EWT and Comp Time are ways of allowing employees to receive compensation when they work more than their regular scheduled hours. It is typically used for salaried employees.

EWT (Extra Work Time) allows a salaried employee to be paid for hours they work in excess of their regular schedule. For example, if an employee works more than 4 hours past their scheduled hours for the week, these extra hours are given a different hours classification and the employee is paid accordingly for these hours.

Comp Time (Compensatory Time) allows a salaried employee to use the hours they worked in excess of their regular schedule as paid time off at a later time. For example, if an employee works more than 5 hours past their scheduled hours for the week, these extra hours are added to a Comp Time Balance. The following week, the employee uses the hours in his Comp Time Balance to take a vacation day.

EWT and Comp Time are calculated by the Pay Rules Ruleset in the employee’s Pay Policy. The hours that an employee works will count toward EWT and Comp Time depending on how the events and hours classifications are configured in the Pay Policy.

A supervisor can authorize hours for EWT and Comp Time for a particular pay week or pay period. The authorized hours will be included in the pay rule that is used to calculate EWT and/or Comp Time. The authorized EWT and Comp Time hours will also display in the timecard.

This section explains how to configure the EWT and Comp Time feature.

See Also:

Configure the Pay Policy for EWT/Comp Time

Define the Events and Hours Classes That Are Eligible for EWT and Comp Time

Configure the Pay Rules for EWT/Comp Time

Using Manual Timecard Classification

Using the Authorized Hours Form

Viewing Eligible/Ineligible Hours, EWT, and Comp Time in the Timecard

Importing Approved EWT and Comp Time

The EWT/Comp Time feature requires the following:

You must have the EWT and Comp Time Form and Configuration module included in your license file.

The EWT and Comp Time Form and Configuration module must be enabled.

To check if the module is included in your license and enabled:

Click Main Menu > Configuration > System > Licensing.

On the License Modules tab, select EWT and Comp Time Form and Configuration under the Module Name column.

Ensure that the following check boxes are selected: Licensed and Module Enabled.

EWT and Comp Time are enabled in a person’s Pay Policy. You need to configure the Extra Work Time, Comp Time, and Time Classification fields for the EWT/Comp Time feature.

Extra Work Time

Indicates whether this Pay Policy supports EWT. Select Disabled, Pay Period, or Weekly.

These settings determine whether you can authorize EWT for the pay week or the pay period using the Authorized Hours form.

Select Disabled if employees assigned to this Pay Policy will not be receiving EWT.

The Weekly option is only available when the Period Type is Biweekly. Select Weekly if you want to authorize EWT for each week in the biweekly pay period separately. This option is used when employees have a biweekly pay period but their pay rules classify time for the pay week, and you want to approve different amounts of EWT or Comp Time for each week.

The Extra Work Time and Comp Time (see below) settings must be the same unless one of the fields is set to Disabled.

Select Pay Period if you want to authorize EWT and Comp Time for the entire pay period.

If you set Extra Work Time to Pay Period or Weekly, you must also specify which events and hours classifications count toward EWT and Comp Time (using the Events and Hours Class tabs on the Pay Policy form). You also need to configure your Pay Rules Ruleset for EWT and Comp Time.

You should also make sure the EWT and Comp Time fields are visible in the timecard if you have enabled this feature. See Viewing Eligible/Ineligible Hours, EWT, and Comp Time in the Timecard for more information.

Comp Time

Indicates whether this Pay Policy supports Comp Time. Select Disabled, Pay Period, or Weekly.

These settings determine whether you can authorize Comp Time for the pay week or the pay period using the Authorized Hours form.

Select Disabled if employees assigned to this Pay Policy will not be receiving Comp Time.

The Weekly option is only available when the Period Type is Biweekly. Select Weekly if you want to authorize Comp Time for each week in the biweekly pay period separately. This option is used when employees have a biweekly pay period but their pay rules classify time for the pay week, and you want to approve different amounts of EWT or Comp Time for each week.

The Extra Work Time (see above) and Comp Time settings must be the same unless one of the fields is set to Disabled.

Select Pay Period if you want to authorize EWT and Comp Time for the entire pay period.

If you set Comp Time to Pay Period or Weekly, you must also specify which events and hours classifications count toward EWT and Comp Time (using the Events and Hours Class tabs on the Pay Policy form). You also need to configure your Pay Rules Ruleset for EWT and Comp Time.

You should also make sure the EWT and Comp Time fields are visible in the timecard if you have enabled this feature. See Viewing Eligible/Ineligible Hours, EWT, and Comp Time in the Timecard for more information.

Time Classification

Indicates when the appropriate hours classification will be posted on the timecard.

Select IMMEDIATE if you want the timecard to be classified as soon as the time is entered on the timecard.

Select DISABLED if you do not want to classify hours on the timecard.

Select MANUAL to display the Classify Period button in the timecard. The Classify Period button will recalculate the previously unclassified timecard and classify the hours. See Using Manual Timecard Classification.

If the employee’s Pay Policy uses MANUAL Time Classification, you can also configure the Sign Policy to classify the timecard when you sign the week or pay period.

If you are using the EWT and Comp Time feature, you may want to select MANUAL so you can wait and classify the timecard after all the hours have been worked and all EWT or Comp Time has been authorized. With this method, adjustments to the timecard will not affect the hours classifications, and you will not have to reprocess the payroll export unnecessarily.

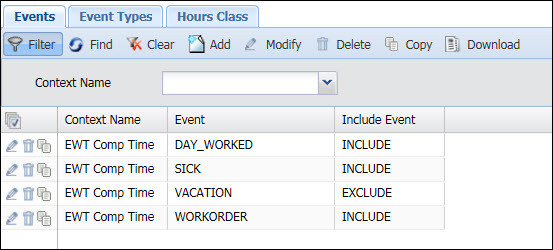

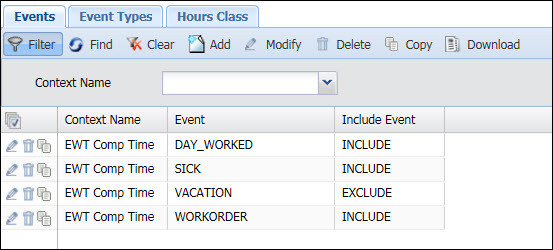

If you set EWT or Comp Time to Pay Week or Pay Period, you must define the events and hours classifications that are eligible for EWT and Comp Time.

To define the events that will be eligible for (count toward) EWT and/or Comp Time, use the Events tab on the Pay Policy form. Use the Context Name EWT Comp Time and set Include Event to INCLUDE or EXCLUDE.

If an event is Included, the event’s hours may be eligible for EWT/Comp Time. If an event is Excluded, the event’s hours will be ineligible for EWT/Comp Time.

If there are no records for EWT Comp Time on the Events tab, then all LABOR events are included (eligible) and all ATTENDANCE events are excluded (ineligible) for EWT/Comp Time.

If there are any records for EWT Comp Time on the Events tab, then only those events with an INCLUDE or EXCLUDE record will be eligible or ineligible for EWT/Comp Time. In this case, if you want a particular event to be eligible or ineligible for EWT/Comp Time, make sure you create an INCLUDE or EXCLUDE record for it.

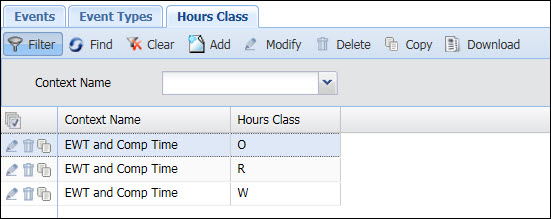

To define the hours classifications that will count toward the eligible hours, use the Hours Class tab on the Pay Policy form. To do so, assign the EWT and Comp Time Context Name to the hours class. For example, you might create an Hours Class record for R (regular time) and O (overtime) but not for U (unpaid time).

If you do not specify an hours classification, then none of the Event hours will be considered "eligible” hours.

It is important that you include all hours classes that will count toward the number of eligible hours. For example, if the pay rules specify that an employee must work a certain number of extra hours before they are eligible for EWT/Comp Time, the classification for these extra hours must be included in the Pay Policy.

You must also include the hours classifications that are used to classify EWT and Comp Time, especially if the pay rules specify that time in excess of the EWT and Comp Time should receive a particular hours class.

To make sure EWT and/or Comp time will be calculated for a transaction, you must define Pay Rules with the following operands:

Add to Balance

Get Aggregate Eligible Hours

Get Authorized Hours

Get Eligible Hours

Get Hours In Between

Is Balance Valid

Refer to the Pay Rules Operands topic for more information.

If you want to prevent the employee’s Comp Time balance from exceeding a maximum value when events are posted, you can also define Pay Rules with the Is Under Balance Available Limit and Get Under Balance Available Limit operands. See Limit Comp Time During Event Posting for more information.

These Pay Rules must be included in the Pay Rules Ruleset in the employee's Pay Policy.

Example 1: The following rule sets the hours classification to “E” for hours in excess of the scheduled hours in a pay period.

IF: Get Eligible Hours( Pay Period, Get Totals Scheduled Paid Hours( Aggregate, Pay Period ) Plus Get Authorized Hours( EWT Hours, Pay Period ), To Date ) Greater Than 0

THEN: Set Hours Classification( Get Eligible Hours( Pay Period, Get Totals Scheduled Paid Hours( Aggregate, Pay Period ) Plus Get Authorized Hours( EWT Hours, Pay Period ), To Date ), E, False, False, False )

Example 2: The following rule gets the time that is eligible for EWT/Comp Time, sets the hours classification to “C,” and then adds these hours to the COMP balance. In this example, employees must work at least five hours past their scheduled hours to be eligible for EWT/Comp Time.

IF: Get Eligible Hours( Pay

Week, Get Total Scheduled Paid Hours( Aggregate, Pay Week )Plus 5 Plus

Get Authorized Hours( EWT Hours, Pay Week ), Aggregate )Greater Than 0

And

Is Balance Valid (COMP)

THEN: Set Hours Classification(

Get Eligible Hours( Pay Week, Get Total Scheduled Paid Hours( Aggregate,

Pay Week ) Plus 5 Plus Get Authorized Hours( EWT Hours, Pay Week ), Aggregate

), C, False, False, False )

And

Add To Balance( Get Eligible Hours( Pay Week, Get Total Scheduled Paid

Hours( Aggregate, Pay Week ) Plus 5 Plus Get Authorized Hours( EWT Hours,

Pay Week ), Aggregate ), COMP )

Example 3: The following ruleset pays employees overtime for the hours they work between 40 and 45 only if the employees work 45 hours or more. Otherwise the hours between 40 and 45 will be classified as “E.” The remaining hours would be classified as “R” (regular). This ruleset would have the following rules:

Overtime Over 40 if 45 Rule:

IF: Get Aggregate Eligible

Hours( Pay Week) Greater Than Equal To 45

And

Get Eligible Hours( Pay Week, 40, To Date) Greater Than 0

THEN: Set Hours Classification( Get Eligible Hours( Pay Week, 40, To Date), O, False, False, False)

Over 40 Excess Rule:

IF: Is Total Hours To( Weekly Overtime Bucket Threshold, 40, Aggregate )

THEN: Set Hours Classification( Get Total Hours To( Weekly Overtime Bucket Threshold, 40, Aggregate ), E, False, True, False )

Everything Else Regular Rule:

IF: Is Duration Not Exhausted( )

THEN: Set Hours Classification( Get Remaining Duration( ), R, True, True, True )

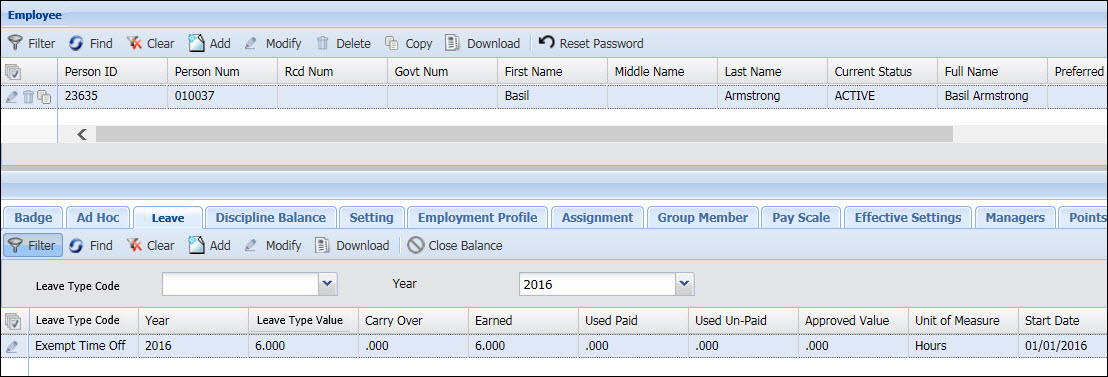

You can view a person’s Comp Time balance on the Balance tab of the Employee form.

The Comp Time balance is updated by the Add to Balance operand in the Pay Rules Ruleset. A person’s Comp Time balance is not updated by the Accruals service.

You need to configure a time-off event (or other event that does not count toward Comp Time) to draw from the Comp Time balance. To do so, use the Leave Type Code tab of the Events form.

Some companies have a policy that Comp Time will not accrue past a certain date in the year, and employees cannot draw from the Comp Time bank after a certain date. For example, unused Comp Time will be paid out on December 1 and no additional Comp Time will be accrued or can be used until January 1 of the following year.

To support this type of policy, your Person Balance records for Comp Time will need to End Date on the appropriate date (for example, the first of December). When the Comp Time balance is no longer effective, employees will not be able to draw from this bank. You also need to include the Is Balance Valid operand in your Pay Rules that add to the Comp Time balance. This operand verifies that a particular balance (in this case, the Comp Time balance) is in effect before adding to the balance.

In the rule example below, time posted to the DAY_WORKED_COMP event will be classified as “C” hours and will be added to the COMP balance only if there is a valid Person Balance record for the COMP leave type code.

IF

Is Event Name (DAY_WORKED_COMP)

And

Is Balance Valid (COMP)

THEN

Set Hours Classification (Get Remaining Duration( ), C, False, False, False)

And

Add To Balance (Get Remaining Duration( ), COMP)

If the Is Balance Valid operand is not included in this rule, the hours will still be classified as “C” even though they may not be added to the COMP balance if it is not valid.

Note: Another way to prevent Comp Time from accruing for a certain period of time is to create a duplicate Pay Policy that has Comp Time disabled with a Start and End Date for that time period. However, as long as the Comp Time balance is still in effect, employees will still be able to draw from it.

If you are using the EWT/Comp Time feature, you may want to use Manual Time Classification so you can wait and classify the timecard after all the hours have been worked and all EWT or Comp Time has been authorized. With this method, adjustments to the timecard will not affect the hours classifications, and you will not have to reprocess the payroll export unnecessarily.

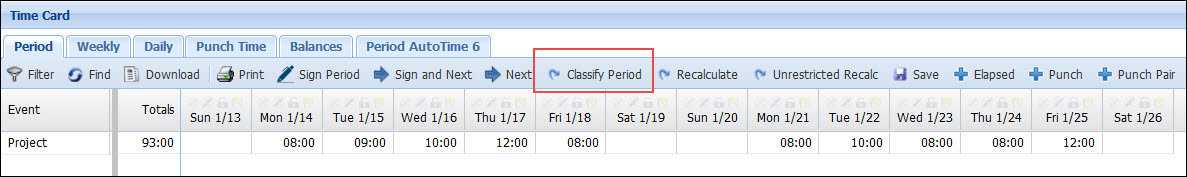

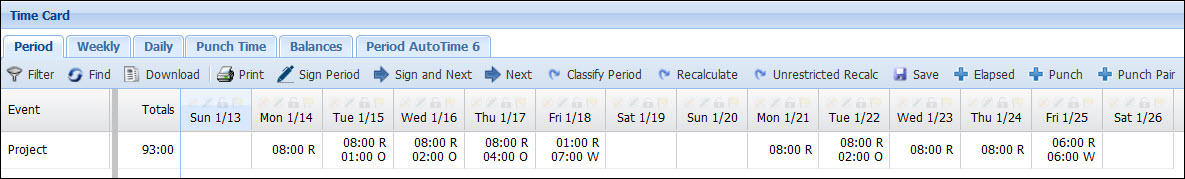

If the employee’s Pay Policy uses MANUAL Time Classification, the Classify Period button will display in the timecard. The Classify Period button will recalculate the previously unclassified timecard and classify the hours. The supervisor will not be able to sign the timecard until the time is classified.

You can configure the Sign Policy to classify the timecard when you sign the week or pay period.

You can also use the CLASSIFY_MANUAL service to automatically classify the timecards of employees assigned to specific Pay Policies for the previous or current pay period.

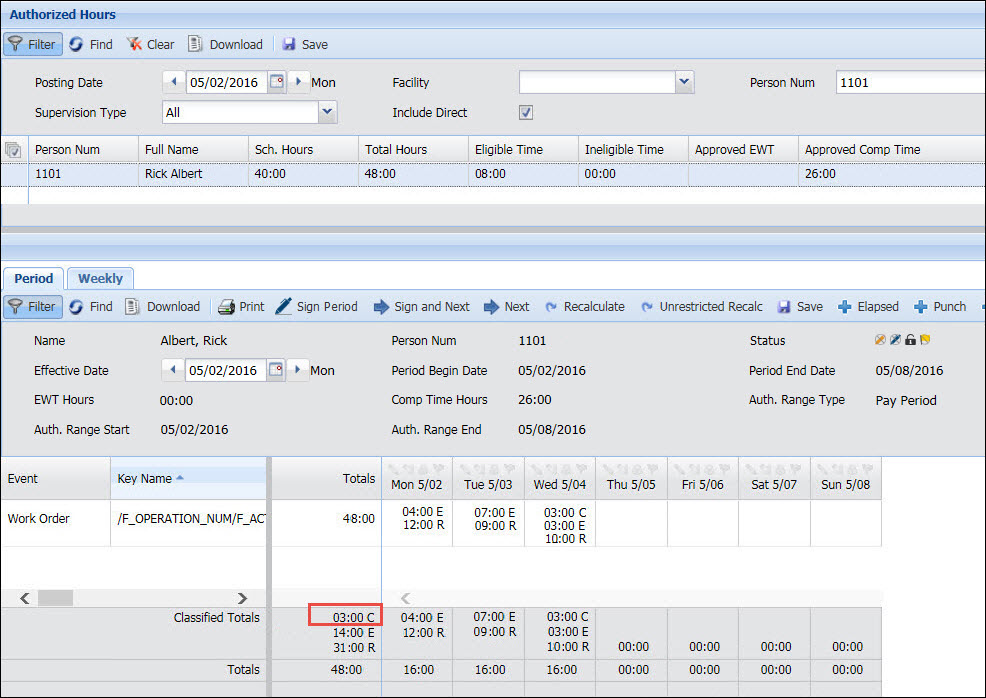

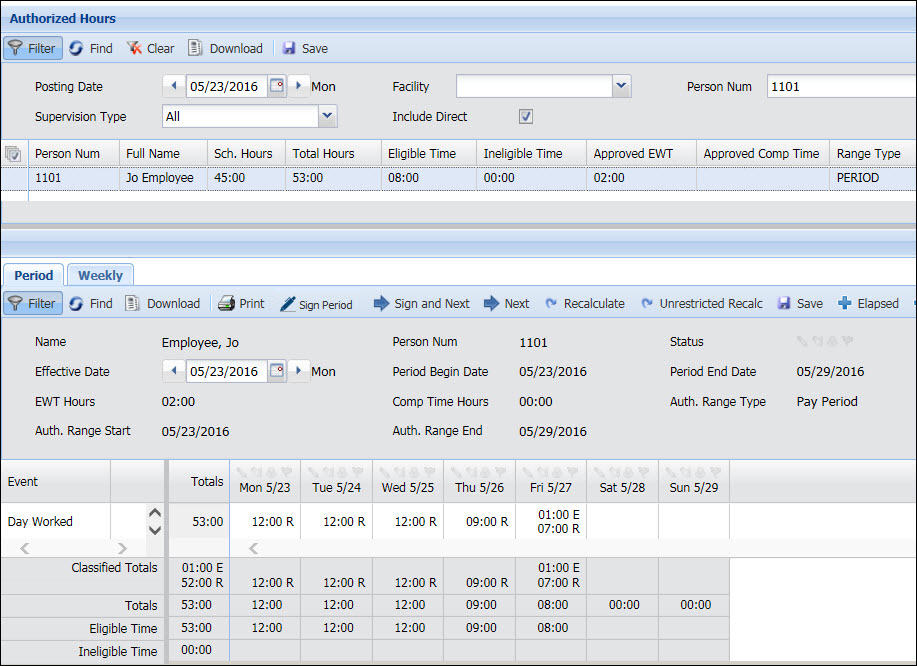

The Authorized Hours form (Main Menu > Manage > Authorized Hours) is used to authorize EWT and Comp Time hours. The authorized hours can be included in the Pay Rule that is used to calculate EWT and/or Comp Time.

A supervisor can authorize EWT or Comp Time hours for an employee by entering the number of hours directly in the grid of the Authorized Hours form.

The Authorized Hours form shows an employee’s scheduled hours, total hours worked, and the number of hours that are eligible or ineligible for EWT and Comp Time. It also shows the Period and Weekly timecard tabs for the employee.

You can also import authorized EWT or Comp Time hours for an employee using the Person Authorized Hours context.

The Period and Weekly timecard tabs can display several fields related to EWT and Comp Time. You will need to enable these fields in your Form Profile to make them visible.

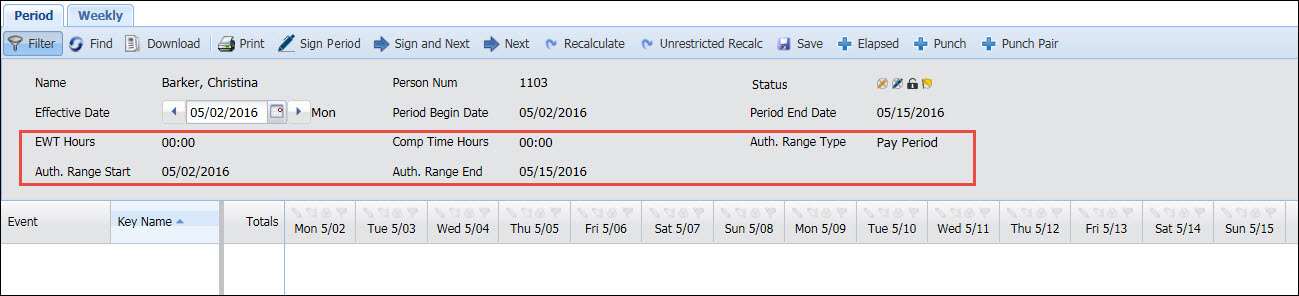

In the filter area of the Period and Weekly timecard, the following fields display for the EWT and Comp Time feature.

EWT Hours displays the Approved EWT hours from the Authorized Hours form for the Effective Date you selected.

Comp Time Hours displays the Approved Comp Time hours from the Authorized Hours form for the Effective Date you selected.

Auth. Range Type is based on the Pay Policy that is in effect on the Effective Date. The Auth. Range Type will be WEEKLY if Extra Work Time and Comp Time in the Pay Policy are set to Weekly. The Auth. Range Type will be PERIOD if Extra Work Time and Comp Time in the Pay Policy are set to Pay Period.

Auth. Range Start, Auth. Range End display the dates for the Auth. Range Type (WEEKLY or PERIOD) based on the Pay Policy that is in effect on the Effective Date you selected.

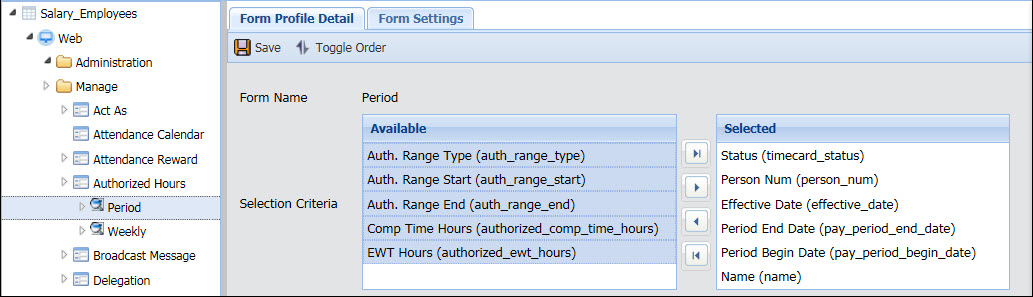

To enable these fields, go to the Form Profile form and select the Form Profile you want to modify. On the left side of the form, select the Period tab in a timecard (for example, Web > Manage > Authorized Hours > Period). On the Form Profile Detail tab, go to the Selection Criteria area. Move the fields from the Available box to the Selected box. Then, click Save.

When you enable or disable these fields for one supervisor timecard tab, the same setting change will be made to all supervisor timecard tabs. For example, if you enable these fields in the Period tab of the Authorized Hours form, the same fields will be enabled on the Period tab of the Current Situation and Time Card Review forms.

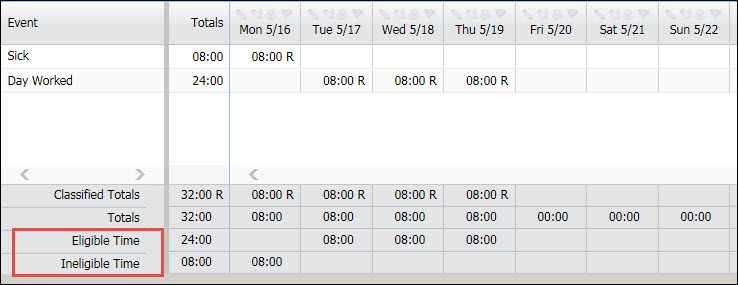

The Period and Weekly tabs of the Supervisor Review and Self Service timecards can display the Eligible Time and Ineligible Time rows. These rows show the number of hours that are eligible or ineligible for EWT and Comp Time.

Note: The Eligible Time that displays in the timecard is different from the Eligible Time on the Authorized Hours form. In the timecard, Eligible Hours is total number of hours worked minus any ineligible time. On the Authorized Hours form, the Eligible Time is calculated by taking the number of hours over schedule that the employee worked and subtracting any Ineligible Time.

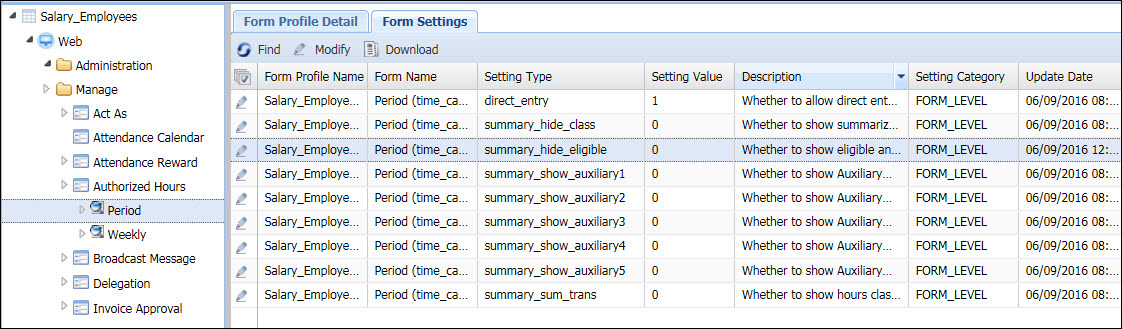

You can show or hide these rows using the summary_hide_eligible setting in the Form Settings form. This setting can be configured differently for the Period and Weekly tabs of the timecard. If summary_hide_eligible is set to 1, the Eligible Time and Ineligible Time rows will not display in the timecard. Change this setting to 0 to display the rows.

When you change the summary_hide_eligible setting for one supervisor timecard tab, the same setting change will be made to all supervisor timecard tabs. For example, if you change this setting to 0 on the Period tab of the Authorized Hours form, the setting will also change to 0 on the Period tab of the Current Situation and Time Card Review forms.

You can limit the amount of Comp Time hours an employee earns to prevent the employee’s Comp Time balance from exceeding a maximum value. This limit can be enforced when the hours are authorized or when the events are posted.

This feature will alert a supervisor if the amount of hours they are approving for Comp Time will cause the person’s Comp Time balance to exceed a maximum value. The supervisors will be alerted when they enter a value in the Approved Comp Time field of the Authorized Hours form and click Save.

This feature is defined in the person’s Pay Policy using the Comp Time Cap, Comp Time Cap Amount, and Comp Time Balance fields.

To determine whether a person’s Comp Time Cap has been reached, the system looks at the following values:

The person’s Comp Time balance (Balance Value shown on the Balances form for the Comp Time Balance specified in the Pay Policy)

The amount of Comp Time hours the supervisor has entered in the Approved Comp Time field of the Authorized Hours form

The amount of Comp Time hours the person has yet to earn. This value is calculated by subtracting the amount already earned from the amount already authorized.

If the sum of the above amounts exceeds the Comp Time Cap Amount, then the supervisor will be warned.

Note that prior pay periods are not considered when determining the amount of Comp Time hours the person has yet to earn; this validation is done for the current period or later. Also, if the current period is payroll locked, the amount yet to earn for that period is considered to be zero.

Example 1:

An employee has 25 hours in his Comp Time Balance. The Comp Time Cap Amount is 27 hours. The supervisor attempts to approve 5 hours of Comp Time in the Authorized Hours form. When the supervisor clicks Save, a message displays that the approval will exceed the Comp Time Cap.

At this point, the supervisor can click OK to approve the hours anyway and exceed the cap. Or, the supervisor can click Cancel to return to the Authorized Hours form and enter a different amount of Comp Time to approve.

You can also configure this feature to display a message that forbids the approval (set Comp Time Cap to Forbid in the Pay Policy). Using the above example, the following message would display:

Example 2:

An employee has 10 hours in his Comp Time Balance. In the current pay period, the employee has earned 3 Comp Time hours and his supervisor has already approved 26 hours of Comp Time. The Comp Time Cap Amount is 27 hours.

The supervisor wants to approve 2 Comp Time hours for the following pay period. The supervisor brings up the following pay period in the Authorized Hours form, enters 2 in the Approved Comp Time field, and clicks Save. The following warning displays:

The warning tells the supervisor the following:

The employee has 10 hours in his Comp Time balance.

If the 2 hours are approved, the total authorized hours will be (26 hours already approved in the current pay period) – (3 earned hours in the current period) + (2 hours the supervisor is trying to approve in the following pay period) = 25.

If the 2 hours are approved, the employee will exceed the Comp Time Cap by 8 hours (25 total authorized hours + 10 hours in Comp Time balance = 35, which is 8 hours over the 27 hour cap).

You can also use Pay Rules to limit the amount of Comp Time hours an employee earns. When the employee posts an event, these Pay Rules will add hours to the Comp Time balance if the hours do not exceed the available balance.

Example

Employee_A is scheduled to work 40 hours per week, Monday - Friday. Time worked over 40 hours will receive the Flextime classification (F) and be added to the FLEXTIME balance, or be classified as Extra Time (E). The employee’s FLEXTIME balance can have a maximum of 8 hours.

Employee_A has an available balance of 5 in his FLEXTIME balance. From Monday – Thursday, he works 36 hours. On Friday, the employee posts a single labor event for 8 hours. These 8 hours are classified as follows:

4 R (Regular) hours

3 F (Flextime) hours. These 3 hours are added to his FLEXTIME balance, bringing the available balance up from 5 to 8.

1 E (Extra Time) hour

Configuration

The following Pay Rule operands have been designed for this feature:

Is Under Balance Available Limit: This operand checks to see if the available balance for a particular Leave Type Code is under a specified limit. The available balance is the Carryover + Earned – Used Paid – Used Unpaid hours in the balance.

Get Under Balance Available Limit: This operand gets the difference between a Limit Amount and the available balance of a Leave Type Code.

These operands will most likely be used in different clauses of the same rule. See Pay Rules Operands for more information.

Rule Example

This rule checks to see if the eligible and authorized Comp Time hours are greater than zero and that these hours are under the limit (8 hours, in this case) for the balance. If these conditions are met, the hours are added to the balance and given the classification “V.”

IF:

Get Eligible Hours( Pay Period, Get Totals Scheduled Paid Hours( Aggregate,

Pay Week ) Plus Get Authorized Hours( EWT Hours, Pay Week ), Aggregate

) Greater Than 0

And

Is Under Balance Available Limit(FLEXTIME, 8 )

THEN:

Add To Balance( Min( Get Eligible Hours( Pay Period, Get Totals Scheduled

Paid Hours( Aggregate, Pay Week ) Plus Get Authorized Hours( EWT Hours,

Pay Week ), Aggregate ), Get Under Balance Available Limit( FLEXTIME,

8 ) ), FLEXTIME )

And

Set Hours Classification( Min( Get Eligible Hours( Pay Period, Get Totals

Scheduled Paid Hours( Aggregate, Pay Week ) Plus Get Authorized Hours(

EWT Hours, Pay Week ), Aggregate ), Get Under Balance Available Limit(

FLEXTIME, 8 ) ), V, False, False, False)

In addition to entering approved EWT and Comp Time hours into the Authorized Hours form, you can also import authorized hours. To do so, you must define an Import Definition for Person Authorized Hours and create an import file with the hours you are importing. After you run this import, the hours can be viewed in the Authorized Hours form.

If your Pay Policy is configured for Weekly EWT and Comp Time authorizations (Extra Work Time and Comp Time fields in the Pay Policy are set to Weekly), your import file needs to specify a date in the pay week for which the hours will be inserted.

Note: The Comp Time Cap will not be supported when you import approved EWT and Comp Time hours. The imported hours will not be checked against the person’s Comp Time Balance.

Click Main Menu > Configuration > Interfaces > Import Definition.

Click the ![]() icon next to the Import Name

field and select Add.

icon next to the Import Name

field and select Add.

You can select CSV, Fixed, or XML as the Import Type. Configure the other settings as necessary and click Save.

With the new Import Name displayed, click the Destination Records tab and click Add.

For the Context Name, select Person Authorized Hours, and click Save.

On the Source Fields tab, click Add.

For the Record Name, select PERSON_AUTHORIZED_HOURS.

Select each Field Name and click Save and Add after each one. Click Save after the last one.

You can change the order of these fields using the Move Up and Move Down buttons.

When you create the import file, make sure the fields in the file are in the same order as the records on the Source Fields tab.

After you run this import, you can view the hours on the Authorized Hours form.

The authorized hours import file must have the same fields you selected for your Import Definition on the Source Fields tab. The fields in the import file must also be in the same order as the records on the Source Fields tab. These fields are explained below.

Action (FI_ACTION)

Indicates whether the hours are to be added (A), updated (U), or deleted (D).

If the Action is A but the person already has authorized hours of that type for the period, these hours will be updated. Likewise, if the Action is U but the person has no authorized hours of that type for the period, the hours will be added.

If the number of authorized hours being imported (the Duration) is zero, you must set the Action to U. If the Action is A and the number of authorized hours being imported is zero, an error will occur.

If the Action is U and the number of authorized hours being imported is zero, the hours will be deleted.

You do not need to include a Duration if the Action is D.

Duration (FI_DURATION)

This field indicates the number of hours being authorized. It must be a decimal number.

If the Duration is set to zero, the action will be considered a deletion. If the Duration is zero, you must set the Action to U. If the Action is A and the Duration is zero, an error will occur.

Hours Type (FI_HOURS_TYPE)

This field indicates the type of authorized hours you are importing. Valid values are EWT_HOURS and COMP_TIME_HOURS.

Pay Period Date (FI_PAY_PERIOD_DATE)

This field is used to determine the pay period into which the authorized EWT or Comp Time hours are being imported.

Note that EWT and/or Comp Time must be enabled in the person’s Pay Policy that is in effect on this date.

If your Pay Policy is configured for Weekly EWT and Comp Time authorizations (Extra Work Time and Comp Time fields in the Pay Policy are set to Weekly), the hours will be imported to the pay week that contains this Pay Period Date. Therefore you should set the Pay Period Date to a date in the pay week for which the hours will be inserted.

Employee (FI_PERSON_NUM)

This field identifies the person who will receive the authorized EWT or Comp Time hours.

The following pay rule classifies time as casual unpaid time (“E”) for hours over 5 in the week that employee works, plus any approved EWT or Comp Time hours.

IF:

Get Eligible Hours (Pay Period, Get Totals Scheduled Paid Hours (Aggregate,

Pay Week) Plus Get Authorized Hours (EWT Hours, Pay Period) Plus Get Authorized

Hours (Comp Time Hours, Pay Period) Plus 5, Aggregate) Greater Than 0

THEN:

Set Hours Classification (Get Eligible Hours (Pay Period, Get Totals Scheduled

Paid Hours (Aggregate, Pay Week) Plus Get Authorized Hours (EWT Hours,

Pay Period) Plus Get Authorized Hours (Comp Time Hours, Pay Period) Plus

5, Aggregate), E, False, False, False)

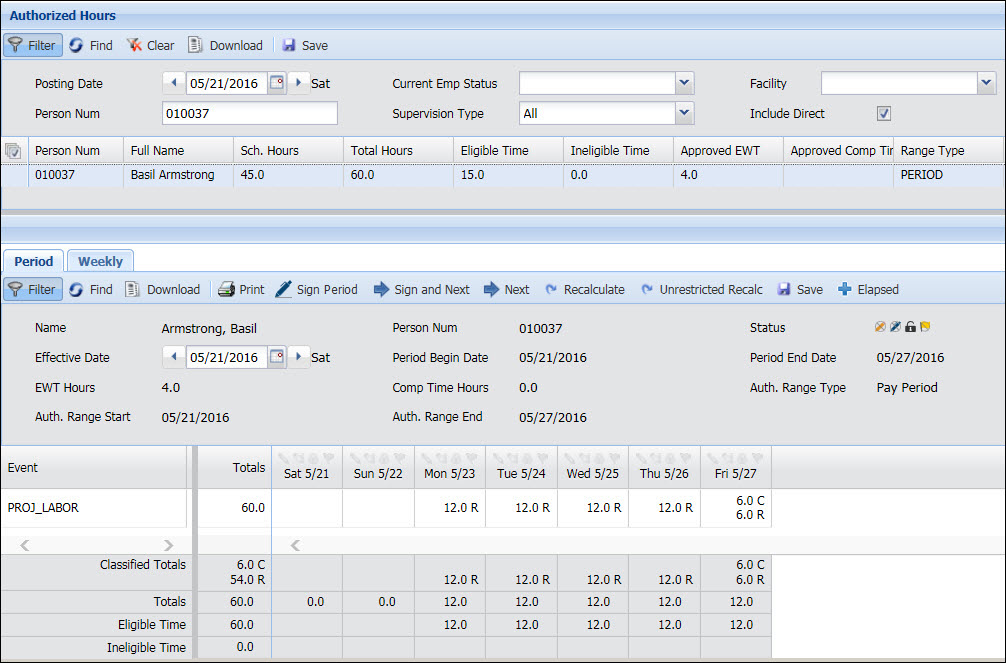

An employee is scheduled to work 45 hours in a weekly pay period. The supervisor approves 2 EWT hours for the pay period. The employee works 53 hours for a total of 8 hours over schedule. The first 5 of these 8 hours will still be classified as R. Of the remaining 3 hours, only 2 have been approved as EWT and will still be classified as R. The employee has 1 hour classified as E.

The following pay rule takes the eligible hours – which are the hours over 5 that the employee works in the week plus any approved EWT hours – and classifies these hours as “C.” It also adds these hours to the person’s ETO balance.

IF:

Get Eligible Hours (Pay Period, Get Totals Scheduled Paid Hours (Aggregate,

Pay Week) Plus Get Authorized Hours (EWT Hours, Pay Period) Plus 5, Aggregate)

Greater Than 0

And

Is Balance Valid (ETO)

THEN:

Set Hours Classification (Get Eligible Hours (Pay Period, Get Totals Scheduled

Paid Hours (Aggregate, Pay Week) Plus Get Authorized Hours (EWT Hours,

Pay Period) Plus 5, Aggregate), C, False, False, False)

And

Add To Balance (Get Eligible Hours (Pay Period, Get Totals Scheduled Paid

Hours (Aggregate, Pay Week) Plus Get Authorized Hours (EWT Hours, Pay

Period) Plus 5, Aggregate), ETO)

An employee is scheduled to work 45 hours in a weekly pay period. The supervisor approves 4 EWT hours for the pay period. The employee works 60 hours for a total of 15 hours over schedule. The first 5 of these 15 hours will still be classified as R. Of the remaining 10 hours, 4 have been approved as EWT and will still be classified as R. The employee will then have 6 hours classified as C.

The employee’s ETO balance will increase by 6 hours as well.