State-Specific Updates

Use this section to view the details of state-specific regulatory updates.

State Tax Withholding - Blind/Age Exemption

Costpoint Payroll has been updated to support income tax withholding calculations for states that have an exemption amount for blindness or age. The Manage Employee Taxes screen and other applicable screens now provide new fields for holding employee's additional blindness or age exemptions claimed.

New records were added on the Manage State Tax Withholding Adjustments table for the state of Virginia’s exemption amounts.

Release Dates

- 7.1.1 (on-premise): MR 7.1.20 (July 12, 2021)

- 8.0 (on-premise): MR 8.0.11 (June 28, 2021)

Alabama 2022 Standard Deductions/Dependent Exemptions

Alabama's withholding guide was updated to incorporate changes from a bill increasing the state's standard deductions, the state revenue department said May 2.

Costpoint will be updated to support the following new requirements with an effective date of 01/01/2022.

Release Dates

- 8.0 (on-premise): MR 8.0.22 (June 2, 2022)

- 8.1 (on-premise): MR 8.1.8 (May 26, 2022)

Alaska 2023 SUTA Wage Base

Costpoint has been updated to support the 2023 Alaska SUTA taxable wage base limit of $47,100 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Alaska 2022 SUTA Wage Base

Costpoint has been updated to support the new Alaska SUTA taxable wage base limit of $45,200 with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Alaska 2021 SUTA Wage Base

Costpoint has been updated to support the new Alaska SUTA taxable wage base limit of $43,600 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Alaska 2021 Geographic Codes

Costpoint has been updated to support Alaska’s new geographic codes. The Valdez-Cordova Census Area (code 75) was subdivided into the following two new codes:

- Chugach (code 74)

- Copper River (code 76)

Release Dates

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.8 (March 22, 2021)

- 8.0 (on-premise): MR 8.0.8 (Marc 29, 2021)

Arizona 2023 State Tax Withholding

Tax rates used on Arizona’s withholding certificate will decrease for 2023, and all taxpayers must complete a new Arizona Form A-4 for 2023.

State Requirements

For more information, refer to: https://azdor.gov/forms/withholding-forms/arizona-withholding-percentage-election

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Arizona 2023 SUTA Wage Base

Costpoint will be updated to support the new Arizona SUTA taxable wage base limit of $8,000 (from $7,000 in 2022) with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

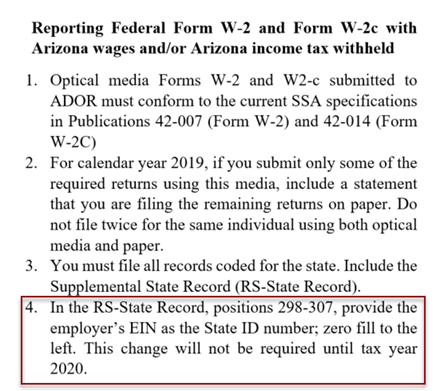

Arizona 2020 W-2 Electronic Filing

The Arizona Department of Revenue has updated their W-2 electronic reporting requirements with the following changes:

- Beginning with the 2020 tax year (due January 31, 2021), all W-2s and 1099s must be submitted electronically.

- In the RS-State Record, positions 298-307, provide the employer’s EIN as the State ID number; zero fill to the left.

State Requirements

Please see the following Arizona Department of Revenue site for additional information: https://azdor.gov/sites/default/files/media/PUBLICATION_701.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

Arkansas 2023 Supplemental Tax Rate

The Arkansas supplemental tax rate has been updated. The rate decreases from 4.9% to 4.7%.

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.24 (September 18, 2023)

8.2. (on-premise): MR 8.2.3 (September 5, 2023)

Arkansas 2023 State Tax Withholding

Arkansas’ withholding methods were updated by the state Department of Finance and Administration. The new withholding formula took effect June 1, 2023. The highest rate decreases to 4.7%, from 4.9%.

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.23 (August 21, 2023)

8.2. (on-premise): MR 8.2.2 (August 7, 2023)

Arkansas 2023 SUTA Wage Base

Costpoint has been updated to support the 2023 Arkansas SUTA taxable wage base limit of $7,000 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Arkansas 2022 State Tax Withholding (Update #2)

Arkansas’ withholding methods were updated by the state Department of Finance and Administration on September 2, 2022 following an income tax cut passed in a legislative special session. The new withholding formula took effect October 1, 2022.

The highest tax rate used decreased to 4.9%, instead of 5.5%, and the tax brackets used were adjusted.

The formula’s standard deduction increased to $2,270, from $2,200, but the value of a state allowance was unchanged at $29.

The withholding instructions were updated to decrease the supplemental withholding rate to 4.9%, also effective October 1, 2022.

The standard deduction increases to $8,000, from $4,500, for single individuals, and to $16,000, from $9,000, for married individuals filing jointly.

The new withholding methods took effect October 1, 2022. The withholding formula was otherwise unchanged except for the increased standard deduction.

State Requirements

For more information, refer to:

Withholding Formula: https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/whformula.pdf

Withholding Instructions: https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/withholdInstructions.pdf

Release Dates

8.0 (on-premise): MR 8.0.27 (October 17, 2022)

8.1 (on-premise): MR 8.1.13 (October 31, 2022)

Arkansas 2022 State Tax Withholding (Update #1)

The Arkansas Department of Finance and Administration updated their 2022 state tax withholding rules effective January 1, 2022. The following are the updates:

- Compared to the 2021 formula, the highest tax rate used is 5.5%, instead of 5.9%, and the number of tax brackets used increased. The value of a state allowance remained $29 and the standard deduction remained $2,200 annually, the department said.

- The supplemental withholding rate also decreased to 5.5%, from 5.9%, the department said in its withholding instructions effective Jan. 1, 2022.

State Requirements

For more information, refer to: https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/withholdInstructions.pdf

Release Dates

- 8.0 (on-premise): MR 8.0.20 (March 28, 2022)

- 8.1 (on-premise): MR 8.1.6 (March 21, 2022)

Arkansas 2021 State W-2 Electronic Filing

The Arkansas Department of Finance and Administration updated their W-2 electronic filing requirements for 2021 reporting. The following two fields in the RS record are now required:

- Supplemental Data Field 1 (Position number 338 - 412) of the Code RS record is required. This field should contain the FEIN of the company as reported in the Code RE Record. Report the number in the first nine places (left justify) and blank fill the rest (9 +66). Do not include hyphens in the FEIN number.

- Supplemental Data Field 2 (Position number 413 - 487) of the Code RS record is required. This field should contain the eleven (11) digit State of Arkansas ID number (ex 12345678whw). Report the account ID in the first eleven places (left justify) and blank fill the rest (9 +66). Do not include hyphens in the ID number.

State Requirements

https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/Mag_Media2021.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

Arkansas 2021 SUTA Wage Base

Costpoint has been updated to support the new Arkansas SUTA taxable wage base limit of $10,000 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

Arkansas 2021 State Tax Withholding

The Arkansas Department of Finance updated their state tax withholding rules effective January 1, 2021. The following are the updates:

- The threshold for adjusting the net taxable income at the $50 range (midrange of 100) increased to 88,001 (from 87,001).

- The value of a state withholding allowance increased to $29, up from $26.

- The tax rates used in the formula decreased to zero to 5.9%, down from zero to 6.6%, and the income tax brackets were adjusted.

State Requirements

For more information, refer to: https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/whformula.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Arkansas 2021 Supplemental Tax Rate

Arkansas updated its 2021 Withholding Tax Employer’s Instructions and reduced the supplemental tax rate from 6.9% to 5.9%, effective January 1, 2021.

State Requirements

For more information, refer to: https://www.dfa.arkansas.gov/images/uploads/incomeTaxOffice/withholdInstructions.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.9 (April 22, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

California EEO-1 Pay Data Report

The California Pay Data Report generated by Costpoint’s Print EEO-1 Report application shall be updated with the following changes:

There will be two sections in the report — Payroll Employee Report and Labor Contractor Employee Report.

The following changes shall be applied to both Payroll Employee Report and Labor Contractor Employee Report:

Include Mean Hourly Rate and Median Hourly Rate.

Update the pay band thresholds.

The Row-Level Clarifying Remark if W-2 Box 1 total earnings will be used for at least one employee in the report shall be reworded to “W-2 Box 1 earnings data have been used for at least one employee.” (from “At least one employee uses W-2 Box 1 earnings.”)

The following Race/Ethnicity/Sex combinations shall be applied to the Labor Contractor Employee Report only:

U10 - Unknown Race/Ethnicity, Known Male

U20 - Unknown Race/Ethnicity, Known Female

U30 - Unknown Race/Ethnicity, Known Non-binary

UU - Unknown Race/Ethnicity, Unknown Sex

To identify the particular pay band to count the payroll employee, the earnings shown in W-2c will be used if there is a record, otherwise the earnings shown in W-2 will be used.

An information message regarding the snapshot period shall be added.

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.24 (September 18, 2023)

8.2. (on-premise): MR 8.2.3 (September 5, 2023)

California 2023 State Tax Withholding

California’s withholding methods were updated for 2023. The following are the updates:

The annual low income exemption threshold increases to $17,252 or $34,503, up from $15,916 or $31,831, depending on the employee’s filing status and, for married employees, the number of allowances claimed.

The annual standard deduction increases to $5,202 or $10,404, up from $4,803 or $9,606, depending on the employee’s filing status and, for married employees, the number of allowances claimed.

The value of a state allowance increases to $154 annually, up from $141.90.

The tax rates used in Method B continue to range from 1.1% to 14.63%. The tax brackets used are to be adjusted compared to 2022.

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

California 2021 Affordable Care Act (ACA) Electronic Reporting

California mandates that any employers filing 250 or more 1095-C returns must file electronically.

Costpoint has been updated to allow generation of an ACA electronic file in the format required by California.

Release Dates

7.1.1 (on-premise): MR 7.1.25 (December 15, 2021)

8.0 (on-premise): MR 8.0.17 (January 4, 2022)

8.1 (on-premise): MR 8.1.3 (December 21, 2021)

California 2022 FUTA Credit Reduction

The Federal Unemployment Insurance Tax Act (FUTA), Sections 3302(c)(2) and 3302(d)(3), provides that employers in states that have an outstanding balance of advances under Title XII of the Social Security Act at the beginning of January 1 of two or more consecutive years are subject to a reduction in credits otherwise available against the FUTA tax, if all advances are not repaid before November 10 of the taxable year. These credit reductions are made from the regular credit reduction of 5.4%. So, while employers in states without a further credit reduction will have a FUTA tax rate of .6% (on the first $7,000 of wages paid) for the year, employers in states with a further credit reduction due to an outstanding balance of advances will incur a FUTA tax rate of .6% + FUTA credit reduction.

According to the U.S. Department of Labor (DOL), California will have a credit reduction of 0.3% for 2022.

For further information, refer to: https://oui.doleta.gov/unemploy/futa_credit.asp

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

California 2022 State Tax Withholding

California updated their withholding schedules for Method B-Exact Calculation Method effective January 1, 2022. The following are the updates:

- The annual standard deduction used in the Method B exact-calculation method and instructions will be either $4,803 or $9,606, up from $4,601 or $9,202, depending on the employee's filing status and, for married employees, the number of state allowances claimed.

- The value of a state allowance increased to $141.90 annually, up from $136.40. The tax rates in Method B continue to range from 1.1% to 14.63%, and the tax brackets were adjusted compared to 2021.

State Requirements

For more information, refer to:

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

California 2021 Affordable Care Act (ACA) Electronic Reporting

California mandates that any employers filing 250 or more 1095-C returns must file electronically.

Costpoint has been updated to allow generation of an ACA electronic file in the format required by California.

Release Dates

- 7.1.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

California 2021 State Tax Withholding

California updated their withholding schedules for Method B-Exact Calculation Method effective January 1, 2021. The following are the updates:

- The annual standard deduction is $4,601, up from $4,537 in 2020.

- The value of a state annual allowance increased to $136.40, up from $134.20 in 2020.

- The low income exemption table has been updated for all filing statuses.

- The withholding tax rate table has been updated for all filing statuses.

State Requirements

For more information, refer to:

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 16, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

California 2021 Pay Data Reporting

California employers of 100 or more employees must report pay and hours-worked data by establishment, job category, sex, race, and ethnicity to the Department of Fair Employment and Housing (DFEH) by March 31, 2021 and annually thereafter. This reporting is required under Government Code section 12999 enacted in SB 973.

A new California Pay Data option has been added to the Costpoint Print EEO-1 Report application to accommodate this requirement.

State Requirements

- Complete list of FAQs: https://www.dfeh.ca.gov/paydatareporting/faqs/

- CA Pay Data Reporting Main Page: https://www.dfeh.ca.gov/paydatareporting/

- CA Pay Data Reporting User Guide:

https://www.dfeh.ca.gov/wp-content/uploads/sites/32/2021/01/CA-Pay-Data-Reporting-User-Guide.pdf

Important Information

The ability to link an employee to a non-binary gender has been added in a separate feature. Please see the following section for more information: Add New Non-Binary Gender Category.

Release Dates

- 7.1.1 (on-premise): MR 7.1.20 (July 12, 2021)

- 8.0 (on-premise): MR 8.0.10 (June 4, 2021)

Colorado Paid Family and Medical Leave Insurance (FAMLI) Program Wage Reporting (Second Update)

Colorado updated their electronic file specifications to Version 1.16 where they have removed the seasonal field for employees. This Costpoint release updates the Create Quarterly Family and Medical Leave File application to support the state’s specifications up to Version 1.16.

For more information, refer to: https://famli.colorado.gov/EMPLOYERS

Target Date

The following target date is subject to change:

8.1 (on-premise): MR 8.1.19 (May 1, 2023)

Colorado Paid Family and Medical Leave Insurance (FAMLI) Program Wage Reporting

Colorado voters approved Proposition 118 in November of 2020, paving the way for a state-run Paid Family and Medical Leave Insurance (FAMLI) program. The FAMLI program is a social insurance program with both employers and employees contributing to the fund that will eventually pay out benefits. Costpoint has been updated to be compliant with version 1.15 of the Colorado Department of Labor and Employment’s My FAMLI+ EmployerWage Report File Formats.

State Requirements

For more information, refer to: https://famli.colorado.gov/EMPLOYERS

Release Date

8.1 (on-premise): MR 8.1.18 (March 31, 2023)

Colorado 2023 State Tax Withholding

Colorado released 2023 versions of withholding formula and its optional withholding certificate were released.

The changes to the withholding formula included the lower tax rate and a clarification in the instructions that amounts of zero entered on Form DR 0004, Colorado Employee Withholding Certificate, must still be used in the formula. In the November elections, voters approved a proposition to reduce the state income tax rate to 4.4% from 4.55%. The standard amounts used in the formula increases if an employee either does not submit Form DR 0004 or leaves Line 2 of the form blank:

For employees with a federal filing status of married filing jointly or qualifying widow or widower, the standard amount increases from $8,000 to $9,000.

For all other filing statuses, the standard amount rises to from $4,000 to $4,500.

State Requirements

For more information, refer to:

DR 1098 Colorado Withholding Worksheet for Employers:

https://tax.colorado.gov/sites/tax/files/documents/DR%201098.pdf

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Colorado 2023 SUTA Wage Base

Costpoint will be updated to support the new Colorado SUTA taxable wage base limit of $20,400 with an effective date of 01/01/2023.

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Colorado - Add New Deduction Type for Paid Family and Medical Leave Insurance (FAMLI) Tracking

Colorado voters approved Proposition 118 in November 2020, paving the way for a state-run paid Family and Medical Leave Insurance (FAMLI) program. FAMLI supports both employees and businesses alike by protecting and supporting them when certain life events happen.

The FAMLI program is funded through premiums paid by both workers and employers (depending on how many employees the business has). In order to comply with the Colorado FAMLI requirements, a new Deduction type will be added, enabling you to indicate which deduction code(s) will be used to track employer and employee contributions for the Paid Leave Oregon program beginning January 1, 2023. Costpoint will be updated as follows:

Manage Deductions

Deduction type COPFML (Colorado FAMLI) will be added to the Deduction Type lookup list.

Manage Employee Deductions

A warning will display if the specified Deduction Code has a deduction type of COPFML but the employee’s SUTA State is not CO (Colorado) in the Manage Employee Taxes screen.

Manage Employee Contributions

A warning will display if the specified Colorado Code has a deduction type of COPFML, but the employee’s SUTA State is not CO (Colorado) in the Manage Employee Taxes screen.

Create Quarterly SUTA Tax File

Beginning Q1 2023, the following positions in the RS record will be populated:

State Quarterly PFMLI Total Wages (RS 341-351)

State Wide Transit Tax Subject Wages (RS 352-362)

State Wide Transit Tax (STT) (RS 363-373)

Important Note

Deltek recommends that Paid Family Medical Leave Insurance (FAMLI) be tracked using a Local Tax code, rather than a Deduction code, so that you’ll have the ability to exclude other deduction amounts, if necessary. A deduction code should only be used to track Family Medical Leave Insurance if your employees currently have no and will never have deductions that need to be excluded from the FAMLI wage base.

State Requirements

For more information, refer to: https://famli.colorado.gov/employers

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Colorado 2022 State Tax Withholding

The Colorado Department of Revenue updated their 2022 state tax withholding rules effective January 1, 2022. The following are the updates:

- Colorado’s 2022 withholding formula incorporates the new optional state withholding certificate, Form DR 0004. If an employee does not complete the new Form DR 0004 certificate, then the employer will calculate Colorado withholding based on the employee’s IRS Form W-4. That calculation is designed to withhold the required Colorado income tax due on your wages throughout the year, and it will generally result in a refund when you file your Colorado income tax return.

- The final version of Form DR 0004 was also released.

State Requirements

- Colorado Withholding Worksheet for Employers: https://tax.colorado.gov/sites/tax/files/DR1098_12-2020.pdf

- 2022 Colorado Employee Withholding Certificate: https://tax.colorado.gov/sites/tax/files/documents/DR0004_2021.pdf

Release Dates

- 8.0 (on-premise): MR 8.0.20 (March 28, 2022)

- 8.1 (on-premise): MR 8.1.6 (March 21, 2022)

Colorado 2022 SUTA Wage Base

Costpoint has been updated to support the new Colorado SUTA taxable wage base limit of $17,000 with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

Colorado 2021 Q1 SUTA Electronic Filing

According to the latest Colorado Department of Labor and Employment Secure File Transfer Protocol Guide for Quarterly Wage Reports, dated January 2021, the format for the reporting quarter and year in the ICESA S record should provide the 4-digit year and the two digit quarter (01, 02, 03, or 04) in the format YYYYQQ. The S record reports this in positions 215-220.

State Requirements

Please see the following Colorado Department of Labor and Employment pdf for additional information: https://cdle.colorado.gov/sites/cdle/files/documents/WageFTPInstructions.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.16 (March 8, 2021)

- 8.0 (on-premise): MR 8.0.7 (February 26, 2021)

Colorado 2020 State Tax Withholding (Retroactive to 01/01/2020)

The Colorado Department of Revenue updated their 2021 state tax withholding rules effective January 1, 2021. The following are the updates:

- Colorado’s flat income tax rate, used for regular and supplemental wages, decreases to 4.55%, from 4.63%. (The decrease was approved by voters at the November 3, 2020 election, and is effective retroactive to January 1, 2020.)

- All employers must calculate the required Colorado wage withholding using the formula (worksheet) and must be used with all Forms W-4. (Previously, Colorado allowed its 2019 percentage method, which included withholding allowances, to be used with Forms W-4 from 2019 or earlier.)

State Requirements

For more information, refer to: https://tax.colorado.gov/sites/tax/files/DR1098_12-2020.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.7 (February 23, 2020)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Connecticut 2022 Q2 SUTA Electronic Filing

The Connecticut Department of Labor (CTDOL) will launch the new tax and benefit system, ReEmployCT, on July 5, 2022. The first quarter of the 2022 tax and wage return will be the last return filed in their current system. Beginning July 5, 2022, employers will file their second quarter 2022 returns and any outstanding returns for previous quarters in the ReEmployCT system. CTDOL has provided a new file format for Unemployment Wage and Tax Reporting. ReEmployCT will allow employers to securely login to the ReEmployCT system and directly upload their files for processing; they will no longer use the File Transfer Protocol (FTP).

ReEmployCT New Format Overview:

- The new file must be a 276-character fixed length text file. It must have a .txt extension.

- Each file that contains wages must contain one “S” record for each reportable employee followed by a “T” record for each employer.

- If submitting a “zero wage tax report”, each file must contain a single “T” record for the employer. Do not submit any “S” records.

- Zero wage tax reports can be included in the same file with employers reporting wages.

- All numbers, including dollar amounts, may not contain decimals, commas, or dollar signs.

- Example: $12,345.67 must appear as 1234567.

- ReEmployCT Page:

- New File Format Requirements for FTP Filers starting July 2022:

https://www.ctdol.state.ct.us/uitax/FTPFileFormatforReEmploy.pdf

Release Dates

- 8.0 (on-premise): MR 8.0.23 (June 27, 2022)

- 8.1 (on-premise): MR 8.1.9 (June 21, 2022)

Connecticut 2022 FUTA Credit Reduction

The Federal Unemployment Insurance Tax Act (FUTA), Sections 3302(c)(2) and 3302(d)(3), provides that employers in states that have an outstanding balance of advances under Title XII of the Social Security Act at the beginning of January 1 of two or more consecutive years are subject to a reduction in credits otherwise available against the FUTA tax, if all advances are not repaid before November 10 of the taxable year. These credit reductions are made from the regular credit reduction of 5.4%. So, while employers in states without a further credit reduction will have a FUTA tax rate of .6% (on the first $7,000 of wages paid) for the year, employers in states with a further credit reduction due to an outstanding balance of advances will incur a FUTA tax rate of .6% + FUTA credit reduction.

According to the U.S. Department of Labor (DOL), Connecticut will have a credit reduction of 0.3% for 2022.

For further information, refer to: https://oui.doleta.gov/unemploy/futa_credit.asp

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Delaware 2023 SUTA Wage Base

Costpoint has been updated to support the 2023 Delaware SUTA taxable wage base limit of $10,500 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Delaware 2022 SUTA Wage Base

Costpoint has been updated to support the new Delaware SUTA taxable wage base limit of $14,500 (down from $16,500 in 2021) with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.28 (February 25, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.5 (February 21, 2022)

Delaware 2020 W-2 Electronic Filing

Costpoint has been updated to support the following 2020 file format updates for Delaware W-2 electronic reporting:

- EFW2 “RW” records should be included in W-2 submissions

- Do not truncate the employee SSN on W-2 “Copy 1—For State, City, or Local Tax Department” or in the EFW2 “RS” record. All nine digits must be present.

State Requirements

For more information, refer to: https://revenue.delaware.gov/frequently-asked-questions/w-2-and-1099-form-faqs/

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

District of Columbia 2022 State Tax Withholding

The District of Columbia Office of Tax and Revenue implemented new personal income tax rates effective January 1, 2022. The new rates were enacted in the Fiscal Year 2023 Budget Support Emergency Amendment Act of 2022. Per the Office of Tax and Revenue, the new rates should be used for withholding despite no formal update to the district’s withholding methods.

The amendment increased tax rates for those earning more than $250,000 per year, up to a highest rate of 10.75%, instead of 8.95%.

State Requirements

For more information, refer to:

Release Dates

8.0 (on-premise): MR 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

District of Columbia 2021 Affordable Care Act Electronic Filing

The District of Columbia enacted legislation that requires all District residents to have minimal essential health care coverage, or have a coverage exemption or pay a tax penalty for tax years ending on or after December 31, 2019. See Individual Taxpayer Health Insurance Responsibility Requirement Amendment Act of 2018, effective October 30, 2018 (D.C. Law 22-168). Those requirements were codified in a new Chapter 51 to Title 47 of the D.C. Official Code.

Insurance companies, businesses providing insurance to their employees, and other applicable entities and third-party service providers that provide minimum essential coverage are required to file returns consistent with D.C. Official Code § 47-5105 as well as other information required by OTR.

All filers are required to file the Health Care Information Returns electronically even if they file less than 250 information returns via the OTR web portal, MyTax.DC.gov.

State Requirements

For more information, refer to:

- Specifications for Electronically Filing DC Health Care Information Returns for Software Developers and Applicable Entities: DC Health Care Info Returns

- File format:

1094B, 1095B, 1094C, and 1095C Layouts-Changes Highlighted in Organge.xlsx

Release Dates

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.5 (February 21, 2022)

District of Columbia 2022 Q1 SUTA Electronic Filing

According to the latest District of Columbia Department of Employment Services, the file requirements have been updated:

- Employer ICESA Record Type A: Fields 208-275 have been updated

- Employer ICESA Record Type E: Fields 149-158 have been updated

- Employer ICESA Record Type S: Fields 135-275 have been updated

State Requirements

Please be advised that the Department of Employment Services (DOES) is scheduled to transition to their new tax system, the District of Columbia Employer Tax System (DCETS), in early 2022. However, they are still testing the new system and are not sure when they will require the new file requirements.

Please see the District of Columbia DCETS Wage File Format Specifications for additional information: https://essp.does.dc.gov/DCETSWageFileSpecs_121.pdf

Release Dates

(Work is in progress, but target dates are to be determined as the Department of Employment Services (DOES) has not implemented the new system requirements yet.)

- 8.0 (on-premise): (To be determined)

- 8.1 (on-premise): (To be determined)

Florida 2023 Q3 SUTA Electronic Filing

Florida now requires an amendment reason if an amended quarterly SUTA file is submitted. You will be able to select from the following list on the Create Quarterly SUTA Tax File screen:

28 – Response to RTFL04A

29 – Response to RTFL06A

30 – Respone to RTFL13A

31 – SSN Correction

32 – Out of State Wages

33 – Adding Wages

34 – Decreasing Wages

41 – Employee Name Change

42 – Exempt - Cafeteria Plan

43 – Exempt - Family Employee

44 – Exempt - Student

46 – Owner's Wages \

47 – Modify Tips Reported

48 – Modify Educational Wages 49 – Other

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.23 (August 21, 2023)

8.2 (on-premise): MR 8.2.2 (August 7, 2022)

Florida 2023 Q2 SUTA Electronic Filing

Costpoint's Software ID for Reemployment Tax XML has been updated to HN3THwvdM4 as of March 13, 2023. The current Software ID, GYaUXnCCLz, will remain active for six months. The Create Quarterly SUTA Tax File screen was updated to support this change.

Target Dates

The following target dates are subject to change:

8.0 (on-premise): MR 8.0.34 (May 9, 2023)

8.1 (on-premise): MR 8.1.19 (May 1, 2023)

Florida 2022 Q4 SUTA Electronic Filing

The Florida Department of Revenue published a new reemployment tax XML specifications package, which provides enhancements including the ability to file reports with no employees. The following requirement to report at least one employee has been removed in XML schema v2022 1.0:

At least one employee must be reported. If there are no employees to report, enter “Jane Doe”, with a Social Security number of “999999999”.

Release Dates

8.0 (on-premise): MR 8.0.27 (October 17, 2022)

8.1 (on-premise): MR 8.1.13 (October 31, 2022)

Florida 2021 Q3 SUTA Electronic Filing

The Florida Department of Revenue provided a new production Software ID for Costpoint.

- Current Software ID: E5jrxLXfPM

- New Software ID: GYaUXnCCLz

Important

The current Software ID will remain active for four months so clients must have the update implemented by December 3, 2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.22 (September 13, 2021)

- 8.0 (on-premise): MR 8.0.14 (September 29, 2021)

- 8.1 (on-premise): MR 8.1.1 (October 21, 2021)

Georgia State 2022 Tax Withholding

The Georgia Department of Revenue has increased the standard deduction amounts effective January 1, 2022. The personal and dependent allowances used in the percentage method, as well as the percentage method tables themselves, were unchanged from the 2021 guide.

- The standard deduction amount increases to $7,100 (from 6,000) for employees that are Married Filing Joint Return.

- The standard deduction amount increases to $5,400 (from 4,600) for employees that are Single or Head of Household.

- The standard deduction amount increases to $3,550 (from 3,300) for employees that are Married Filing Separate Return.

State Requirements

For more information, refer to: https://dor.georgia.gov/document/document/2022-employers-tax-guidepdf/download

Release Dates

- 7.1.1 (on-premise): MR 7.1.24 (November 17, 2021)

- 8.0 (on-premise): MR 8.0.16 (December 3, 2021)

- 8.1 (on-premise): MR 8.1.2 (November 24, 2021)

Guam 2023 Tax Withholding

The Guam tax tables have been updated to reflect the 2023 U.S. federal tax tables.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Guam 2022 Tax Withholding

The Guam tax tables have been updated to reflect the 2022 U.S. federal tax tables.

Release Dates

- 7.1.1 (on-premise): MR 7.1.28 (February 25, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.5 (November 21, 2022)

Guam 2021 Tax Withholding

The Guam tax tables will be updated to reflect the 2021 U.S. federal updates.

State Requirements

For more information, refer to: https://www.irs.gov/pub/irs-pdf/p15t.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Guam 2020 Tax Withholding

The following changes were made to support Guam's 2020 tax table rules:

- A check box has been added to the Manage State Taxes (PRMSTI) screen which will allow you to indicate whether or not the US territory's income tax calculations is the same as the federal income tax calculations.

- New filing statuses have been added to indicate if withholding method will be based from the 2020 Form W-4.

- Guam tax tables have been provided.

- All applications which calculate Guam taxable wages and tax withholding have been updated to accommodate Guam's requirements.

- Costpoint ESS now allows employees to provide their State W-4 data for Guam and any other territory that has the same income tax calculations as the federal income tax calculations.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.2 (September 22, 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

Hawaii 2023 SUTA Wage Base

Costpoint has been updated to support the new Hawaii SUTA taxable wage base limit of $56,700 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Hawaii 2022 SUTA Wage Base

Costpoint has been updated to support the new Hawaii SUTA taxable wage base limit of $51,600 with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Hawaii 2021 SUTA Wage Base

Costpoint has been updated to support the new Hawaii SUTA taxable wage base limit of $47,400 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Hawaii 2020 W-2 Electronic Filing

If you are an employer or payroll provider who is required by the federal government to electronically file Form W‐2, Wage and Tax Statements, or Form W‐2C during the year, you must also electronically transmit these informational returns to the Hawaii Department of Taxation. Costpoint has been updated to support the EFW2 file for Hawaii W-2 electronic reporting.

State Requirements

Please see the following State of Hawaii Department of Taxation site for additional information:

https://files.hawaii.gov/tax/eservices/ebiz/20pubef10-HI_EFW2SpecsGuide-v1rev102020.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Idaho 2023 State Tax Withholding

Idaho’s 2023 table for percentage computation method of withholding has been updated.

The percentage method flat rate is now 5.8%.

The 0% tax bracket’s upper threshold increased from $12,950 to $13,850 for single employees and heads of households and from $25,900 to $27,700 for married employees.

The value of Idaho Child Tax Credit Allowance increased from $3,417 to $3,534 annually.

Release Dates

- 8.1 (on-premise): MR 8.1.22 (July 31, 2023)

- 8.2 (on-premise): MR 8.2.2 (August 7, 2023)

Idaho 2023 SUTA Wage Base

Costpoint has been updated to support the new Idaho SUTA taxable wage base limit of $49,900 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Idaho 2022 State Tax Withholding

Idaho’s 2022 withholding methods were released by the state tax commission. The percentage method implements tax rate cuts in a bill (H.B. 436). The bill reduced the number of tax rates used to four instead of five and reduced the highest rate used to 6%, instead of 6.5%. Other updates include the following:

- The zero-percent tax bracket’s upper threshold increased from $12,550 to $12,950 for single employees and heads of households and from $25,100 to $25,900 for married employees.

- The value of Idaho Child Tax Credit Allowance increased from $3,154 to $3,417 annually.

- The tax rate for supplemental payments decreased from 6.5% to 6%.

Release Dates

- 8.0 (on-premise): MR 8.0.24 (July 12, 2022)

- 8.1 (on-premise): MR 8.1.10 (July 25, 2022)

Idaho 2022 SUTA Wage Base

Costpoint has been updated to support the new Idaho SUTA taxable wage base limit of $46,500 with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Idaho 2021 State Tax Withholding

On July 7, the Idaho state tax commission updated their withholding methods to include income tax rate and bracket changes:

- Number of income tax brackets reduced to five, from seven

- Tax rates have been set from zero to 6.5%, instead of from zero to 6.925%

- Upper threshold of the zero-percent tax bracket increased to $12,550, from $12,400, for single employees

- Upper threshold of the zero-percent tax bracket increased to $25,100, from $24,800, for married employees

- Value of a state allowance increased to $3,154, from $2,960

- Supplemental withholding rate decreased to 6.5%, from 6.925%

Release Dates

- 7.1.1 (on-premise): MR 7.1.21 (August 16, 2021)

- 8.0 (on-premise): MR 8.0.13 (August 30, 2021)

Idaho 2021 SUTA Wage Base

Costpoint has been updated to support the new Idaho SUTA taxable wage base limit of $43,000 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

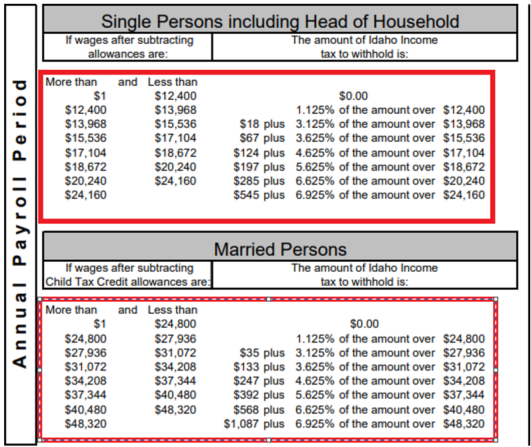

Idaho 2020 State Tax Withholding

Idaho's 2020 withholding methods, were released June 16 by the State Tax Commission. The highest tax bracket now starts at annual income of $48,320, up from $47,508, for married individuals, and at annual income of $24,160, up from $23,754, for other individuals. Costpoint has been updated to support these tax table changes.

Release Dates

- 7.1.1 (on-premise): MR 7.1.8 (July 31, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.2 (September 22, 2020)

Illinois 2023 State Withholding – Update #2

Illinois updated its withholding formula by reducing the value of a state allowance to its 2022 level. Public Act 103-0009 set the value of a state allowance at $2,425, instead of the 2023 value of $2,625.

An additional formula was added to correct withholding for existing employees for the remainder of 2023. The formula is the same as the standard formula but uses an allowance value of $2,225. Costpoint has been updated as follows:

Added 06/07/2023 record in Manage State Tax Withholding Adjustments by setting the amount per exemption to 2,425.00

Added special programming in Compute Payroll to use the allowance of 2,225 until 12/31/2023 for employees hired prior to 06/07/2023.

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.23 (August 21, 2023)

8.2 (on-premise): MR 8.2.2 (August 7, 2022)

Illinois 2023 SUTA Wage Base

Costpoint has been updated to support the 2023 Illinois SUTA taxable wage base limit of $13,271 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Illinois 2023 State Withholding - Update # 1

The Illinois Department of Revenue updated their Booklet IL-700-T effective 01/01/2023:

The value of a state allowance increases to $2,625, from $2,425.

The value of an additional allowance for age or blindness was unchanged at $1,000.

The state uses a 4.95% flat tax rate.

State Requirements

For more information, refer to the Illinois Withholding Tax Tables - Booklet IL-700-T.

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Illinois 2022 FUTA Credit Reduction

The Federal Unemployment Insurance Tax Act (FUTA), Sections 3302(c)(2) and 3302(d)(3), provides that employers in states that have an outstanding balance of advances under Title XII of the Social Security Act at the beginning of January 1 of two or more consecutive years are subject to a reduction in credits otherwise available against the FUTA tax, if all advances are not repaid before November 10 of the taxable year. These credit reductions are made from the regular credit reduction of 5.4%. So, while employers in states without a further credit reduction will have a FUTA tax rate of .6% (on the first $7,000 of wages paid) for the year, employers in states with a further credit reduction due to an outstanding balance of advances will incur a FUTA tax rate of .6% + FUTA credit reduction.

According to the U.S. Department of Labor (DOL), Illinois will have a credit reduction of 0.3% for 2022.

For further information, refer to: https://oui.doleta.gov/unemploy/futa_credit.asp

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Illinois 2022 State Withholding

The Illinois Department of Revenue updated their withholding formula effective 01/01/2021:

- Update the personal exemption to $2,425

State Requirements

https://www2.illinois.gov/rev/forms/withholding/Documents/currentyear/2022%20IL-700-T.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Illinois 2021 SUTA Wage Base

Costpoint has been updated to support the new Illinois SUTA taxable wage base limit of $12,960 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Illinois 2021 State Tax Withholding

The Illinois Department of Revenue updated their 2021 state tax withholding rules effective January 1, 2021. The value of a state withholding allowance in the withholding formula increased to $2,375, from $2,325 in 2020.

State Requirements

For more information, refer to: https://www2.illinois.gov/rev/forms/withholding/Documents/currentyear/il-700-t.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Indiana 2023 State Tax Withholding

Effective on or after January 1, 2023, the state income tax rate decreases from 3.23% to 3.15%.

State Requirements

For more information, refer to:

Departmental Notice #1 (R40/12-22): https://www.in.gov/dor/files/dn01.pdf

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Indiana W-2 Reporting Box 20 Format

The Indiana Department of Revenue issued an information bulletin that provides employers with the necessary information to correctly indicate Indiana adjusted gross income tax withheld and county income tax withheld on the state copy of Federal Form W-2, Wage, and Tax Statement.

All Indiana state and county income tax withheld by an employer must be designated in the appropriate boxes of the state copy of the W-2 form.

Box 15 – abbreviation IN

Box 16 – amount of wages subject to Indiana income tax

Box 17 – amount of Indiana income tax withheld

Box 18 – amount of wages subject to county income tax

Box 19 – amount of county income tax withheld

Box 20 – enter C and the adopting county code in box 20

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Indiana 2022 State Tax Withholding - Phase 2

Indiana's Departmental Notice No. 1 was updated to add a third deduction constant table for a new exemption for adopted children. The $3,000 annual exemption for adopted children was added in the legislation.

The Actual Number of Adopted Children field was recently added on the Manage Employee Taxes screen and in ESS, where you were instructed to specify the actual number of adopted children claimed by the employee on the Form WH-4. This value was not used with the first phase of the Indiana 2022 tax withholding updates. You were also instructed to temporarily include the number of adopted children for both state and local dependents in order for payroll to calculate the withholding tax, even when there was not yet an adopted children exemption type on the Manage State Tax Withholding Adjustments screen

You must now use the Reduce Employee Number of Dependents for Indiana toolkit to reduce the state's number of dependents, based on the number of adopted children.

This maintenance release updates the Toolkit Status table for each company that has no employees in Indiana. You cannot run Compute Payroll until you have run the toolkit for any company that has employees in Indiana.

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.23 (August 21, 2023)

8.2 (on-premise): MR 8.2.2 (August 7, 2023)

Indiana 2022 State Tax Withholding – Phase 1

The state’s Departmental Notice No. 1 was updated to add a third deduction constant table for a new exemption for adopted children, the department said in a news release. The $3,000 annual exemption for adopted children was added in legislation (S.B. 2) signed Aug. 5 by Gov. Eric Holcomb (R). The other two deduction constant tables and the 3.23% income tax rate were unchanged.

Form WH-4, Employee’s Withholding Exemption and County Status Certificate, was also updated to include the adopted child exemption.

With this phase, Costpoint will be updated as follows:

Created tax tables with an effective date of 10/01/2022. The data is the same as the 01/01/2022 tables.

Updated tax documentation with new special setup instructions for Indiana employees.

Manage Employee Taxes screen/Employee Payroll Setup Menu

State Withholding Exemptions Enter the number of personal exemptions the employee is claiming on line 5 of his/her Form WH-4. State Withholding Dependents Enter the number of additional dependent exemptions the employee is claiming on line 6 of his/her Form WH-4.

If the employee is claiming adopted child dependent exemptions on line 7 of his/her Form WH-4, multiply it by two and add the number to this field.

For example, if employee has 3 additional dependent exemptions (Form WH-4 line 6) and 2 adopted child dependent exemptions (Form WH-4 line 7), enter 7 as the total number of exemptions for State Withholding Dependents.

Note:The number of dependent exemptions for Indiana county tax (local) withholding must be the same as the number of dependent exemptions for Indiana state withholding.

Local Taxes Dependents Enter the number of additional dependent exemptions the employee is claiming on line 6 of his/her Form WH-4.

If the employee is claiming adopted child dependent exemptions on line 7 of his/her Form WH-4, multiply it by two and add the number to this field.

For example, if employee has 3 additional dependent exemptions (Form WH-4 line 6) and 2 adopted child dependent exemptions (Form WH-4 line 7), enter 7 as the total number of exemptions for Local Taxes Dependents.

Note:The number of dependent exemptions for Indiana county tax (local) withholding must be the same as the number of dependent exemptions for Indiana state withholding.

Number of adopted children Use this field to specify the number of adopted children claimed by the employee on the Form WH-4. This value will not be used with the first phase of the Indiana 2022 tax withholding updates, but should still be entered as it will be used in the second phase. It is important that you provide this information if the State Withholding Number of Dependents and Local Withholding Number of Dependents includes exemptions for an adopted child or children.

Important Information

Phase 2 of the Indiana tax withholding updates will include the following updates:

Rather than expecting the Indiana state and local Number of Dependents to include the number of adopted children, Costpoint’s Compute Payroll application will be updated to use the Number of Adopted Children value when Indiana state and local tax withholding are calculated.

A new toolkit will be provided that will reduce the number of dependents based on the number of adopted children. For example, if employee has 3 additional dependent exemptions (Form WH-4 line 6) and 2 adopted child dependent exemptions (Form WH-4 line 7), with Phase 1, we instructed you to enter 7 as the total number of exemptions for Local Taxes Dependents (2 dependent exemptions plus 4 exemptions for the 2 adopted children). Because, in Phase 2, Compute Payroll will be updated to use the Number of Adopted Children value when computing for Indiana, the toolkit will reduce the number of dependents based on the number of adopted children. So, using the same example, the Number of Dependents will be updated from 7 to 2 (to remove the 4 exemption credits for the 2 adopted children).

State Requirements

For more information, refer to:

Departmental Notice #1: https://www.in.gov/dor/files/reference/dn01.pdf

WH-4: https://www.in.gov/dor/tax-forms/withholding-tax-forms/

Phase 1 Release Dates

The following target dates are subject to change:

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

Phase 2 Target Dates

To be determined.

Indiana 2021 State W-2 Electronic Filing

The Indiana Department of Revenue recently published an updated version of their W-2 and WH-3 Electronic Filing Requirement. This publication provides instructions and electronic filing specifications for filing electronic media with the Indiana Department of Revenue for State and County taxes withheld from Indiana residents. The most notable change to the most recent version of this publication is that Indiana does not use the RV record and it can be left out. Only the RS record is now unique to Indiana. The Code RS section found on page 6 has the only deviations Indiana requires from the Federal EFW2 specifications.

State Requirements

For more information, refer to: https://www.in.gov/dor/files/w2-wh3-guide.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.16 (December 3, 2021)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

Iowa 2023 State Tax Withholding

Iowa’s 2023 withholding formula and instructions were released with the following updates:

For 2023 Iowa withholding calculations, federal withholding is no longer subtracted from taxable wages.

The amounts of the standard deduction (in Step 1), rates, and brackets (in Step 2) have been updated for 2023.

State Requirements

For more information, refer to the Iowa Department of Revenue Individual Income Tax Withholding Formula:

https://tax.iowa.gov/sites/default/files/2022-11/IAWithholdingFormulaAndInstructionsTY2023.pdf

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Iowa 2023 SUTA Wage Base

Costpoint will be updated to support the new Iowa SUTA taxable wage base limit of $36,100 (from $34,800 in 2022) with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

Iowa 2022 State Tax Withholding

Iowa updated their withholding formula effective January 1, 2022. The following are the updates:

- The tax rates used in the formula continue to range from 0.33% to 8.53%, but the tax brackets were adjusted compared to the 2021 formula.

- Compared to the 2021 formula, the standard deductions used increased to $2,210 annually, from $2,130, when an employee claims zero or one state allowances, and to $5,450, from $5,240, when an employee claims at least two state allowances.

- The value of a state allowance remained $40 annually.

For more information, refer to:

Iowa Withholding Formula For Wages Paid Beginning January 1, 2022 (abouttax.com).

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Iowa 2022 SUTA Wage Base

Costpoint has been updated to support the new Iowa SUTA taxable wage base limit of $34,800 with an effective date of 01/01/2022.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.24 (November 17, 2021)

- 8.0 (on-premise): MR 8.0.15 (October 25, 2021)

- 8.1 (on-premise): MR 8.1.1 (October 21, 2021)

Iowa 2021 State W-2 Electronic Filing

The Iowa Department of Revenue updated their W-2 electronic filing requirements for 2021 reporting:

- BEN numbers are no longer required, but still can be listed.

- The "State Employer Account Number" can either be the 9 or 12-digit Iowa Withholding Permit Number. The Department is moving away from the 12-digit permit number, so any new withholding permits issued out in GovConnectIowa will be 9-digits.

State Requirements

For more information, refer to:

https://tax.iowa.gov/electronic-reporting-wage-tax-statements-and-information-returns

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Iowa 2021 SUTA Wage Base

Costpoint has been updated to support the new Iowa SUTA taxable wage base limit of $32,400 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (October 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12, 2020)

Iowa 2021 State Tax Withholding

The Iowa Department of Revenue updated their state tax withholding rules effective January 1, 2021. The following are the updates:

- The annual tax bracket thresholds were adjusted.

- The standard deduction increased to $2,130 a year, from $1,880, for employees who claim one or zero allowances, and to $5,240 a year, from $4,630, for employees who claim more than one allowance.

State Requirements

For more information, refer to:

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

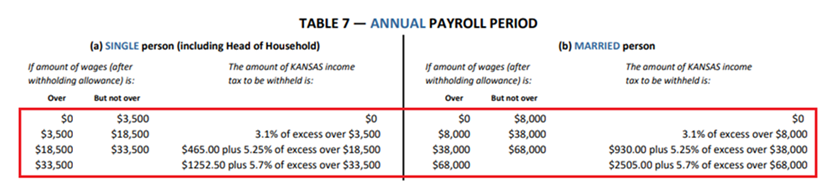

Kansas 2021 State Tax Withholding

The Kansas Department of Revenue updated their state tax withholding rules effective January 1, 2021. The following are the updates:

State Requirements

For more information, refer to:

- Notice 21-22 (Withholding Tax Tables Updated – July 13, 2021):

- Kansas Withholding Tax Guide:

Release Dates

- 7.1.1 (on-premise): MR 7.1.21 (August 16, 2021)

- 8.0 (on-premise): MR 8.0.13 (August 30, 2021)

Kentucky 2023 SUTA Wage Base

Costpoint has been updated to support the new Kentucky SUTA taxable wage base limit of $11,100 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Kentucky 2023 State Tax Withholding

Costpoint will be updated to support the new Kentucky withholding tax formula updates.

The Kentucky standard deduction will be $2,980.

The Kentucky tax rate will be 4.5% of taxable income.

Target Dates

The following target dates are subject to change:

8.0 (on-premise): MR. 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

Kentucky 2022 SUTA Wage Base Update (Revision #2)

Kentucky lowered their SUTA taxable wage base limit to $10,800 (down from $11,100) with an effective date of 01/01/2022.

Release Dates

- 8.0 (on-premise): MR 8.0.21 (April 25, 2022)

- 8.1 (on-premise): MR 8.1.7 (April 20, 2022)

Kentucky 2022 SUTA Wage Base Update

Kentucky updated their SUTA taxable wage base limit to $11,100 (up from $10,800 in 2021) with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Kentucky 2022 State Tax Withholding

The Kentucky Department of Revenue updated their tax withholding formula effective 01/01/2022:

- The standard deduction was updated to $2,770.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Kentucky 2021 SUTA Wage Base Update #2

Kentucky’s unemployment-taxable wage base for 2021 was revised. Costpoint has been updated to support the new Kentucky SUTA taxable wage base limit of $10,800 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.18 (May 10, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.10 (May 21, 2021)

- 8.0 (on-premise): MR 8.0.10 (June 4, 2021)

Kentucky 2021 SUTA Wage Base Update #1

Costpoint has been updated to support the new Kentucky SUTA taxable wage base limit of $11,100 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Kentucky 2021 State Tax Withholding

The Kentucky Department of Revenue updated their state tax withholding rules effective January 1, 2021. The standard deduction amount for Kentucky increased to $2,690 (from 2,650 in 2020).

State Requirements

Please see the following for additional information: https://revenue.ky.gov/Forms/2021%2042A003(TCF)(12-2020).pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Louisiana 2022 State Tax Withholding

The Louisiana Department of Revenue updated their state tax withholding rules effective January 1, 2022. The withholding formulas for the following statuses have been updated:

- Single or Married Taxpayers Claiming 0 or 1 Personal Exemption

- Married Taxpayers Claiming 2 Personal Exemptions

State Requirements

Please see the Louisiana Income Tax Withholding Tables for additional information:

https://revenue.louisiana.gov/LawsPolicies/Emergency%20Rule_LAC%2061.I.1501_Withholding%20Tables.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Maine 2023 State Tax Withholding

The Maine Department of Administrative and Financial Services updated their state tax withholding rules effective January 1, 2023. The following are the updates:

Compared to the 2022 withholding methods, the value of a state allowance in the 2023 withholding methods increased to $4,700, from $4,450.

The maximum standard deduction increased to $11,000, from $10,100, for single employees and to $24,850, from $23,050, for married employees.

The standard deduction decreased according to a formula for single employees who earn more than $91,500 annually, up from $85,850, or for married employees who earn more than $183,050 annually, up from $171,700.

The deduction reaches zero when a single employee earns at least $166,500 annually, up from $160,850, or when a married employee earns at least $333,050 annually, up from $321,700.

The tax brackets used in the percentage method were also adjusted.

State Requirements

For more information, refer to the 2023 Withholding Tables for Individual Income Tax.

Release Dates

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

Maine 2022 State Tax Withholding

The Maine Department of Administrative and Financial Services updated their state tax withholding rules effective January 1, 2022. The following are the updates:

- The amount of one withholding allowance increases to 4,450 (from 4,300 in 2021).

- The standard deduction amounts have been updated.

- The annual withholding tax tables for Married and Single have been updated.

Please see the Maine Revenue Services Withholding Tables for Individual Income Tax guide for additional information:

https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/22_wh_tab_instr.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

Maine 2021 State Tax Withholding

The Maine Department of Administrative and Financial Services updated their state tax withholding rules effective January 1, 2021. The following are the updates:

- The standard deduction amounts have been updated.

- The annual withholding tax tables for Married and Single have been updated

Please see the Maine Revenue Services Withholding Tables for Individual Income Tax guide for additional information:

https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/21_wh_tab_instr_1.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

Maryland 2023 State Tax Withholding – New 2.75 Rate

Maryland’s 2023 withholding guide was released by the state comptroller’s office and contains a withholding percentage method for one additional local tax rate compared to 2022.

The minimum and maximum standard deduction increases to $1,700 and $2,550 annually, up from $1,600 and $2,400.

The value of a state allowance was unchanged at $3,200 annually.

A percentage method corresponding to a 2.75% local tax rate was added to the guide.

State Requirements

For more information, refer to:

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Maryland 2023 State Tax Withholding

Six Maryland counties made changes to their income tax rates for 2023, including two counties that introduced graduated rates.

Anne Arundel County

Anne Arundel County introduced graduated tax brackets. Anne Arundel County, which used a tax rate of 2.81% in 2022, now uses that rate for taxable income of more than $50,000 in 2023 and uses a 2.7% rate for taxable income of up to $50,000.

Note:There are no changes to Anne Arundel County withholding tables as both rates will still be using the 2.85% tables.

Frederick County

Frederick County introduced graduated tax brackets. Frederick County used a tax rate of 2.96% in 2022. In 2023, a 2.75% rate applies when an employee earns up to $100,000 and has a filing status of married filing jointly, head of household, or qualifying widow/widower with dependent child, or when an employee earns up to $50,000 and has a filing status of single, married filing separately, or dependent. Otherwise, the rate of 2.96% applies.

Note:Frederick County will now use the combination of 2.85% and 3.00% withholding tables.

Allegany County

Allegany County decreased tax rates from 3.05% to 3.03%.

Note:There are no changes to Allegany County as it will still be using the 3.05% withholding tables.

Cecil County

Cecil County decreased tax rates from 3% to 2.8%.

Note:Cecil County will now use the 2.85% withholding tables.

St. Mary’s County

St. Mary’s County decreased tax rates from 3.1% to 3%.

Note:St. Mary's County will now use the 3.00% withholding tables.

Washington County

Washington County decreased tax rates from 3% to 2.95%.

Note:There are no changes to Washington County as it will still be using the 3.00% withholding tables.

State Requirements

For more information, refer to:

2023 Withholding Tax Facts:

Withholding Guide:

https://marylandtaxes.gov/forms/22_forms/Withholding_Guide.pdf

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Maryland 2022 State Tax Withholding - Update Standard Deduction

The Maryland Treasury Department 2022 withholding guide was revised in late March 2022. The standard deduction, which is 15% of the employee’s gross income subject to a minimum and maximum, increased to a minimum of $1,600 and a maximum of $2,400, up from a range of $1,550 to $2,350, the state comptroller’s office said in the guide. The change is backdated with an effective date of January 2022.

State Requirements

Please see the Maryland Employer Withholding Guide for additional information.

Release Dates

- 8.0 (on-premise): MR 8.0.21 (April 29, 2022)

- 8.1 (on-premise): MR 8.1.8 (May 26, 2022)

Maryland 2022 State Tax Withholding

The Maryland Treasury Department updated their state tax withholding rules effective January 1, 2022.

- Tax rates for Washington county changed from 3.20% to 3.00%.

- Tax rates for Saint Mary's country changed from 3.17% to 3.10%.

- All other counties remained the same.

State Requirements

Please see the Maryland Employer Withholding Guide for additional information:

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28. 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26. 2022)

Maryland 2021 State Tax Withholding

The Maryland Treasury Department updated their state tax withholding rules effective January 1, 2021. The maximum standard deduction used in the percentage methods increased to $2,350 annually, from $2,300.

State Requirements

Please see the Maryland Employer Withholding Guide for additional information:

https://marylandtaxes.gov/forms/20_forms/Withholding_Guide.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.16 (March 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.7 (February 2021)

- 8.0 (on-premise): MR 8.0.7 (February 26, 2020)

Maryland Q3 2020 SUTA Electronic Filing Update

According to the Maryland Department of Labor, their new system, BEACON, will go live in late September 2020. This system allows employers to submit wage and employment reports online. Employers can submit wage reports using manual entry via the online screens or they can upload a file containing the wage information. The file types accepted by Maryland are:

- Comma Separated Values (CSV) format

- The Social Security format for filing W-2 electronically (EFW2)

- The Interstate Conference of Employment Security Agencies (ICESA) format

- Extensible Markup Language (XML) format

Costpoint was updated to support the EFW2 file format for Maryland SUTA electronic reporting.

State Requirements

Please see the following Maryland Department of Labor site for additional information:

http://www.dllr.maryland.gov/uim/employer/uimempfaqs.shtml

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (October 8, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.2 (September 22, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12, 2020)

Michigan 2023 State Tax Withholding (Second Update)

The Michigan Department of Treasury updated their 2023 withholding guide with a lower flat tax rate. The tax rate for 2023 is 4.05%, instead of 4.25% with an effective date of 01/01/2023.

State Requirements

Please see the 2023 Michigan Income Tax Withholding Guide for additional information.

Release Dates

8.0 (on-premise): MR 8.0.34 (May 9, 2023)

8.1 (on-premise): MR 8.1.20 (May 30, 2023)

Michigan 2023 State Tax Withholding

The Michigan Department of Treasury increased their personal exemption amount to $5,400.00 with an effective date of 01/01/2023.

State Requirements

Please see the 2023 Michigan Income Tax Withholding Guide for additional information.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Michigan 2022 State Tax Withholding

The Michigan Department of Treasury increased their personal exemption amount to $5,000.00.

State Requirements

For more information, refer to:

https://www.michigan.gov/taxes/0%2c4676%2c7-238-43519_43531_75250-573278--%2c00.html

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Michigan 2021 State Tax Withholding

The Michigan Department of Treasury updated their state tax withholding rules effective January 1, 2021. The personal exemption amount increases to $4,900, from 4,750 in 2020.

State Requirements

For more information, refer to: https://www.michigan.gov/documents/taxes/446_711611_7.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Michigan 2021 SUTA Wage Base

Costpoint has been updated to support the 2021 Michigan SUTA taxable wage base limit of $9,500 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.16 (March 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.8 (March 22, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

Minnesota 2023 State Tax Withholding

The following are the tax updates for Minnesota effective January 1, 2023:

In the 2023 computer formula, the value of a state allowance increased from $4,450 to $4,800.

The formula’s tax brackets were also adjusted, and tax rates continue to range from 5.35% to 9.85%.

State Requirements

For more information, refer to the Minnesota Department of Revenue Withholding Computer Formula:

https://www.revenue.state.mn.us/sites/default/files/2022-11/wh_inst_23_0.pdf

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Minnesota 2023 SUTA Wage Base

Costpoint has been updated to support the new Minnesota SUTA taxable wage base limit of $40,000 with an effective date of 01/01/2023.

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

Minnesota 2022 State Tax Withholding

The Minnesota Department of Revenue updated their state tax withholding rules effective January 1, 2022. The following are the updates:

- The value of a state allowance increased to $4,450, from $4,350.

- The formula’s tax brackets were adjusted.

- Tax rates continue to range from 5.35% to 9.85%.

- The department also released a 2022 version of Form W-4MN, Minnesota Withholding Allowance/Exemption Certificate.

State Requirements

For more information, refer to:

https://www.revenue.state.mn.us/sites/default/files/2021-12/wh_inst_22_0.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Minnesota 2022 SUTA Wage Base

Costpoint has been updated to support the new Minnesota SUTA taxable wage base limit of $38,000 with an effective date of 01/01/2022.

Release Dates

- 7.1.1 (on-premise): MR 7.1.26 (January 10, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

Minnesota 2021 SUTA Electronic Filing

Costpoint has been updated to support Minnesota's quarterly unemployment wage detail report in EFW2 format.

State Requirements