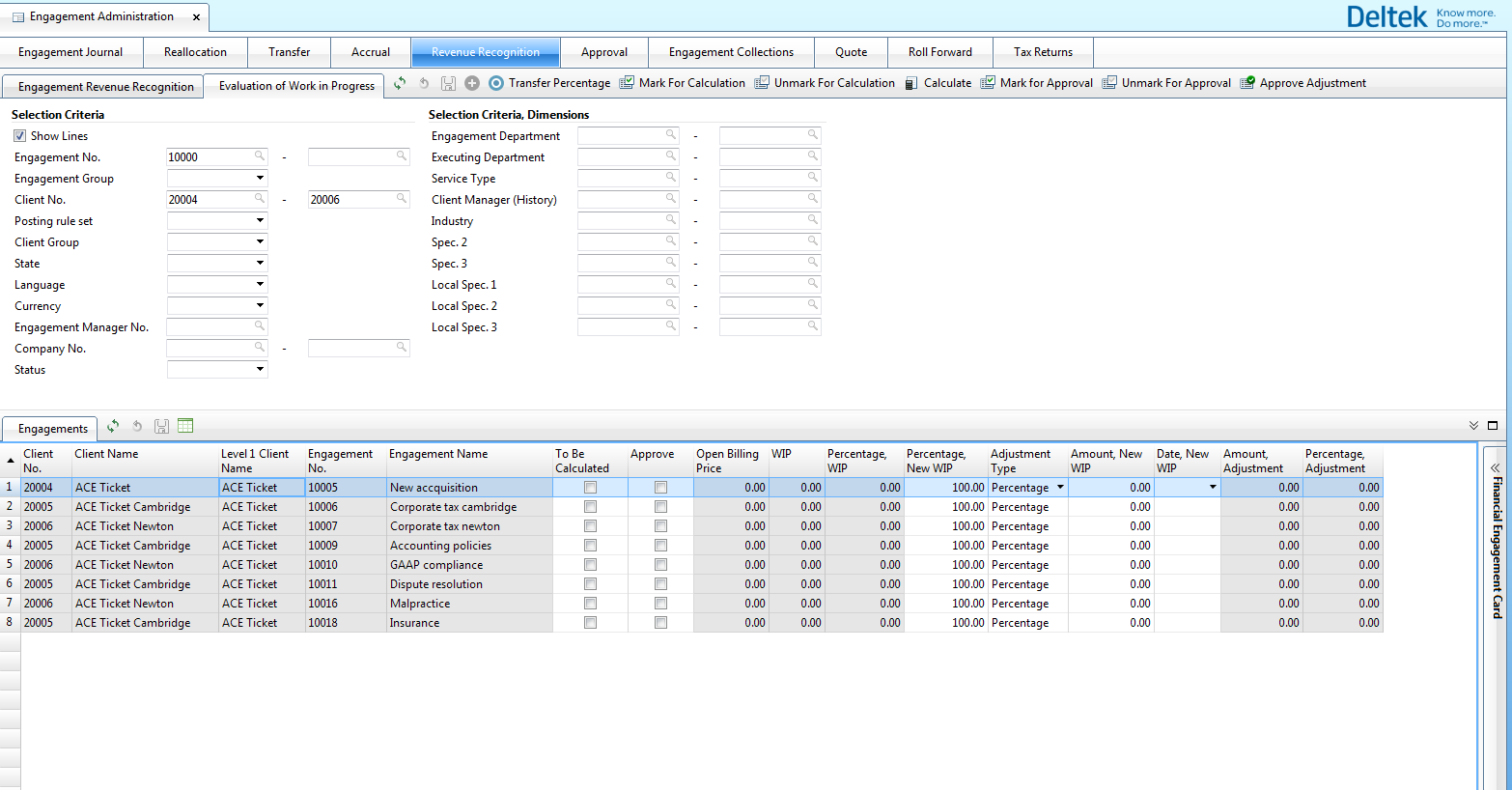

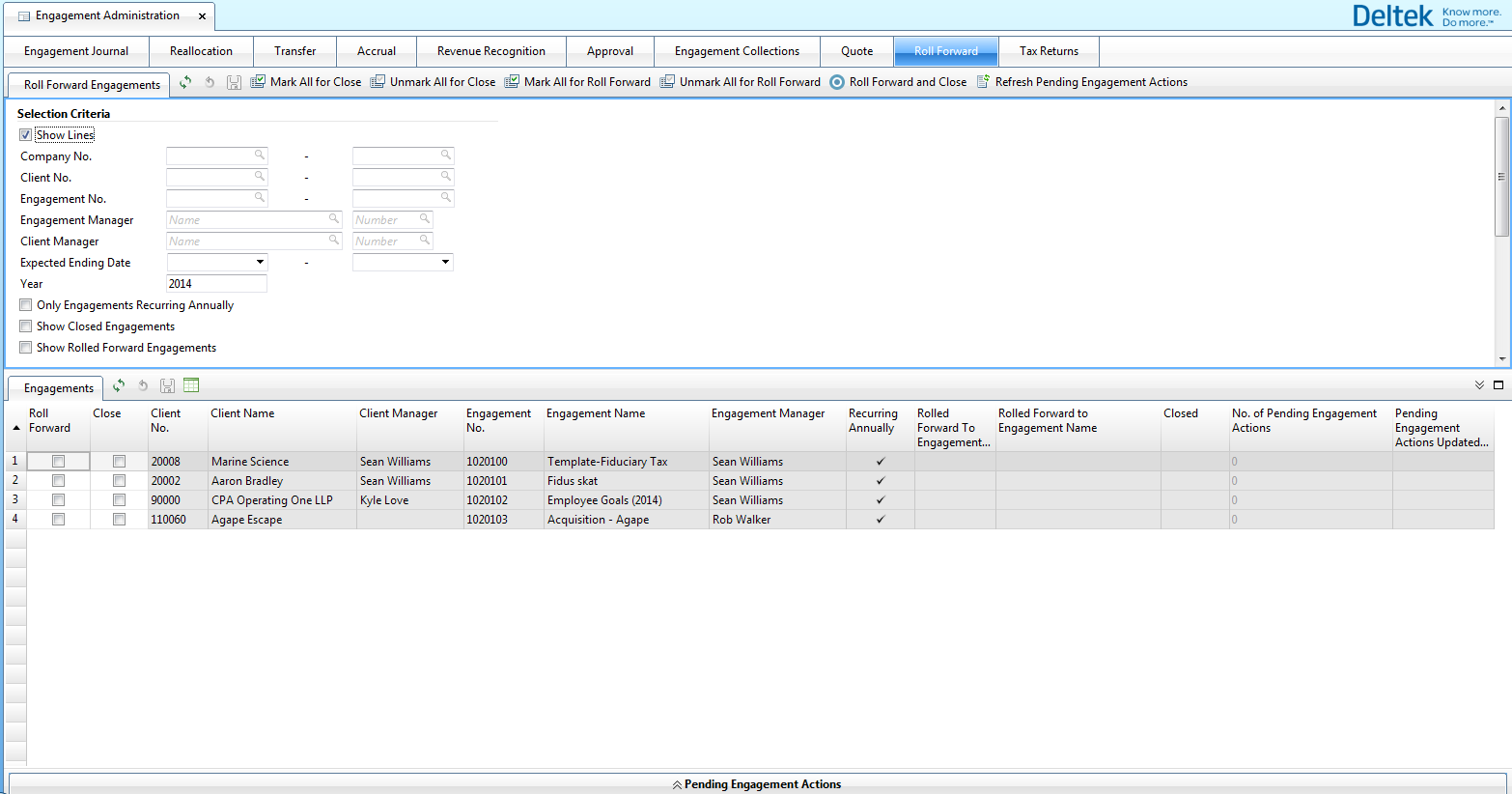

Engagement Administration

You can perform several actions against engagements in general, commonly in a batch process against a group of engagements; these are located in the Engagement Administration workspace.

The key features of this workspace include:

- Journal: The CPA solution offers you the opportunity to book one-off transactions against engagements, known as Engagement Journals. You can post engagement Journals using the engagement number, task, quantity, and billing price/cost price. These are helpful to post one-time charges to an engagement in real time, rather than asking an employee to post time or expenses, and so on.

- Reallocation: You can reallocate transactions (for example, time, expenses, and so on) from one engagement to another. You can do this in three different ways, which, depending on how you want to reallocate the entries, drives complete efficiency into the process.

- Transfer: The transfer functionality is similar to reallocating entries, but is specifically for transferring transactions between Maconomy dimensions, for reporting purposes. For instance, if a transaction went into the system and was tagged with a particular engagement department, and it should be transferred to a different department, for P&L reporting purposes.

- Accrual: You can book engagement accruals within the CPA solution.

- Revenue Recognition (WIP Evaluation): The revenue recognition engine in Maconomy offers a number of methods; however, the method that is most commonly used by CPA firms is the Evaluation of WIP feature. You can evaluate WIP at the client/engagement/task level or book a top-line WIP evaluation at the G/L level.

- Approval: Depending on the type of approvals that you want to require on an engagement, this workspace supports the batch approval process (that is, approving across multiple engagements at one time).

- Collections: The engagement collection functionality offers you the ability to combine engagements for billing purposes. The CPA solution automatically organizes the engagements by Bill-To client; however, you can break this down into billing “groups” or collections.

- Quotes: You can generate quotes for engagement services and print quotes accordingly.

- Roll Forward: The CPA solution offers a roll-forward feature that is commonly used by CPA firms to roll forward engagements from one year to the next. The solution automatically updates the engagement year (for example, from 2013 to 2014) and copies the critical engagement information to the new engagement.

- Tax Returns: Each tax engagement may use the tax return due date tracking feature in the solution. The administrative view to this window is located in the Engagement Administration workspace, where it is possible to manage the Tax Return Types and view each individual engagement and the associated tax return table.

The following figure is an example of the Engagement Administration workspace, where the Evaluation of WIP window is shown.

The following figure is an example of the Engagement Administration workspace, where the Roll Forward window is shown.

Parent Topic: Engagement Management