About effective cost

If your company wants to track salaried costs based on actual hours worked, use effective cost. With effective cost, you can record cost and billing amounts based on actual cost, instead of standard cost.

Effective cost requires a different workflow than standard cost. Ajera must first process the actual hours worked before it can calculate effective cost rates. As a result, client invoices and project reports display standard cost until you run payroll. After running payroll, Ajera replaces standard cost with effective cost rates, and you can then invoice the client with these rates.

You can still use standard cost for projects not requiring total time accounting.

Should you use effective cost?

You can use effective cost only if you meet both of the following conditions:

- You are applying it to salaried employees. Effective cost is not applicable to hourly employees.

- Your company has a payroll type of Process Payroll or Payroll Service. Ajera calculates the effective cost rate when it processes payroll.

Effective cost affects many areas in Ajera - company preferences, billing rate tables, payroll, timesheets, client invoices, and reporting - and only companies that need effective cost should use it.

Before using effective cost, ask yourself:

- Do you understand how effective cost affects the general ledger?

- Can you postpone invoicing until after running payroll? Effective cost is available only after running payroll.

- Will your principals and project managers understand that they can view only standard cost until you run payroll?

|

Note: |

Be sure to read all the help regarding effective cost before turning this feature on. If you have questions, contact your Deltek consultant. |

When can you turn on effective cost?

|

Caution: |

You may be using standard cost and want to start using effective cost. Because your existing projects have been using standard cost for costing and possibly billing rate calculation, turn on effective cost only after completing a payroll and billing cycle. Otherwise, you may make incorrect entries to the general ledger. Example You may end up with unpaid time before the effective cost date, which affects the Salaries Payable balance. You cannot pay or reconcile these unpaid hours, and you may be unable to create a Final client invoice. |

How does it work?

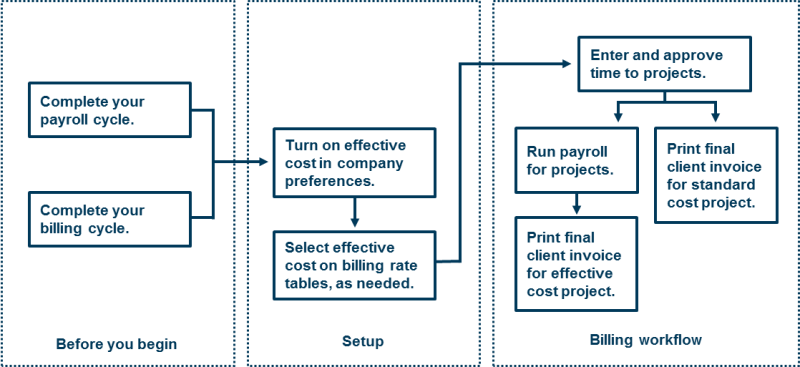

After completing a payroll and billing cycle, turn on effective cost in company preferences, which makes effective cost options available in billing rate tables, employee setups, and client invoices.

When you turn on effective cost, Ajera applies it to all employees. If you use multi-company, each company with employees must be set up with a payroll type of Process Payroll or Payroll Service.

In the billing rate tables, select whether a table uses effective cost. When you bill, Ajera calculates billing rates using effective cost only for phases that use a billing rate table with effective cost turned on.

What is the overall workflow?

Before billing:

- Carefully review all timesheets to ensure the required time is entered for payroll.

- Process payroll.

- Review client invoices to determine which to print as Final. Invoices may cross different pay periods, and an invoice cannot be billed if it contains an unpaid salaried labor transaction and the billing rate is based on effective cost.

Before processing payroll, Ajera uses standard cost in project reports and the general ledger. After processing payroll, it uses effective cost. You can choose to use effective cost only for reporting purposes and not apply it to any of your billing rate tables. If you do this, there is no change in your billing workflow - you can bill whenever needed because you are not billing at effective cost rates.