EU Purchase and Sale

The windows used in Maconomy for registering purchases and sales in the Item Purchase and Sales Orders modules have specific fields to denote EU trade.

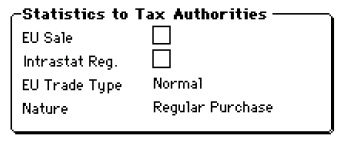

The Sales Orders window, for example, has a field which is marked for EU sales, which means the sale will be reported to the EU Sales List System and Intrastat.

Maconomy automatically marks the fields “EU Sale” and “Intrastat Reg.” if an order is being delivered to another EU country and is not subject to sales tax. However, it is a condition that the current country has been marked as being a member of EU in the field “Member of EU” in the window Countries. After it is invoiced, the sales amount and customer tax number are automatically included in the periodical report to the Sales List System, just as the CN code and item lines are reported to Intrastat.

The system works similarly for EU purchases entered in the Item Purchase Orders window. The item lines are included in the Intrastat statistics when the items are received in the Item Receipt window. The invoice for the items must be registered in the Vendor Invoices window with the tax code for EU acquisitions.