Miscellaneous Updates

Use this section to view details of other regulatory updates.

Update the Affirmative Action Race Code List

If reporting affirmative action from Costpoint, customers have the ability to link Affirmative Action race codes to their user-defined Race/Ethnicity codes in the Manage Race and Ethnicity Codes screen. Prior to this enhancement, the Affirmative Action race codes included codes that were used for past EO Survey reporting. Since the EO Survey race codes are no longer needed, we have removed them from the available mapping list. The available affirmative action race codes are now:

Two or more races

Asian

Black or African American

Hispanic or Latino American

Indian or Alaskan Native

Race missing or unknown

Native Hawaiian or Other Pacific Islander

White

The following codes have been removed from the Affirmative Action Race Code list:

Black & White non-Hispanic

American Indian/Alaskan Native & White non-Hispanic

American Indian/Alaskan Native & Black non-Hispanic

Asian & White non-Hispanic

Other Hispanic or Latino

Target Dates

The following target dates are subject to change:

8.1 (on-premise): MR 8.1.24 (September 18, 2023)

8.2 (on-premise): MR 8.2.3 (September 5, 2023)

Enhanced Tracking and Reporting of the Pennsylvania PSD Code

Based on Pennsylvania Act 18 of 2018, when reporting a Pennsylvania Local Tax, box 20 of the W-2 should be populated with the employee’s six-digit Worksite PSD Code concatenated with a dash (-) and then the first two digits of the local tax’s District PSD Code. The PSD code will be stored when payroll is computed and ultimately stored in the Employee Earnings History table after payroll is posted. Costpoint’s Create W-2s application will be updated to populate Box 20 of the W-2 with the stored value and customers will also be able to edit the value on the Manage W-2s screen.

Release Dates

- 8.0 (on-premise): MR 8.0.28 (November 14, 2022)

- 8.1 (on-premise): MR 8.1.13 (October 31, 2022)

Add the Ability to Withhold More than Five Local Taxes

Costpoint Payroll has historically only allowed assignment of five local taxes to an employee at a time. With this update, customers will be able to assign an unlimited number of local taxes to an employee.

Release Dates

- 8.0 (on-premise): MR 8.0.26 (September 12, 2022)

- 8.1 (on-premise): MR 8.1.12 (September 27, 2022)

Add the Ability to Base Local Tax Withholding on an Override Percentage

Costpoint Payroll will be updated to allow an employee's local tax withholding to be based on an override percentage.

Release Dates

- 8.0 (on-premise): MR 8.0.26 (September 12, 2022)

- 8.1 (on-premise): MR 8.1.12 (September 27, 2022)

Add the Ability to Include Bonus Timesheets in Weighted Average Processing

Costpoint Labor has been updated to allow bonus timesheets to be included when determining and applying the weighted average rate.

Version 8.0.12 and above

- Configure Weighted Average Overtime Settings (LDMCOST)

The screen provides the following new field:

Field Description Include Bonus Timesheets Select this check box if Bonus-type timesheets should be included when determining weighted average rates in the Apply Weighted Average Rates to Timesheets utility. Regardless of the timesheet types selected, only pay types with a Weighted Average method of Include this pay type in determining weighted average rate on the Manage Pay Types screen will be included when determining the weighted average rate. - Apply Weighted Average Rates to Timesheets (LDPCOST)

The screen provides the following new functionality:

If the Include Bonus Timesheets check box is selected on the Configure Weighted Average Overtime Settings screen, include B (Bonus) type timesheets when selecting timesheets to determine and apply the weighted average rate.

Version 7.1.20

- Apply Weighted Average Rates to Timesheets (LDPCOST)

The screen provides the following new field:

Field Description Include Bonus Timesheets Select this check box if Bonus-type timesheets should be included when determining weighted average rates in the Apply Weighted Average Rates to Timesheets utility. Regardless of the timesheet types selected, only pay types with a Weighted Average method of Include this pay type in determining weighted average rate on the Manage Pay Types screen will be included when determining the weighted average rate.

Release Dates

- 7.1.1 (on-premise): MR 7.1.20 (July 12, 2021)

- 8.0 (on-premise): MR 8.0.12 (July 26, 2021)

Local Tax Dependent Exemptions

Costpoint Payroll has been updated to allow for a separate exemption amount based on the number of dependents claimed by the employee.

- Manage Local Taxes (PRMLTI)

The screen provides the following new field:

Field Description Exempt Amt Dependent Enter the dependent exemption allowance (used as a deduction from income) for employee’s dependents. The locality exemption allowance is used in the computation of the amount of locality income tax withheld from each employee paycheck. - Manage Payroll Records (PRMPTF)

The local tax calculation was updated to subtract the dependent exemption amount from the annualized gross wages.

- Manage Employee Earnings History (PRMERF)

The local tax calculation was updated to subtract the dependent exemption amount from the annualized gross wages.

- Compute Payroll (PRPCPR)

The local tax calculation was updated to subtract the dependent exemption amount from the annualized gross wages.

Release Dates

- 7.1.1 (on-premise): MR 7.1.21 (August 16, 2021)

- 8.0 (on-premise): MR 8.0.12 (July 26, 2021)

Add New Non-Binary Gender Category for Employees

Under the California legislation enacted on September 30, 2020 (Senate Bill 973), private employers of 100 or more employees (with at least one employee in California) must report certain pay and other data to the Department of Fair Employment and Housing (DFEH) by March 31, 2021 and annually thereafter. Under the Gender Recognition Act of 2017 (Senate Bill 179), California officially recognizes three genders: female, male, and non-binary. Therefore, employers should report employees' gender according to these three categories.

Costpoint Solution

Costpoint added Non-Binary as an option in the Gender drop-down list on the following screens:

- Manage Employee Information

- Manage Employee Benefit Elections

Additionally, all reports and processes have been updated to support the new gender option. Since the federal government still only allows reporting of two genders (male and female), the federal reports where gender is required have been updated to exclude non-binary individuals and an additional report has been added to report non-binary numbers.

Release Dates

- 7.1.1 (on-premise): MR 7.1.20 (July 12, 2021)

- 8.0 (on-premise): MR 8.0.10 (June 4, 2021)

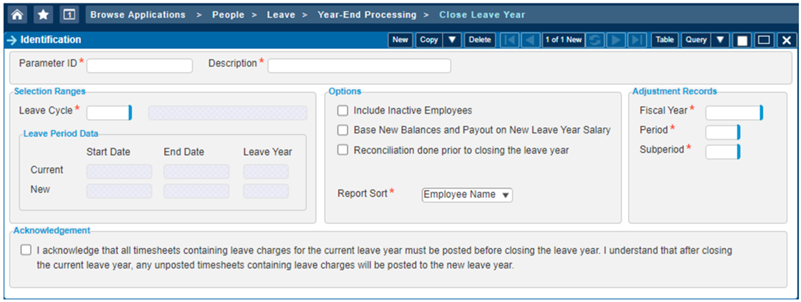

Require Acknowledgement of Used Leave Posting Prior to Closing the Leave Year

In the past few years, there have been cases where Costpoint users have posted used leave from the prior leave year after that leave year has already been closed. When this occurs, the used leave is posted to the incorrect leave year, resulting in incorrect leave balances and often requiring Costpoint users to work with Deltek Support Services to reverse the leave year closing.

Costpoint Solution

To help prevent this issue and encourage the Leave Administrator to verify that all used leave for the current year has already been posted, Costpoint will be updated to require users to acknowledge that timesheets with leave charges have been posted prior to closing the leave year. The Close Leave Year screen will be updated with a new Acknowledgement group box:

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 19, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)