Half-Depreciation Percentage the First Year

This section shows an example of the Italian half depreciation percentage the first year.

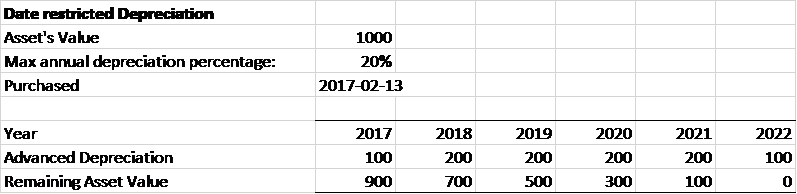

The restricted depreciation is different from the straight line depreciation in the first and last year.

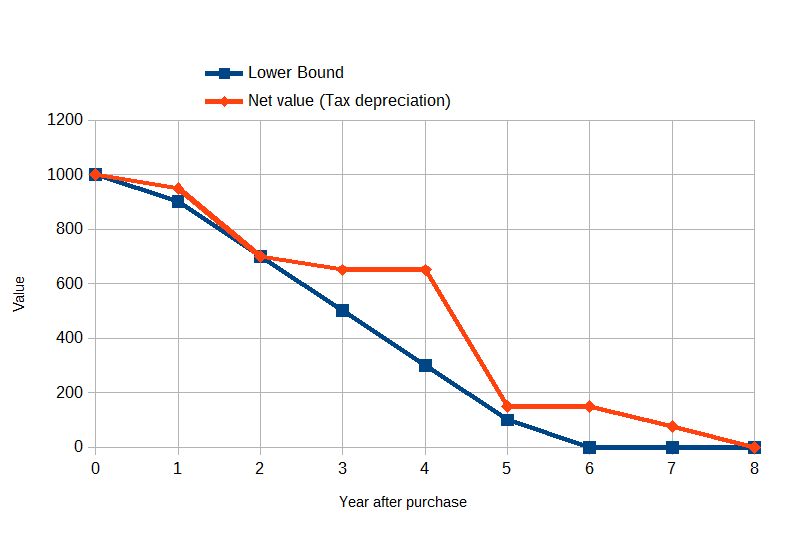

When you use tax depreciation, it can reduce the net value but it cannot reduce the value lesser than the lower bound.

The line chart below shows an example of a depreciation limit and the actual depreciation:

In the line chart example, the blue line shows the depreciation limit while the orange line shows the actual depreciation. The actual depreciation cannot cross the depreciation limit. Whether the actual depreciation aligns with the limit or changes, as seen on the orange line, depends on the user.

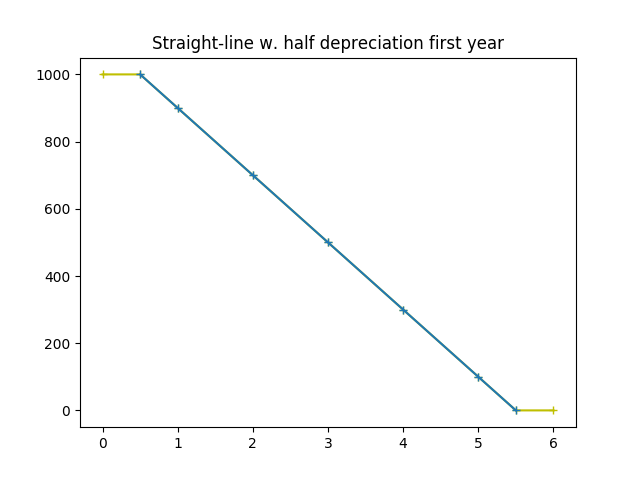

Half depreciation is a straight line of five years. Depreciation shifts half a year in a six-year period. Note that the five-year straight line depreciation, which uses half depreciation in the first year, is a straight line in the half-year to five and a half-year period, and spans six years of depreciation.

Thus, the straight line changed to start at the middle of the fiscal year. This, without further interventions, ensures that the depreciation does not violate the lower bound restriction. The company sees the depreciation with no concerns of the monthly difference in a report evaluated annually.

Example

Accountant A has an advanced knowledge of the tax system. There are other accountants in the company that have car purchases that need to depreciate in the following years. Accountant A sets up a new asset group for Automobiles that can be used widely in the company. The accountants focus on making the tax payment most beneficial for the company. They adjust the assets value with that in mind. Thus, they can focus on business strategy and statutory compliance. They also do not have to calculate the limitation of the assets adjustment.

To accomplish this, Accountant A sets up the new asset group for Automobiles in . He completes the fields in Tax Depreciation Information island.

Accountant B creates an asset in . He also uses the asset group that Accountant A created. He updates the fields in the Tax Depreciation Information island in

Then, the asset must be depreciated. He uses the automatic depreciation method in to depreciate the assets. He accesses the new tax depreciation in the Adjustment sub-tab. It shows the maximum amount that they could depreciate in the fiscal year. He could reduce the amount if necessary but he could not go beyond.