COVID Updates

Use this section to view COVID-related regulatory news and updates.

COVID-2020 H.R. 6201: Families First Coronavirus Response Act - National Paid Sick Leave and FMLA Expansion

March 2020

In March 2020, the U.S. government signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new legislation:

- Emergency Paid Sick Leave: This legislation mandates covered employers to provide paid leave for employees affected by the coronavirus if those employees are unable to work or telework. An eligible employee is allowed two weeks (80 hours) of paid sick time at the employee's full regular rate of pay, subject to dollar caps; this is reduced to two-thirds pay if the leave is due to caring for others (for example, a sick or quarantined family member or a child whose school is closed or whose childcare provider is unavailable due to the coronavirus).

- Emergency Family and Medical Leave Expansion: An employee is eligible for ten additional weeks of FMLA leave, but only for those who must stay at home to care for a child whose school is closed. These 10 weeks will be paid at two-thirds the employee's regular rate of pay, subject to a $200 maximum payable amount per day and a $10,000 maximum total amount payable to an employee for public health emergency leave.

COVID Emergency Paid Sick Leave and Emergency FMLA Expansion

March 2020

Costpoint's existing Paid Family Leave functionality already supports the ability to accrue and track paid leave and adjust a salaried employee's timesheet so that the total labor cost for Paid Sick Leave is based on an average hourly compensation rate. However, the Families First Coronavirus Response Act imposes a daily dollar cap that will require Costpoint users to manually adjust the average hourly compensation rate if it would cause the daily labor cost for an employee's paid sick leave or paid FMLA to exceed the cap. The Average Hourly Compensation Rate field already exists in the Paid Family Leave subtask of the Manage Employee Leave screen, but it is not currently editable. An enhancement will enable the Average Hourly Compensation Rate field, allowing you to edit the rate, if necessary. To ensure compliance by April 2, 2020, all Deltek Costpoint, on-premise customers with fewer than 500 employees will need to apply the update to their environment with the following file requirements:

| Scenario | Action |

|---|---|

| Due to rules established in H.R. 6201 Families First Coronavirus Response Act, you have an employee that requires paid sick leave or paid FMLA and... | |

| You're a 7.1.1 client using System Jar 060 or older and you're not ready to put MR 7.1.4 into production. | Download cp711_ldmelv_003.zip from the DSM 7.1.1 folder and then apply the file. The minimum file requirements for this enhancement are as follows:

Release Date 7.1.1 (on-premise) file cp711_ldmelv_003.zip: Deployed to DSM on 03/27/2020 |

| You're a 7.1.1 client using MR 7.1.2 or MR 7.1.3. | Upgrade to 7.1.4 or higher. Release Date 7.1.1 (on-premise) MR 7.1.4:: Deployed to DSM on 03/31/2020 |

| You're a 7.1.1 client that's already applied MR 7.1.4 or a higher version. | No further action necessary. |

| You're a 7.0.1 client using System Jar 059 (or lower) and not ready to put System Jar 060 or a higher version into production. |

The minimum file requirements for this enhancement are as follows:

Release Date 7.0.1 cp701_patch5132_001.zip: Deployed to DSM 03/27/2020 |

| You're a 7.0.1 client that is ready to put 7.0.1 System Jar 060 or a higher version into production. | Implement the System Jar. Release Date 7.0.1 System Jar 060: 05/06/2020 |

| You're a 7.0.1 client that's already applied System Jar 060 or a higher version. | No further action necessary. |

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) has been created with instructions on the following:

- Pay type setup

- Leave type setup

- Leave code setup

- How to set up the employee Paid Family Leave information in relation to the Families First Coronavirus Response Act

- Examples of timesheet entry

- Instruction and examples of Paid Family Leave adjustment processing

COVID 2020 H.R. 6201: Families First Coronavirus Response Act - Payroll Tax Credits

March 2020

The U.S. government recently signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new tax credit legislation:

Employers covered by the Families First Coronavirus Response Act may take advantage of special tax credits designed to reimburse them for providing coronavirus-related paid sick and family medical leave to their employees.

- Paid Sick Leave Credit: As per the IRS, for an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days. For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

- Child Care Leave Credit: As per the IRS, in addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Costpoint Solution

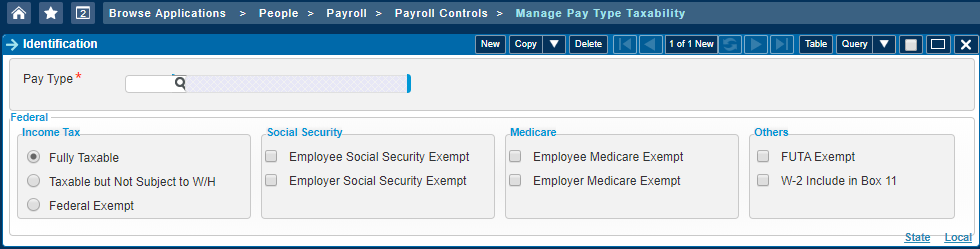

Costpoint currently allows for pay types to be flagged as exempt from both employer and employee Social Security and Medicare (FICA) taxes in the Manage Pay Type Taxability screen. However, the Families First Coronavirus Response Act allows for coronavirus-related sick and family medical leave to be exempt from only the employer's FICA tax. In order to comply with this requirement, we will update the Manage Pay Type Taxability application so you can specify a pay type's employer Social Security and Medicare taxability separately from the employee Social Security and Medicare taxability. This will allow you to set up your Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act pay types as employer-FICA-exempt, but not exempt for employee FICA tax.

Accordingly, Costpoint will compute and track the employee and employer FICA exempt pay type amounts, exempt deduction amounts, and taxable wages separately from the employee FICA information throughout the payroll process.

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) will be updated with data setup instructions in the coming weeks.

Release Dates

- 7.1.1 (on-premise): MR 7.1.7 (June 30, 2020)

- 7.0.1: System Jar 061 (June 30, 2020)

COVID-CARES Act Deferral of Employment Tax Deposits and Payments

Source: IRS website

March 2020

The Coronavirus, Aid, Relief and Economic Security Act (CARES Act) allows employers to defer the deposit and payment of the employer's share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes.

- What deposits and payments of employment taxes are employers entitled to defer?

Section 2302 of the CARES Act provides that employers may defer the deposit and payment of the employer's portion of Social Security taxes and certain railroad retirement taxes. These are the taxes imposed under section 3111(a) of the Internal Revenue Code (the "Code") and, for Railroad employers, so much of the taxes imposed under section 3221(a) of the Code as are attributable to the rate in effect under section 3111(a) of the Code (collectively referred to as the "employer's share of Social Security tax"). Employers that received a Paycheck Protection Program loan may not defer the deposit and payment of the employer's share of Social Security tax that is otherwise due after the employer receives a decision from the lender that the loan was forgiven. (See FAQ 4).

- When can employers begin deferring deposit and payment of the employer's share of Social Security tax without incurring failure to deposit and failure to pay penalties?

The deferral applies to deposits and payments of the employer's share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020. (Section 2302 of the CARES Act calls this period the "payroll tax deferral period.")

The Form 941, Employer's QUARTERLY Federal Tax Return, will be revised for the second calendar quarter of 2020 (April - June, 2020). Information will be provided in the near future to instruct employers how to reflect the deferred deposits and payments otherwise due on or after March 27, 2020 for the first quarter of 2020 (January - March 2020). In no case will Employers be required to make a special election to be able to defer deposits and payments of these employment taxes.

Costpoint Solution

Costpoint's existing A/P Voucher functionality already allows for partial liability payments as part of standard functionality. On the Edit Voucher Payment Status screen, the Amount to Pay is automatically calculated by the system (based on discounts, etc.) but you may override this value in order to do a partial payment. You may enter an override amount, for example the 50% of the employer portion of Social Security tax, but there is also retainage options that limit how much to pay.

COVID-Export of Leave Data to Shop Floor Time to Include Paid Family Leave Dates for COVID-19 H.R. 6201

The recent H.R. 6201: Families First Coronavirus Response Act regulations for COVID-19 allows employees to receive paid sick leave and Paid Family Medical Leave for certain COVID-19-related situations. The regulations, however, state that employees must use the leave between 04/01/2020 and 12/31/2020.

To allow Costpoint Shop Floor Time users comply to with the regulations, Costpoint MR 7.1.6 updates the way the Export Project Manufacturing Data (LDPEXPM) process handles the export of leave data. The application will now use the start and end dates on the Paid Family Leave subtask of the Manage Employee Leave (LDMELV) screen as the basis of the leave start and end dates exported to Shop Floor Time. This update will prevent employees from charging the COVID-19-related leave outside of the dates allowed by the government regulation.

Release Date

- 7.1.1 (on-premise): MR 7.1.6 (May 25, 2020)

COVID 2020 Quarterly Federal Payroll Tax Report

The U.S. Department of Treasury has not yet announced how the recent Social Security withholding deferral (CARES Act Memorandum) will affect the federal quarterly reporting. However, to help provide critical information, the Quarterly Federal Payroll Tax Report will be updated to provide the following information:

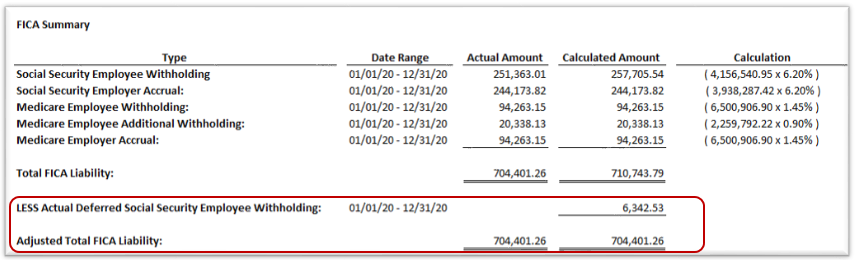

- Since it currently reports the expected Social Security Employee Withholding without adjusting for the amount of employee Social Security withholding that was deferred from September 1, 2020 to December 31, 2020, a new Actual Deferred Social Security Employee Withholding row has been added to the FICA Summary section of the Quarterly Federal Payroll Tax Report. This value is a sum of the Social Security employee withholding that was deferred during the reporting period. This amount will only be included on the report if at least one employee’s Social Security withholding was deferred. An Adjusted Total FICA Liability row was added to show the difference between the calculated amount and the deferred Social Security withholding.

- To provide additional information, a new Deferred Employee Social Security Withholding section was added to the Quarterly Federal Payroll Tax Report. This report will provide a detailed list of the employees whose Social Security withholding was deferred during the reporting period as a result of the CARES Act memorandum.

The 941 section of the Quarterly Federal Payroll Tax Report will be updated when an updated 941 form is provided by the U.S. government.

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (September 30, 2020)

- 7.1.7 Hot Fix (on-premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.1 (on-premise): MR 8.0.2 (October 12, 2020)

COVID 2020 Employee Social Security Tax Withholding Deferred from 9/1 to 12/31

Source: Bloomberg Tax

Employee Social Security Tax Deferred from Sept. 1 to Dec. 31

- The relief is in addition to the deferral of the employer portion of Social Security tax with respect to March 27 to Dec. 31

- Employees generally must have biweekly pay of less than $4,000 to be eligible for the new deferral

Withholding, deposits, and payments of the employee portion of Social Security tax are to be deferred with respect to the period from Sept. 1 to Dec. 31, 2020, under a presidential memorandum signed August 8 by President Donald Trump.

This relief for employees is separate from, and in addition to, the deferral of deposits and payments of the employer portion of Social Security tax with respect to the period from March 27 to Dec. 31, 2020, which was authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The deferral provisions pertaining to the employee portion of Social Security tax are to apply only to compensation paid to employees whose biweekly pretax compensation generally is less than $4,000. The employee portion of Medicare tax is not affected by the memorandum, as the memorandum specifies its applicability to the employee portion of Social Security tax imposed by Internal Revenue Code Section 3101(a) without also identifying applicability to the employee portion of Medicare tax imposed by IRC Section 3101(b).

Although the memorandum indicates that deferrals of the employee portion of Social Security tax are available with regard to compensation paid during the period from Sept. 1 to Dec. 31, the memorandum does not indicate that the employee relief would extend to deposit deadlines from Sept. 1 to Dec. 31 for assessments on compensation paid before that period. By contrast, deferrals of the employer portion of Social Security tax are available both with respect to deposit deadlines that occur within the period from March 27 to Dec. 31, even if those deposit deadlines are for assessments on compensation paid before that period, and deposit deadlines after that period but that are based on compensation paid during that period.

While the CARES Act did not require employers to defer their portion of Social Security tax and instead merely provided them with the option to do so, Sections 1 and 2 of the memorandum appear to have the combined effect of requiring the deferral of the employee portion of Social Security tax for eligible employees. It is likely that Treasury Department guidance issued pursuant to Section 3 of the memorandum will clarify whether deferral of the employee portion of Social Security tax indeed is required.

Although the CARES Act specified that half of the deferred employer portion of Social Security tax would be due Dec. 31, 2021, with the other half due Dec. 31, 2022, the memorandum does not specify when the deferred employee portion of Social Security tax would be due. Instead, Section 3 of the memorandum authorizes the Treasury Department to issue guidance that would clarify when the deferred employee portion would be due.

However, the memorandum identified that there is a possibility that the deferral of the employee portion of Social Security tax with respect to the period from Sept. 1 to Dec. 31 will be transformed into an elimination of the liability to pay that amount. Section 4 of the memorandum specifies in this regard that the Treasury Department "shall explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum."

As it is uncertain whether the liability to pay the deferred amounts of the employee portion of Social Security is to eventually be eliminated, the deferrals of the employee portion of Social Security tax are for now, like the deferrals of the employer portion of Social Security tax, not to be treated as deferrals of liability.

Therefore, for now, the employee portion of Social Security tax, even with deferrals, that normally would be due with respect to the period from Sept. 1 to Dec. 31 would need to continue to be included in Lines 12 and 16 of Form 941, Employer's Quarterly Federal Tax Return, and in applicable boxes for Form 941's Schedule B for semiweekly depositors, with respect to the returns reporting data for the period from Sept. 1 to Dec. 31. Amounts of the employee portion of Social Security tax, regardless of deferral, also would continue to be factored into determinations during the period from Sept. 1 to Dec. 31 of whether an employer must perform a next-day deposit because it accumulated employment tax liability of at least $100,000.

In light of the new line 13b that was added to Form 941, upon the release of its finalized revision June 19, to report deferrals of the employer portion of Social Security tax, it remains to be seen whether Form 941 will be further modified to accommodate reporting of deferrals of the employee portion of Social Security tax.

Presidential Memorandum: https://www.whitehouse.gov/presidential-actions/memorandum-deferring-payroll-tax-obligations-light-ongoing-covid-19-disaster/?fbclid=IwAR19mUMFDE3Sr62xogkuwOM9kHtg17Rw3vaancO78WBacuDqlrO445uof3w

Costpoint Solution

Based on the information provided in the memorandum, here are the required steps you will need to take to be compliant with this federal requirement:

Caution: Before computing payroll for your first paycheck in September 2020, you must complete the steps in the first two bullets below, even if you have not yet downloaded Costpoint MR 7.1.9 or MR 8.0.1.

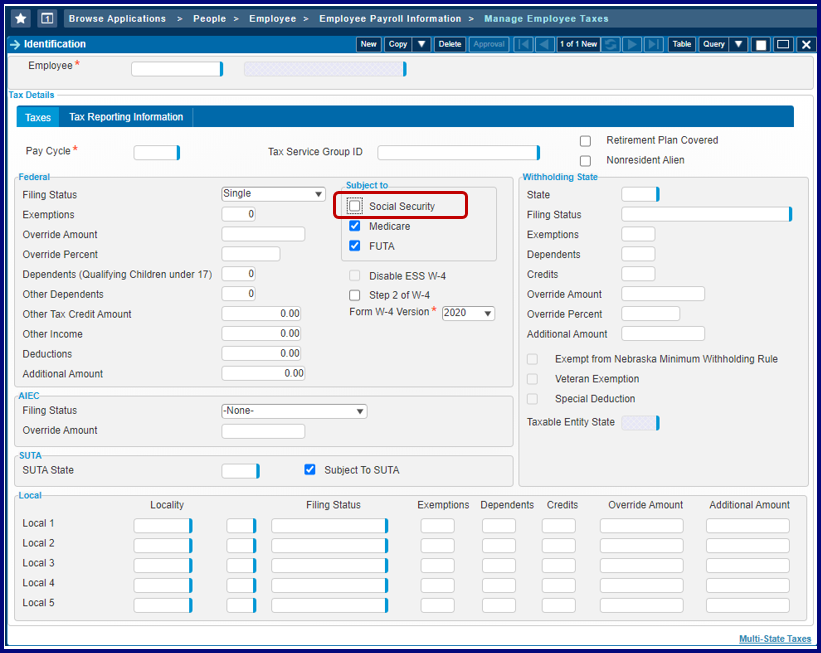

- Identify the employees that are eligible for deferral from their portion of Social Security taxes by identifying employees that generally have biweekly pay of less than $4,000.

- Clear the Subject to Social Security check box on the Manage Payroll Taxes screen for the identified employees. This will impede the calculation of both the employee's portion of Social Security taxes and the employer's portion of Social Security taxes when Compute Payroll is processed. You must complete this step before the first paycheck with a date that falls within the 9/1/2020 to 12/31/2020 period of deferral.

- The presidential memorandum states that only the employee's portion of Social Security taxes will be deferred. Therefore, after you post payroll and before you generate the Quarterly Federal Tax Report for 941 reporting, you will need to download MR 7.1.9, MR 8.0.1, or a higher version in order to obtain the updates that will allow you to calculate the employer portion of the Social Security tax and the employee's Social Security taxable wages.

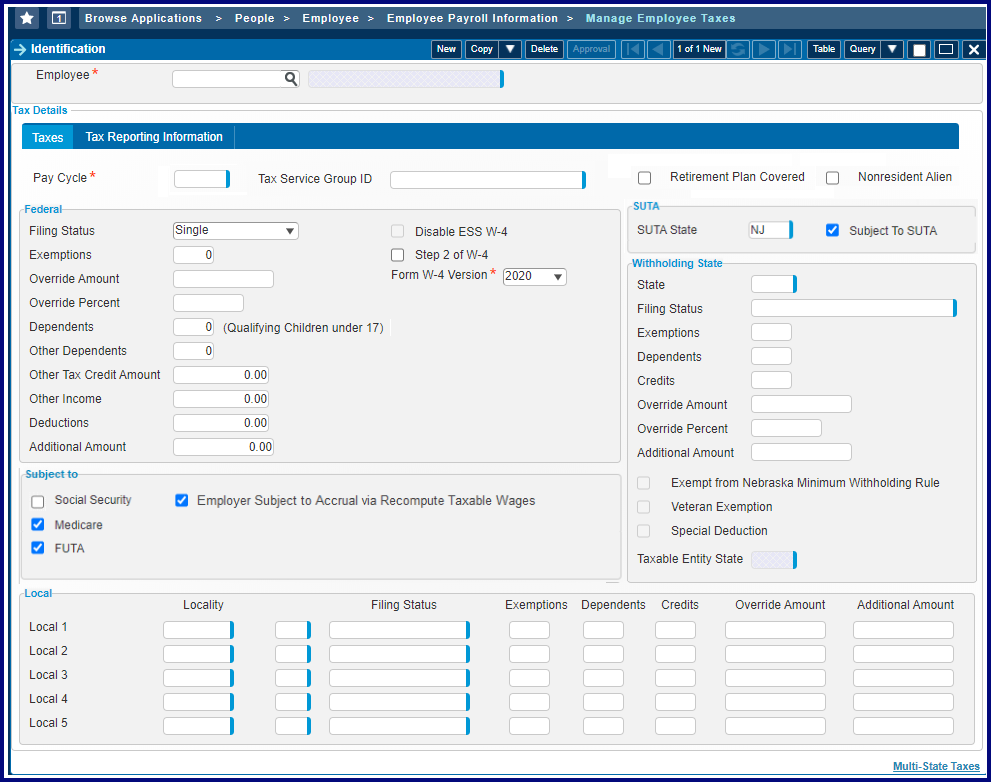

- Once MR 7.1.9 or MR 8.0.1 is loaded, query the employees that were identified for deferral from the employee portion of Social Security taxes and select the new Employer Subject to Accrual via Recompute Taxable Wages check box for each of the employees. Selecting this check box indicates that the employer is still liable for their portion of the Social Security taxes while the employee's Social Security Withholding is in a deferred status from 09/01/2020 through 12/31/2020.

- In order to update the employer's Social Security tax liability and the employee's Social Security taxable wages, you will need to run the Recompute Taxable Wages application. If an employee's Employer Subject to Accrual via Recompute Taxable Wages check box is selected on the Manage Employee Taxes screen and the check date falls within the 9/1/2020 to 12/31/2020 deferral period, the Recompute Taxable Wages application will do the following:

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security taxable wages.

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security tax accrual amount.

- Calculate and populate the Manage Employee Earnings History record with the employee's Social Security taxable wages.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.2 (September 22. 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

COVID 2021 Repayment of Deferred Social Security Withholding

On August 8, 2020, the President signed an executive order which allowed employers to defer Social Security tax withholding for certain employees from September 1, 2020 through December 31, 2020. In late August, the Internal Revenue Service (IRS) announced that employers that opted to defer the withholding must pay the money back by April 2021.

Costpoint Solution

For those employers that opted to defer employee Social Security tax withholding in 2020, Costpoint has provided the following new functionality to track and process the repayments.

A. The ability to establish the total deferred amount and the rules for repayment

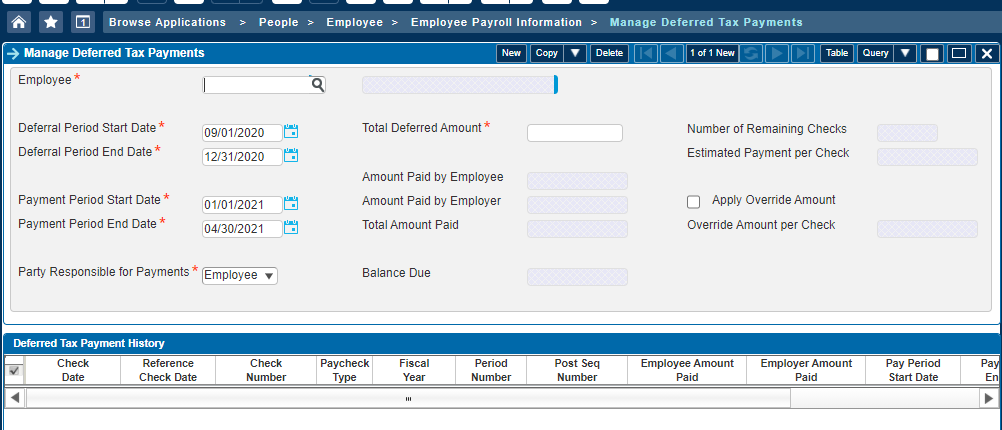

A new screen, titled Manage Deferred Tax Payments (EMMDFRDTAXPAY), will be added to Costpoint. This new screen will allow you to manage an employee's deferred Social Security amount and set up the rules for repayment of the deferral.

In this screen, you will be able to specify the deferral dates, the repayment date range, whether the employee or the employer is responsible for repaying the deferred amount, and, if necessary, an override amount to be withheld for any upcoming paychecks. Once the repayments have started, you will also be able to view the check detail for each repayment in the Deferred Tax Payment History subtask. The subtask will be populated with any pertinent data when an existing record is queried.

There are two ways of populating this new screen:

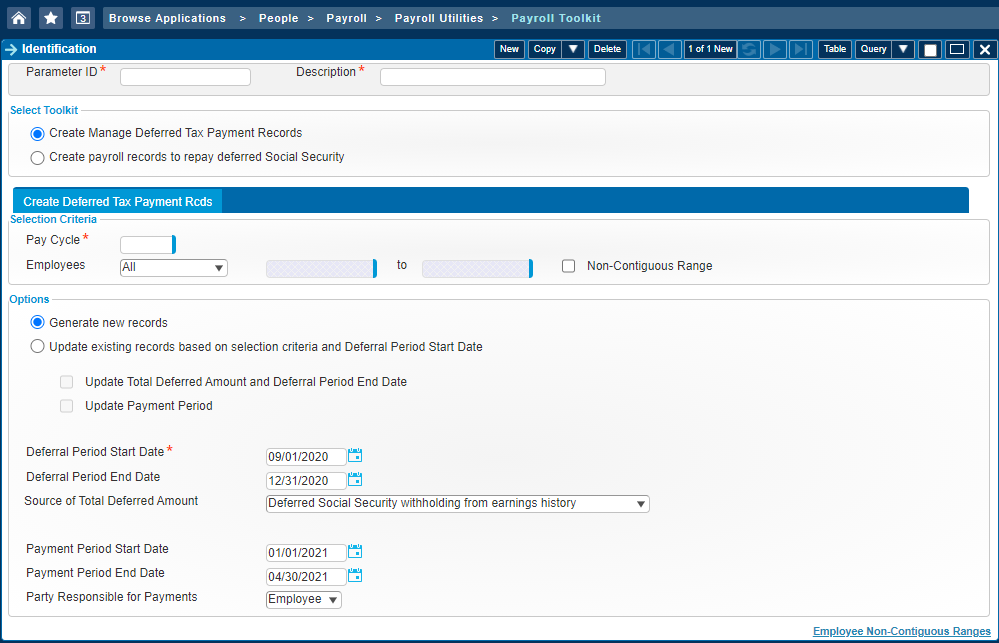

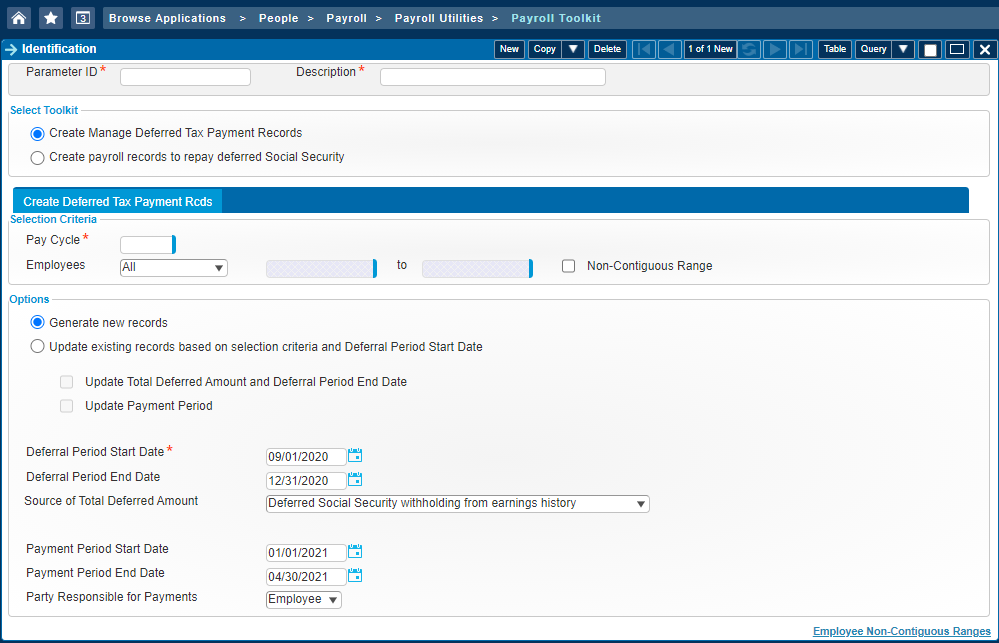

- If you used Deltek's recommended method of deferring the employee Social Security withholding (see " 2020 Employee Social Security Tax Withholding Deferred from 9/1 to 12/31" in the Regulatory - Latest News section), you may populate this screen using the new Create Manage Deferred Tax Payment Records toolkit in the Payroll Toolkits application. To determine the Total Deferred Amount, the toolkit will sum the Deferred Employee Withholding amounts from Manage Employee Earnings History, where the check date is between the specified deferral dates.

Timing: If this is the method that you choose to create the Deferred Tax Payment records, you should run this toolkit after your final paycheck of 2020 and before computing payroll for the first paycheck in 2021.

- If you did not use Deltek's recommended method of deferring the employee Social Security withholding, you may manually enter the data on the Manage Deferred Tax Payments (EMMDFRDTAXPAY) screen. You will need to determine each affected employee's total deferred withholding and specify the amount in the Total Deferred Amount field.

Timing: If this is the method you choose to create the Deferred Tax Payment records, you should enter and save the records after your final paycheck of 2020 and before computing payroll for the first paycheck in 2021.

B. The ability to process the repayment

Whether you use the new Create Manage Deferred Tax Payment records toolkit to generate the Manage Deferred Tax Payments (EMMDFRDTAXPAY) or manually enter the records, you may use either one of the following methods to process the deferred Social Security withholding repayments:

- A new toolkit, titled Create payroll records to repay deferred Social Security, has been added to the Payroll Toolkits screen. This toolkit can be used to generate X or Y type records to repay the deferral. In order to determine the repayment amount, the toolkit will prorate the employee's balance due over the remaining number of checks within the repayment period or, if you specified an Override Amount per Check, the toolkit will use that value as the repayment amount. The X or Y records generated by this toolkit cannot be edited and will only include the repayment amount. If the Manage Deferred Tax Payments (EMMDFRDTAXPAY) record specifies the employee as the party responsible for the repayments, the amount will be withheld from the employee. Otherwise, if the employer is the responsible party, the repayment amount will be recorded as the employer's Social Security liability.

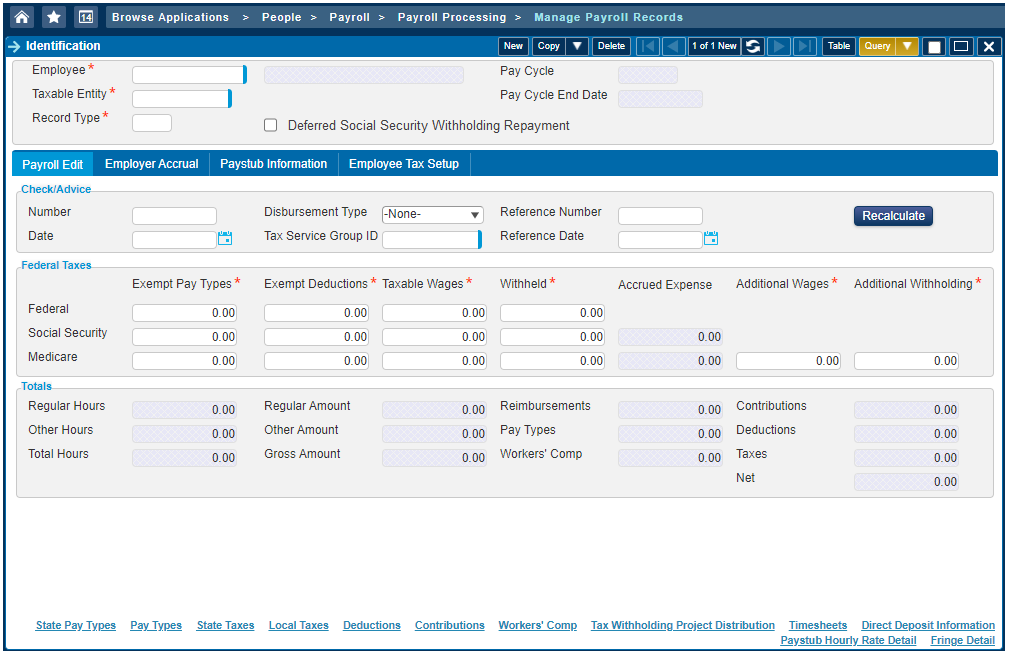

- You can manually enter an X or Y record on the Manage Payroll Records screen. In order to identify the record as a deferred Social Security repayment record, you must select the Deferred Social Security Withholding Repayment check box. By selecting this box, you will have limited access to fields on the screen and you will only be able to either enter an employee Social Security withholding amount or an employer Social Security accrual amount. You must also have at least one row in the Pay Types subtask or the State Pay Types subtask (for multi-state users) with zero hours and amounts.

Timing: It is important to perform the correct steps in order to process the repayment correctly:

- If you are using the new Create payroll records to repay deferred Social Security toolkit to generate the repayment records, ensure you have Check Dates assigned to your pay periods on the Manage Pay Periods screen. Each pay period with a check dated within the deferred Social Security withholding repayment period must have a Check Date assigned to it in order for the repayment amounts to be calculated correctly.

- If the employee is responsible for repaying the deferred Social Security withholding, compute a Regular or Bonus payroll for the affected employee on the Compute Payroll screen. If the employer (not the employee) is responsible for repayment of the deferral, this step is not necessary.

- Run the Create payroll records to repay deferred Social Security toolkit or manually enter the repayment record in the Manage Payroll Records screen.

- Print paychecks or payment advices.

- Post payroll.

C. The ability to export the deferred Social Security repayment amounts to a third party tax-reporting software

Costpoint's Export Payroll Taxes application will be updated to include the following:

- Add CHECK Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 70)

- Add QTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 71)

- Add YTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 72)

- Add CHECK Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 76)

- Add QTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 77)

- Add YTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 78)

Release Dates

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

COVID 2021 Reporting Deferred Social Security Withholding Repayments

In March 2021, the IRS released updated instructions for Form 941. Within the document, a section titled "How to pay the deferred amount of the employer and employee share of social security tax" stated that the payments could be made using a check or money order along with a 2020 Form 941-V payment voucher for the quarter in which you originally deferred the deposit and payment. This requires tracking of the deferred amount from Q3 2020 and the deferred amount from Q4 2020.

Costpoint Solution

For those employers that opted to defer employee Social Security tax withholding in 2020, Costpoint has provided the following new functionality to maintain and report the repayment amount towards Q3 2020 and Q4 2020:

- Manage Deferred Tax Payments (EMMDFRDTAXPAY)

- Two new fields have been added to the application to store the Q3 2020 and Q4 2020 deferred Social Security withholding amounts.

- Payroll Toolkits (PRPTOOLKIT)

- Changed the existing check box title from Update Total Deferred Amount and Deferral Period End Date to Update Q3/Q4/Total Deferred Amounts and Deferral Period End Date.

- Updated the process to determine and store the Social Security withholding amount that was deferred in Q3 and Q4 2020.

- Print Quarterly Federal Payroll Tax Report (PRRFDTAX)

- Added new report titled Repayment of Deferred Social Security Withholding Due to COVID-19 (941-V), which will include the information needed to report the Q3 2020 and Q4 2020 deferred Social Security withholding amounts on the 941-V

For more information, refer to the following IRS site: https://www.irs.gov/pub/irs-dft/i941--dft.pdf.

Release Dates

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 8.0 (on-premise): MR 8.0.8 (March 29, 2021)

COVID-CARES Act Paycheck Protection Program (Re-Release)

March 30, 2021

President Biden signed an extension for the Paycheck Protection Program (PPP), which was created in 2020 to help small businesses weather the economic fallout from the coronavirus pandemic. The deadline to apply for a PPP loan has been extended from March 31 to May 31, and the law extends authorization of loans to June 30 to give the Small Business Administration additional time to process applications.

IRS Requirements

https://home.treasury.gov/system/files/136/PPP--Fact-Sheet.pdf

Costpoint Solution

To help employers report accurate data for any loan applications, a new report was added in the Payroll module to calculate employer payroll expenses. The new application, titled ‘Print COVID Paycheck Protection Program Report’ which is available in the People\Payroll\Payroll Utilities menu, will provide a 12-month breakdown of total employee earnings, Employer paid state and local taxes, Employer benefits, Earnings in excess of $100,000, Total payroll costs and the Number of employees. The report will also display the yearly average for the total payroll costs and number of employees. Only U.S. based employees will be included in the report.

Release Dates

- 7.1.1 (on-premise): MR 7.1.18 (May 10, 2021)

- 8.0 (on-premise): MR 8.0.9 (April 30, 2021)

American Rescue Plan Act of 2021

The qualified leave wages that employers pay employees under the American Rescue Plan Act of 2021 (ARPA) are now subject to the employer share of Social Security tax. Previously, under the Families First Coronavirus Response Act (FFCRA), enacted in March 2020, any wages paid as a result of the Emergency Paid Sick Leave Act (EPSLA) and the Emergency Family and Medical Leave Expansion Act (EFMLEA) are not subject to the employer portion of Social Security tax.

Costpoint Solution

The Manage Pay Type Taxability screen has been updated to allow selection of COVID-19 Paid Sick Leave from the COVID-19 Tax Credit drop-down box even when the Employer Social Security Exempt check box is not selected. Previously, under the FFCRA, pay types could only be assigned as COVID-19 paid sick leave if the employer portion of social security tax was flagged as exempt.

Workaround

Prior to downloading the update, you can clear the Employer Social Security Exempt check box on the Manage Pay Type Taxability screen as qualified leave wages that employers pay employees under ARPA are now subject to the employer share of Social Security tax. When the update becomes available, you should open the Manage Pay Type Taxability screen, query the appropriate pay type(s) and select COVID-19 Paid Sick Leave from the COVID-19 Tax Credit drop-down box so that the taxes will be reported correctly.

Release Dates

- 7.1.1 (on-premise): MR 7.1.18 (May 10, 2021)

- 8.0 (on-premise): MR 8.0.9 (April 30, 2021)