Lesson 3: Review your firm's financials

Learn how to do the following as an important part of evaluating your firm's financial information:

| Start here! | Review the basic financial situation of your firm |

| Evaluate your firm's profitability | |

| Review your firm's cash flow | |

| Test your knowledge |

Review the basic financial situation of your firm

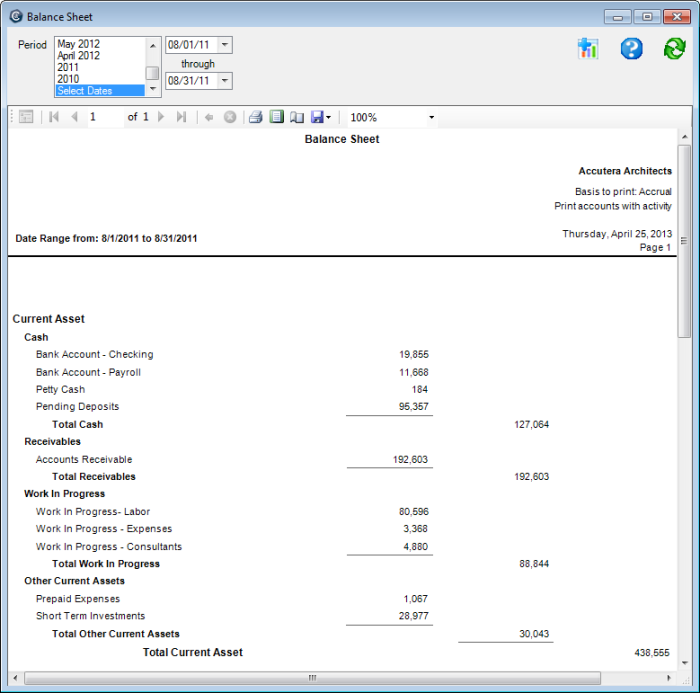

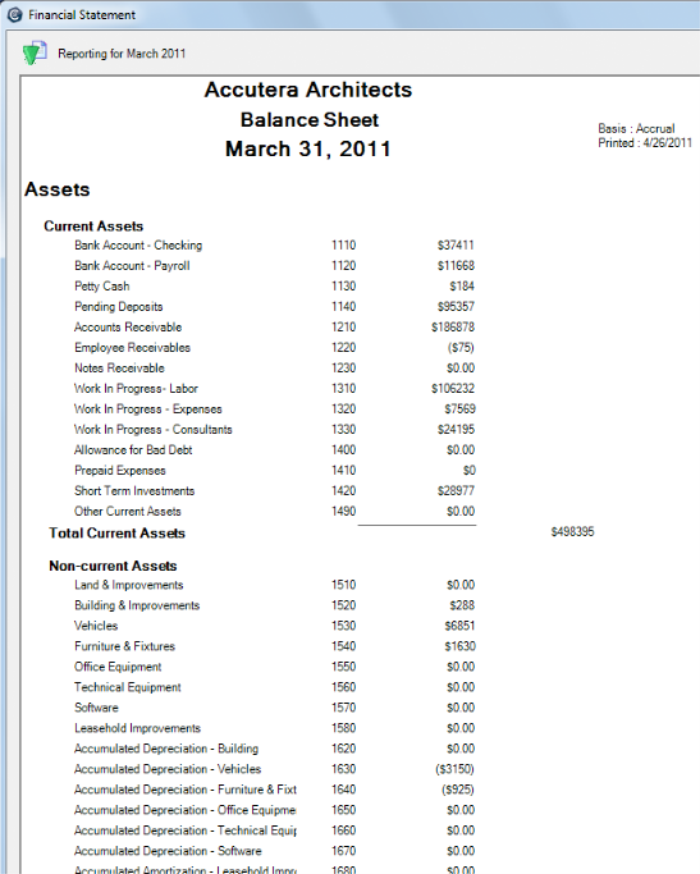

Use the Balance Sheet to review the basic financial position of your company, in a cash or accrual basis.

The report examines the relative relationship between a company's assets, liabilities, and owner's equity as of a specified date.

The report contains subtotals for current and long-term assets and liabilities and owner’s equity accounts. The total assets should always be equal to the total liabilities plus owner’s equity.

Ajera contains two versions of the Balance Sheet:

- Microsoft SQL Server Reporting Services 2005, which is viewable over the web

- Financial Statement Designer, which is easier to customize

You may use both versions to look at the financial position of your company in different ways.

Where to see it

- Microsoft SQL Server Reporting Services 2005: From the Reports menu, click Financial > Balance Sheet.

- Financial Statement Designer:From the Reports menu, click Financial > Financial Statements >Balance Sheet Group.

You can also create and print a Balance Sheet using the Financial Statement Designer. For more information, see this topic in help: Changing the Balance Sheet template design. To return to this course, click the Back button.

What it looks like

Microsoft SQL Server Reporting Services 2005:

Financial Statement Designer:

Evaluate your firm's profitability

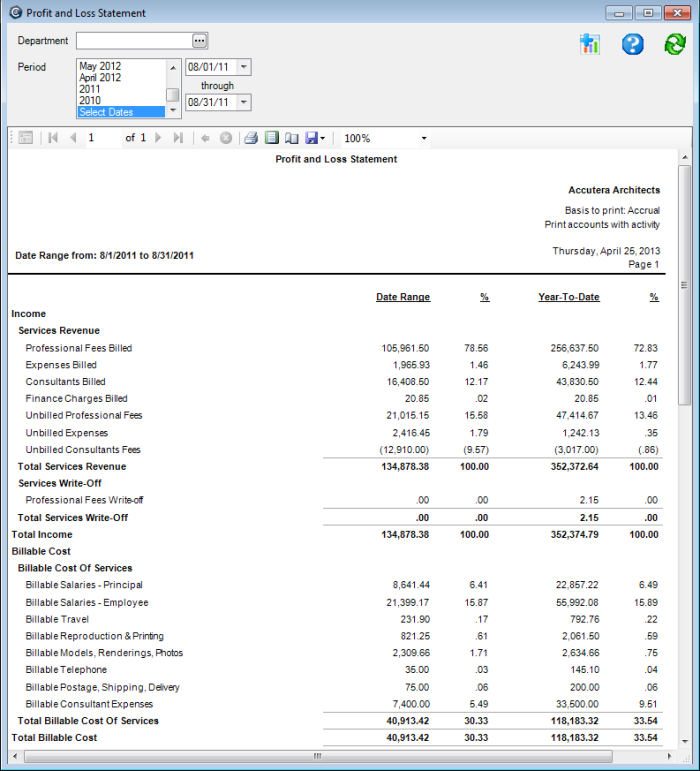

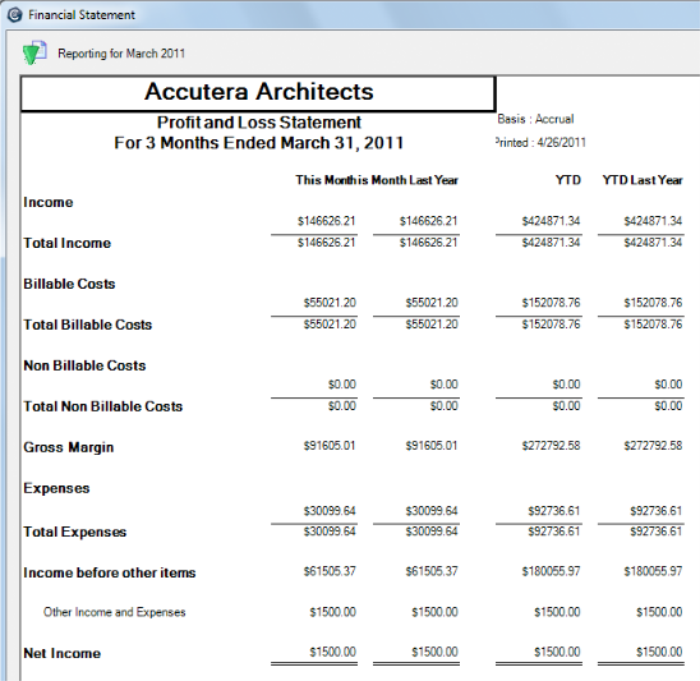

Use the Profit and Loss Statement to help you evaluate your profitability and make adjustments as needed. This report displays basic financial information that measures income relative to expenses for a specified period of time. This report is also called a P&L or Income statement.

Ajera contains two versions of the Profit and Loss Statement:

- Microsoft SQL Server Reporting Services 2005, which is viewable over the web

- Financial Statement Designer, which is easier to customize

You may use both versions to evaluate your profitability in different ways.

Where to see it

- Microsoft SQL Server Reporting Services 2005: From the Reports menu, click Financial > Profit and Loss Statement.

- Financial Statement Designer: From the Reports menu, click Financial > Financial Statements > Profit and Loss Group.

You can also create and print a Profit and Loss Statement using the Financial Statement Designer. For more information, see this topic in help: Changing the Profit and Loss Statement template design. To return to this course, click the Back button.

What it looks like

Microsoft SQL Server Reporting Services 2005:

Financial Statement Designer:

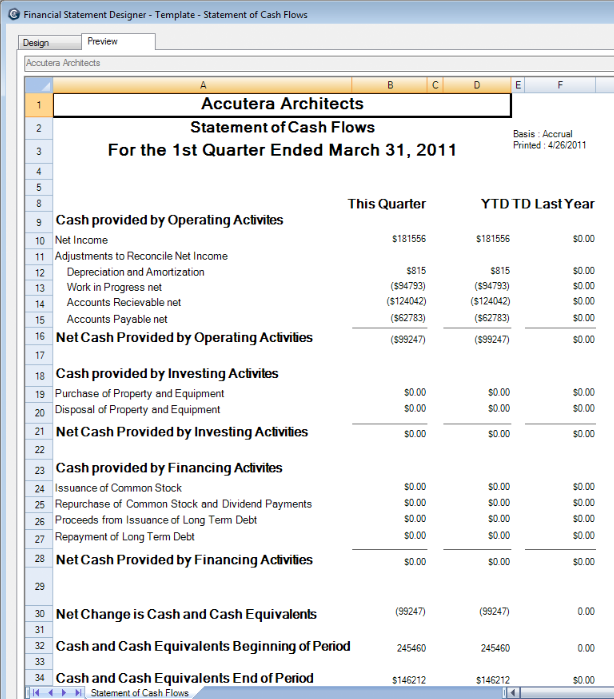

Review your firm's cash flow

Use the statement of cash flows to review the movement of cash through your company. It presents the cash receipts and payments of the company over a period of time. It complements the profit and loss statement by providing information on the company's liquidity and financial flexibility. It also shows the change of cash and cash equivalents during the period.

Where to see it

You can create and print it using the Financial Statement Designer. For more information, see this topic in help: Changing the Statement of Cash Flows template design. To return to this course, click the Back button.

What it looks like

Learn the details

These links go to help. To return to this course, click the Back button.

Changing the Balance Sheet template design

Changing the Profit and Loss Statement template design

Changing the Statement of Cash Flows template design

About designing financial statements

Test your knowledge

Quiz: Review your firm's financials

Next