In light of the new line 13b that was added to Form 941, upon the release of its finalized revision June 19, to report deferrals of the employer portion of Social Security tax, it remains to be seen whether Form 941 will be further modified to accommodate reporting of deferrals of the employee portion of Social Security tax.

Presidential Memorandum: https://www.whitehouse.gov/presidential-actions/memorandum-deferring-payroll-tax-obligations-light-ongoing-covid-19-disaster/?fbclid=IwAR19mUMFDE3Sr62xogkuwOM9kHtg17Rw3vaancO78WBacuDqlrO445uof3w

Costpoint Solution

Based on the information provided in the memorandum, here are the required steps you will need to take to be compliant with this federal requirement:

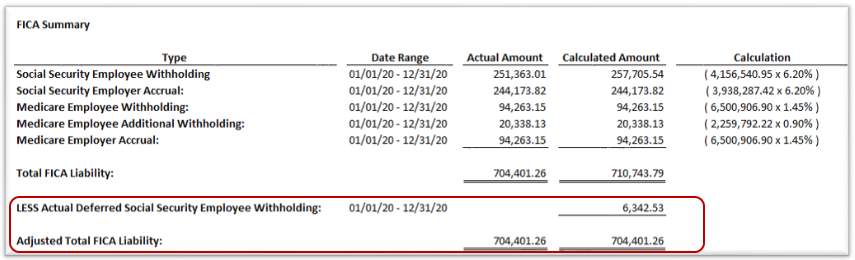

- Identify the employees that are eligible for deferral from their portion of Social Security taxes by identifying employees that generally have biweekly pay of less than $4,000.

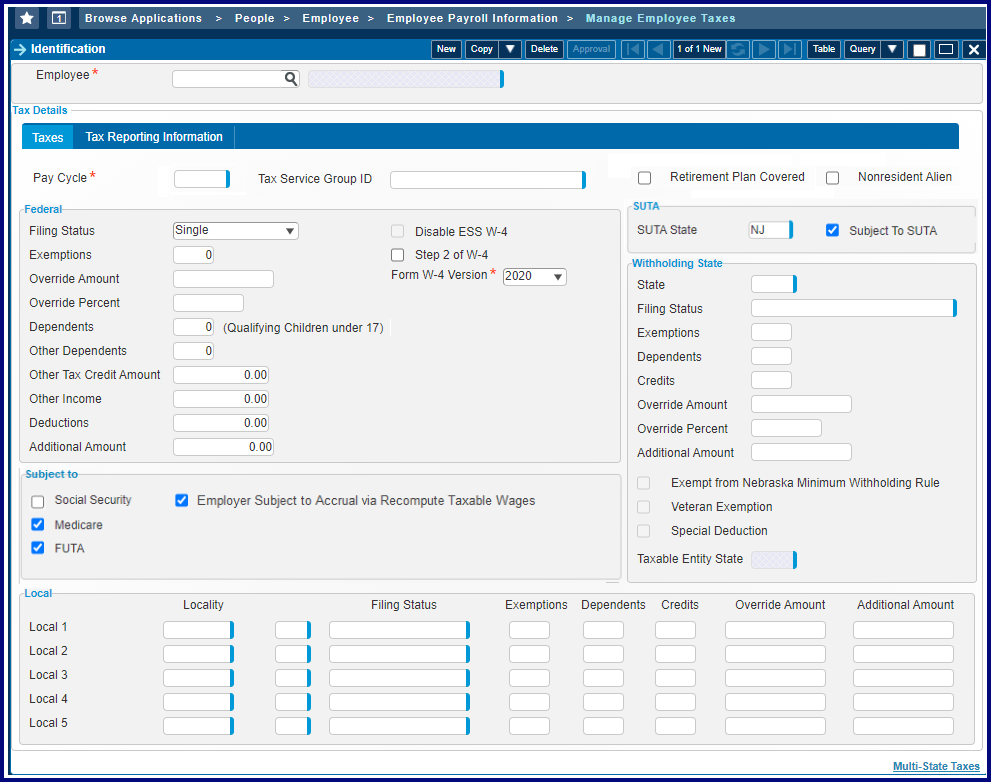

- Clear the Subject to Social Security check box in the Manage Payroll Taxes screen for the identified employees. This will impede the calculation of both the employee's portion of Social Security taxes and the employer's portion of Social Security taxes when Compute Payroll is processed. This step MUST be done before the first paycheck with a date that falls within the 9/1/2020 to 12/31/2020 period of deferral.

- The presidential memorandum states that only the employee's portion of Social Security taxes will be deferred. Therefore, after you post payroll and before you generate the Quarterly Federal Tax Report for 941 reporting, you will need to download MR 7.1.9 or MR 8.0.1 in order to obtain the updates that will allow you to calculate the employer portion of the Social Security tax and the employee's Social Security taxable wages.The presidential memorandum states that only the employee's portion of Social Security taxes will be deferred. Therefore, after you post payroll and before you generate the Quarterly Federal Tax Report for 941 reporting, you will need to download MR 7.1.9 or MR 8.0.1 in order to obtain the updates that will allow you to calculate the employer portion of the Social Security tax and the employee's Social Security taxable wages.

- Once MR 7.1.9 or MR 8.0.1 is loaded, query the employees that were identified for deferral from the employee portion of Social Security taxes and select the new Employer Subject to Accrual via Recompute Taxable Wages check box for each of the employees. Selecting this check box indicates that the employer is still liable for their portion of the Social Security taxes while the employee's Social Security Withholding is in a deferred status from 09/01/2020 through 12/31/2020.

- In order to update the employer's Social Security tax liability and the employee's Social Security taxable wages, you will need to run the Recompute Taxable Wages application. If an employee's

Employer Subject to Accrual via Recompute Taxable Wages check box is selected in Manage Employee Taxes and the check date falls within the 9/1/2020 to 12/31/2020 deferral period, the Recompute Taxable Wages application will do the following:

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security taxable wages.

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security tax accrual amount.

- Calculate and populate the Manage Employee Earnings History record with the employee's Social Security taxable wages.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (On-Premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.1 (On-Premise): MR 8.0.1 (September 14, 2020)

Maryland SUTA Electronic Filing

According to the Maryland Department of Labor, their new system, BEACON, will go live in late September 2020. This system allows employers to submit wage and employment reports online. Employers can submit wage reports using manual entry via the online screens or they can upload a file containing the wage information. The file types accepted by Maryland are:

- Comma Separated Values (CSV) format

- The Social Security format for filing W-2 electronically (EFW2)

- The Interstate Conference of Employment Security Agencies (ICESA) format

- Extensible Markup Language (XML) format

Costpoint will be updated to support the EFW2 file format for Maryland SUTA electronic reporting.

Please see the following Maryland Department of Labor site for additional information: http://www.dllr.maryland.gov/uim/employer/uimempfaqs.shtml

Target Dates

Note: The following is a target date which is subject to change.

- 7.1.1 (On-Premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (On-Premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.2 (On-Premise): MR 8.0.2 (October 12, 20200

Guam Tax Withholding

Costpoint will support Guam tax table updates and income tax withholding calculations. The following changes will be made in Costpoint for Guam:

- A check box has been added to the Manage State Taxes (PRMSTI) screen which will allow you to indicate whether or not the US territory's income tax calculations is the same as the federal income tax calculations.

- New filing statuses have been added to indicate if withholding method will be based from the 2020 Form W-4.

- Guam tax tables have been provided.

- All applications which calculate Guam taxable wages and tax withholding have been updated to accommodate Guam's requirements.

- Costpoint ESS now allows employees to provide their State W-4 data for Guam and any other territory that's has the same income tax calculations as the federal income tax calculations.

Target Dates

- 7.1.1 (On-Premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (On-Premise): MR 7.1.7.2 (September 22. 2020)

- 8.0 (On-Premise): MR 8.0.1 (September 14, 20200

New Jersey SUTA Electronic Filing

According to the New Jersey Department of Labor and Workforce Development, all types of magnetic media have been phased out and replaced by the Employer Report of Wages Paid ( WR-30) form. All employers must file their quarterly wage reporting information (Form WR-30) electronically either online via the New Jersey Payroll Taxes and Wage Withholding-Filing, Payment, and Reporting Service or by Secure File Transfer Protocol (SFTP). Costpoint will be updated to support the generation of the WR-30 file in MR 7.1.8.

Please see the following site for additional information: https://www.nj.gov/labor/handbook/chap1/chap1sec2WageReporting.html

Release Date

- 7.1.1 (On-Premise): MR 7.1.8 (July 31, 2020)

Target Date

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.2 (September 22, 2020)

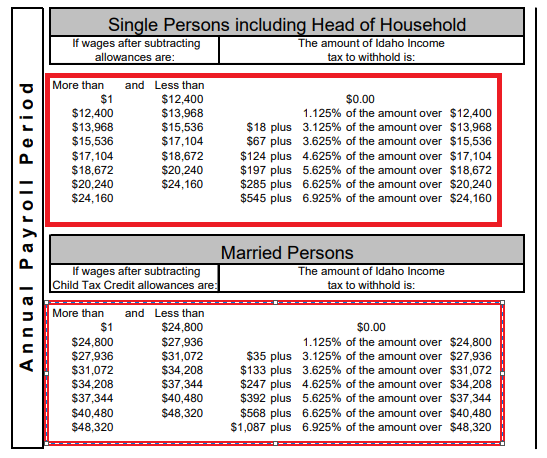

Idaho's 2020 withholding methods, were released June 16 by the State Tax Commission. The highest tax bracket now starts at annual income of $48,320, up from $47,508, for married individuals, and at annual income of $24,160, up from $23,754, for other individuals. Costpoint will be updated to support these tax table changes in MR 7.1.8.

Release Date

- 7.1.1 (On-Premise): MR 7.1.8 (July 31, 2020)

Target Date

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.2 (September 22, 2020)

Texas SUTA Electronic Filing

The Texas Workforce Commission has updated their SUTA wage reporting requirements. The following fields in the ICESA file which were previously populated will now be blank:

- Record A 220: Allocation List Indicator

- Record A 221-229: Service Agent ID

- Record A 230-242: Total Remittance Amount

- Record B 15-22: Computer

- Record B 23-24: Internal Label

- Record B 26-27: Density

- Record B 28-30: Recording Code (EBCDIC or ASCII Character Set)

- Record B 31-32: Number of Tracks

- Record B 33-34: Blocking Factor

- Record B 147-190: Organization Name

- Record B 191-225: Street Address

- Record B 226-245: City

- Record B 246-247: State

- Record B 253-257: Zip Code

- Record B 258-262: Zip Code Extension

- Record T 186-198: Allocation Amount

Manage SUTA Tax File Data (PRMSMM)

The following new field will be added to this screen:

| Field | Description |

|---|---|

| NAICS Code | Enter the 6-digit North American Industry Classification System code that best classifies your company. |

Fields and validations that are no longer applicable for Texas will be removed from the Manage SUTA Tax File Data screen.

Create Quarterly SUTA Tax File (PRPSMM)

The Create Quarterly SUTA Tax File screen will generate a SUTA tax file for Texas in the updated ICESA file format required by the state.

This release will also apply the following changes for Texas:

- The values in the following fields will also be updated:

- Record E Position 182 - 187 NAICS Code field will report the value entered in NAICS Code field on the Manage SUTA Tax File Data screen.

- Record T Position 248 - 250 County Code field will report the value entered in the Industry/County Code/Location Code/Branch field on the Manage SUTA Tax File Data screen.

- Record T Position 251 - 257 Outside County Employees will report the value entered in the Remitter Number/Employees Outside County field on the Manage SUTA Tax File Data screen.

- The application will no longer display the message: "Warning: This file should be named 'TWCWAGES' before submitting to the government agency. Continue?"

- The application will provide validations on fields that are related to the Configure Company information screen.

- The Computer Manufacturer field will be disabled for the State of Texas.

Release Date

- 7.1.1 (On-Premise): MR 7.1.8 (July 31, 2020)

Target Date

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.2 (September 22, 2020)

Colorado State Filing Status

The 2020 Form W-4,Employee's Withholding Certificate, was revamped to reflect the elimination of withholding allowances under the tax code overhaul. The new form relies on dollar-amount adjustments reported by employees to calculate income tax withholding.

Revisions to the federal form created a wave of changes in states that used the federal withholding certificate for state income tax withholding purposes and states that used allowances in withholding formulas.

Colorado was among the states that did not develop state withholding certificates and continued to use federal Form W-4 for state withholding. Head of household is a newly added filing status in the federal 2020 Form W-4 and before this release Colorado did have the Head of Household filing status in Costpoint. This release adds the Head of Household filing status for Colorado in Costpoint for any employee who selected this filing status in the 2020 Form W-4.

Costpoint PATCH3790 will add the Head of Household filing status records for Colorado in the following screens:

- Manage State Tax Withholding Adjustments

- Manage State Standard Deductions

- Manage State Tax Tables

The patch will also apply the following updates to the State Filing Status (STATE_FILING_STATUS) table:

- The new HEAD OF HOUSEHOLD filing status will be added.

- The descriptions of MARRIED and SINGLE OR MARRIED filing statuses will be updated.

Release Date

- 7.1.1 (On-Premise): MR 7.1.8 (July 31, 2020)

Target Date

- 7.1.7 Hot Fix (On-Premise): Hot Fix 7.1.7.2 (September 22, 2020)

Arizona SUTA Electronic Filing

Effective February 28, 2020, the Arizona Department of Economic Security department discontinued allowing quarterly SUTA wage data to be submitted on CDs or diskettes in the MMREF format. Arizona now requires employers to file wage data in one of the following formats:

- Comma Separated Value (CSV) file upload on the Arizona Unemployment Tax and Wage System website (https://uitws.azdes.gov/App/EmployerLogin.aspx)

- Bulk filing process (a server to server process using the XML file format)

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.7 (June 30, 2020)

VETS-4212 Report

Costpoint MR 7.1.6 updates the Print VETS-4212 Report (HARV100) screen and changes the existing single date parameter on the screen into a range of dates. You will now be able to enter a pay period date range which represents the pay period used as the basis for filing the VETS-4212 report. Costpoint will use the pay period date range for reporting the following:

- Number of employees: The application will use the pay period start and end dates as the basis for the employment figure.

- Number of new-hires for the 12 month reporting period: The application will use the pay period end date as the end date for the twelve-month reporting period.

The following are the updates to the Print VETS-4212 Report screen:

- The "Period End Date" label in the Selection Range group box changed to "Pay Period Date."

- The value in the Option field for Pay Period Date changed to Range.

- The screen now requires a start and end date for the reporting period in the following fields:

- Pay Period Date - Start field: Enter, or use the calendar lookup, the pay period start date to determine the number of employees.

- Pay Period Date - End field: Enter, or use the calendar lookup, the pay period end date to determine the number of employees and the number of new-hires in the previous 12-month period.

Release Date

- 7.1.1 (On-Premise): Released with MR 7.1.6 (May 2020)

COVID-2020 H.R. 6201: Families First Coronavirus Response Act - National Paid Sick Leave and FMLA Expansion

Description

The U.S. government recently signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new legislation:

- Emergency Paid Sick Leave: This legislation mandates covered employers to provide paid leave for employees affected by the coronavirus if those employees are unable to work or telework. An eligible employee is allowed two weeks (80 hours) of paid sick time at the employee's full regular rate of pay, subject to dollar caps; this is reduced to two-thirds pay if the leave is due to caring for others (for example, a sick or quarantined family member or a child whose school is closed or whose childcare provider is unavailable due to the coronavirus).

- Emergency Family and Medical Leave Expansion: An employee is eligible for ten additional weeks of FMLA leave, but only for those who must stay at home to care for a child whose school is closed. These 10 weeks will be paid at two-thirds the employee's regular rate of pay, subject to a $200 maximum payable amount per day and a $10,000 maximum total amount payable to an employee for public health emergency leave.

Emergency Paid Sick Leave and Emergency FMLA Expansion

Costpoint's existing Paid Family Leave functionality already supports the ability to accrue and track paid leave and adjust a salaried employee's timesheet so that the total labor cost for Paid Sick Leave is based on an average hourly compensation rate. However, the Families First Coronavirus Response Act imposes a daily dollar cap that will require clients to manually adjust the average hourly compensation rate if it would cause the daily labor cost for an employee's paid sick leave or paid FMLA to exceed the cap. The Average Hourly Compensation Rate field already exists in the Paid Family Leave subtask of the Manage Employee Leave screen, but it is not currently editable. An enhancement will enable the Average Hourly Compensation Rate field, allowing you to edit the rate, if necessary. To ensure compliance by April 2, 2020, all Deltek Costpoint, On-Premise customers with LESS THAN 500 employees will need to apply the update to their environment with the following file requirements:

| Scenario | Action |

|---|---|

| Due to rules established in H.R. 6201 Families First Coronavirus Response Act, you have an employee that requires paid sick leave or paid FMLA and... | |

| You're a 7.1.1 client using System Jar 060 or older and you're not ready to put MR 7.1.4 into production. |

Download cp711_ldmelv_003.zip from the DSM 7.1.1 folder and then apply the file. The minimum file requirements for this enhancement are as follows:

Release Date 7.1.1 (On-Premise) file cp711_ldmelv_003.zip: Deployed to DSM on 03/27/2020 |

| You're a 7.1.1 client using MR 7.1.2 or MR 7.1.3. | Upgrade to

7.1.4 or higher.

Release Date 7.1.1 (On-Premise) MR 7.1.4: Deployed to DSM on 03/31/2020 |

| You're a 7.1.1 client that's already applied MR 7.1.4 or a higher version. | No further action necessary. |

| You're a 7.0.1 client using System Jar 059 (or lower) and not ready to put System Jar 060 or a higher version into production. |

The minimum file requirements for this enhancement are as follows:

Release Date 7.0.1cp701_patch5132_001.zip: Deployed to DSM 03/27/2020 |

| You're a 7.0.1 client that is ready to put 7.0.1 System Jar 060 or a higher version into production. | Implement the System Jar.

Release Date 7.0.1 System Jar 060: 05/06/2020 |

| You're a 7.0.1 client that's already applied System Jar 060 or a higher version. | No further action necessary. |

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) has been created with instructions on the following:

- Pay type setup

- Leave type setup

- Leave code setup

- How to set up the employee Paid Family Leave information in relation to the Families First Coronavirus Response Act

- Examples of timesheet entry

- Instruction and examples of Paid Family Leave adjustment processing

COVID-Export of Leave Data to Shop Floor Time to Include Paid Family Leave Dates for COVID-19 H.R. 6201

Description

The recent H.R. 6201: Families First Coronavirus Response Act regulations for COVID-19 allows employees to receive paid sick leave and Paid Family Medical Leave for certain COVID-19-related situations. The regulations, however, state that employees must use the leave between 04/01/2020 and 12/31/2020.

To allow Costpoint Shop Floor Time users comply to with the regulations, Costpoint MR 7.1.6 updates the way the Export Project Manufacturing Data (LDPEXPM) process handles the export of leave data. The application will now use the start and end dates on the Paid Family Leave subtask of the Manage Employee Leave (LDMELV) screen as the basis of the leave start and end dates exported to Shop Floor Time. This update will prevent employees from charging the COVID-19-related leave outside of the dates allowed by the government regulation.

Release Dates

- 7.1.1 (On-Premise): MR 7.1.6 (May 25, 2020)

COVID-CARES Act Paycheck Protection Program

Description

The Paycheck Protection Program, established by the Coronavirus, Aid, Relief and Economic Security Act (CARES Act), is implemented by the Small Business Administration with support from the Department of the Treasury. This program provides small businesses with funds to pay up to eight weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities.

The program allows qualifying employers with up to 500 employees to apply for a forgivable loan to cover payroll costs over an eight-week period from Feb. 15 to June 30, 2020.

Employers will need the following data to apply for the loan:

- Employee gross pay (capped at $100,000 on an annualized basis for each employee)

- Employer-paid benefits contributions

- Employer-paid retirement contributions

- Employer-paid state and local taxes

Costpoint Solution

To help employees report accurate data for any loan applications, a new report will be added in the Payroll module to calculate employer payroll expenses. The new report, which will be found in the Payroll Toolkits screen, will provide a 12-month breakdown of total employee earnings, Employer paid state and local taxes, Employer benefits, Earnings in excess of $100,000, Total payroll costs and the Number of employees. The report will also display the yearly average for the total payroll costs and number of employees. Only U.S. based employees will be included in the report.

Release Dates

- 7.1.1 (On-Premise): MR 7.1.6 (May 25, 2020)

- 7.0.1: PRPTOOLKIT application was deployed to DSM on 6/2/2020 (Requires System Jar 060 which was deployed on May 11, 2020)

2020 H.R. 6201: Families First Coronavirus Response Act - Payroll Tax Credits

Description

The U.S. government recently signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new tax credit legislation:

Employers covered by the Families First Coronavirus Response Act may take advantage of special tax credits designed to reimburse them for providing coronavirus-related paid sick and family medical leave to their employees.

- Paid Sick Leave Credit: As per the IRS, for an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days. For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

- Child Care Leave Credit: As per the IRS, in addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Costpoint Solution

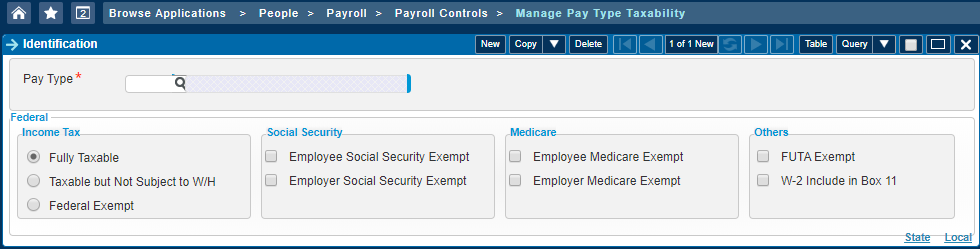

Costpoint currently allows for pay types to be flagged as exempt from both employer and employee Social Security and Medicare (FICA) taxes in the Manage Pay Type Taxability screen. However, the Families First Coronavirus Response Act allows for coronavirus-related sick and family medical leave to be exempt from only the employer's FICA tax. In order to comply with this requirement, we will update the Manage Pay Type Taxability application so you can specify a pay type's employer Social Security and Medicare taxability separately from the employee Social Security and Medicare taxability. This will allow you to set up your Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act pay types as employer-FICA-exempt, but not exempt for employee FICA tax.

Accordingly, Costpoint will compute and track the employee and employer FICA exempt pay type amounts, exempt deduction amounts, and taxable wages separately from the employee FICA information throughout the payroll process.

Release Dates

- 7.1.1 (On-Premise): MR 7.1.7 (June 30, 2020)

- 7.0.1: System Jar 061 (June 30, 2020)

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) will be updated with data setup instructions in the coming weeks.

2020 Federal Form 941 Updates

Description

The Internal Revenue Service recently announced that a revised federal Form 941 (Employer's Quarterly Federal Tax Return) is to be used starting with the second quarter of 2020 to report employment tax amounts that were retained by employers instead of being deposited in anticipation of refundable payroll tax credits.

A draft of the expanded form, with new data-entry fields to accommodate additional reporting for three payroll credits related to the coronavirus outbreak, was released April 29 by the Internal Revenue Service. The draft form includes the following changes:

Draft 941-Part 1

New fields added:

-

Line 5a (i) Qualified sick leave wages.

-

Line 5a (ii) Qualified family leave wages.

-

Line 11b Nonrefundable portion of credit for qualified sick and family leave wages from Worksheet 1.

-

Line 11c Nonrefundable portion of employee retention credit from Worksheet 1.

-

Line 11d Total nonrefundable credits. Add lines 11a, 11b, and 11c.

-

Line 13b Deferred amount of the employer share of social security tax.

-

Line 13c Refundable portion of credit for qualified sick and family leave wages from Worksheet 1.

-

Line 13d Refundable portion of employee retention credit from Worksheet 1.

-

Line 13e Total deposits, deferrals, and refundable credits. Add lines 13a, 13b, 13c, and 13d.

-

Line 13f Total advances received from filing Form(s) 7200 for the quarter.

Line 13g Total deposits, deferrals, and refundable credits less advances. Subtract line 13f from line 13e.

Existing lines updated:

-

Line 5e Total social security and Medicare taxes. (The existing field was updated to include Qualified sick leave wages and qualified family leave wages.)

-

Line 14 Balance due. If line 12 is more than line 13g, enter the difference and see instructions. (The existing line was updated.)

-

Line 15 Overpayment. If line 13g is more than line 12, enter the difference. (The existing line was updated.)

-

Line 17 (The IRS now instructs you to attach a statement to your return if your business closed or stopped paying wages).

Draft 941-Part 3

New fields added:

-

Line 19 Qualified health plan expenses allocable to qualified sick leave wages.

-

Line 20 Qualified health plan expenses allocable to qualified family leave wages.

-

Line 21 Qualified wages for the employee retention credit.

-

Line 22 Qualified health plan expenses allocable to wages reported on line 21.

-

Line 23 Credit from Form 5884-C, line 11, for this quarter.

-

Line 24 Qualified wages paid March 13 through March 31, 2020, for the employee retention credit. (Use this line only for the second quarter filing of Form 941.)

- Line 25 Qualified health plan expenses allocable to wages reported on line 24. (Use this line only for the second quarter filing of Form 941.)

Costpoint Solution

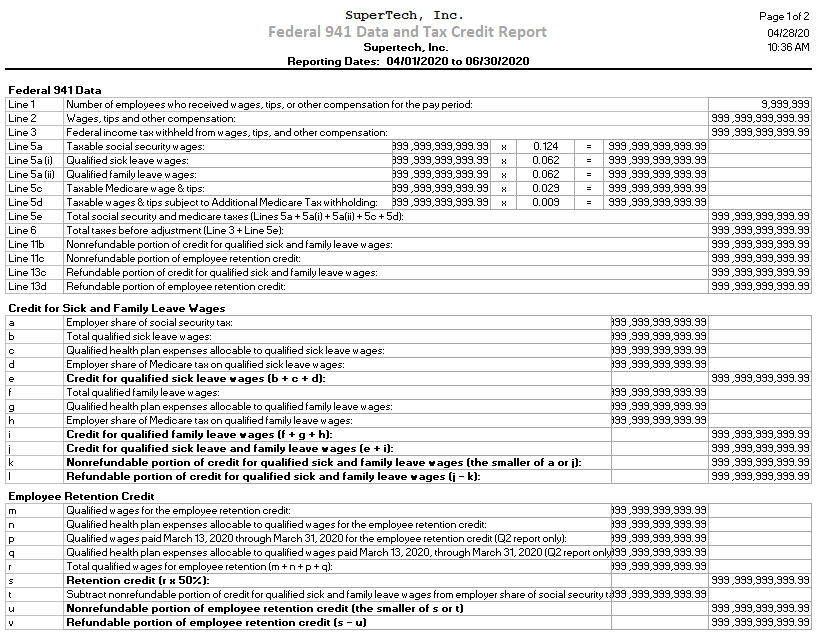

Costpoint's Print Quarterly Federal Payroll Tax Report (PRRFDTAX) will be updated as follows:

- New fields will be added on screen which will allow you to enter the amount of qualified health plan expenses allocable to qualified sick leave wages, FMLA wages, and qualified wages for the employee retention credit.

- The Federal 941 Data section will be removed from the Quarterly Federal Tax Payroll Report. The information in this section will be reported in a new separate report.

- The screen provides a new Federal 941 Data and Tax Credit Report.

Target Dates

The following are target dates which are subject to change.

- 7.1.1 (On-Premise): MR 7.1.7 (June 30, 2020)

- 7.0.1: June 30, 2020

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) has been updated with additional information regarding this enhancement.

COVID-CARES Act Deferral of Employment Tax Deposits and Payments

DescriptionSource: IRS website

The Coronavirus, Aid, Relief and Economic Security Act (CARES Act) allows employers to defer the deposit and payment of the employer's share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes.

- What deposits and payments of employment taxes are employers entitled to defer?

Section 2302 of the CARES Act provides that employers may defer the deposit and payment of the employer's portion of Social Security taxes and certain railroad retirement taxes. These are the taxes imposed under section 3111(a) of the Internal Revenue Code (the "Code") and, for Railroad employers, so much of the taxes imposed under section 3221(a) of the Code as are attributable to the rate in effect under section 3111(a) of the Code (collectively referred to as the "employer's share of Social Security tax"). Employers that received a Paycheck Protection Program loan may not defer the deposit and payment of the employer's share of Social Security tax that is otherwise due after the employer receives a decision from the lender that the loan was forgiven. (See FAQ 4).

- When can employers begin deferring deposit and payment of the employer's share of Social Security tax without incurring failure to deposit and failure to pay penalties?

The deferral applies to deposits and payments of the employer's share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020. (Section 2302 of the CARES Act calls this period the "payroll tax deferral period.")

The Form 941, Employer's QUARTERLY Federal Tax Return, will be revised for the second calendar quarter of 2020 (April - June, 2020). Information will be provided in the near future to instruct employers how to reflect the deferred deposits and payments otherwise due on or after March 27, 2020 for the first quarter of 2020 (January - March 2020). In no case will Employers be required to make a special election to be able to defer deposits and payments of these employment taxes.

Costpoint Solution

Costpoint's existing A/P Voucher functionality already allows for partial liability payments as part of standard functionality. In the Edit Voucher Payment Status screen, the Amount to Pay is automatically calculated by the system (based on discounts, etc.) but you may override this value in order to do a partial payment. You may enter an override amount, for example the 50% of the employer portion of Social Security tax, but there is also retainage options that limit how much to pay.

Pennsylvania Electronic File Reporting-2020 First Quarter Updates

Description

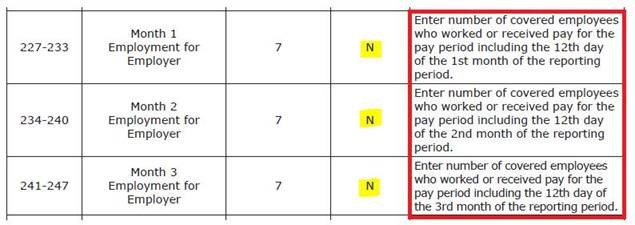

Effective January 1, 2020, the monthly employee count fields in the Total Tax Record (T Record) are now required for all Pennsylvania file submissions (both original and amended). Prior to this change, the monthly employee counts were only required for the amended files.

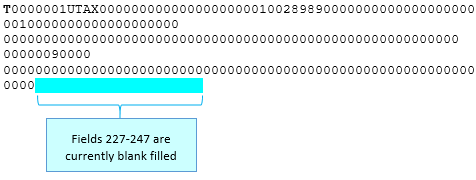

Example of what T record currently looks like:

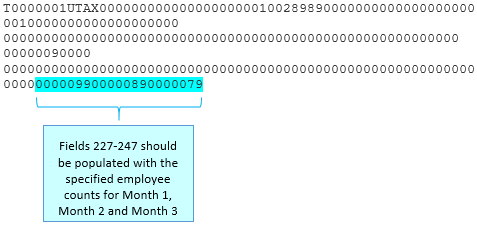

Example of what T record should look like. (In this example, Month 1 Employment = 99, Month 2 Employment = 89, and Month 3 Employment = 79.)

Possible scenarios with the steps that you must take:

| Scenario | Action |

|---|---|

| You're a Costpoint Payroll client that needs to submit a SUTA quarterly electronic file for the state of Pennsylvania and... | |

| You're a 7.1.1 client using System Jar 060 or older and you're not ready to put M.R. 7.1.5 into production. | Download cp711_prpsmm_033.zip from the DSM

7.1.1 folder and then apply the file.

The minimum file requirements for this enhancement are as follows:

Release Date 7.1.1 cp711_prpsmm_033.zip : Deployed to DSM on 05/04/2020 |

| You're a 7.1.1 client using M.R. 7.1.2, M.R. 7.1.3, or M.R. 7.1.4. | Upgrade to

M.R. 7.1.5. and apply latest

M.R. 7.1.5 Hot Fix

Release Date 7.1.5 (On-Premise) MR 7.1.5 with MR 7.1.5 Hot Fix: Deployed to DSM on 05/05/2020 |

| You're a 7.0.1 client |

Download cp701_prpsmm_039.zip from DSM and then apply it to your system. The minimum file requirements for this enhancement are as follows:

Release Date 7.0.1 cp701_prpsmm_039.zip : Deployed to DSM on 05/04/2020 |

Federal Tax Updates

Description

- The Federal Poverty Level for 2020 is $12,760.00.

- The Internal Revenue Service (IRS) released the final 2020 Federal Income Tax Withholding Instructions and set the 2020 Nonresident Alien Amount to $12,400

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.3 in February 2020

- 7.0.1: Released on 03/03/2020

- System Jar Requirement: 7.0.1 Sys Jar 059 (February 2020)

Virgin Islands Tax Withholding Part I

Description

The following are tax updates for the Virgin Islands, effective January 1, 2020:- The unemployment limit for 2020 is $28,900.00.

- The exemption amount increases from $4,200 to $4,300.

- The state tax tables were updated with Federal Standard Withholding Rate Schedules using the existing Married, Single, and Head of Household filing statuses.

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.3 in February 2020

- 7.0.1: Released on 03/03/2020

- System Jar Requirement: 7.0.1 Sys Jar 059 (February 2020)

Virgin Islands Tax Withholding Part 2

Description

- Manage Employee Taxes will be updated so that fields pertaining to Virgin Islands will be enabled.

- New Virgin Island filing statuses and tax tables will be added.

- Special programming in Compute Payroll will be added.

Target Dates

The following are target dates which are subject to change.

- 7.1.1 (On-Premise): MR 7.1.5 (Deployed April 27, 2020)

- 7.0.1: System Jar 060 (Deployed May 11, 2020)

North Dakota Tax Withholding Update & Nonresident Alien Update

Description

- North Dakota recently updated their income tax withholding methods and tables for 2020 to conform to the redesigned 2020 IRS Form W-4. Costpoint will be updated to utilize a different withholding method for employees that fill out the 2020 Form W-4 vs employees that have a 2019 Form W-4 or earlier version.

- As a result of the new 2020 IRS Form W-4, the method of determining the Nonresident Alien Additional Amount will be updated. Per the IRS, if the check date is greater than or equal to 01/01/2020, but the employee's W-4 is from 2019 or earlier, the Nonresident Alien Additional Amount must be $8,100.00. If the employee has completed a 2020 IRS Form W-4, the Nonresident Alien Additional Amount will be $12,400.00.

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.3 in February 2020

- 7.0.1: Released with 7.0.1 Sys Jar 059 in February 2020

Arkansas Tax Withholding

Description

The following are tax updates for Arkansas, effective March 1, 2020:- The state tax tables were updated.

- The threshold for adjusting the net taxable income at the $50 range (midrange of $100) increased from $50,000 to $87,001.

- The tax rates used in the formula decreased and range from zero to 6.6%, down from 0.9% to 6.9%.

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.3 in February 2020

- 7.0.1: Released with 7.0.1 System Jar 059 in February 2020

Maryland Tax Withholding

Description

The following are tax updates for Maryland, effective January 1, 2020:- The minimum standard deduction value used in the percentage method increases from $1,500 to $1,550. The maximum increases from $2,250 to $2,300.

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.3 in February 2020

- 7.0.1: Released 03/03/2020

- System Jar Requirement: 7.0.1 Sys Jar 059 (February 2020)

Minnesota/Mississippi/Rhode Island Tax Updates

Description

- Minnesota

- The amount of one withholding allowance increases from $4,250 to $4,300.

- The withholding tables for Single and Married were updated.

Attention: For more information, refer to the Minnesota Income Tax Withholding instructions Booklet and Tax Tables: https://www.revenue.state.mn.us/sites/default/files/2019-12/wh_inst_20_0.pdf

- Mississippi

- The annual withholding table was updated.

Attention: For more information, refer to the Computer Payroll Accounting - For Periods In 2020: https://www.dor.ms.gov/Documents/Computer%20Payroll%20Flowchart.pdf

- Rhode Island

- The annual withholding table was updated.

- The threshold for 0.00 allowance amount increases from $227,050.00 to $231,500.00.

Attention: For more information, refer to the Rhode Island Employer's Income Tax Withholding Tables: http://www.tax.ri.gov/forms/2020/Withholding/2020%20Withhholding%20Tax%20Booklet.pdf

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.2 in February 2020

- 7.0.1: Released 02/04/2020

- System Jar Requirement: 7.0.1 Sys Jar 054 (June 2018)

Massachusetts Paid Family and Medical Leave Reporting

Description

As stated by the Massachusetts Department of Family and Medical Leave, "Beginning Oct. 1, 2019, most Massachusetts employers will be required to make payroll withholdings on behalf of their workforce in compliance with the Paid Family and Medical Leave law. These withholdings are based on contribution rates set by the Department of Family and Medical Leave to fund the administration of benefits." The State of Massachusetts Paid Family and Medical Leave program allows the following:

- Up to 12 weeks to care for a family member

- Up to 20 week for an employee's own illness

- Up to 26 weeks to address needs related to a family members impending military deployment

The tax that pays for the program begins 2019 and the leave will be available beginning 2021. The program's benefits are to be calculated as a percentage of the employee's wage, up to a maximum of 64 percent of the state's average weekly wage. Following the end of each calendar quarter, every employer and covered business entity and any self-employed individual who has elected coverage shall file an employment and wage detail report and payment for their contribution through the MassTaxConnect system on or before the quarterly filing deadline established by the Massachusetts Department of Revenue. To allow employers to comply with the state requirements, this release adds an application that generates a file for reporting Paid Family and Medical Leave. You can find this new screen in People » Leave » Leave Reporting » Create Quarterly Family and Medical Leave File. Other related screens are also updated for storing Paid Family and Medical Leave data.

Application Updates

- Create Quarterly Family and Medical Leave File (LDPPFML): Use the Create Quarterly Family and Medical Leave File screen to generate a file for reporting Paid Family and Medical Leave to the Massachusetts Department of Revenue.

- Manage Deductions (PRMDED): A new Paid FML tab on the Manage Deductions screen provides fields for entering Paid Family and Medical Leave data for Massachusetts. To track Massachusetts paid family and medical leave, you must set up a deduction with a deduction type of MAPFML on this screen.

Release Dates

- 7.1.1 (On-Premise): Released with MR 7.1.2 in February 2020

2020 Form W-4 and Federal Tax Table Updates

In July 2019, the IRS began posting long-anticipated draft updates to the 2020 Form W-4. Subsequent draft updates were provided, but the final form was not released by the IRS until late November 2019. As per the IRS, "The 2020 Form W-4 has been redesigned to reduce the form's complexity and to increase transparency and accuracy in the withholding system. Beginning with the 2020 Form W-4, employees will no longer be able to request adjustments to their withholding using withholding allowances. Instead, using the new Form W-4, employees will provide employers with amounts to increase or reduce taxes and amounts to increase or decrease the amount of wage income subject to income tax withholding." In order to be compliant with the IRS regulations, the 2020 Form W-4 must be used by any employees hired on or after January 1, 2020 or by any existing employees that change their W-4 on or after January 1, 2020. The W-4 update was only part of the overall change. After the W-4 form was finalized, the IRS finalized the 2020 federal withholding tables.

In response to the new W-4 requirements, Deltek released two separate regulatory updates (released as two separate updates due to the lag between receiving the finalized W-4 form and receiving the federal tax table requirements). The first, released in early December 2019, added the ability to support the 2020 Form W-4. The second, released in mid-December, updated the Federal Tax Information screen and also updated the Federal Tax Withholding tables for any clients that had already applied the 2020 Form W-4 updates.

Possible scenarios with the steps that you must take

| Scenario 1: You want to run payroll before applying the 2020 W-4 updates | |

|---|---|

| 1a | You want to run payroll before applying the 2020 W-4 updates *AND* you already applied patch 3739 and tried to apply patch 3742 (application of patch 3742 would have failed because you don't yet have the W-4 update).

THEN please do the following in the specified order: Contact Deltek Customer Care to get scripts that will load the 2020 Federal Tax Tables. This is a separate script that will not require the 2020 Form W-4 database changes. |

| 1b | You want to run payroll before applying the 2020 W-4 updates *AND* you have

not applied patch 3739 and patch 3742.

THEN please do the following in the specified order: Apply patch 3739. This patch will update the 2020 record in the Manage Federal Tax Information screen. Contact Deltek Customer Care to get scripts that will load the 2020 Federal Tax Tables. This is a separate script that will not require the 2020 Form W-4 database changes. |

| Scenario 2: You want to apply the 2020 W-4 updates before you run payroll | |

|---|---|

|

Note: If you apply the 2020 W-4 updates, you must also apply the federal tax updates (patches 3739 and 3742) as they are required for accurate 2020 federal tax withholding.

|

|

| 2a | You want to apply the 2020 W-4 updates before you run payroll *AND* you have

not applied patch 3739 and patch 3742.

THEN please do the following in the specified order: Apply the 2020 Form W-4 patches and applications

Apply patch 3739 Apply patch 3742 |

| 2b | You want to apply the 2020 W-4 updates before you run payroll *AND* you have already applied patch 3739 and patch 3742.

THEN please do the following in the specified order: Apply the 2020 Form W-4 patches and applications

Apply patch 3739 again Apply patch 3742 again |

PatchKey

| Patch | Description |

|---|---|

| 3695 | Adds new columns for the 2020 W-4 feature |

| 3720 | Adds new columns for the W-4 and Paystub features |

| 3739 | Updates the Federal Tax Information data based on W-4 updates (FED_TAX_INFO) |

| 3742 | Updates the Federal Tax Tables with 2020 data based on W-4 updates (FED_TAX_TBL) |