About state withholding for multiple states

unavailable in ajeraCore unless you have the Payroll add-on

| Caution: | Do not turn on withholding for multiple states if you only have employees who live and work in the same state, or live in one state and work in another. |

State withholding for home and work state only

Firms often have employees who live and work in the same state, or live in one state and work in another.

The default option in Ajera for setting up employees provides for these situations. If this is how employees at your firm work, you simply leave this check box cleared: ![]() > Setup >

> Setup >

If employees at your firm never work in multiple states, Ajera hides all the extra fields to keep it clean and simple for you.

State withholding for multiple states

If any of the following situations apply, you can activate processing in Ajera for multiple state withholding:

- You have employees who work in the state where they live and also work in another state where they need to pay taxes during the same pay period.

- You have employees who work in several states during the same pay period.

- You have employees who repeatedly work in different states, even if it is during different pay periods.

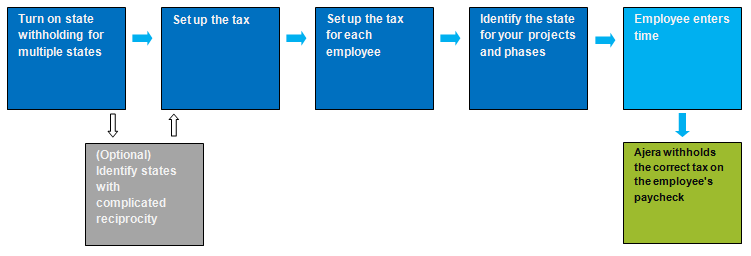

Here is an overview of the main setup tasks.

For step-by step instructions, see Setting up state withholding for multiple states .

|

Do this |

Here |

To accomplish this |

|||||

|---|---|---|---|---|---|---|---|

|

1. |

Turn it on |

|

Display all the fields you need to set up and maintain state withholding for more than one state. | ||||

|

2. |

Identify states that have complicated reciprocal agreements (Optional) |

|

Instruct Ajera to automatically handle complicated reciprocal agreements between specific states.

|

||||

|

3. |

Set up a tax for each state where your employees work |

|

Identify information about the tax (such as the type of tax and the affected financial accounts) so Ajera can process the withholding correctly. |

||||

|

4. |

Set up state withholding for each employee |

|

Instruct Ajera where to withhold state taxes for each employee. You also specify exemptions, and if applicable, withhold for SUI or SDI. |

||||

|

5. |

Identify the work state for your projects and phases

|

|

Withhold state tax according to where the employee performs the work. When employees enter time for a project or phase, Ajera assigns that time to the applicable state and then does the state withholding for that state on the employee's paycheck. |

To set up withholding for local taxes, see Setting up withholding for local taxes when processing for multiple states.