The Total Time Accounting feature allows you to configure specific events to receive an adjusted Total Time Rate. This Total Time Rate is designed to make labor costs the same per hour for all transactions in a pay period, even when some of those transactions are unpaid.

For example, if an employee earns $1000 a week for a 40-hour week, the employee's pay rate is effectively $25/hour. The employee is not compensated for overtime, so the employee earns $1000 regardless of the number of hours worked.

The employee's company is being reimbursed for labor costs. During one week, the employee works 40 hours on Project A and 10 hours on Project B. The 40 hours for Project A are considered "compensated" hours. The 10 hours on Project B are uncompensated overtime.

Without Total Time Accounting, the employee's pay rate (25) would be multiplied by the number of hours worked (50) for a total of $1250. This amount is not an accurate reflection of the employee's labor costs.

With Total Time Accounting, a Total Time Rate would be calculated based on the number of compensated hours vs. the total hours worked. In this case, the employee's pay rate (25) would be multiplied by the compensated hours (40) divided by the total hours (50). The Total Time Rate would be 25 * 0.8 = $20. When the Total Time Rate (20) is multiplied by the employee's hours (50), the result is $800 for Project A and $200 for Project B, which is an accurate reflection of the employee's labor costs.

To use the Total Time Accounting feature, you need to enable Total Time Accounting in your Pay Policy and specify which events and hours classes will be considered “compensated hours” and “total hours” when calculating the Total Time Rate. You must also select the rate type and the range type.

You also need to configure and run the TOTAL_TIME_ACCOUNTING service, which will calculate the Total Time Rate.

See Also:

Total Time Accounting Limitations

How the Total Time Rate is Calculated

Configure the Pay Policy to Support Total Time Accounting

Define the Compensated and Total Events and Hours Classes

Run the TOTAL_TIME_ACCOUNTING Service

Viewing the Total Time Rate in Transaction Details

Exporting the Total Time Labor Rate and Amount

The Total Time Accounting feature requires the following:

You must have the Total Time Accounting module included in your license file.

The Total Time Accounting module must be enabled.

To check if the module is included in your license and enabled:

Click Main Menu > Configuration > System > Licensing.

On the License Modules tab, select the Module Name called Total Time Accounting.

The following boxes must be checked: Licensed and Module Enabled.

Total Time Accounting has the following limitations:

It only works if the employee has one rate for the whole pay week/period.

It does not factor in coefficients for premium time, such as 1.5 (time-and-a-half) for overtime or 2.0 for double-time.

It does not factor in shift premiums.

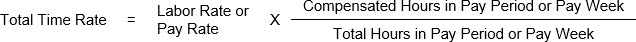

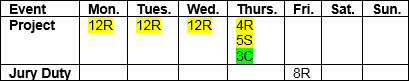

The Total Time Rate is calculated by the TOTAL_TIME_ACCOUNTING service as follows:

The use of the person’s Labor Rate or Pay Rate is determined by the TTA Rate Type in the Pay Policy.

“Compensated Hours” refers to transactions for events and hours classes that are configured with the Total Time Accounting context in the Pay Policy.

“Total Hours” refers to transactions for events and hours classes that are configured with the Total Time Accounting or TTA Total Hours contexts in the Pay Policy.

The Compensated and Total hours may be summed for the pay week or the pay period, depending on how the Pay Policy and the TOTAL_TIME_ACCOUNTING service are configured.

For example, an employee has a rate of $25/hour. The employee works 45 hours in the pay period. 42 of these count as “total” hours and 40 of these hours are “compensated”. The Total Time Rate will be 25 * (40/42) = $23.80/hour.

Total Time Accounting is enabled in a person’s Pay Policy. There are four settings you need to configure.

Total Time Acct

Check this box if you want the TOTAL_TIME_ACCOUNTING service to process transactions for persons assigned to this Pay Policy. The TOTAL_TIME_ACCOUNTING service calculates the Total Time Rate, which is designed to make labor costs the same per hour for all transactions in a week, even when some of those transactions are unpaid.

If you do not check this box, the TOTAL_TIME_ACCOUNTING service will not process transactions for persons assigned to this Pay Policy.

If you check this box, you must also configure the TTA Lock Ind, TTA Range Type, and TTA Rate Type (see below).

You must also use the Events, Event Types, and Hours Class tabs of the Pay Policy form to configure the events and hour classifications that will be used to calculate the Total Time Rate.

TTA Lock Ind

Indicates whether the timecard must be payroll locked and/or signed for the TOTAL_TIME_ACCOUNTING service to process the transactions.

You can set the TTA Lock Ind to Ignore, Require Locks, or Require Sign Locks.

Ignore: The TOTAL_TIME_ACCOUNTING service will process transactions regardless of whether they are payroll locked or signed.

Require Locks: The TOTAL_TIME_ACCOUNTING service will only process transactions when all the days in the range are payroll locked. The date range for the transactions is based on the TTA Range Type in the Pay Policy, the PERIOD_OFFSET parameter for the TOTAL_TIME_ACCOUNTING service, and the date the service runs.

Require Sign Lock: The TOTAL_TIME_ACCOUNTING service checks the employee’s Sign Policy to see if Employee Lock and/or Supervisor Lock are checked. If these options are checked, the service will only process transactions when all the days in the range have the required signatures and locks. The date range for the transactions is based on the TTA Range Type in the Pay Policy, the PERIOD_OFFSET parameter for the TOTAL_TIME_ACCOUNTING service, and the date the service runs.

TTA Range Type

The TTA Range Type is used by the TOTAL_TIME_ACCOUNTING service and its PERIOD_OFFSET parameter to select the date range for which to process transactions. These settings determine whether the Total Time Rate is calculated based on all the transactions in a pay period or based on a single week of transactions in the pay period.

Period: The TOTAL_TIME_ACCOUNTING service will process transactions for the entire pay period. The service’s PERIOD_OFFSET parameter is the minimum number of days after the end of the pay period when the service will process transactions. For example, if the PERIOD_OFFSET is 0, the service will process the current period and earlier periods if it is run on the last day of the period (or later). If the PERIOD_OFFSET is 1, the service will process the current period and earlier periods if it is run on the first day past the end of the period (or later).

Week: This option is only available when the Period Type is Biweekly. The TOTAL_TIME_ACCOUNTING service will process transactions for one week at a time in the biweekly pay period. When you select Week as your TTA Range Type, the service’s PERIOD_OFFSET becomes the minimum number of days after the end of the pay week when the service will process transactions. For example, a biweekly pay period is from Saturday 4/30 to Friday 5/13. The first pay week is from 4/30 to 5/6 and the second pay week is from 5/7 to 5/13. The PERIOD_OFFSET is 0 and the service runs on 5/7. The service calculates the Total Time Rate for the first week (4/30-5/6) only. If the service runs on 5/14, it will calculate the Total Time Rate for each pay week separately. The Total Time Rate for the first week (4/30-5/6) may be different from the Total Time Rate of the second week (5/7-5/13).

Period Incremental Week: This option is only available when the Period Type is Biweekly. The TOTAL_TIME_ACCOUNTING service will process transactions for the first pay week in the biweekly pay period or for the entire biweekly pay period, depending on when the service is run within the pay period and the value of the service’s PERIOD_OFFSET parameter.

This option may be useful if you need to process and export the first week of a biweekly period, instead of waiting for the second week to complete. You can then process and export the entire biweekly period as a single unit when the whole period is ready. When the service processes the entire biweekly period, the service takes both weeks into account to calculate the Total Time Rate. For this reason, the Total Time Rate may be different when the TOTAL_TIME_ACCOUNTING service processes the first week of the period and when it processes both weeks of the period.

See TOTAL_TIME_ACCOUNTING Service Parameters for more information about how the service’s PERIOD_OFFSET parameter and the TTA Range Type affect the date range that is processed.

TTA Rate Type

Indicates whether the person’s Pay Rate or Labor Rate will be used to calculate the Total Time Rate. The Total Time Rate is calculated as (Pay Rate or Labor Rate) x (Compensated Hours/Total Hours).

Select Paid Labor Rate or Paid Pay Rate. A transaction’s Paid Labor Rate and Paid Pay Rate are shown in the Transaction Duration tab of the Transaction Details form.

The Paid Pay Rate is determined by the CALCULATE_RATES service based on the Pay Rate Ruleset in the person’s Pay Policy, unless the transaction has an ADHOC_PAY rate. If the transaction has an ADHOC_PAY rate, the Paid Pay Rate will match the ADHOC_PAY rate.

The Paid Labor Rate is determined by the CALCULATE_RATES service based on the Labor Rate Ruleset in the person’s Pay Policy, unless the transaction has an ADHOC_LABOR rate. If the transaction has an ADHOC_LABOR rate, the Paid Labor Rate will match the ADHOC_LABOR rate.

You need to define the “compensated” and “total” events and hours classes that will be included in the calculation of the Total Time Rate. To do so, use the Events, Event Types, and Hours Class tabs on the Pay Policy form.

Compensated Hours are the events, event types, and hours classifications defined on the Pay Policy tabs with the context Total Time Accounting. Both an event and its hours classification must have the Total Time Accounting context for the transaction’s hours to be considered compensated.

Total Hours are the events, event types, and hours classifications defined on the Pay Policy tabs with the context TTA Total Hours.

Use the Events tab of the Pay Policy form to define specific events for which the hours will be considered “compensated” and/or “total” hours when calculating the Total Time Rate.

Select the Pay Policy (Pay Group Name) from the top of the Pay Policy form. On the Events tab, click Add.

Select the name of the Event you want to include.

Use the Context Name Total Time Accounting if you want the event’s hours to be considered “compensated” hours when determining the Total Time Rate.

Use the Context Name TTA Total Hours if you want the event’s hours to be considered “total” hours when determining the Total Time Rate. Note that “total” hours will also include events and hours classes defined as “compensated” hours (with the Total Time Accounting context).

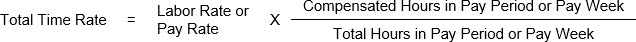

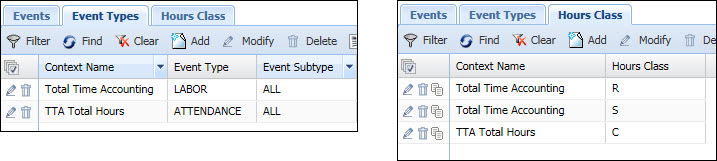

You can also use the Event Types tab of the Pay Policy form to specify the type of event whose hours will be considered “compensated” and/or “total” hours when calculating the Total Time Rate.

Select the Pay Policy (Pay Group Name) from the top of the Pay Policy form. On the Event Types tab, click Add.

Select the Event Type and Event Subtype you want to include.

Use the Context Name Total Time Accounting if you want the event type’s hours to be considered “compensated” hours when determining the Total Time Rate.

Use the Context Name TTA Total Hours if you want the event type’s hours to be considered “total” hours when determining the Total Time Rate. Note that “total” hours will also include events and hours classes defined as “compensated” hours (with the Total Time Accounting context).

Use the Hours Class tab of the Pay Policy form to define the hours classifications that will be considered “compensated” hours and “total” hours when calculating the Total Time Rate. Both an event and its hours classification must be compensated for the transaction’s hours to be considered compensated.

Select the Pay Policy (Pay Group Name) from the top of the Pay Policy form. On the Hours Class tab, click Add.

Select the Hours Class you want to include.

Use the Context Name Total Time Accounting to specify the hour classifications that are considered “compensated” hours when determining the Total Time Rate.

Use the Context Name TTA Total Hours to specify the hours classifications that are considered “total” hours when determining the Total Time Rate. Note that “total” hours will also include events and hours classes defined as “compensated” hours (with the Total Time Accounting context).

At Acme Aerospace, employees are exempt from overtime and receive the same amount each week. Any hours worked over 40 are classified as uncompensated overtime. To ensure the company is reimbursed for their labor costs correctly, Acme Aerospace uses Total Time Accounting.

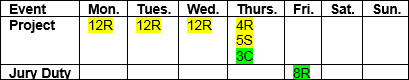

When Acme Aerospace calculates the Total Time Rate, the Compensated Hours will include Labor events with the R (regular time) and S (straight or uncompensated overtime). The Total Hours will include – in addition to R and S hours - those with the C (Comp Time) classification.

The Pay Policy has the configuration shown below on the Event Types and Hours Class tabs.

On the Event Types tab, the Event Type/Subtype of LABOR/ALL with the context Total Time Accounting is added. On Hours Class tab, the R and S classifications are added with the context Total Time Accounting and the C classification is added with the context TTA Total Hours.

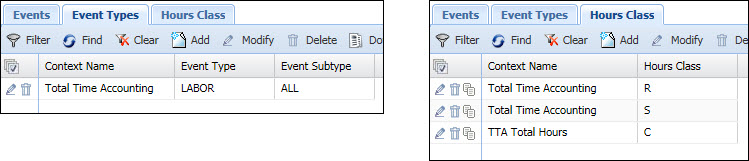

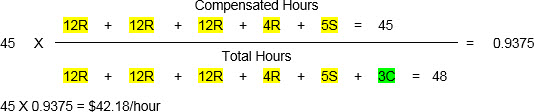

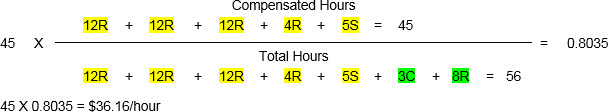

An employee’s timecard shows the following hours. Jury Duty is an ATTENDANCE event. Project is a LABOR event. The employee’s pay rate is $45/hour. Compensated hours (shown in yellow) are labor events with the R and S classification. Total hours consist of the Compensated hours plus labor events with the C hours classification (shown in green).

The Total Time Rate will be calculated as shown below.

If Acme Aerospace decided to include Jury Duty in the calculation for the Total Time Rate, the Pay Policy Event Type configuration would need to change. The Event Type/Subtype of ATTENDANCE/ALL with the context TTA Total Hours would need to be added. The Hours Class configuration would remain the same.

The employee has the same timecard as shown in the previous example. The employee’s pay rate is still $45/hour.

Compensated hours (shown in yellow) are labor events with the R and S classification. Total hours consist of the Compensated hours plus labor events with the C hours classification and the 8-hour Jury Duty event (shown in green).

The Total Time Rate will be calculated as shown below.

Once you have configured your Pay Policies to support Total Time Accounting and defined the “Compensated” and "Total" events and hours classes, you need to schedule or run the TOTAL_TIME_ACCOUNTING service. The TOTAL_TIME_ACCOUNTING service calculates the Total Time Rate for transactions that are configured for Total Time Accounting.

The TOTAL_TIME_ACCOUNTING service will process the transactions of employees assigned to Pay Policies that have Total Time Acct enabled in the Pay Policy. The transactions that will be processed will also depend on the TTA Range Type in the Pay Policy and the service’s PERIOD_OFFSET and PAY_POLICY parameters.

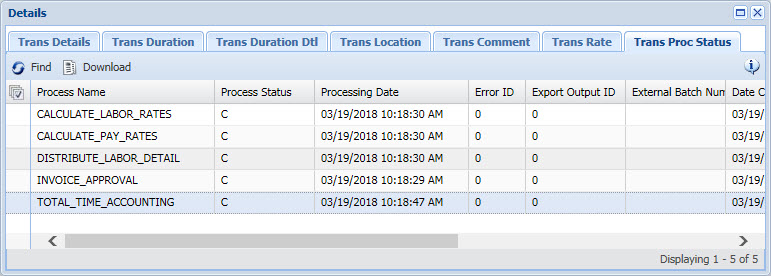

You can check to see whether a transaction has been processed by the TOTAL_TIME_ACCOUNTING service by viewing the Transaction Process Status tab on the Transaction Details form. The Process Name TOTAL_TIME_ACCOUNTING will show a status of R if it is ready to be processed, and C when processing is complete.

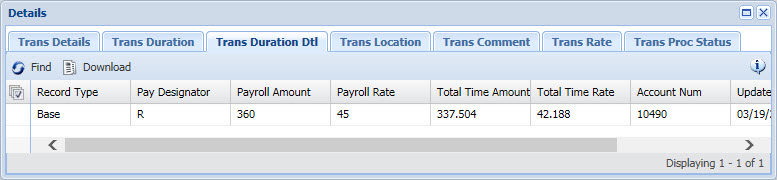

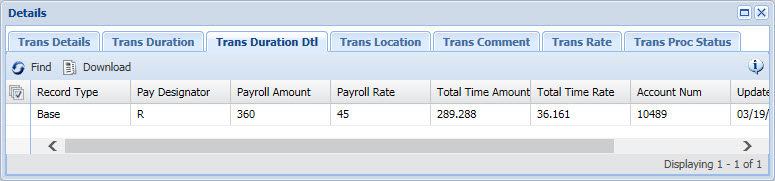

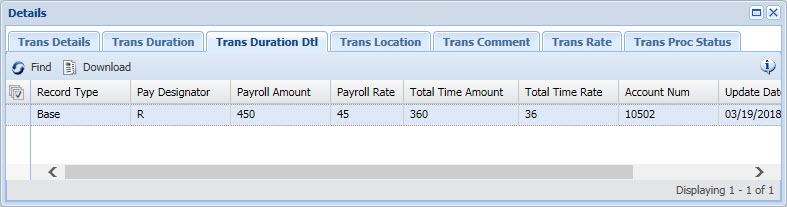

When the service finishes processing, the Total Time Rate and Total Time Amount will display on the Transaction Duration Detail tab of the Transaction Details form.

You can check to see whether a transaction has been processed by the TOTAL_TIME_ACCOUNTING service by checking the Transaction Process Status tab on the Transaction Details form. The Process Name TOTAL_TIME_ACCOUNTING will show a status of R if it is ready to be processed, and C when processing is complete.

When the TOTAL_TIME_ACCOUNTING service finishes processing, the Total Time Rate and Total Time Amount will appear on the Transaction Duration Detail tab of the Transaction Details form.

Once the TOTAL_TIME_ACCOUNTING service has processed the transaction’s Total Time Rate, you can export these values in a Labor Export.

To define your Labor Export, use the Export Definition form.

Click Main Menu > Configuration > Interfaces > Export Definition.

Select your Labor Export from

the Export Name

field (or click the ![]() quick

link and select Add to create a new one).

quick

link and select Add to create a new one).

On the Export Field tab, click Add and begin defining a new record for the Total Time Rate.

Set the Field Source to Table. From the Field Value, select Total Time Labor Rate (Trans Action Duration).

Continue defining the Export Field record for the Total Time Rate and then click Save and Add.

On the Export Parameters tab, set the INCLUDE_DURATION_DETAIL field to True.

Repeat steps 3-6 for the Total Time Labor Amount (Trans Action Duration Dtl). Click Save when you are done.