Special Pay

Special Pay is additional pay that is awarded to an employee

as a result of a special assignment. This additional pay recognizes the

special conditions in which the employee will be working.

For example, an employee who is assigned to work in a place

with hazardous conditions may receive a 10% premium in addition to his

base pay. The employee’s Base Rate of 15.00/hour will be multiplied by

this premium amount and his Special Pay Rate will be 1.50/hour. On a day

when the employee works 9 hours, his regular pay will be 15.00/hour *

9 hours = 135.00. The Special Pay for these hours will be 1.50 * 9 hours

= 13.50. Note that this example assumes the number of hours for which

the employee can receive Special Pay is unlimited. If the employee can

only receive Special Pay for a limited number of hours, his Special Pay

Rate will be prorated. These scenarios are explained in more detail below.

This section explains how to configure the Special Pay

feature.

See Also:

Configure

a Pay Policy for Special Pay

Define the Premium

Codes

Limited and

Unlimited Special Pay

Enable

the Premium Code Event Prompt

Run the SPECIAL_PAY

Service

Export the Special Pay

Premium Codes

Configure

a Pay Policy for Special Pay

Special Pay premiums are calculated for employees assigned

to Pay Policies that have Special Pay enabled. You will need to configure

the following settings in a Pay Policy to enable Special Pay:

Check the Special

Pay box to enable Special

Pay for the Pay Group. When this box is checked, the SPECIAL_PAY service

can process records for the Pay Group.

Set the Special

Pay Limit, if any.

Special Pay Limit defines the maximum number of hours

in the pay week or pay period for which an employee can receive the

premium for Special Pay. For example, an employee may work 120 hours

in a pay period and when these hours are entered in the timecard,

they are all given the Premium Code “D” indicating Special Pay. However,

the employee’s Pay Policy has a Special Pay Limit of 80 hours. When

the SPECIAL_PAY service runs, it prorates the employee’s Special Pay

rate based on this limit.

See Limited

and Unlimited Special Pay for more information.

If you want to limit the number of Special Pay hours

that can be compensated, select whether the Special Pay Limit will

be a Flat Value or the Pay Period Scheduled Paid hours.

If you selected Flat Value as your

Special Pay Limit, enter this hours limit in the Special

Flat Limit box.

Use the Special

Pay Locks field to indicate whether the timecard must be payroll

locked and/or signed for the SPECIAL_PAY service to process the transactions.

The Special

Pay Range is used by the SPECIAL_PAY service and its PERIOD

parameter to select which transactions to process. These settings

determine whether Special Pay is calculated for all the transactions

in a pay period or for the transactions in a single week of the pay

period. See SPECIAL_PAY

Service Parameters

for more information.

Limited

and Unlimited Special Pay

When you enable Special Pay in a Pay Policy, you can define

the Special Pay as Unlimited or Limited (based on a Flat Value or the

Pay Period Scheduled Paid hours) via the Special Pay Limit field. The

Special Pay Limit is used to determine how the Special Pay Premium is

applied.

If Special Pay Limit is Unlimited,

then all the hours that an employee reports with a Special Pay Premium

Code will receive the Special Pay premium.

For example, a person’s Base Rate is 15.00 an hour, the

Premium Code amount is 10%, and the person works 9 hours in one day (all

9 hours have the Special Pay Premium Code). The employee’s regular pay

amount will be 15.00/hr * 9 hours = 135.00. The employee’s Special Pay

amount will be (15.00/hr) * (10% Premium Code) * (9 hours) = 13.50. Likewise,

if the Premium Code amount is a flat rate of 10.00, the employee’s Special

Pay amount will be 10.00/hr * 9 hours = 90.00.

Note: The Premium

Code amount (a percentage or flat rate) is determined by configurations

in the Premium Master, Charge Element, and Element Premium/Rate forms.

See Define the Premium Codes for

more information.

If Special Pay Limit is Flat

Value or Pay Period Scheduled

Paid, and the number of hours in the pay period that have a Special

Pay Premium Code exceeds the Special Pay limit, the Special Pay Rate will

be prorated based on this limit.

This Special Pay Rate will be the Special Pay Rate * (Special

Pay Limit/Total Hours with Special Pay Premium Code).

For example, the employee’s base rate is 15.00/hour and

the employee works 80 hours in the pay period. All 80 hours have the Special

Pay Premium Code but the employee’s Pay Policy has a Special Pay Limit

of 40 hours.

On a day when the employee works 9 hours:

If the Premium Code Amount is 10%, the Special Pay Rate

is calculated as 15.00/hr * 10% * (40/80) = 0.75/hr. The employee’s Special

Pay on this day will be 0.75/hr * 9 hours = 6.75.

If the Premium Code Amount is Flat amount of 10.00, the

Special Pay Rate is calculated as 10.00/hr * (40/80) = 5.00/hr. The employee’s

Special Pay on this day will be 5.00/hr * 9 hours = 45.00.

Define

the Premium Codes

To define the premium codes used for reporting Special

Pay transactions, you need to define the Premiums, define the Premium

Code charge elements, and then assign the Premiums to the Premium Codes.

Note: You can also

import premium codes by creating a Charge Element import in the Import

Definition form.

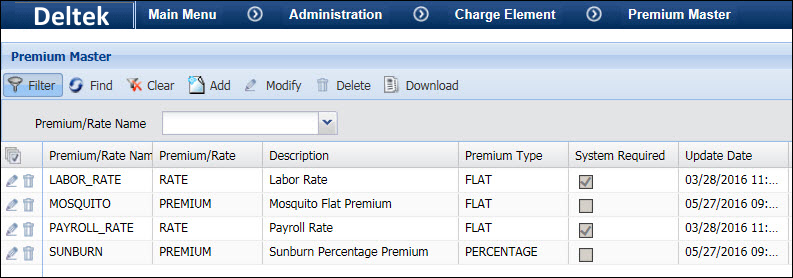

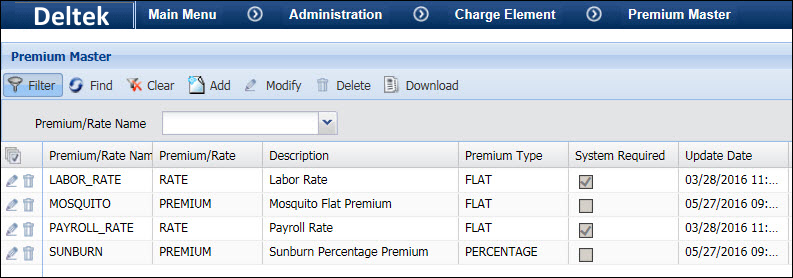

To define the premiums, use

the Premium Master form (Main

Menu > Administration > Charge Element > Premium Master).

The Premium Master form determines whether the premium will be a flat

amount or a percentage; the actual premium amount is defined in the

Element Premium/Rate tab of the Charge Element form.

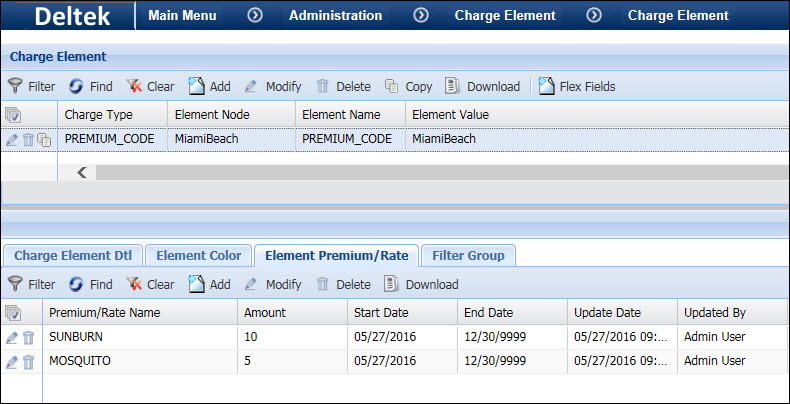

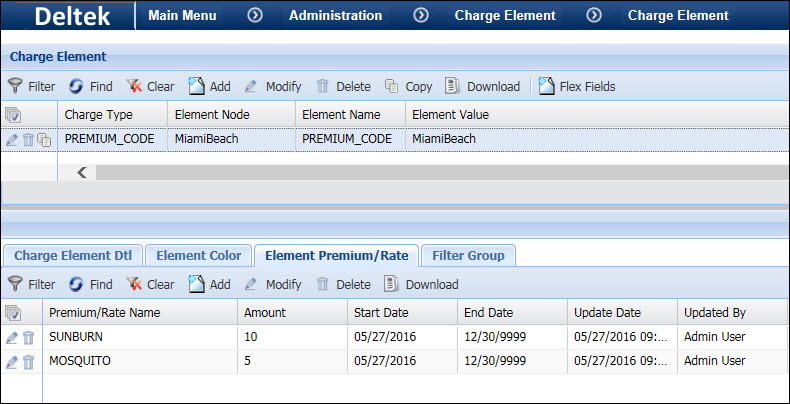

To define the Premium Codes,

use the Charge Element form

(Main Menu > Administration > Charge Element > Charge Element).

To assign one or more premiums

to a Premium Code, use the Element

Premium/Rate tab in the Charge Element form.

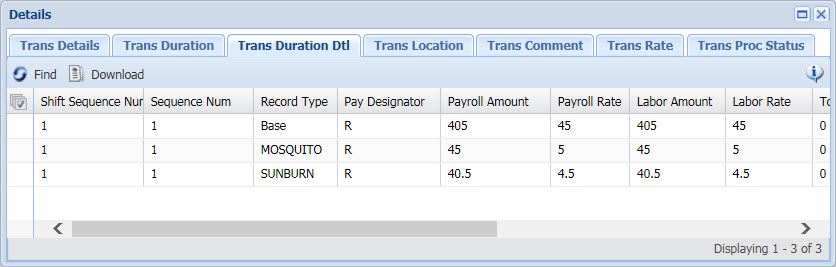

Example

Employees are assigned to work in an area with high temperatures

and aggressive insects (Miami Beach). The employees receive Special Pay

premiums for this work.

In the Premium Master

form, two premiums are defined for this assignment: SUNBURN

(a Percentage premium) and MOSQUITO

(a Flat premium).

In the Charge Element

form, a PREMIUM_CODE named MiamiBeach

is defined.

In the Element Premium/Rate

tab of the Charge Element form, the SUNBURN and MOSQUITO premiums

are added to the MiamiBeach PREMIUM_CODE. SUNBURN has a (percentage)

premium amount of 10 and MOSQUITO has a (flat) premium amount of 5.

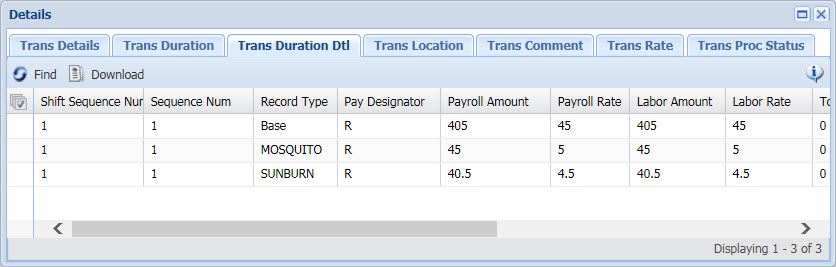

A person’s Base Rate is 45.00 an hour and

the person works 9 hours in one day (all 9 hours have the MiamiBeach PREMIUM_CODE).

For the SUNBURN premium, the employee’s Special Pay amount will be (45.00/hr)

* (10% Premium Code) * (9 hours) = 40.5. For the MOSQUITO premium, the

employee’s Special Pay amount will be 5.00/hr * 9 hours = 45.

Note that the above example assumes Special Pay is unlimited;

if the employee can only receive Special Pay for a limited number of hours,

his or her Special Pay Rate will be prorated. See Limited

and Unlimited Special Pay for more information.

Enable

the Premium Code Event Prompt

The Premium Code event prompt (F_SPECIAL_PAY)

will prompt a user for a Premium Code for hours that should receive Special

Pay. Transactions with this premium code can be processed by the SPECIAL_PAY

service.

The Premium Code event prompt can be enabled for any event.

By default, the prompt is not

included with any event.

You will need to add this prompt (F_SPECIAL_PAY) to any

event for which Special Pay will be reported. To do so, use the Prompt

tab of the Events form.

To control which persons will see the Premium Code prompt

when posting the event, you can use the Person

on Add, Person on Modify,

Manager on Add, and Manager

on Modify options in the Prompt tab.

Set the Valid Value option in the Prompt tab to

Premium Code Valid Values. This

option will display the available premiums in a drop-down list when the

event is posted.

Set the Charge

Type and Element Name options

in the Prompt tab to PREMIUM_CODE.

These options will ensure that the Premium Code event prompt displays

Premium Codes in the list box.

Run

the SPECIAL_PAY Service

The SPECIAL_PAY

service is used to process transactions that have a Premium Code for

Special Pay.

The SPECIAL_PAY service will only process the transactions

of employees assigned to Pay Policies that have Special Pay enabled.

Make sure you run the SPECIAL_PAY service before

you run your Payroll Export.

You must configure three parameters

for this service:

PAY_POLICY: Select

the Pay Policies that will be processed by the SPECIAL_PAY service; make

sure these Pay Policies have Special Pay enabled. If no Pay Policies are

in the Selected column for this

parameter, the SPECIAL_PAY service will process all Pay Policies that

have Special Pay enabled. Note that the MAXIMUM_TIME parameter (see below)

also determines which of the selected Pay Policies will be processed by

the SPECIAL_PAY service.

PERIOD: Select

whether the SPECIAL_PAY service will process transactions in the PREVIOUS

pay week or pay period or the CURRENT pay week or pay period (as well

as earlier periods or weeks). The service selects the transactions to

process based on the PERIOD parameter and the Special Pay Range (Period,

Week, or Period Incremental Week) in the Pay Policy.

MAXIMUM_TIME: Select

whether the SPECIAL_PAY service will process Pay Policies that have Special

Pay Limit set to UNLIMITED or to Flat Value/Pay Period Schedule Paid (LIMITED).

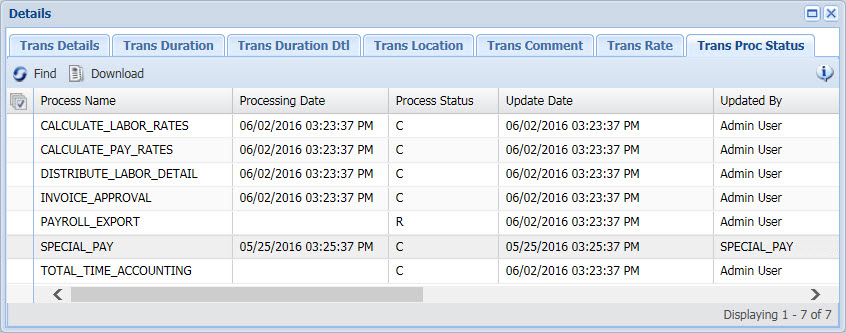

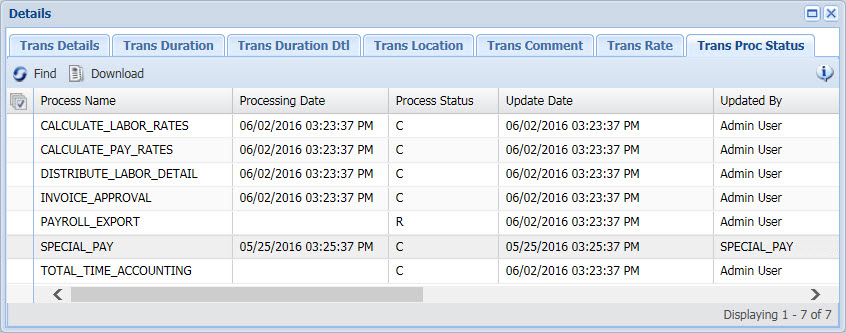

You can check to see whether a transaction

has been processed by the SPECIAL_PAY service by checking the Transaction

Process Status tab in the Transaction Details form. The Process Name

SPECIAL_PAY will show a status of R

if it is ready to be processed, and C

when processing is complete.

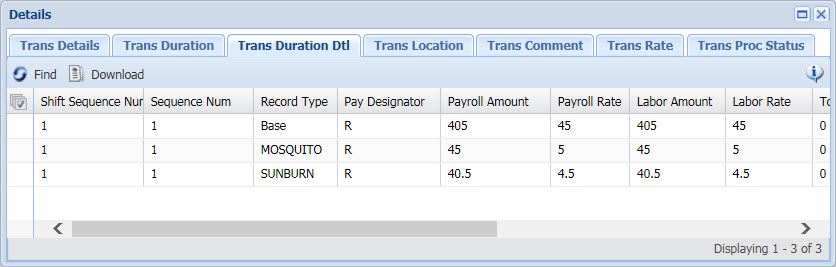

When the service finishes processing, the

Special Pay rates and amounts will display in the Transaction

Duration Detail tab of the Transaction Details form.

Export

the Special Pay Premium Codes

To export the Special Pay rates and amounts with your transactions,

you need to use the Is Record Type

operand in your Export Ruleset.

This operand checks to see if a transaction has a specific premium, such

as Special Pay.

Example:

The following rule exports the payroll amount for transactions

with the Special Pay premium called SP_PREMIUM.

IF:

Is Duration Not Zero( )

And

Is Record Type(SP_PREMIUM )

THEN:

Set Output Double( Get Duration Detail Payroll Rate( ) Multiply Get Duration(

) )

And

Stop Processing( )