Item Group Information Card Tab

This section includes the fields and descriptions for the Item Group Information Card Tab.

Item Group Island

| Field | Description |

|---|---|

| Name | Enter the name of the item group here. This name identifies the group and must be unique. You can change the name of an existing item group. You must complete the field. |

Buyer Island

| Field | Description |

|---|---|

| Buyer | In this field, you can specify the name of the person typically responsible for buying items in the current group. You can enter any text. The information in this field is used when running item purchase selections, where you can set up criteria where the buyer information on each item and the item group to which it pertains determines whether the item in question is to be included in the selection. In this process, the buyer on the item group is only used if a buyer has been specified neither for the warehouse for which items are being purchased nor in the card part of the item in question. For further information on this process, see the description of the field “Buyer” in the window Item Purchase Orders in the Item Purchase module. |

Inventory Island

| Field | Description |

|---|---|

| Inventory Control | If you mark this field, you apply inventory control to the items in the item group. Inventory control means that you can enter information such as storage location, delivery times, and so on, in the table part of the window Item Information card. Maconomy also calculates average and last cost prices for items with inventory control, and keeps track of item volumes for each warehouse. For items without inventory control, only limited warehouse specific information, such as preferred vendor and standard cost, can be entered.

If you do not mark this field, then select “Standard” in the “Costing Method” field, since average and last costs are not updated for items without inventory control. When an item has inventory control, both the average and last costs are updated when there are inventory changes, regardless of which costing method you have selected. You can change the value of the field for an existing item group, but the change will not affect items already assigned to the group. It will only be effective for new items assigned to the group after the change. You cannot change the inventory control method for existing items. |

Sales Order Island

| Field | Description |

|---|---|

| Tax Code | Here you can specify the tax code to be suggested for items in this group on order lines. The tax code(s) can be changed on individual order lines or determined by a tax table from the Tax Tables window in the G/L module. Tax is only added if the customer to whom the item is sold pays tax.

You can add up to three different tax codes if necessary. To enable multiple tax codes, the system parameters “Show Three Tax Levels” and/or “Show Two Tax Levels” must be marked in the System Parameters window. When multiple tax codes are enabled, the “Tax Code” field will be replaced by the following fields: “Tax Code 1,” “Tax Code 2” and, if enabled, “Tax Code 3.” For further information on multiple tax codes, please see the description in “Tax Codes.” You can change the value for an existing item group, but it will not affect items already assigned to the group. The change will only be effective for items that are assigned to the group after the change. Tax codes are defined in the Tax Codes window in the G/L module. |

| Markup % of Cost | Here you enter the GM % for calculating gross margin, if an item is not in a price list. The sales price is then calculated from the cost plus whichever gross margin – from this field or the “GM % Sales Price” field – is greater than zero; otherwise, it uses zero.

You can change the value for an existing item group, but it will not affect items already assigned to the group. The change will only be effective for items assigned to the group after the change. You can change the GM % for items individually in the Item Information Card window. |

Costs Island

| Field | Description |

|---|---|

| Costing Method | Select one of four values, “Average,” “Last,” “Standard,” and “FIFO,” to be used for determining the inventory value of items in the group. This selection is also used in the calculation of sales prices on order lines if the item is not priced in a price list and if costs are not calculated from sales prices.

You can change the costing method for an existing item group, but it will not affect items already assigned to the group. Changes will only affect new items assigned to the group after the change. You cannot change costing method for an existing item. Use the “Standard” costing method if you leave the “Inventory Control” field unmarked. Since Maconomy does not keep track of item batches for items without inventory control, the average cost always corresponds to the cost of the last item purchase. This makes the Average and Last costing methods irrelevant for an item without inventory control. If an item is under inventory control, both the average and last costs will be updated when there are inventory changes, regardless of the costing method you have applied. Only if the field “Inventory Control” has been marked are you allowed to create an item group with the FIFO costing method. By the FIFO method (First In First Out) is meant that items are shipped from the inventory at the same price as at their receipt. The stock of any given item in a given warehouse is therefore divided into a number of item batches corresponding with the item receipts which form the stock of the warehouse. Each item batch is described by a quantity of items which is equivalent to their part of the total stock, a date of receipt, and the cost. Items are shipped from stock at the price of the oldest item batch in the warehouse in question. Each warehouse has its own FIFO queue. Thus, each item batch is identified by an item number, a warehouse, and an item batch number. Item batches are numbered consecutively for each combination of item and warehouse. For items with FIFO control, it is not sufficient to calculate the inventory value on the basis of stock times cost. It is thus necessary to calculate it on the basis of the total value of the individual batches. For each batch, this value is calculated from the batch’s cost times the stock on hand at the warehouse in question. The control of the FIFO queue involves the cost of the items only and thus not physical item numbers. At shipment, the inventory value account will be credited the cost of the oldest receipt. However, there is no verification that the serial numbers shipped are the exact same numbers which were once entered at the particular cost. For items under inventory control, shipment from a single item line on an item with FIFO control can take place from different batches and thus at more than one cost at the same time. The value of the cost of sales is thus a total of the value of the batches, and it is this value which is credited the inventory value account. The cost of sales is calculated as follows:

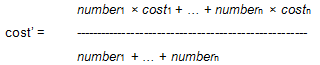

However, in the invoicing procedure, it is more beneficial to operate with only one cost per packing slip line. Therefore, an average cost of the items shipped from a given warehouse is calculated to be used on the item entry and for further invoicing. The average cost is calculated as follows:

As the amount calculated has been rounded to the nearest currency unit, a difference may occur between the cost of sales posted and the value registered on the packing slip line.

The difference between cost of sales - cost of sales’, is posted to:

For items with FIFO control, it thus applies that the cost cannot be determined until at the time of shipment. In certain functions in Maconomy, the cost of an item is used without a concomitant shipment (for instance in the case of order lines in which the cost at the warehouse in question is used to calculate the sales price if no sales price list is used and if no sales price costing is used). These functions therefore require a selection as to a suitable cost. If the cost is used in connection with an expected shipment, the cost of the oldest item batch in the warehouse in question is used. If the cost is to be used in connection with an expected receipt, the last cost should be used. |

| Order Item | In this field, you can specify whether the field “Order Item” should automatically be marked on new items created in the current item group. For further information on the functionality of order items, see the description of the field “Order Item.” |

| Sales Price Costing | By marking this field, costs of items in this group will be calculated from sales prices, when they are sold on an order.

This facility can be used when you must use a vendor’s suggested retail prices. The gross margin is thus determined by the discount you receive from the vendor. You can change the value of this field for an existing item group, but the change will not affect items already assigned to the group. It will only be effective for new items assigned to the group after the change. You cannot change the value for existing items. |

| GM % Sales Price | Here you can enter the GM % if your company uses the Sales Price Costing for the items in this group. If the Sales Price Costing is not used, Maconomy uses that which is greater than zero of the GM % from this field or the “Markup % of Cost.” Otherwise it uses zero.

You can change the value for an existing item group, but it will not affect items already assigned to the group. The change will only be effective for items assigned to the group after the change. You can change the GM % for items individually in theItem Information Card window. |

User Island

See the “Getting Started” topic for a description of the fields in the island User.