Straight Line Depreciation with Parameter

This functionality prevents you from making a depreciation when the net value of an asset is decreased further than a lower bound.

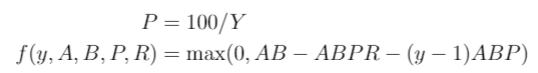

To calculate the lower bound, we use the following formulas:

where:

- A = asset’s purchase value

- B = asset cost factor

- P = maximum depreciation percentage

- Y = years of the asset’s lifetime

- R = first year factor

- y = the current year

P = 100/Y states that the year of the asset’s lifetime (Y) and the maximum depreciation percentage (P) are dependent on each other. Therefore, you can only supply one of them. The second formula defines the lower bound on the asset’s value for every given year (y). Note that the lower case y is for the running year since the assets purchase. The formulas enforce a check on the asset depreciation, to ensure the compliance with the law.

Example Calculation

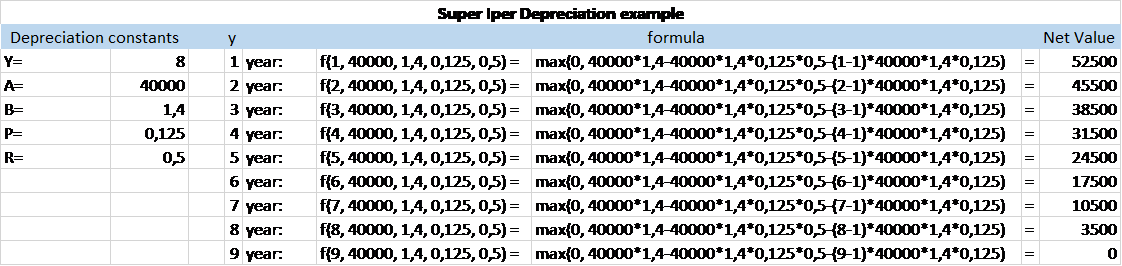

The figure below shows an example of the Super Iper Depreciation:

Parent Topic: Options to Set Up Limitation on Tax Depreciation