13.5 Features and Enhancements

This section includes details about the new features and enhancements in WorkBook Release 13.5.

New WorkBook Resource Center

The new WorkBook Resource Center is a central hub that enables you to access all of the WorkBook information that you need. The top menu bar provides links to videos, training, and more. Scroll down to find Release Notes, Online Help, Coffee Breaks, the Ideas Portal, and popular learning assets. Bookmark the following link: https://enablement.deltek.com/resource-center/workbook

Agents

You Might Need to Change Agent Parameters to Enhance Access Control on File Upload for Azure Blob Storage Provider

Deltek Tacking Number: 2091607

Description: As a result of changes in the AzureStorageProvider and SASAzureStorageProvider, you might need to adjust the parameters of the General Import Agent and the General Export Agent.

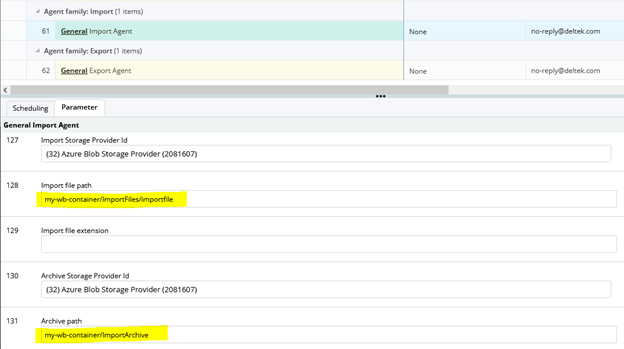

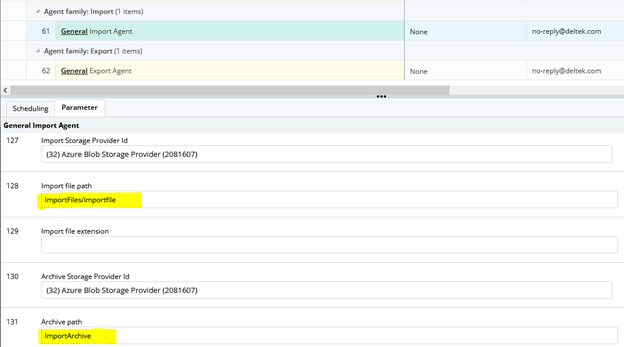

- If the Import Storage Provider Id parameter is set to an AzureStorageProvider (or SASAzureStorageProvider), the Import file path must not start with the storage provider's RootPath (or CustomerContainerName, respectively).

- If the Archive Storage Provider Id parameter is set to an AzureStorageProvider (or SASAzureStorageProvider), the Archive path must not start with the storage provider's RootPath (or CustomerContainerName , respectively).

- If the Export Storage Provider parameter is set to an AzureStorageProvider (or SASAzureStorageProvider), the Export folder must not start with the storage provider's RootPath (or CustomerContainerName , respectively).

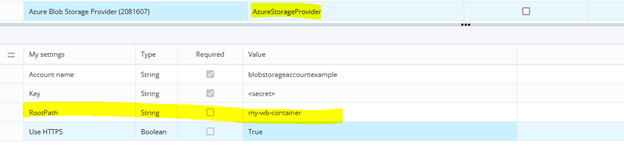

For example, with the following configuration:

You must change the following parameters for the General Import Agent:

To the following:

API

For more information about the API, you can access the Deltek WorkBook API Guide at: https://workbookapi.deltek.com/?version=latest.

Obsolete Endpoint Removed: PUT ErrorReportRequest

Deltek Tracking Number: 2072715

Description: The obsolete endpoint PUT ErrorReportRequest is removed.

Exceptions from PatchObject Return HTTP 440 Instead of 500 Internal Server Error

Deltek Tracking Number: 1994789

Description: PATCH endpoints now return 400 Bad Request instead of 500 Internal Server Error when a patch payload that is sent through the API is not valid.

Databoard

Upgrade of WorkBook Databoard Module to Microsoft .NET 6 – ExportDataRequest Endpoint Removed

Deltek Tracking Number: 1994318

- POST /api/Export/Data

- POST /api/json/reply/ExportDataRequest

The ExportFormRequest endpoint, which provides exactly the same functionality, is still available. It is accessible through POST /api/Export/Form and POST /api/json/reply/ExportDataRequest.

- ExportDataRequest – POST /report/api/Export/Data or POST /report/api/json/reply/ExportDataRequest

- ExportFormRequest – POST /report/api/Export/Form or POST /report/api/json/reply/ExportDataRequest

For information about the WorkBook API, you can access the Deltek WorkBook API Guide at the following link: https://workbookapi.deltek.com/?version=latest

Finance & Administration

Creditors - Creditor Invoices - Download and View e-Invoice Lines and Attachments from Pagero

Deltek Tracking Number: 1975169

Description: You can now download and view Creditor Invoice lines from e-invoices created in Pagero. The information that is extracted from the Articles section of Pagero is generated as lines within the Creditor Invoices Lines grid in the Creditor Invoices sub-module. You can view the documents that are added as attachments to the invoice and download them when you click Preview Creditor Invoice File or Invoice Conversation in the bottom grid of the Creditor Invoices sub-module.

Previously, you could only download and view e-invoice headers from Pagero.

See the link to Pagero Guide for more information.

Creditors – Creditor Invoices – Send Response to Pagero

Deltek Tracking Number: 1975158

Description: You can now send a response to Pagero to communicate the invoice status or provide updates about the downloaded invoice. New buttons and an Imported From column have been added to support this enhancement.

The Imported From column has been added in the top grid of the Creditor Invoices sub-module. This column provides details about the source of each downloaded invoice.

The Send Response to Pagero button has been added to the following pages. Use it specifically for invoices downloaded from Pagero.

button has been added to the following pages. Use it specifically for invoices downloaded from Pagero.

When you click the Pagero Response Log button, WorkBook displays the Pagero Response Log tab. This tab contains a list of responses sent for an invoice. You can also view the Pagero Response Log tab when you click a Creditor Invoice's Voucher card.

Journal Posting Performance Improvements

Deltek Tracking Number: 2056116

Description: Incremental performance improvements when performing journal postings are implemented by Release 13.5.Payment Proposals – GDFF Payment Proposal Type Added

Deltek Tracking Number: 2069268

You can now use the new Global Delimited Flat File (GDFF) payment method in India.

New SKAT Integration Enables Danish Companies to Comply with the Danish Bookkeeping Act

Deltek Tracking Number: 1761074

Description: WorkBook enables Danish Companies who are required to submit VAT Returns to submit them direcly to DK SKAT using their VAT API.

New Danish VAT Returns Page

The Danish VAT Returns page has been added to the Finance & Administration module, Month-End sub-module, to enable Danish Companies to enter, submit, view, and resubmit the required VAT Returns information. Navigate to Finance & Administration > Month-End > Danish VAT Returns.

- You have access to Finance in the Company that is required to file Danish VAT Returns.

- A new Company Variable 80 (Enable Communication Between SKAT and WorkBook) is enabled.

- The Company's Country is set to Denmark.

- The Company's CVR contains a valid CVR. (The CVR is the unique identifier for a business in Denmark's Central Business Register, the official database of Danish businesses.)

If the Company's country is set to something other than Denmark, and the CVR is blank, WorkBook displays an overlay that explains that you cannot access the Danish VAT Returns page.

VAT Returns Process Overview

To begin the VAT Returns process, you must first load the VAT calendar on the Danish VAT Returns page. When you click the Load Calendar button, WorkBook generates periods from half a year before the current date to one year after the current date, with the frequency of periods based on the Company's CVR number.

For example, if today's date is July 1, 2023, half a year before the current date would be January 1, 2023. A full year after today's date would be July 1, 2024. Thus, if you click the Load Calendar button on July 1, 2023, periods from January 1, 2023 to July 1, 2024 are generated. You can edit period dates if the frequency is not monthly, quarterly, or half-yearly. Based on the frequency, WorkBook populates the lines on the Danish VAT Returns page.

You click the Create Return button on the Danish VAT Returns page to display the VAT Return page so that you can enter the information that SKAT requires for VAT Returns. If you already have a VAT Return that you have not yet submitted and approved, a dialog box tells you that creating a return overwrites the current version and asks you to confirm before it displays the VAT Return page.

After you enter the required information—or update it, if you are working with an existing VAT Return—WorkBook displays a confirmation page so that you can verify that the information that you are going to submit is correct and complete, including the total.

You can click the Send to SKAT.dk button when you are ready to submit your VAT Return.

Submit the VAT Return Overview

- The page footer displays the figures that you submitted, along with their total.

- A status message from SKAT is displayed in the Message from SKAT pane.

- The following buttons are displayed:

- Approve Return on SKAT.dk – Click to log in to the SKAT web site to approve the VAT Return. This is required.

- Download Receipt – Click to download the receipt for a VAT Return. If the VAT Return was not approved on the SKAT website, or if it expired, SKAT sends an appropriate error message. If you successfully downloaded the VAT Return from SKAT, its status changes to Status-50 – Approved. The receipt is always available to you when it is in Status-50, and it is returned to you directly from WorkBook.

Sometimes you might need to resubmit a VAT Return. When you start to resubmit a VAT Return the following message is displayed: Creating a new return will overwrite the current return. Continue?

After you confirm, the VAT Returns page is displayed so that you can enter or update any information as needed. You can then submit and approve it as you did the initial VAT Return.

Resubmitting a VAT Return retains its status as resubmitted, and the footer displays the resubmitted figures.

- The Submitted by column displays the user who resubmitted the VAT Return.

- The Transaction Timestamp column displays the date on which the VAT Return was resubmitted.

Framework

Rich Text Editor Update and Enhancement

Deltek Tracking Number: 1897012

- – Edit the text field at the bottom

- – New page to replace the previous Notification Email Text page

Webhooks – New Webhook Subscription

Deltek Tracking Number: 2131442

Description: This release adds a new webhook subscription, FinanceJournalPosted.

Webhooks – Use Event Aggregation to Limit the Number of Events Delivered to a Webhook Subscription

Deltek Tracking Number: 2131418

Description: Almost every change in WorkBook triggers a new event. Some webhook events might be triggered more often than they were previously. This can result in many events being delivered to a subscription. You can use event aggregation to reduce the number of calls to a webhook, which in turn reduces the number of events that are delivered to a subscription.

- Events that are related to updates

- Events that have the same types

- Events that are associated with the same entity

- Events that have been retried the same number of times.

For more detailed information about using event aggregation, see Deltek WorkBook Webhooks Guide.

General

DevExpress Upgrade

Deltek Tracking Number: 2037288

Description: DevExpress has been upgraded to Version 23.1. This updates PDF and image processing algorithms. This means that in some cases, document previews may be improved.

ImageMagick Component Updated

Deltek Tracking Number: 2063290

Description: Deltek upgraded the third-party component ImageMagick that WorkBook uses to version 13.6.0.

Jobs

Price Quote (PQ) – Confirmation before Canceling

Deltek Tracking Number: 1565641

Description: A dialog box has been added for you to confirm the cancellation of a PQ before it is canceled. This reduces the risk of accidentally canceling a valid PQ.

Pagero Integration

Pagero Integration Guide Updated for On-Premises WorkBook Deployment Instructions

Deltek Tracking Number: 2110203

Description: Instructions for configuring the integration between WorkBook and Pagero for customer sites that have on-premises WorkBook deployments have been added to the Deltek WorkBook Pagero Integration Guide.

Settings

Settings – Finance – Import and Export Basic Company Information in SAF-T File Format

Deltek Tracking Number: 1761071

Description: In compliance with the Danish Bookkeeping Act's requirements for bookkeeping systems to import and export Danish Company data in Standard Audit File for Tax (SAF-T) format, the SAF-T Import/Export sub-module has been added in

In this submodule, Administrators can generate a SAF-T file in XML format, export a Danish Company's basic information in SAF-T file format, and import a SAF-T file from other bookkeeping systems to WorkBook.

Time & Expense

Additional Information Field for Personal Expense Added

Deltek Tracking Number: 2040474

Description: A new checkbox has been added on the Activity Settings page, enabling System Administrators to specify which Activities require additional information for regulatory reporting. By default, this checkbox is disabled; you must enable it manually for the appropriate Activities. System Administrators can also set default text via the Standard Texts page to guide users in providing the required information using their preferred language.

For users who enter job-based expense entries that are associated with those Activities, a new Information field is now displayed on the Expense Entry Details sidebar. The Information field is a read-only text field, limited to 255 alphanumeric characters. This field helps to ensure compliance with regulatory reporting standards. If you need to add or modify this information, click the edit icon to access a separate text entry dialog box.

For more information, see Enable the Information Field in Personal Expense and Add Additional Information to Your Expense Entry.