Creating a payroll file (payroll service or outsourced payroll)

|

Note: |

|

- From the Manage menu, click Payroll.

- Multi-company only. Select a company. The Payroll window appears. To create the payroll file, Ajera uses the payroll type from the Company > Companies window and the payroll settings from the Company > Preferences window.

- For all payroll other than

QuickBooks, in the Output File field, click

and browse to select the location

and file name of the file you want to send to your payroll service for outsourced payroll. You

can also type the path and file name.

and browse to select the location

and file name of the file you want to send to your payroll service for outsourced payroll. You

can also type the path and file name.

If you are using QuickBooks to process your payroll, in the Company File field, browse to select the location and file name of the file that contains your QuickBooks payroll data (for example, Mycompany.QBW).

- For the pay date, enter the date when pay for this period is issued.

- For the date range, enter the earliest date for the information that you want to include in the file. To include all information not previously sent to the payroll service, leave this field blank. For the through date, enter the latest date for the information you want to include.

For example, if your pay period is semimonthly, to include all time through the 15th, your date range would be from the 1st day of the month through the 15th day of the month.

- If you need to run payroll for only one employee, enter the employee name. Otherwise, leave the field blank.

For example, you might run payroll for one employee if the employee was terminated and you need to issue a paycheck before the next payroll.

- If you need to recreate a payroll service file before sending it, select the Reexport previously exported transactions check box.

Verify that the date in the Prior Pay Date field is correct, or click the arrow to select another date.

| Note: |

You cannot reexport transactions for pay periods when the vendor invoice has already been paid. If using QuickBooks payroll, and you want to update existing time in QuickBooks with only the time entered in Ajera since the last export, select the Export new time only to QuickBooks timesheets check box. |

- Click OK.

The output file is ready for you to send it to your payroll service. Ajera also creates a vendor invoice for you to pay your service.

| Note: |

If you are using QuickBooks, a message appears asking you to confirm installation of a program that provides an interface to QuickBooks data. You receive this message the first time you create a payroll file on a workstation. |

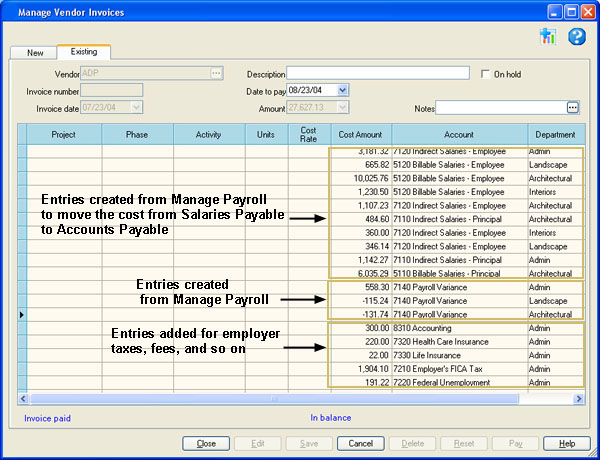

- To add items such as employer tax, benefits, and service fees to your payroll service invoice, from the Manage menu, click Vendor Invoices. On the Existing tab, select the invoice and make changes, as needed.

See also

Example

Example