Introduction

Maconomy contains a number of possibilities for stating precisely how a specific price is to be calculated.

In a price calculation Maconomy can make use of price lists, activities, and employees. When the system is set up correctly, the price calculation is transparent to the user, who does not have to consider the factors influencing the different prices. This appendix contains a detailed description of how Maconomy calculates prices in the Job Cost module, and is useful when setting up the system. Several references are made to this appendix in the Reference Manual.

The calculation of a price is influenced by many factors. In order for Maconomy to be able to show, for example, a billing price for a time activity in the Job Journal window, the system has to consider the following issues:

- Does a price list specific to the job exist?

- Is a general job price list assigned to the current job?

- Does the job specific price list or the general job price list contain a billing price?

- Has a billing price been assigned to the employee?

- Has an item number been assigned to the activity?

- Is the hourly rate calculated by activity or by employee?

- Has a markup percentage been specified anywhere?

If Maconomy’s multi-company model is used, a distinction between the responsible and the executing company is made. The company responsible for a job is stated on the information card of the job in question. When a company registers an activity pertaining to a job for which the company itself is responsible, but which is, for example, being executed by an employee belonging to another company in Maconomy’s multi-company model, the current company is still considered as the responsible company whereas the employee’s company is considered the executing company. In this case, Maconomy creates intercompany entries between the responsible company (the settling company) and the executing company (the intercompany company).

However, if the Create intercompany entries for companies with same parent company system parameter is not marked, intercompany entries are only created if the two companies involved are not both assigned to the same parent company. In this way, the cost price of the responsible company equals the intercompany price of the registration, which in turn is the executing company’s billing price.

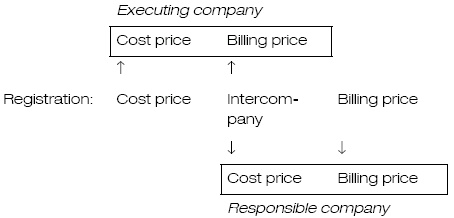

This can be shown in a table as follows:

The resource (employee) belonging to the executing company has a cost price. This price is the executing company’s cost price. The resource also has an intercompany price. This intercompany price is registered with a view to the internal intercompany calculations in Maconomy and can be seen as the executing company’s billing price. At the same time, the intercompany price is the cost price of the responsible company. The billing price given to the customer is therefore calculated based on this cost price.

You can find further information about companies in the section “Multiple Companies” in the chapter “Introduction to the G/L module”.

The price calculation is made based on priorities, where some of the elements put in order of priority depend on the setup of Maconomy. The following sections briefly describe the elements influencing the order of priority.