Federal Updates

Use this section to view the details of federal regulatory updates.

Federal W-4 Updates

2023 Federal W-4 Update

The IRS now requires the electronic W-4 form to be identical to the IRS form. They also require an electronic signature and additional reporting requirements.

Electronic Submission Requirements from Publication 15-A

The electronic system must ensure that the information received by the payer is the information sent by the payee, must document all occasions of user access that result in a submission, and must provide reasonable certainty that the person accessing the system and submitting the form is the person identified on the form.

The electronic system must provide exactly the same information as the paper form.

The electronic submission must be signed with an electronic signature by the payee whose name is on the form. The electronic signature must be the final entry in the submission.

The employer must, upon request, provide the IRS with a hard copy of any completed electronic form along with a statement that, to the best of the payer’s knowledge, the electronic form was submitted by the named payee. The hard copy must provide information identical to what appears on the paper form but does not have to be a facsimile of the paper form. The signature must be under penalty of perjury, and the perjury statement, or jurat, must contain the same language as the paper version of the form. The electronic system must indicate that the employee must make a declaration contained in the jurat and that the declaration is made by signing the Form W-4.

Prior to this release, employees could edit/add a W-4 in Costpoint ESS but the form was not identical to the IRS. To support the IRS electronic W-4 requirements, Costpoint now provides the following features:

The redesign of the ESS Federal Withholding screen so that it is identical to the IRS W-4 form

The electronic signature functionality for the employee W-4

A new table to store the employee’s electronic W-4 information

A new payroll report to allow users to print historical electronic W-4 information for employees

For more information, refer to:

Release Dates

8.1 (on-premise): MR 8.1.19 (May 1, 2023)

2022 Federal W-4 Update

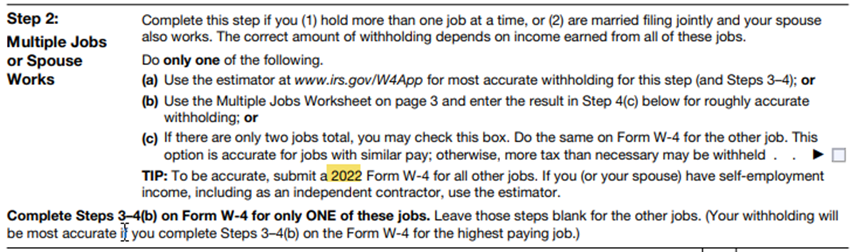

The final version of the 2022 Form W-4, Employee’s Withholding Certificate was released by the IRS with only a change to the year referenced in the TIP provided in Step 2 of the form.

The following Costpoint screens have been updated to comply with the 2022 version of the form:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

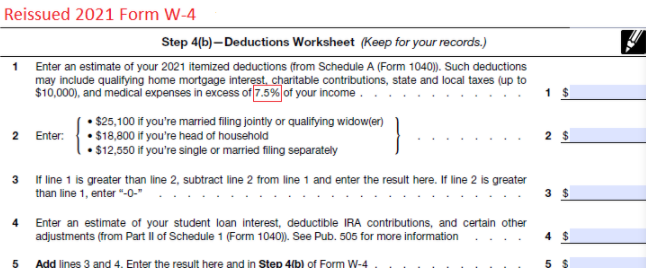

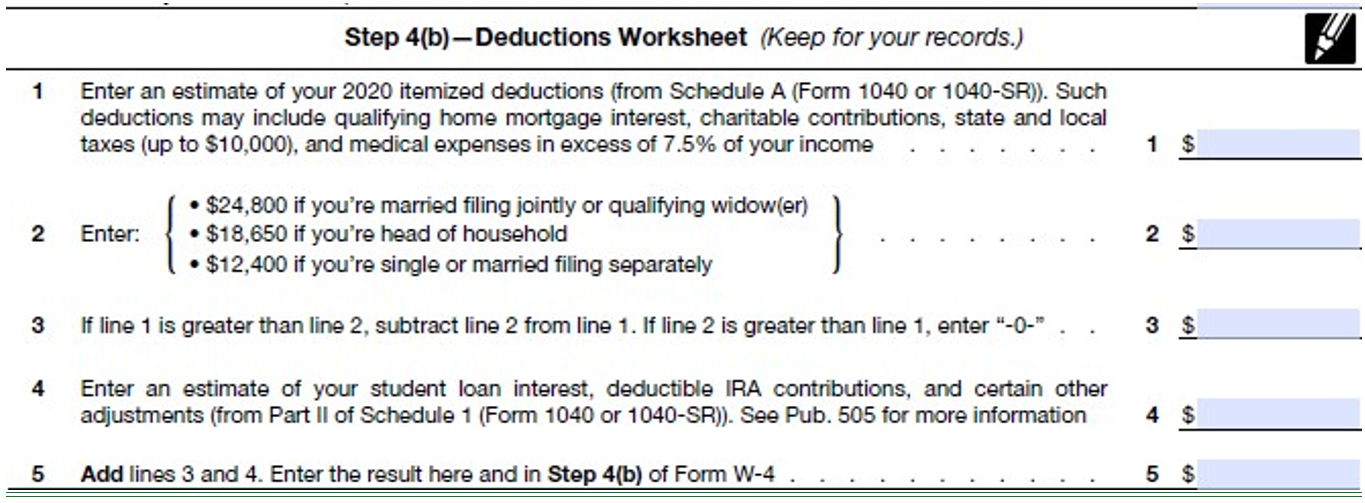

2021 Reissued Federal W-4 Deductions Worksheet (Final)

The Internal Revenue Service (IRS) reissued the final version of the 2021 W-4 and introduced changes to Step 4(b)–Deductions Worksheet. In line 1, the percentage was changed from 10% to 7.5%.

2021 Form W-4

Costpoint has updated the following screens to comply with the reissued version of the worksheet:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

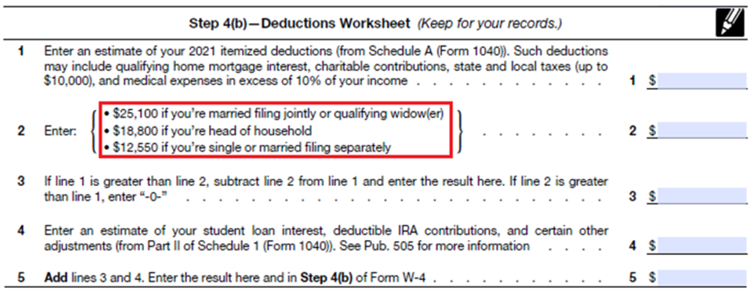

2021 Federal W-4 Deductions Worksheet

The Internal Revenue Service (IRS) supplied the final version of the 2021 W-4 and introduced changes to Step 4(b)-Deductions Worksheet.

2021 Form W-4

Costpoint will update the following screens to comply with the final version of the worksheet:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

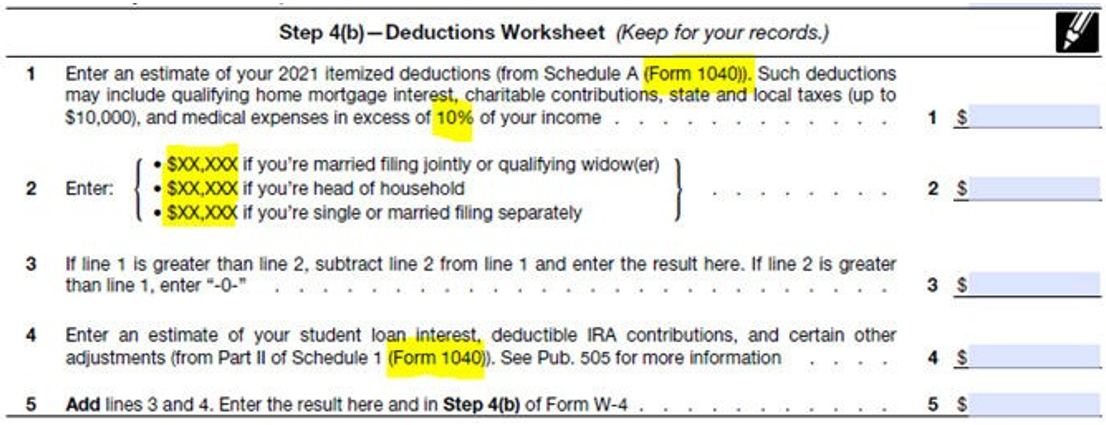

2021 Federal W-4 Deductions Worksheet (Updates Based on IRS Draft)

On July 27, 2020, the Internal Revenue Service (IRS) supplied a draft version of the 2021 W-4 and introduced changes to Step 4(b)–Deductions Worksheet.

2021 Form W-4 Draft (July 2020)

2020 Form W-4

Costpoint will update the following screens to comply with the draft version of the worksheet, which may be further updated if the IRS releases additional changes:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (September 30, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12, 2020)

Federal Tax and Wage Limit Updates

2023 Federal Poverty Level

The 2023 federal poverty guideline for the 48 contiguous states and the District of Columbia is $14,580.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

2023 Federal Tax Tables

The 2023 federal income tax withholding methods was released by the Internal Revenue Service.

The percentage method‘s tax brackets were adjusted.

The annual additional amount if the nonresident alien employee was first paid wages before 2020 and has not submitted a Form W-4 for 2020 or later, increases to $9,550 (from 8,650 in 2022).

The annual additional amount if the nonresident alien employee has submitted a Form W-4 for 2020 or later or was first paid wages in 2020 or later, increases to $13,850 (from 12,950 in 2022).

Safe Harbor Affordability Rate: 0.0912

Release Dates

8.0 (on-premise): MR 8.0.30 (January 23, 2023)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

2023 401(K) Limits

The 2023 salary deferral limit is $22,500 in 2023 (from $20,500 in 2022).

The 2023 annual compensation limit is $330,000 in 2023 (from $305,000 in 2022).

The 2023 catch-up contribution limit for employees aged 50 and over is $7,500 (from $6,500 in 2022).

Release Dates

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

2023 Social Security Wage Limit

The maximum amount of earnings subject to the Social Security tax will increase to $160,200 from $147,000 in 2022.

Release Dates

8.0 (on-premise): MR 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

2022 Federal Poverty Level

The 2022 federal poverty guideline for the 48 contiguous states and the District of Columbia is $13,590.

Release Dates

8.0 (on-premise): MR 8.0.28 (November 17, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

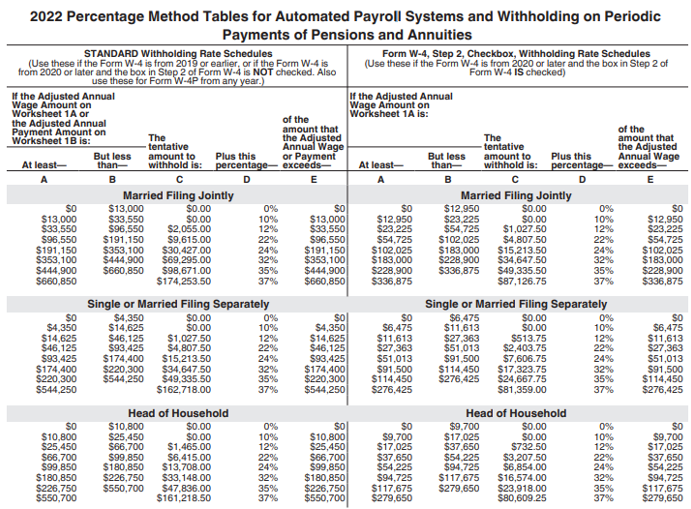

2022 Federal Tax Tables

The IRS finalized Publication 15-T-Federal Income Tax Withholding Methods.

- The IRS updated their percentage method tables, effective 01/01/2022.

- The deduction amounts from the W-4 Step 4(b)—Deductions Worksheet have been updated.

- $12,950 for single individuals

- $25,900 for married couples filing jointly

- $19,400 for heads of households.

- The annual amount to add to the wages of nonresident alien employees will be $12,950 when calculating withholding from Forms W-4 filed in 2020 and later.

- The safe harbor affordability rate decreases to 9.61% in 2022.

Federal Requirements

Please see the following for additional information:

https://www.irs.gov/pub/irs-pdf/p15t.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.4 (January 26, 2022)

2022 Social Security Wage Limit

The 2022 Social Security taxable wage base limit is $147,000 (increased from $142,800 in 2022).

Release Dates

- 7.1 (on-premise): MR 7.1.24 (November 17, 2021)

- 8.0 (on-premise): MR 8.0.16 (December 3, 2021)

- 8.1 (on-premise): MR 8.1.2 (November 24, 2021)

2022 401(K) Contribution Limit

The 2022 401(K) compensation limit is $20,500 (increased from $19,500 in 2021).

Target Dates

The following target dates are subject to change:

- 7.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.17 (January 4, 2022)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

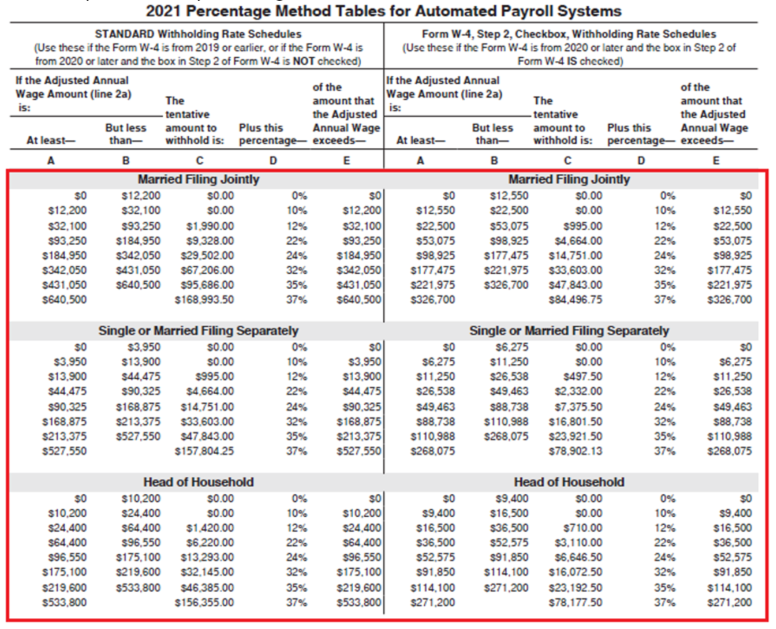

2021 Federal Tax Tables

The IRS updated their percentage method tables for 2021.

Federal Requirements

Please see the following for additional information:

https://www.irs.gov/pub/irs-pdf/p15t.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5(January 15, 2021)

2021 Social Security Wage Limit

The 2021 Social Security taxable wage base limit is $142,800 (increased from $137,700 in 2020).

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

2021 Medicare Wage Limit

Costpoint will update the 2021 Medicare Wage Limit from 9,999,999.99 to 999,999,999.99 in order to support larger wages.

Release Dates

- 7.1.1 (on-premise): MR 7.1.16 (March 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.8 (March 22, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

2021 401(K) Compensation Limit

The 2021 401(K) compensation limit is $290,000 (increased from $285,000 in 2020).

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

2021 Federal Poverty Level

Costpoint has been updated to support the 2021 federal poverty level of $12,880, up from $12,760 for 2020.

Release Dates

- 7.1.1 (on-premise): MR 7.1.16 (March 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.8 (March 22, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

2022 Federal Nonresident Alien Additional Amounts

The Compute Payroll application now supports the updated additional amount for a nonresident alien employee who has not submitted a Form W-4 for 2020 or later. The application will now apply use the following amounts in the withholding tax calculation of both federal and territory:

- Nonresident alien additional amount is 8,650 if the employee’s Form W-4 is 2019 or earlier, and check date is from tax year 2022.

- Nonresident alien additional amount is 8,250 if the employee’s Form W-4 is 2019 or earlier, and check date is within tax year 2021.

- Nonresident alien additional amount is 8,100 if the employee’s Form W-4 is 2019 or earlier, and check date is within tax year 2020.

Release Dates

- 8.0 (on-premise): MR 8.0.20 (March 28, 2022)

- 8.1 (on-premise): MR 8.1.6 (March 21, 2022)

2021 Federal Nonresident Alien Additional Amounts

The IRS increased the amount to be added to the wages for nonresident alien employees for taxability purposes.

- The amount added to the wages of a nonresident alien employee, who was first paid wages before 2020 and has not submitted a Form W-4 for 2020 or later, has increased to $8,250 (from $8,100 in 2020).

- The amount added to the wages of a nonresident alien employee, who was first paid wages in 2020 or later or has submitted a Form W-4 for 2020 or later, has increased to $12,550 (from $12,400 in 2020).

Costpoint Solution

Costpoint will be updated to support the 2021 Manage Federal Taxes Nonresident Alien Additional Amount of $12,550 for Payroll Year 2021.

The Compute Payroll application will be updated as follows:

- If the employee's Form W-4 is set to 2019 on the Manage Employee Taxes screen and the check date is within 2021, an additional nonresident alien amount of $8,250 will be used.

- If the employee's Form W-4 is set to 2019 on the Manage Employee Taxes screen and the check date is within 2020, an additional nonresident alien amount of $8,100 will be used.

- If the preceding two scenarios do not apply, the Nonresident Alien Additional Amount from the Manage Federal Taxes screen will be used.

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

2021 Safe Harbor Affordability Percentage

The 2021 affordability of employer-sponsored health coverage increased to 9.83% of an employee's household income.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

Federal Quarterly Reporting Updates

2023 Q1 Form 941

A draft of Form 941 for use in the first quarter of 2023 was issued by the Internal Revenue Service.

The Form 941, Employer’s Quarterly Federal Tax Return verbiage was updated as follows:

Section | Current | New |

|---|---|---|

The text at the rightmost column of Lines 5a, 5a(i), 5a(ii) | *Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021. | *Include taxable qualified sick and family leave wages paid in this quarter for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in this quarter for leave taken after March 31, 2020, and before April 1, 2021. |

Worksheet 1 | Worksheet 1: Credit for Sick and Family Leave Wages for Leave Taken After March 31, 2020, and Before April 1, 2021 | Worksheet 1. Credit for Qualified Sick and Family Leave Wages Paid This Quarter for Leave Taken After March 31, 2020, and Before April 1, 2021 |

Worksheet 2 | Worksheet 2: Credit for Qualified Sick and Family Leave Wages Paid in 2022 for Leave Taken After March 31, 2021, and Before October 1, 2021 | Worksheet 2: Credit for Qualified Sick and Family Leave Wages Paid This Quarter for Leave Taken After March 31, 2021, and Before October 1, 2021 |

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

8.0 (on-premise): MR 8.0.32 (March 13, 2023)

2022 Q2 Form 941 - Updates as of April 2022

An updated version of Form 941 for use in the second to fourth quarters of 2022 was issued April 14 by the Internal Revenue Service.

The Form 941, Employer’s Quarterly Federal Tax Return, was updated to remove lines pertaining to the COBRA premium assistance credit. The credit expired in September but could still be claimed by some employers on Form 941 for the first quarter of 2022.

The structure of the draft form indicates that the form is expected to be used for each of the remaining quarters of 2022. In the list of check boxes indicating the quarter for which the form is to be filed, the boxes for the second to fourth quarters of 2022 are blank. Only the box for the first quarter is grayed out.

Lines 11e, 11f, and 13f were labeled “Reserved for future use” on the draft form. Line 11e previously reported the non-refundable portion of the COBRA premium assistance credit, Line 11f reported the number of individuals receiving assistance, and Line 13f reported the non-refundable portion of the credit.

Line 11g, which reports the total amount of non-refundable credits, was updated to remove a reference to Line 11e. Similarly, Line 13g, which reports the total amount of refundable credits, was updated to remove a reference to Line 13f.

Release Dates

- 8.0 (on-premise): MR 8.0.22 (June 2, 2022)

- 8.1 (on-premise): MR 8.1.8 (May 26, 2022)

2022 Q1 Form 941 - Updates as of March 2022

The updated Form 941, which has a March 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. The changes are the following:

- The note next to Lines 5a to 5d was revised to clarify the reporting of qualified paid sick and family leave wages. Qualified wages paid in 2022 for leave taken in the second and third quarters of 2021 are to be included in Line 5a. Lines 5ai and 5aii only are to be used for qualified leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021

- Line 11c, 13d, 21, and 22, which previously were used to report amounts pertaining to the employee retention credit, were labeled “Reserved for future use” in the draft 2022 version. Lines 13h and 13i, which pertained to Form 7200 advances, were similarly labeled.

- The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for leave taken after March 31, 2020, and before Oct. 1, 2021. However, employers that pay qualifying wages in 2022 for leave taken in that time period still may claim the credit; Lines 11b, 11d, 13c, and 13e may be used only for this purpose.

- The COBRA premium assistance credit expired Sept. 30, 2021. However, employers still may claim the credit if an eligible person elected coverage in the first quarter of 2022 for periods between April 1 and Sept. 30, 2021

- The worksheets that allowed employers to calculate the employee retention credit, formerly named Worksheets 2 and 4, were removed.

- The worksheet for calculating the credit for qualified leave wages for leave taken in the second and third quarters of 2021, formerly named Worksheet 3, was renamed Worksheet 2 and updated to remove lines that referred to the employee retention credit.

- The worksheet for calculating the COBRA premium assistance credit, formerly Worksheet 5, was renamed Worksheet 3.

Earlier versions of Form 941 may not be used for reporting in 2022.

Release Dates

- 8.0 (on-premise): MR 8.0.20 (March 28, 2022)

- 8.1 (on-premise): MR 8.1.6 (March 21, 2022)

2021 Q2 Form 941 Updates as of May 25, 2021

An updated version of Form 941, Employer's Quarterly Federal Tax Return, for use in the second through fourth quarters of 2021 was issued May 25 by the Internal Revenue Service (IRS).

The draft Form 941 was updated to reflect provisions of the American Rescue Plan Act. New lines were added to take into account the new COBRA premium assistance credit. Changes to the form will also allow employers to report the refundable and nonrefundable portions of employment tax credits for qualified paid-sick or paid-family leave wages paid starting April 1, 2021, that are attributable to leave taken up to March 31, 2021.

Costpoint's 941 reporting has been updated with the following:

- Taxable qualified sick and family leave wages for leave taken after March 31, 2021 must be included on Line 5a.

- Line 5a(i) and 5a(ii) are only for wages paid after March 31, 2020 for leave taken before April 1, 2021.

- Lines 11b and 13c — "for leave taken before April 1, 2021" has been added to the labels.

- Lines 11d and 13e — these are new lines for nonrefundable and refundable portion of credit for qualified sick and family leave wages taken after March 31, 2021.

- Qualified health plan expenses allocable to qualified sick leave wages will now have a breakdown for leave taken before April 1, 2021 and for leave taken after March 31, 2021.

- Qualified health plan expenses allocable to qualified family leave wages will now have a breakdown for leave taken before April 1, 2021 and for leave taken after March 31, 2021.

- Qualified sick leave wages for leave taken after March 31, 2021 is to be reported.

- Qualified family leave wages for leave taken after March 31, 2021 is to be reported.

Release Dates

- 7.1.1 (on-premise): MR 7.1.20 (July 12, 2021)

- 8.0 (on-premise): MR 8.0.11 (June 28, 2021)

Important Information

As of June 22, 2021, the IRS had not yet finalized Q2 2021 941 requirements. Beyond the changes listed above, they have released two newer draft updates with the most recent released on June 16, 2021 with no indication of whether further updates will be released or when the requirements will be finalized. Therefore, the 941 updates released in MR 7.1.20 and MR 8.0.11 are not all of the updates needed for Q2 2021 941 reporting.

2021 Q1 Quarterly Federal Payroll Tax Report

The Employee Retention Credit section of the Federal 941 Data and Tax Credit Report in the Print Quarterly Federal Payroll Tax Report application has been updated with the following:

- Line 3a: Updated the calculation of qualified wages for payroll year 2021, but retained the existing calculation for payroll year 2020. The qualified wages for the employee retention credit, including qualified health plan expenses, are limited to a maximum of $10,000 for each employee for the quarter. (Source: Instructions for Form 941 Rev. 3-2021)

- Line 3d: Updated the rate to 70% in the calculation for payroll year 2021, but retained the rate of 50% for payroll year 2020. The tax credit is equal to 70% of qualified wages paid to employees after December 31, 2020, and before July 1, 2021. (Source: Instructions for Form 941 Rev. 3-2021)

- Labels: The label shall be updated to "Retention credit (3c x Rate*):" from "Retention credit (3c x 50%):", and an italicized text "*Rate is 70% for 2021, while 50% for 2020." shall be added below Line 3i.

Release Dates

- 7.1.1 (On-Premise): MR 7.1.17 (April 12, 2021)

- 8.0 (On-Premise): MR 8.0.8 (March 29, 2021)

2021 Q2 Form 941 Worksheet – Draft Updates as of June 16, 2021 (Drafts #2 & #3)

A draft version of the Form 941 instructions and worksheets, for use in the second through fourth quarters of 2021, were issued by the Internal Revenue Service (IRS) on June 2, 2021 and June 16, 2021.

- The instructions provide guidance on a number of new and changed lines that incorporate the changes from the American Rescue Plan Act.'

- Five worksheets are included with the instructions, which allow employers to calculate the employment tax credits for qualified sick and family leave wages, the employee retention credit, and the COBRA premium assistance credit for the applicable quarters of 2021.

- Worksheet 1 covers the credit for qualified sick and family leave wages paid starting April 1, 2021, when the leave was taken up to March 31, 2021.

- Worksheet 2 covers the employee retention credit for wages paid after March 31, 2021, and before July 1, 2021.

- Worksheet 3 covers the credit for qualified sick and family leave wages for leave taken after March 31, 2021.

- Worksheet 4 covers the employee retention credit for wages paid after June 30, 2021.

- Worksheet 5 covers COBRA premium assistance credit.

Federal Requirements

Please see the following for additional information:

- Draft Form 941: https://www.irs.gov/pub/irs-dft/f941--dft.pdf

- Draft Form 941 Instructions: https://www.irs.gov/pub/irs-dft/i941--dft.pdf

Release Dates

- 7.1.1 (on-premise): MR 7.1.21 (August 16, 2021)

- 8.0 (on-premise): MR 8.0.12 (July 26, 2021)

Important Information

Because these draft requirements were provided so late, the Deltek Engineering team will not have enough time to implement all changes before the July 31st filing deadline. Therefore, we have provided instructions on how to manually calculate or determine the data needed for the Q2 2021 941 reporting. Please see KB article 105350.

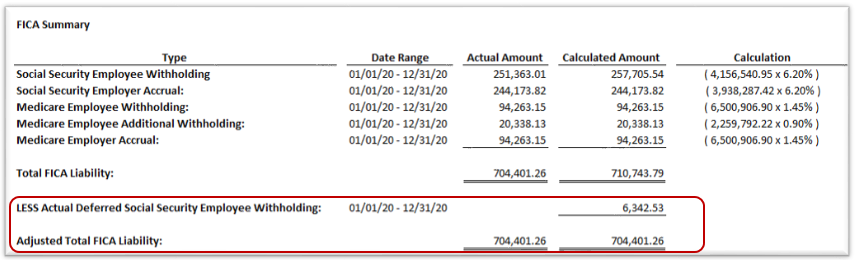

2020 Q4 Federal Payroll Tax Report

The U.S. Department of Treasury has not yet announced how the recent Social Security withholding deferral (CARES Act Memorandum) will affect the federal quarterly reporting. However, to help provide critical information, the Quarterly Federal Payroll Tax Report will be updated to provide the following information:

- Since it currently reports the expected Social Security Employee Withholding without adjusting for the amount of employee Social Security withholding that was deferred from September 1, 2020 to December 31, 2020, a new Actual Deferred Social Security Employee Withholding row has been added to the FICA Summary section of the Quarterly Federal Payroll Tax Report. This value is a sum of the Social Security employee withholding that was deferred during the reporting period. This amount will only be included on the report if at least one employee’s Social Security withholding was deferred. An Adjusted Total FICA Liability row was added to show the difference between the calculated amount and the deferred Social Security withholding.

- To provide additional information, a new Deferred Employee Social Security Withholding section was added to the Quarterly Federal Payroll Tax Report. This report will provide a detailed list of the employees whose Social Security withholding was deferred during the reporting period as a result of the CARES Act memorandum.

The 941 section of the Quarterly Federal Payroll Tax Report will be updated when an updated 941 form is provided by the U.S. government.

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (September 30, 2020)

- 7.1.7 Hot Fix (on-premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.1 (on-premise): MR 8.0.2 (October 12, 2020)

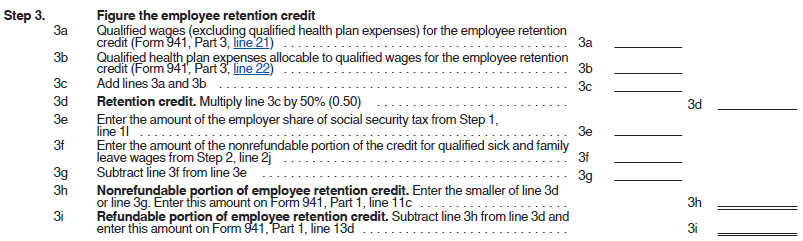

2020 Q3 Form 941 Instructions - Worksheet 1

The Internal Revenue Service (IRS) released revised instructions for Form 941, which include changes to Step 3 of Worksheet 1 (Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit). Employers will need to use the new worksheet to complete their 2020 third quarter 941 reporting.

Worksheet 1. Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit (July 2020 Revision) https://www.irs.gov/pub/irs-prior/i941--2020.pdf

Costpoint Solution

Print Quarter Federal Payroll Tax Report

To comply with the revised Form 941, Costpoint will update the numbering and text in the Employee Retention Credit section of the Federal 941 Data and Tax Credit Report in MR 7.1.7.4, MR 7.1.11 and MR 8.0.3. The following chart provides a mapping of the new IRS worksheet to Costpoint's updated report.

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

|---|---|

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3cq2 on the updated report.) | 3cq2 Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3dq2 on the updated report) | 3dq2 Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3c Total qualified wages for employee retention credit (3a + 3b + 3cq2 + 3dq2): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3d Retention credit (3c x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3g Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3h Nonrefundable portion of employee retention credit (the smaller of 3d or 3g): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3i Refundable portion of employee retention credit (3d - 3h): |

Important Information

If you do not download the Costpoint updates in MR 7.1.11, MR 8.0.3, or MR 7.1.7.4 before completing your 941 for Q3 2020 and are therefore using an old version of Costpoint's Federal 941 Data and Tax Credit Report, please use the following mapping to help you complete your report:

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (Pre-MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

|---|---|

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below.) | 3c Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below.) | 3d Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3e Total qualified wages for employee retention credit (3a + 3b + 3c + 3d): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3f Retention credit (3e x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3i Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3j Nonrefundable portion of employee retention credit (the smaller of 3f or 3i): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3k Refundable portion of employee retention credit (3f - 3j): |

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10. 2020)

Federal 1099 Updates

2021 1099 Updates

The IRS released the 2021 updates to forms 1099-MISC and 1099-NEC.

Form 1099-MISC Updates

The following are the changes to form 1099-MISC:

- Title Change: The title for form 1099-MISC has been changed from Miscellaneous Income to Miscellaneous Information.

- Box 11: Box 11 includes any reporting under section 6050R regarding cash payments for the purchase of fish for resale purposes, from an individual or corporation who is engaged in catching fish.

Form 1099-NEC Updates

The following are the changes to form 1099-NEC:

- Box 1: Box 1 will not be used for reporting under section 6050R regarding cash payments for the purchase of fish for resale purposes.

- Box 2: Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling $5,000 or more of consumer products for resale, on buy-sell, deposit-commission, or any other basis.

- Resizing: The IRS has reduced the height of the form so it can accommodate 3 forms on a page.

Print/Create 1099s and Magnetic Media

The Print/Create 1099s and Magnetic Media screen has been updated to accommodate the IRS 2021 updates to forms 1099-MISC and 1099-NEC. When you print 1099s on this screen, the output displays using the 2021 layout for the 1099 forms. The magnetic media format has also been updated according to the 2021 Specifications for Electronic Filing of Forms.

The new NEC Copy to Print group box, which allows you to select the NEC copy you want to print, is now available.

| Field | Description |

|---|---|

| Copy A | Select this option to print the IRS Service Center copy of form 1099-NEC. |

| Other Copies | Select this option to print the receiver and payer copies of form 1099-NEC. |

The options in this group box are enabled if the Calendar Year is 2021 and when you select 1099-NEC in the Print Options group box.

Release Dates

- 7.1.1 (on-premise) : MR 7.1.24 (November 16, 2021)

- 8.0 (on-premise) : MR 8.0.16 (December 3, 2021)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

2020 1099 Updates

The following updates have been made to for 2020 1099 reporting:

The IRS released the 2020 Form 1099-NEC, Nonemployee Compensation, which replaces Box 7 in Form 1099-MISC for reporting nonemployee compensation. This shifts the role of the 1099-MISC for reporting all other types of compensation.

- The 1099 mag media file format was updated to accommodate the new form and its contents

- The Print/Create 1099s and Magnetic Media (APR1099) screen was updated to select the appropriate forms for printing

- The contents of 1099-MISC was reformatted to match the government-required output.

Release Dates

- 7.1.1 (on-premise) : MR 7.1.13 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise) : Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise) : MR 8.0.4 (December 11. 2020)

Federal W-2 Updates

Ability to Print W-2 Forms on Blank Stock Using a PDF Template File

Prior to this release, you were able to print Form W-2 on only pre-printed forms from recommended vendors. In this release, Costpoint adds the ability to save Form W-2s as PDF files, which you can use to print on plain paper or blank stock. This feature will prevent alignment problems that occur when you use pre-printed forms.

This Costpoint release also introduced an option to create a Substitute Copy A on the Print W-2’s screen, which automatically creates a corresponding Form W-3. The W-3 includes additional employer information that you can now set up on the existing Manage Tax File Data screen.

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

Add Ability to Print W-2Cs

In early 2022, we added the ability to generate W-2C records and report the information via electronic file. This update will allow customers to print W-2Cs to pre-printed forms in the existing Print W-2s application.

Release Dates

- 8.0 (on-premise) : MR 8.0.25 (August 8, 2022)

- 8.1 (on-premise) : MR 8.1.11 (August 29, 2022)

Support W-2C Electronic Filing

The Taxpayer First Act, which became Public Law 116-25 in July 2019, requires more employers to file W-2s or W-2Cs electronically. Although the IRS has not yet issued formal regulation on the implementation, here is the tentative schedule:

- By midnight on January 31, 2022, employers who file 100 or more W-2s or W-2Cs will have to send W-2s or W-2Cs to SSA electronically.

- By midnight on January 31, 2023, employers who file 10 or more W-2s or W-2Cs will have to send W-2s or W-2Cs to SSA electronically.

When the IRS issues formal guidance on implementing this new law, the above date may change. The IRS has the authority to penalize any employer who does not file electronically if they meet the threshold.

Costpoint has existing capability to generate EFW2. However, to support the requirements of IRS, Costpoint adds the ability to generate EFW2C to the Create Federal W-2 File screen. W-2 corrections beginning tax year 2021 will also be supported.

- Taxpayer First Act: https://www.ssa.gov/employer/taxpayer.html

- Filing Forms W-2c Electronically (EFW2C) for Tax Year 2021: https://www.ssa.gov/employer/EFW2&EFW2C.htm

Release Dates

- 8.0 (on-premise): MR 8.0.21 (April 25, 2022)

- 8.1 (on-premise): MR 8.1.7 (April 20, 2022)

2021 W-2 - Report COVID Leave Wages

The following types of COVID-19 leave wages will be determined and stored in Box 14 of the W-2. This data will then be used on printed W-2s and ESS W-2 data:

- Sick leave wages subject to the $511 per day limit paid for leave taken after December 31, 2020, and before April 1, 2021.

- Sick leave wages subject to the $200 per day limit paid for leave taken after December 31, 2020, and before April 1, 2021.

- Emergency family leave wages paid for leave taken after December 31, 2020, and before April 1, 2021.

- Sick leave wages subject to the $511 per day limit paid for leave taken after March 31, 2021, and before October 1, 2021.

- Sick leave wages subject to the $200 per day limit paid for leave taken after March 31, 2021, and before October 1, 2021.

- Emergency family leave wages paid for leave taken after March 31, 2021, and before October 1, 2021.

Release Dates

- 7.1 (on-premise): MR 7.1.25 (December 15, 2021)

- 8.0 (on-premise): MR 8.0.16 (December 3, 2021)

- 8.1 (on-premise): MR 8.1.3 (December 21, 2021)

2021 W-2 - Add 2020 USERRA Make-Up Options to the Box 12 Lookup List

The following options have been added to the lookup list for Box 12 on the Manage W-2s (PRMW2) screen:

- D 20 (USERRA 2020 make up elective deferrals to a section 401(k) cash or deferred arrangement)

- E 20 (USERRA 2020 make up elective deferrals to a section 403(b) salary reduction agreement)

- F 20 (USERRA 2020 make up elective deferrals to a section 408(k)(6) salary reduction agreement)

- G 20 (USERRA 2020 make up elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred comp plan)

- H 20 (USERRA 2020 make up elective deferrals under a section 501(c)(18)(D) tax-exempt organization plan)

- S 20 (USERRA 2020 make up employee salary reduction contributions under a section 408(p) SIMPLE)

- Y 20 (USERRA 2020 make up deferrals under section 409A nonqualified deferred compensation plan)

- AA 20 (USERRA 2020 make up designated Roth contributions to a section 401(k) plan)

- BB 20 (USERRA 2020 make up designated Roth contributions under a section 403(b) salary reduction agreement)

- EE 20 (USERRA 2020 make up designated Roth contributions under a section 457(b) plan)

Release Dates

- 7.1.1 (on-premise) : MR 7.1.21 (August 16, 2021)

- 8.0 (on-premise) : MR 8.0.13 (August 30, 2021)

2020 W-2 Updates - Add 2019 USERRA Make-Up Options to the Box 12 Lookup List

The following options will be added to the lookup list for Box 12 on the Manage W-2s (PRMW2) screen:

- D 19 (USERRA 2019 make up elective deferrals to a section 401(k) cash or deferred arrangement)

- E 19 (USERRA 2019 make up elective deferrals to a section 403(b) salary reduction agreement)

- F 19 (USERRA 2019 make up elective deferrals to a section 408(k)(6) salary reduction agreement)

- G 19 (USERRA 2019 make up elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred comp plan)

- H 19 (USERRA 2019 make up elective deferrals under a section 501(c)(18)(D) tax-exempt organization plan)

- S 19 (USERRA 2019 make up employee salary reduction contributions under a section 408(p) SIMPLE)

- Y 19 (USERRA 2019 make up deferrals under section 409A nonqualified deferred compensation plan)

- AA 19 (USERRA 2019 make up designated Roth contributions to a section 401(k) plan)

- BB 19 (USERRA 2019 make up designated Roth contributions under a section 403(b) salary reduction agreement)

- EE 19 (USERRA 2019 make up designated Roth contributions under a section 457(b) plan)

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

2020 W-2 - Reporting COVID-19 Sick Leave and Family Leave Wages

IRS Notice 2020-54 (Guidance on Reporting Qualified Sick Leave Wages and Qualified Family Leave Wages Paid Pursuant to the Families First Coronavirus Response Act)

Source: https://www.irs.gov/pub/irs-drop/n-20-54.pdf

Reporting Qualified Sick Leave Wages

In addition to including qualified sick leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the social security wage base), and 5 of Form W-2, employers must report to the employee the following type and amount of the wages that were paid, with each amount separately reported either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified sick leave wages paid to the quarantined employee under the EPSLA; in labeling this amount, the employer must use the following, or similar, language: "sick leave wages subject to the $511 per day limit."

- the total amount of qualified sick leave wages paid to the employee caring for quarantined individuals and others under the EPSLA; in labeling this amount, the employer must use the following or similar language: "sick leave wages subject to the $200 per day limit."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 provided to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Reporting Qualified Family Leave Wages

In addition to including qualified family leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the Social Security wage base), and 5 of Form W-2, employers must separately report to the employee the following type and amount of the wages that were paid in either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified family leave wages paid to the employee under the EFMLEA; in labeling this amount, the employer must use the following, or similar, language: "emergency family leave wages."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 sent to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Model Language for Employee Instructions

As part of the Instructions for Employee, under the instructions for Box 14, for the Forms W-2, or in a separate statement sent to the employee, the employer may provide additional information about qualified sick leave wages and qualified family leave wages and explain that these wages may limit the amount of the qualified sick leave equivalent or qualified family leave equivalent credits to which the employee may be entitled with 9 respect to any self-employment income. The following model language (modified as necessary) may be used:

"Included in Box 14, if applicable, are amounts paid to you as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act. Specifically, up to three types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:

- Sick leave wages subject to the $511 per day limit because of care you required;

- Sick leave wages subject to the $200 per day limit because of care you provided to another; and

- Emergency family leave wages.

If you have self-employment income in addition to wages paid by your employer, and you intend to claim any qualified sick leave or qualified family leave equivalent credits, you must report the qualified sick leave or qualified family leave wages on Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, included with your income tax return and reduce (but not below zero) any qualified sick leave or qualified family leave equivalent credits by the amount of these qualified leave wages. If you have self employment income, you should refer to the instructions for your individual income tax return for more information."

Costpoint Solution

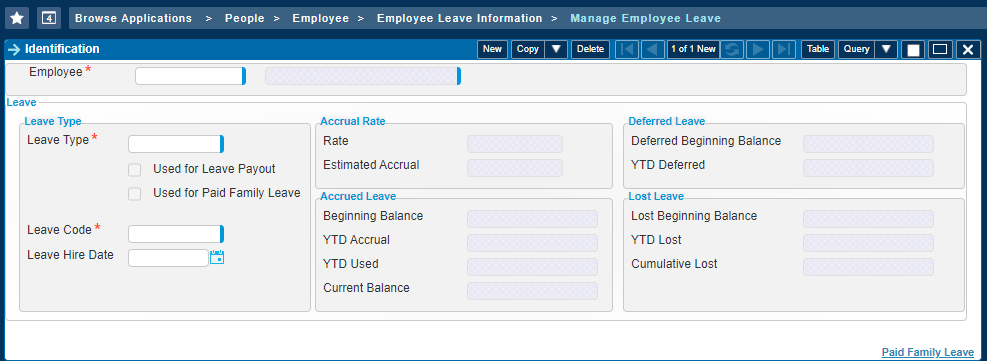

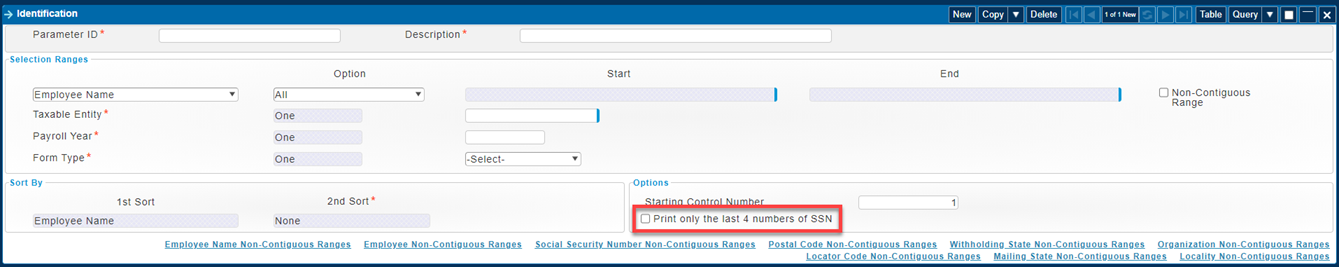

Manage Employee Leave (LDMELV)

When you report the COVID-19 sick leave wages in Box 14 of Form W-2, the sick leave wages must be reported based on the daily limit that was applied:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

A new drop-down box titled Box 14 Description will be added to the Paid Family Leave subtask on the Manage Employee Leave screen so you can specify which daily limit was utilized. This will allow the Create W-2 Table application to appropriately allocate wages to the correct category. The Box 14 Description drop-down box will only be enabled and required if the City/State is "NATIONAL PAID SICK LEAVE COVID19."

A new value "EMERGENCY FAMILY MEDICAL LEAVE COVID19" will also be added in City/State for the FFCRA's EFMLEA provision. The purpose of adding this value is to distinguish it from the existing value "NATIONAL PAID SICK LEAVE COVID19," which is for the FFCRA's EPSLA provision.

¶

¶

Create W-2 Table (PRPCW2)

The application will be updated to generate Box 14 records for any employees with the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Before generating W-2s for an employee with COVID-19 sick leave wages, you must specify the Box 14 Description on the Manage Employee Leave screen.

When you print W-2s, any COVID-19 Box 14 information is printed on a separate W-2 for the employee, due to the lengthy descriptions required by the IRS.

Manage W-2s (PRMW2)

A new subtask titled COVID-19 Box 14 will be added to the screen, allowing you to view and edit Box 14 information for the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Print W-2s (PRRW2)

If an employee has COVID-19 sick leave of family leave wages in 2020, the information will print in Box 14 on a separate W-2 for the employee.

PRRW2: Print W-2s

W-2 Box 14 COVID-19 sick and family leave wages will be added to the report.

ESS W-2s (ESMELECW2)

In order to accommodate the Box 14 COVID-19 reporting, the existing Box 14 (Other) fields on the main screen have been replaced with a Box 14 subtask.

Export Payroll Taxes (PRPEXTAX)

The application will be updated to include the three types of COVID-19 leave wages in the W-2 File.

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10. 2020)

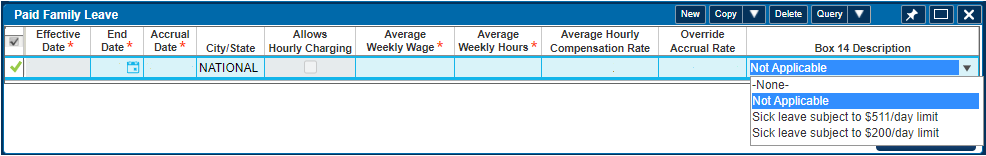

2020 W-2 - Allow for Truncation of Social Security Numbers on W-2s Furnished to Employees

To aid employer efforts to protect employees from identity theft, recent IRS regulations permit employers to voluntarily truncate employee social security numbers (SSN) on the employee copy of the W-2. According to IRS guidelines, when truncating, the first five digits of the employee's nine-digit SSN can be replaced by an asterisk (*) or X.

Costpoint's Print W-2s application was updated to allow for truncation of the employee SSNs when printing W-2s. If opting to truncate, the first five digits of the SSN will be replaced with X. Example: XXX-XX-1234.

Please see the following IRS site for additional information: https://www.federalregister.gov/documents/2019/07/03/2019-11500/use-of-truncated-taxpayer-%20identification-numbers-on-forms-w-2-wage-and-tax-statement-furnished-to

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (September 20, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12. 2020)

Federal Affordable Care Act (ACA) Updates

ACA - 1095-C Updates

Code 1A will only be assigned to employees on Line 14 of form 1095-C if the Qualifying Offer Method checkbox is selected on the Create 1094-C and 1095-C Data screen.

An employee’s employment history is used to determine the Line 14 and Line 16 codes on form 1095-C. Because some clients track employment using the Affirmative Action Effective Date is Hire Date and Effective Date is Term Date checkboxes on the Manage Employee Salary Information screen, we added the ability to use those checkboxes when determining an employee’s employment history.

An employee will now be eligible to receive a form 1095-C if they were offered and elected coverage in the year prior to their hire date. If an employee’s hire date is in the following year, but they elected self-insured coverage for one or more months of the calendar year being analyzed, code 1G would be entered on Line 14.

An employee will now be eligible to receive a form 1095-C if they were offered and elected coverage in the year following their termination date. If an employee was terminated in the prior year, but elected self-insured coverage for one or more months of the calendar year, code 1G would be entered on Line 14.

The priority order for the Form 1095-C Line 14 codes will be updated.

Code 1E will take priority over code 1K

1E. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse. Do not use code 1E if the coverage for the spouse was offered conditionally. Instead, use code 1K.

1K. Minimum essential coverage providing minimum value offered to employee; at least minimum essential coverage offered to dependents; and at least minimum essential coverage conditionally offered to spouse. (See Conditional offer of spousal coverage, earlier, for an additional description of conditional offers.)

Code 1C and 1D will take priority over code 1K

1C. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse).

1D. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)). Do not use code 1D if the coverage for the spouse was offered conditionally. Instead, use code 1J.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

ACA Form 1094-C and 1095-C Alignment Adjustments

Minor alignment adjustments are necessary to accommodate the 2022 ACA forms.

Release Dates

8.0 (on-premise): MR 8.0.31 (February 13, 2023)

8.1 (on-premise): MR 8.1.17 (February 28, 2023)

Ability to Print 1094-C/1095-C Forms on PDF Template Files

Prior to this release, you were able to print Form 1094-C and 1095-C on pre-printed forms from recommended vendors only. In this release, Costpoint adds the ability to print both Form 1094-C and 1095-C on PDF template files. You could use the PDF files to print forms on plain paper. This feature will prevent alignment problems that occur when you use pre-printed forms.

This new feature adds to the existing functionality of printing ACA forms using vendor-provided forms. The current functionality of printing 1094-C and 1095-C data on vendor-provided forms shall be retained in the meantime.

You will be able to print/process Form 1094-Cs and 1095-Cs for the current form and previous three calendar years. Costpoint provides a notification if IRS PDF file template for the calendar year is not yet available.

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.16 (January 16, 2023)

2022 Affordable Care Act (ACA) - Electronic Filing Updates

The Affordable Care Act (ACA) electronic file layout will be updated to accommodate the 2022 reporting requirements:

The system table S_SOFTWARE_ID shall be inserted with the following data.

CAL_TY_NO = 2022

SOFTWARE_ID = 22A0014924

FIRST_NAME = <carry over the value from 2021>

MID_NAME = <carry over the value from 2021>

LAST_NAME = <carry over the value from 2021>

NAME_SFX_CD = <carry over the value from 2021>

PHONE_ID = <carry over the value from 2021>

The tax year in all applicable namespaces must be updated to "ty22" in the manifest and data files.

The following shall be used to generate manifest and data files for Calendar Year 2022 if Government Agency is “Federal”:

Manifest file from tax year 2022 schema package

Form data file from tax year 2022 schema package

PaymentYr value “2022” PriorYearDataInd value “0”

Software ID for 2022

Release Dates

8.0 (on-premise): MR 8.0.29 (December 19, 2022)

8.1 (on-premise): MR 8.1.14 (December 5, 2022)

2021 Affordable Care Act (ACA) - 1094-C and 1095-C Form Alignment Updates

The 1094-C and 1095-C printing has been updated to accommodate the 2021 forms. Deadline dates for 2021 reporting are as follows:

| ACA Requirement | Deadline |

|---|---|

| Deliver 1095-C forms to employees | January 31, 2022 (The due date for furnishing Form 1095-C to individuals is extended from January 31, 2022, to March 2, 2022. See Proposed Regulations section 301.6056-1(g) and Extensions of time to furnish statements to recipients.) |

File paper 1094-C and 1095-C forms with IRS (According to the IRS, employers that file 250 or more 1095-Cs with the IRS must file the returns electronically) | February 28, 2022 |

| Electronic filing with the IRS | March 31, 2022 |

Release Dates

- 7.1.1 (on-premise): MR 7.1.27 (January 21, 2022)

- 8.0 (on-premise): MR 8.0.18 (January 17, 2022)

- 8.1 (on-premise): MR 8.1.5 (February 21, 2022)

2021 Affordable Care Act (ACA) - Electronic Filing Updates

The Affordable Care Act (ACA) electronic file layout has been updated to accommodate the 2021 reporting requirements:

- The Software ID shall be updated with the software ID for tax year 2021.

- Software ID = 21A0012967

- Costpoint contact information = use 2020 data

- The following shall be used to generate manifest and data files for tax year 2021 if Government Agency is "Federal":

- Manifest file from tax year 2021 schema package

- Form data file from tax year 2021 schema package

- PaymentYr value "2021"

- PriorYearDataInd value "0"

- Software Id for 2021

- The year in the namespaces of both manifest and data files shall be updated to 'ty21' from 'ty20' for tax year 2021.

- The submission must be split into two or more transmissions if Form Data File is larger than 100 MB.

The deadline date for 2021 electronic reporting is as follows:

| ACA Requirement | Deadline |

|---|---|

| Electronic Filing with the IRS | March 31, 2022 |

Release Dates

- 7.1.1 (on-premise): MR 7.1.28 (February 25. 2022)

- 8.0 (on-premise): MR 8.0.19 (February 28, 2022)

- 8.1 (on-premise): MR 8.1.5 (February 21, 2022)

2020 Affordable Care Act (ACA) - Add Age and Zip Code to 1095-C Report

The IRS released a draft of Form 1095-C, which included the following updates:

- "Employee's Age on January 1" has been added in Part II

- "Zip Code" has been added in Part II, #17

- Line 17 is for reporting the applicable ZIP code that the employer used for determining affordability if the employee was offered an individual coverage health-reimbursement arrangement.

- If Code 1L, 1M, or 1N were used on Line 14, this will be the employee's primary residence location.

- If Code 1O, 1P, or 1Q were used on Line 14, this will be the employee's primary work location.

- Part III (Covered Individuals) now starts at #18 (instead of #17 in 2019)

- Part III (Covered Individuals) now ends at #30 (instead of #34 in 2019)

- "Name of employee (first name, middle initial, last name)" has been removed from Part III

- "Social Security Number" has been removed from Part III

- New codes related to Health Reimbursement Arrangements (HRA) have been added for use in Line 14 (1L, 1M, 1N, 1O, 1P, 1Q, 1R, and 1S).

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

2020 Affordable Care Act (ACA) - Electronic Filing

The IRS released their E-file instructions for ACA electronic filing, which included the following updates:

- Update 'ty19' to 'ty20' in the namespaces of both manifest and data files

- Update Software ID for 2020 to '20A0010933'

- Add element AgeNum

- Add elements for the ZIP Code, Line 17

- AnnualICHRAZipCd

- MonthlyICHRAZipCdGrp

- JanICHRAZipCd

- FebICHRAZipCd

- MarICHRAZipCd

- AprICHRAZipCd

- MayICHRAZipCd

- JunICHRAZipCd

- JulICHRAZipCd

- AugICHRAZipCd

- SepICHRAZipCd

- OctICHRAZipCd

- NovICHRAZipCd

- DecICHRAZipCd

These updates will be implemented into Costpoint's Create 1094-C and 1095-C Electronic File application.

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 16, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

2020 Affordable Care Act (ACA) – Form 1095-C and Form 1094-C Alignment

The IRS released their layout instructions for the ACA 1095-C and 1094-C forms.

Costpoint Solution

Costpoint will be updated to accommodate the layout changes.

Important

You should not print the 1095-C forms for employees and 1094-C forms for the IRS until after you receive these updates.

Release Dates

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

2020 Affordable Care Act (ACA) – Add New 1095-C Print Options

The IRS released their layout instructions for the ACA 1095-C forms. This included the following changes:

- “Name of employee (first name, middle initial, last name)” has been removed from Part III (Page 2)

- “Social Security Number” has been removed from Part III (Page 2)

This change had a large impact on the printing of the 1095-C forms. Prior to this, you could print Page 2 separately, then use the "Name of employee" at the top of the page to match it up with the employee's Page 1. With the removal of the employee name and social security number from Page 2, there may be no way to match Page 2 with Page 1 as the IRS did not retain or provide a field to match the two pages. In cases where the covered individuals have the same surname as the employee, this would not be an issue, but there may be cases where the covered individuals do not have the same surname or you have multiple employees with the same surname. This can be problematic in matching up the pages correctly.

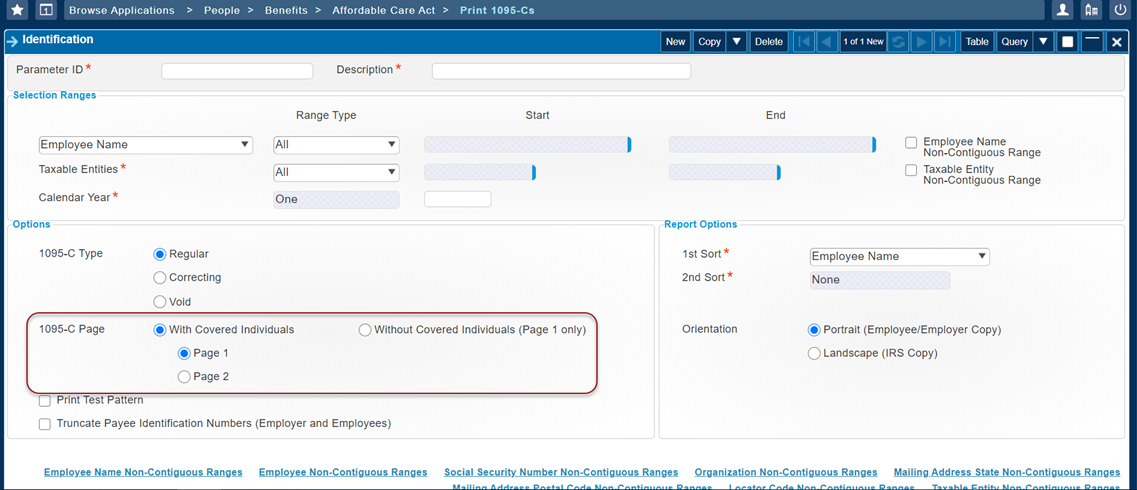

Costpoint Solution

In order to address this issue, Costpoint has been updated with new print options. There will be a four-step approach to printing 1095-Cs:

- Print 1095-C Page 1 for employees with covered individuals.

- Print 1095-C Page 2 for employees with covered individuals. You must use the same 1st Sort and 2nd Sort settings when printing Page 2.

- After printing Page 2, carefully collate the Page 1 forms with the Page 2 forms.

- Print 1095-C Page 1 for employees without covered individuals.

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

2020 Affordable Care Act (ACA) – Add New 1095-C Codes to Report an Offer of an Individual Coverage Health Reimbursement Arrangement (HRA)

An Applicable Large Employer that offers an individual coverage HRA can use two previously reserved codes from Code Series 1 on Form 1095-C, line 14, for reporting offers of coverage for 2020 as follows:

- 1T: Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee's primary residence location ZIP code.

- 1U: Individual coverage HRA offered to employee and spouse (no dependents) using employee's primary employment site ZIP code affordability safe harbor.

IRS Requirements

Costpoint Solution

The Lookup options for the line 14-Offer of Coverage fields have been updated to include 1T and 1U. We will also add the following codes, which are reserved for future use: 1V, 1W, 1X, 1Y, and 1Z

Release Dates

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

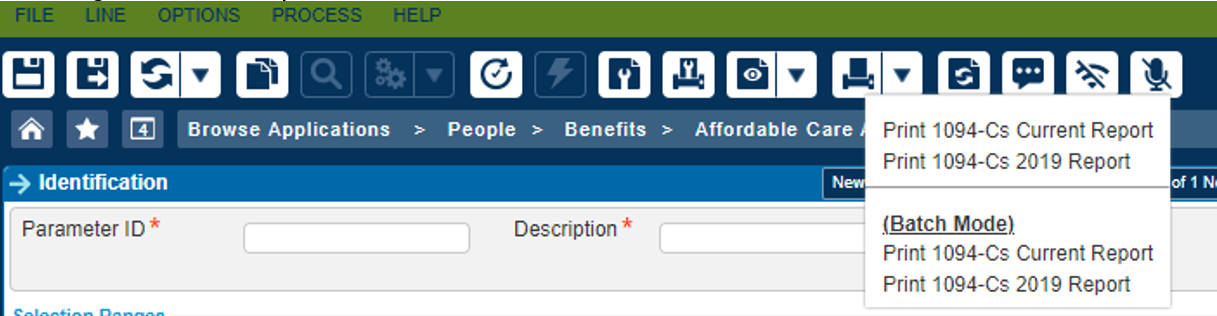

Affordable Care Act (ACA) – Add Option to Print Reports for the Prior Reporting Year

As some Costpoint users may have the need to correct and report the Affordable Care Act 1094-C and 1095-C reports for 2019, Costpoint has been updated to allow you to print the reports for 2019 or the current reporting year (2020). The Print and Preview toolbar now includes an option to print the report for 2019. Starting in 2021, Costpoint will support the current reporting cycle along with the prior year. So, for the 2021 reporting cycle, you will be able to generate the reports for 2021 or 2020.

Release Dates

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 8.0 (on-premise): MR 8.0.9 (April 30, 2021)

- Related Topics:

- COVID Updates

Use this section to view COVID-related regulatory news and updates.