Rounding on client invoices

Rounding discrepancies can occur on client invoices that bill time and expenses because it is possible for the sum of each individual work-in-progress (WIP) transaction to be different from the calculated subtotal of those transactions.

Learn more about why rounding discrepancies occur

How Ajera handles rounding

Ajera creates a rounding adjustment so that you can always track it, yet it is not an issue on your Final client invoices.

- Draft invoice – you see the rounding adjustment

- Final invoice – no rounding issue

- Invoice amounts in Ajera – identical to the Final invoice

- WIP adjustments due to rounding – you can track them in session journals or transaction inquiries

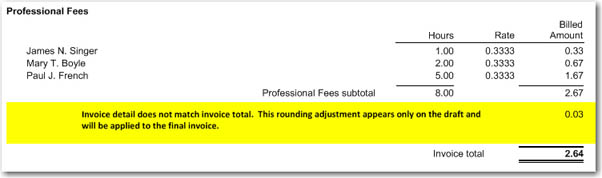

Draft invoice – you see the rounding adjustment

When you print the draft invoice, Ajera shows the rounding adjustment it will make so that the invoice total matches the total of subtotals (the invoice foots across and down).

| Note: | If you have a custom invoice design, the rounding adjustment does not print on the draft invoice. When you print the Final invoice, Ajera creates the adjustments, which you can track in the session journals or transaction inquiries. |

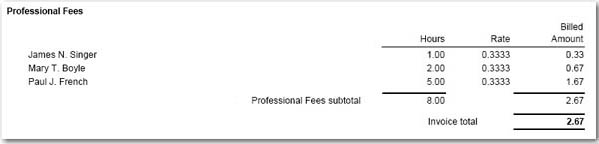

Final invoice – no rounding issues

Before you print the final invoice, Ajera first adjusts the amounts of the WIP transactions so that your invoice is clean and there are no rounding discrepancies.

Ajera adjusts the amounts of the WIP transactions (by 1 cent) so that when added together, they match the subtotal. If the subtotal is off by 1 cent, Ajera adjusts only the first transaction reflected in the subtotal. If it is off by 2 cents, it adjusts the first two transactions by 1 cent each, and so on.

In this way, Ajera ensures that:

- The total of all the WIP transactions is always exactly the same as the total of all the subtotals – the invoice foots across and down.

- If you print the Invoice Summary, the Current Billed total matches the invoice total.

- If you print the Invoice Supporting Detail, the total of the WIP amount matches the invoice total.

| Note: | Invoices that are 100% taxable may show a total sales tax amount that is a few cents off from what would show if the tax was calculated as a fixed percent of the invoice total. |

If the client invoice has phases with different markup percents, for

the subtotals to be accurate, subtotal by phase (on the ![]() >

>

Invoice amounts in Ajera – identical to the final invoice

Because Ajera changes WIP transactions to reconcile rounding discrepancies, the information you see in the Client Invoices window exactly reflects the final invoice you send to the client.

Tracking rounding adjustments

You can see which WIP transactions Ajera adjusted for rounding by viewing:

- The session journal

- The Billed Rounding Adjustment column on the transaction inquiries

Reissuing an invoice

When you reissue a final invoice or change the status to Draft, you start from scratch. Ajera reverses out the rounding adjustment made to any transactions so they appear exactly as you entered them originally.

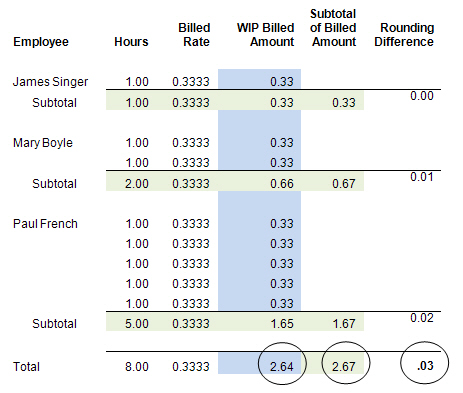

Why rounding discrepancies occur

A rounding difference, often involving 1 cent, can occur because:

- You enter cost rates, billing rates, and multipliers (markups) with as many as 4 decimal places to ensure accuracy or to comply with government requirements.

Invoices show only 2 decimal places for billed amounts; a client cannot pay you fractions of a cent.

- Because your clients require it, you summarize amounts: grouping labor amounts by employee or employee type, expense amounts by activity, or consultant amounts by vendor.

The following example shows how the sum of each transaction is different from the sum of each subtotal.

The effect of rounding from prepayments and adjustments

If you apply a prepayment or adjustment to an invoice where Ajera must round amounts, it can result in 1 cent due on the final invoice.

This issue can occur when the available prepayment matches the unadjusted invoice total, and you apply the full amount of the prepayment or adjustment to the invoice.

Example 1: Rounding adjustment increases invoice total

| Invoice total | Rounding adjustment | Prepayment | |

|---|---|---|---|

|

Draft |

1,000.00 |

.01 |

1,000.00 |

|

Final |

1,000.01 |

|

1,000.00 |

Amount due this invoice: 0.01

Example 2: Rounding adjustment reduces invoice total

| Invoice total | Rounding adjustment | Prepayment | |

|---|---|---|---|

|

Draft |

1,000.00 |

-.01 |

1,000.00 |

|

Final |

999.99 |

|

999.99 |

Amount due this invoice: 0