About Cap at Limit for In-house Payroll

*This option is only available for in-house payroll.

The Cap at Limit feature introduces a new limit available for accrual pays when you process payroll in Ajera. When Cap at Limit is selected, you can put a limit on the amount of accrual hours an employee can earn. Once this cap has been reached, an employee will no longer accrue hours until their accrual hours have been used. This method takes into consideration the Sick and/or Vacation hours entered on a timesheet. When rolling over into a new year, Ajera will continue calculating hours using the total accrual hours from the previous year as the Starting Accrual for the current year.

If you are using the Cap at Limit method, the Auto reduce option will not be available.

| Note: |

If an employee's accrual beginning balance is greater than the amount set in the Cap at Limit field, the first payroll check processed after turning the Cap at Limit option on will reduce the accrual hours to the max limit. |

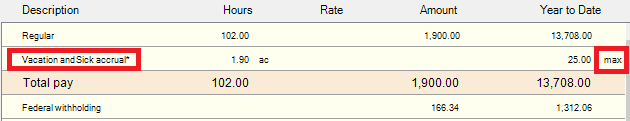

When an employee's accrual pay type is set to Cap at Limit in Setup > Employee > Pay Information tab, an asterisk (*) will be added to the pay description in the Description column in the Edit Paycheck window as well as on the employee's paycheck.

When an employee has reached their accrual cap, max will be displayed next to the accrual total in the Year to Date column in the Edit Paycheck window.

Example: An employee is set up to accrue 10 hours of PTO per pay period with a Cap at Limit of 100 hours.

Scenario 1:

They have a current accrual balance of 95 and they are using 0 hours of vacation this period. When the paycheck is created, the accrual on the paycheck is 5 for a balance of 100 accrual hours.

95 (current balance) - 0 (hours used this period) + 5 (accrued hours available without exceeding the cap limit)

Scenario 2:

They have a current balance of 95 and they use 20 hours of PTO during the current pay period. When the paycheck is created, the accrual on the paycheck is 10 for a total balance of 85.

95 (current balance) - 20 (hours used this period) + 10 (accrued this pay period)