| Attribute Name

|

This field shows the name of the job attribute assigned to the job parameter type selected in the card part of the window. If you have created a job parameter, Maconomy automatically generates lines showing the attributes identified by the job parameter type in question. As the attributes assigned to a job parameter type are predefined, it is not possible to create or delete these lines.

You can choose among the following job parameter types and assigned attributes:

Budgeting

- Approval of Quote Required — For this attribute, you can specify “Yes” or “No.” If you specify “Yes,” a budget must be submitted and approved before an order confirmation can be printed. If you specify “No,” an order confirmation can be printed immediately after the job has been converted to “Order” status, unless the quote has already been approved. In this case, the latest revision of the quote must be approved before an order confirmation can be printed. Note that if the value of the attribute “Check Budget Against Quote” is “Yes,” this attribute must also have the value “Yes.”

- Block Purchase Orders when Budget Not Approved — For this attribute, you can specify “All Activities,” “Turnover Activities,” “Outlay Activities” or a blank value. The attribute determines whether purchase orders can be created on the basis of budget lines if the current budget of the job in question has not been approved. The attribute comes into play when the user attempts to create purchase orders either directly from the job budget using the action “Create Purchase Orders,” or from requisition or request for quote lines assigned to a job. If you specify “All Activities,” purchase orders can only be created for the job if the current budget has been approved. This means that in the window Job Budgets, the action “Create Purchase Orders” is only available if the current budget has been approved. In the windows Requisitions and Requests for Quote, the action “Create Purchase Order” is only available if the table part does not contain any lines assigned to the job in question.

If you specify a blank value, the attribute does not have any effect. If you specify “Turnover Activities,” the action “Create Purchase Orders” in the window Job Budgets and the action “Create Purchase Order” in the windows Requisitions and Requests for Quote are only available if the current job budget has been approved or if the action will not result in the creation of any purchase order lines that are related to the job in question and contain activities of the type “Turnover Activities.”

Example: A requisition contains the following lines:

| Job No.

|

Activity Type

|

| 1

|

Turnover

|

| 1

|

Outlay

|

| 2

|

Turnover

|

For job number 1 this parameter attribute is set to “Turnover Activities.” For job number 2, the attribute is set to a blank value. The action “Create Purchase Order” cannot be used for this requisition, as it would result in a purchase order line with a turnover activity assigned to job number 1. Please note that Maconomy disallows the action completely, meaning that although the line with the outlay activity and the line assigned to job 2, where the attribute is set to blank, do not conflict with the attribute on the individual jobs, Maconomy does not create a purchase order for these lines.

Similar functionality applies to the attribute value “Outlay Activities.”

- Check Budget against Quote — For this attribute, you can specify “Yes” or “No.” If you specify “Yes,” Maconomy will issue a warning when the quote is approved if the quote price deviates from the budgeted billing price of the latest approved revision of the budget. If you specify “No,” no such warning will be issued.

- Default Amount Activity — Every task must derive an activity. When a task is created automatically from the job budget, you can set a default derived activity for the task if the line type in the budget is specified as “Amount.” A workflow can be set up where tasks must be approved before registrations can be made on them. This allows nonfinance people, such as a project manager, to create the tasks in the job budget using default activities for later approval (and probable reassignment of activities) by a finance person.

Maconomy checks that the activity you specify here is of the correct type.

- Default Outlay Activity — The functionality of this job parameter attribute is similar to that of the attribute “Default Amount Activity” above, but applies to budget lines of the type “Outlay.”

- Default Time Activity — The functionality of this job parameter attribute is similar to that of the attribute “Default Amount Activity” above, but applies to budget lines of the type “Time.”

- Detailed Time Budget — If you are working with a project with many tasks and many employees, the number of budget lines can increase significantly as there is typically a line for each combination of task and employee. This makes it difficult to review the budget and can be cumbersome to work with.

Select this attribute to estimate time in a budget matrix that displays a row for each task and columns for employees or employee categories.

Also, this attribute introduces a split between budgeting time and amount separately. The budgeting workspace splits the budgeting into three tabs: Time, Amount, and Full Budget. The following windows support this:

- Time Budgets window — This window allows for budgeting of time activities for a given budget type. The table part displays time-related lines. Columns have been added to the table part to hold the employees and/or employee categories.

- Amount Budgets window — This window allows for estimation of amount activities for a given budget type. The table part displays amount-related lines.

- Time Budget Categories window — Use this window to specify which employee categories or specific employees should be available as columns in the Time Budgets window.

- Time Budget Details window — Use this window to display the price breakdown for a given budget time line. When adding hours in the budget matrix, lines in this window will be created and you can adjust details about the hours and prices.

- Time Budget Revisions and Amount Budget Revisions windows — These windows display revisions of budgets.

Time budgeting in a budget matrix is available in the Budgeting section in the Jobs workspace.

- Keep Purchase Billing Price Upon Recalculation — This attribute and the attribute “Keep Purchase Cost Price Upon Recalculation” below control how Maconomy should act when you recalculate the budget, and the purchase currency differs from the base currency — but only if the cost or billing price was not found through the usual price lookup mechanism of Maconomy, but was entered manually (or, in the case of the billing price, was calculated as a markup percentage). The issue is the following: what happens to the cost and billing price if the exchange rate has changed since the last time the budget line was calculated? Using these job parameter attributes, you can specify that Maconomy should keep the price from the purchase currency rather than the base currency.

For example: The base currency is GBP. A budget line specifies a billing price of EUR 400 for a time activity, which is entered manually. Since the budget line was created, the exchange rate has changed. If the job parameter attribute “Keep Purchase Billing Price Upon Recalculation” is true, Maconomy will keep the EUR 400 and adjust the billing price in base when you recalculate the budget. If the attribute were false, Maconomy would keep the base billing price in GBP and adjust the billing price in EUR when the budget is recalculated.

- Keep Purchase Cost Price Upon Recalculation — The functionality of this job parameter attribute is similar to that of the attribute “Keep Purchase Billing Price Upon Recalculation” above, but applies to the purchase cost.

For example: The base currency is GBP. A budget line specifies a Euro purchase for EUR 5000, which is entered manually. Since the budget line was created, the exchange rate has changed. If the job parameter attribute “Keep Purchase Cost Price Upon Recalculation” is true, Maconomy will keep the EUR 5000 and adjust the cost in base when you recalculate the budget. If the attribute was false, Maconomy would keep the base cost in GBP and adjust the cost in EUR when the budget is recalculated.

- Limit Purchase Amount to Budget — For this attribute, you can specify “All Activities,” “Turnover Activities,” “Outlay Activities,” or a blank value. The attribute determines whether purchase orders assigned to a given job are allowed to cause job budget figures to be exceeded. The attribute comes into play when amounts are entered or changed on purchase order lines assigned to a job, or on budget lines for which purchase orders have been created. This can either be done manually in the window Purchase Orders or automatically as a result of using the action “Create Purchase Order” in the window Requests for Quote.

The functionality is determined by a combination of the values in this attribute and the attribute “Limit Purchase on Line or Sum Level.” In the attribute “Limit Purchase on Line or Sum Level,” you specify whether the budget limit check should be made specifically against the budget line referenced in the field “Budget Line No.” on the purchase order line in question, or against the budget total of the job. In this attribute, you specify whether the functionality should apply to all activity types, to outlay or turnover activities only, or whether the functionality should be disabled. Below is a description of the functionality using different combinations of the two attributes.

When a purchase order line assigned to an activity is created, Maconomy identifies a line in the current budget of the job in question to which the purchase order line corresponds. The number of this budget line is stamped on the purchase order line and is used in the process of determining whether the purchase order causes the budget to be exceeded.

The functionality is as follows, depending on the settings of the two attributes mentioned above. The description is based on the situation where the user is entering an amount on a purchase order line assigned to an activity and thereby to a job budget line:

- All Activities, Limit on Line: Maconomy issues an error message if the amount on the purchase order line causes the cost price on the job budget line to which the purchase order line is assigned to be exceeded. Any other purchase order lines assigned to the same budget line are also included in this calculation.

- Outlay Activities, Limit on Line: As above. However, an error message is only issued if the activity on the line is an outlay activity.

- Turnover Activities, Limit on Line: As above. However, an error message is only issued if the activity on the line is a turnover activity.

- All Activities, Limit on Sum: Maconomy issues an error message if the amount on the purchase order line causes the total cost price of the turnover and outlay activities on the job budget to be exceeded.

- Outlay Activities, Limit on Sum: The attributes only apply when the activity on the purchase order line is an outlay activity. If it is, Maconomy checks if the sum of the amount on the line plus the amounts on any other purchase order lines for outlay activities on the same job exceeds the total cost price of all lines with outlay activities in the budget of the job in question. If it does, an error message is issued.

- Turnover Activities, Limit on Sum: As above. However, functionality applies to turnover activities instead of outlay activities.

Although the description above is based on scenarios where the user manually enters an amount on a purchase order line, similar functionality applies when amounts are indirectly entered on purchase orders, and when it is necessary to ensure that budget changes have not caused existing purchase orders to exceed the new budget. Therefore, the functionality also applies in the following situations:

- When using the action “Create Purchase Orders” in the window Job Budgets or the action “Create Purchase Order” in the windows Requisitions and Requests for Quote, because these actions cause the creation of purchase order lines with amounts.

- When using the actions “Submit Purchase Order” and “Approve Purchase Order” in the window Purchase Orders, because the budget may have changed since the last change to purchase order lines.

In both cases, please note that if but one line causes the budget related to that line to be exceeded, the whole action is cancelled. This means that if you have, for example, selected the action “Create Purchase Order” for a request for quote, and one of the lines would cause the budget to be exceeded, no purchase order is created, even for lines that pertain to different jobs or lines that do not cause any budgets to be exceeded. Please also note that the attributes “Limit Purchase, Currency Margin” and “Limit Purchase, Percentage Margin” can be used for allowing the budget to be exceeded by a certain margin.

The functionality also applies when changing amounts in the window Job Budgets, where Maconomy checks if the new amount will cause the budget to be exceeded by existing purchase orders.

- Limit Purchase on Line or Sum level — For this attribute, you can specify “Limit on Line” or “Limit on Sum.” For a description of the functionality of the attribute, see the attribute “Limit Purchase Amount to Budget.”

- Limit Purchase, Currency Margin — This system parameter is used in connection with the budget limit control described for the attribute “Limit Purchase Amount to Budget.” In this parameter, you can enter an amount by which purchases are allowed to exceed job budgets. The margin can be specified as an amount in the currency of the job in question (in this attribute) or a percentage (in the attribute “Limit Purchase, Percentage Margin”). In this way, you can specify a margin allowing a budget violation of, for example, 100 currency units, a given percentage, or both.

Maconomy uses the margin (amount or percentage) resulting in the greater amount, thus allowing the greater budget violation. The amount specified in the parameter is automatically converted into the currency of the job using the exchange rate table for purchases.

- Limit Purchase, Percentage Margin — For a description of the functionality of this attribute, see the attribute “Limit Purchase, Currency Margin.”

- Postpone Copying of Template Job Budgets — Create a job from a template job that carries a job budget. Set this attribute to "Yes" if you do not want to copy the template job budget to the new job upon job creation. This setting enables job creation to perform faster, as the copy job budget process is delayed until the project manager needs the template job budget added to the new job.

- Price Control from Budgets — This attribute lets the job baseline budget control the job specific price list lines.

- Standard Price Employee Category — This attribute is used to select an employee category for price calculation if no employee or employee category is specified on a budget line. If detailed time budgeting is used, this attribute is used for price calculation for the non-allocated hours.

Employee Revenue Distribution

- Activity for Revenue Distribution — This attribute is used for specifying an activity for the revenue recognition job entries. If the job is set up with a task list, then the activity can be derived from the task instead.

- Allow use of Revenue Distribution — Set this attribute to "Yes" to use the employee revenue distribution functionality.

- Even Distribution upon Invoicing — If this attribute is set to "Yes", Maconomy performs redistribution after printing invoices (except for invoices on account).

- Even Distribution upon Job Closing — If this attribute is set to "Yes", Maconomy performs redistribution when the job is closed (more precisely, all the jobs with the given job parameter).

Events

- Job Processing — For this attribute, you can specify an existing option type. For jobs assigned to this job parameter, the options for job processing status in the windows Events and Job Events in the Contact Management module will be based on the options in the option type specified in this field.

- Result Type — For this attribute, you can specify an existing option type. For jobs assigned to this job parameter, the options for results in the windows Events and Job Events in the Contact Management module will be based on the options in the option type specified in this field.

Invoice Preparation

- Default Invoice Basis — This attribute is used to select the default basis for the invoice to be created by the

Prepare Invoice action. The options are to prepare the invoice from the budget, or from the actuals with either Close All or Delimit.

- Include Budgets from Sub Jobs in case of Main Job Invoicing — If you set this attribute to "Yes", clicking the

Prepare Invoice action includes the budget from sub jobs if the job is set up with main job invoicing and you prepare an invoice from the budget.

- Limit for Invoicing on Account, as % of Budget — This attribute allows you to specify a limit for how much can be invoiced on account as a percentage of the budgeted billing price.

On Account Reconciliation

- Activity for job closing — For this attribute, you can enter an existing, invoiceable amount activity to be used for the closing of fixed-price jobs. Any difference between the quote price for a fixed-price job and the printed job invoices on account will be posted on this activity when closing the job, if you have specified an activity number in this field.

- Allow “Close All” in Job Invoice Allocation — For this attribute, you can on some jobs control the use of “Close All” for each individual job.

- Allow Invoicing on Account Only — For this attribute, you can specify whether or not Maconomy should allow job entries which are set up to be included in the fixed-price job to be invoiced on account only. If you enter the value “Yes” for this attribute, all fixed-price registrations on a job assigned to this parameter must be invoiced by means of on account invoices, and these will only be closed when the job is closed. If you have selected the value “Yes” for this attribute, you must hence also select the value “Yes” for the attribute “Create Invoice Upon Job Closing.”

If you enter the value “No” for this attribute, there will be no restrictions as regards the way in which fixed-price registrations should be invoiced.

- Allow Moving Entries To/From Invoicing — If this attribute is enabled, you can move job entries from the Job Invoice Allocation single dialog workspace and make these available for invoicing.

- Carry Forward Full Amount on Invoices On Account — When you print an invoice on account, Maconomy sets the amount for reconciliation for subsequent invoices by default. This attribute enables you to change the default behavior, so that Maconomy does not set invoices on account for reconciliation unless you directly set an amount for reconciliation in any of the following workspaces: Invoice Selection, Blanket Invoice Selection, or Job Invoices on Account.

- Create invoice upon job closing — For this attribute, you can specify whether or not Maconomy should automatically create an invoice based on the quote price less amounts invoiced on account, that is, a zero invoice, when closing a fixed-price job. Any difference between the quote price and the sales price of the registered job entries is posted on the activity specified in the attribute “Activity For Job Closing” which is also identified by the job parameter type “Fixed Price Job Set-Up.”

By specifying values for this attribute and the attribute “Allow Invoicing On Account Only” it is thus possible to, for example, specify that “normal” invoicing is allowed on fixed price jobs, but an invoice should still be created when the job is closed. Note that in this parameter you cannot use the combination of “Create Invoice Upon Job Closing” having the value “No” and “Allow Invoicing On Account Only” having the value “Yes.”

- Delimit Invoices On Account By Activity Type — With this attribute set to “Yes,” you can delimit invoices on account by activity. For example, you can set up two default tasks that derive a time activity and an amount activity and, through job invoice allocation, you can reconcile time invoices on account against time registrations and amount invoices on account against amount registrations.

- Delimit Invoices On Account By Employee — With this attribute set to “Yes,” you can delimit invoices on account by employee.

- Delimit Invoices On Account By Job — Set this attribute to "Yes" to delimit invoices on account by job in job invoice allocation. This is applicable for job collections which share invoices on account and you want to finely control which jobs reconcile shared invoices on account.

- Detailed Job Invoice Allocation — If this attribute is enabled, you can divide job entries and invoices on account into groups controlled by activities. You can have up to five groups.

- Delimit Invoices On Account By Invoice Date — Setting this attribute to “Yes” will delimit the invoices on account for reconciliation by invoice date.

- Job Invoice Allocation — With this attribute set to “Yes,” job entries included in the fixed price will not be invoiced, but they will appear in the window Job Invoice Allocation. The default value is” No.”

- Job Invoice Allocation upon Job Closing — With this attribute set to “Yes,” invoice allocation will take place when closing the job, provided that the invoice allocation will close open entries and invoices on account. For a fixed-price job the job can be closed if the fixed price equals the amount invoiced as part of the fixed price. This attribute can only be set to “Yes” if the attribute Job Invoice Allocation is set to “Yes.”

- On Account Reconciliation across Bill to Customers — If this attribute is set to “No,” Maconomy will only reconcile invoices on account against invoices with the same Bill-to Customer, unless the job is also set up to fixed price invoicing and to create an invoice upon closing of the job. This is specified by the job parameter attributes “Create invoice upon job closing” and “Invoicing Method.”

If this attribute is set to “Yes,” Maconomy will reconcile invoices on account against all invoices on account of the job. The default value is “No.”

Overhead Cost

- Exclude Overhead from Cost Price — If this attribute is set to "Yes", Maconomy excludes the overhead rate when looking up cost prices. This means that the entries for the job will have no overhead cost. In the case of intercompany transactions, this attribute controls the exclusion of overhead from the cost of the executing company.

- Exclude Overhead from Intercompany Price — If this attribute is set to "Yes", Maconomy excludes the overhead rate when looking up intercompany prices. This attribute only affects intercompany transactions, and can only be set to "Yes" if the "Exclude Overhead from Cost Price" attribute is also set to "Yes".

- Post Offset for Overhead Cost Separately — If this attribute is set to "Yes", Maconomy posts time on the job differently in the general ledger. The cost at base salary rate is posted using the existing posting reference for offset for cost, and the cost at the overhead cost rate is posted using a new posting reference.

Invoicing On Account

- Activity required for Invoicing on Account — For this attribute you can specify whether an activity must be specified for invoices on account. If the job is set up with a task list, a task must be specified.

Note that tasks are often set up to derive an activity and, in that case, setting this attribute to “Yes” requires that tasks be set up on invoices on account.

- Allow Invoice on Account in Multiple Currencies — If this job parameter attribute is set to “No,” the invoice currency on all bill-to customers in the window Bill To Customer Distribution will be the currency of the job and cannot be changed.

If this job parameter attribute is set to “Yes,” every bill-to customer will by default be invoiced on account in the currency of the customer, regardless of the job currency. The invoice currency can be changed on every bill-to customer on the job.

Notice, however, that changing the job parameter attribute for a job will not change the invoice currency on existing bill-to customers.

Notice also that the attribute on job parameters already in use by existing jobs can always be set to “Yes,” thereby allowing this functionality. The opposite is less likely to happen: Changing the attribute to “No” is only allowed if jobs using the job parameter actually all have bill-to customers that only use an invoice currency equal to the job currency of the assigned job (this includes template jobs), and no previous invoices use another invoice currency. An error message will explain if one of the existing jobs blocks for setting the attribute to No.

- Allow Job Pre-Invoices — Select Yes to indicate that users are allowed to print pre-invoices on this job, or No to restrict printing. This attribute can be changed for an existing job even if it has pre-invoices on it already. This enables you to use pre-invoicing on specific stages of a job.

- Base Currency as Job Currency — For this attribute you can specify that all jobs with multi-currency invoicing are created with base currency as job currency.

- Default Activity for Invoicing on Account 1/2 — You use these attributes for stating default activity numbers when you create invoicing on account. The default activities are only applied if the job parameter attribute "Job Dimensions Required in On Account Invoicing" is set to "Yes.”

- Use Job Pre-Invoices by Default — Select Yes to indicate that Maconomy should set the type to Pre-Invoice rather than Invoice on Account.

Invoice Selection

- Allow Combined T&M and On Account Invoicing — Set this parameter to

Yes to enable the combination of T&M and on account invoicing on an invoice. If enabled, the option for "T&M and On Account" is an option for the

Invoice Type field in Invoice Selection..

- Allow Multiple Drafts — For this attribute you can specify whether or not it should be allowed to create multiple drafts. By default, this attribute is set to “No.”

- Approval of Invoicing Plan Lines — For this attribute, you can specify whether or not approval of invoicing plan lines is required before the lines can be invoiced. If you assign this parameter with the value “Yes,” the field “Approved” in the table part of the window Invoicing Plans must be marked on a given line before it can be invoiced.

- 'Close All' resets unit prices — If this attribute is enabled, clicking the

Close All action in the Invoice Selection workspace resets the billing price to the original value in job entries for invoicing.

You can enable or disable this attribute at any time for existing jobs.

- Combine T&M and On Account by Default — Copy to come.

- Default Activity in Invoicing Plan — Attributes for stating default activity numbers when doing invoicing on account in Invoice Selection. The default activities are only applied if the job parameter attribute "Job Dimensions Required in On Account Invoicing" has the value "Yes.”

- Invoice Draft Approval Required — If this attribute is enabled, Maconomy requires approval of invoice drafts.

- Invoice Editing Required — For this attribute, you can specify if invoices created for jobs using the job parameter in question must be edited in the window Invoice Editing before being printed. This means that if you specify “Yes,” the actions for printing the invoice are not available until the action “Close Editing” has been selected in the window Invoice Editing.

- Invoice Editing Required for Invoicing on Account — If this attribute is set to "Yes", Maconomy requires you to edit draft invoices on account . However, it may not be necessary for this attribute to be enabled if you prepare invoices on account from the On Account Invoice Selection workspace, or if you prepare invoices in batches by transferring them from invoicing plans.

- Invoice Editing Required for Zero Invoices — This attribute is only taken into consideration if the attribute “Invoice Editing Required” is set to “Yes.”

In this attribute, you can specify whether invoice editing is also required for zero invoices reconciling on account invoices. This means that if you set the attribute to “No,” zero invoices reconciling on account invoices do not have to be edited in the window Invoice Editing before being printed. If you set the parameter to “Yes,” all invoices including zero invoices reconciling on account invoices must be edited.

- Invoice Name From Plan — For this attribute, you can specify whether the invoice name on the job is filled in with the description on the line that is transferred from the plan when using the action “Transfer Invoicing Plan.” If more than one line is transferred, then Maconomy only gets the description from one of the lines. This is also the case if the lines derive from different bill-to customers on the job.

- Invoice Reporting Codes Required — Set this attribute to "Yes" to not close invoice editing without invoice reporting codes.

- Preferred Invoice Date from Plan — For this attribute, you can specify whether or not Maconomy should transfer the preferred invoice date from an assigned invoicing plan to the field “Preferred Inv. Date” in the window “Invoice Selection,” when you select the action “Transfer Invoicing Plan.” If the assigned invoicing plan consists of several lines, Maconomy will transfer the date of the line most recently created. The date considered for invoicing plan lines which are assigned job phases or milestones is the completion date of the current phase/milestone.

- Split by Invoicing Group — If you enable this attribute, you can split sub-jobs into groups when using main job invoicing. This allows Maconomy to produce one invoice for each group.

Set up groups using the

Invoicing Group field in the bill to customers of the main job. This is done in the Bill To Customer Distribution workspace.

You can create two or more lines with the same bill to customer by assigning different Appropriations, which are labels used for referring to a source of funding)

- Transfer Invoicing Plan to Invoice Selection — For this attribute, you can specify whether or not the invoicing plan should be transferred to Invoice Selection.

- Validate Invoice Reporting Code Foundation — Set this attribute to "Yes" to not close invoice editing unless billing price and the invoice reporting codes billing price foundation match.

Job Descriptions

- Note Type — For this attribute, you can specify an existing note type. For jobs assigned to the job parameter type in question, the options for headings in the window Job Descriptions will be based on the heading options in the note type specified in this field.

Planning

- Budget Time by Employee — If this attribute is set to "True", you need to provide an employee number on job budget lines for time activities in the planning budget.

On jobs with a job parameter where the "Duplicate Lines (time) on Planning Budget" attribute is enabled, the definition of duplicate is changed to include the

Employee field if the "Budget Time by Employee" attribute is also enabled on the job.

In general, job progress evaluation performs better if you do not allow duplicate lines. If you have duplicate lines but the duplicate lines have distinct employees, then it is possible to change the setup to Budget Time by Employee and not allow duplicate lines for time.

If the

Create Budget Lines for Unbudgeted Tasks check box is selected when running a job progress evaluation, and this attribute is also enabled for the job, you will need to create new lines with an employee number (from the actuals).

- Budget Time by Employee Category — Set this attribute to "Yes" for the planning budget to require a unique task, activity, and employee category on job budget lines.

- Prefill time sheet lines — For this attribute, you can specify to what extent the planning made for a given job in the window “Detailed Planning” in the Resource Planning module should be transferred to time sheet lines at the creation of time sheets. Only detailed planning lines with allocations of the booking type “Confirmed” can be transferred. The attribute can have one of these four values:

- Do Not Create Lines — On jobs for which this attribute is specified, Maconomy will not automatically transfer time sheet lines based on detailed resource plans at the creation of day- or week-based time sheets in the windows Daily Time Sheets or Time Sheets, respectively.

- Do Not Prefill — On jobs for which this attribute is specified, time sheet lines are automatically created on the basis of a detailed resource plan, but these will not be prefilled with the planned number of hours.

- Per Period — On jobs for which this attribute is specified, time sheet lines are automatically created on the basis of a detailed resource plan. The number of hours planned for the period covered by the time sheet (that is, a (split) week for weekly time sheets) is displayed for each day in the column Fixed Hours in the card part of the window “Time Sheets,” whereas the lines in the table part only display the job numbers derived from the detailed resource plan. The number of hours planned is thus not specified in the fields on the lines in the table part. On daily time sheet lines, the number of hours expected for the period covered by the weekly time sheet covering the day in question is inserted.

- Per Day — On jobs for which this attribute is specified, the planned number of hours for each day is specified on both weekly time sheet lines and daily time sheet lines.

- Specify estimated time to completion — For this attribute, you can specify whether or not employees must enter an estimate of time to completion for the job in question on their time sheets. The attribute can have one of these three values:

- None means that users are not allowed to enter the required time to completion on time sheet lines assigned to the job in question.

- Optional means that it is optional for each user to enter the required time to completion on time sheet lines for the job in question.

- Mandatory means that each user must enter the required time to completion on time sheet lines for the job in question. Having selected this value, it will not be possible to submit a time sheet containing lines (for a time activity) for the job in question unless the required time to completion has been specified.

- Duplicate lines (time) on planning budget — For this attribute, you can specify whether or not it should be possible to create two planning budget lines for a given job referring to the same time activity and task. If you specify the value “No,” it will thus not be possible to have two planning budget lines referring to the same combination of job, time activity and task. By means of this attribute you can avoid ambiguity as to which planning budget line a given registration on, for example, a time sheet on the job should refer.

- Duplicate lines (amount) on planning budget — For this attribute, you can specify whether or not it should be possible to create two planning budget lines for a given job referring to the same amount activity and task. If you specify the value “No,” it will thus not be possible to have two planning budget lines referring to the same combination of job, amount activity and task. By means of this attribute you can avoid ambiguity as to which planning budget line a given registration on, for example, a time sheet on the job should refer.

- Hours per Man Day — For this attribute, you can specify the number of hours to be suggested in the field “Hours per Man Day” in the window Jobs.

- Baseline Comparison — For this attribute, you can specify whether or not jobs should use a baseline budget for assessing job progress. If you specify the value “No,” the original estimate of the job is used for making progress evaluations. If you specify the value “Yes,” a baseline budget (the type of which is determined by the attribute “Baseline Budget Type” below) is used as the basis of job progress evaluation. The advantage of this is that you can evaluate the progress based on both time and amounts, and the baseline budget can be changed to reflect changes in the scope of a job. For more information, please see the description of the window “Job Progress.”

- Baseline, Budget Type — For this attribute, you can specify the budget type to be used as baseline budget. You must select a value for this attribute if the value of the attribute “Baseline Comparison” above is “Yes.” Job budget types are created in the window Popup Fields in the Set-Up module.

- Pre-fill Time Sheets — This attribute allows Do Not Create Lines, Do Not Prefill, Per Period, or Per Day values. The Do Not Create Lines value will turn off the functionality. The other values will create time sheet lines for resource detailed planning of employees, when the employee creates time sheets.

- Standard Week Calendar — For this attribute, you can specify the week calendar to be used for planning purposes in the Job Cost module. For instance, when changing the duration of a task in the window Job Budgets, the planned ending date will be moved accordingly. If a standard week calendar is specified for the job, the date will be moved by the specified number of working days as defined by the week calendar, instead of simply using calendar days. Week calendars are managed in the window “Week Calendars” in the Set-Up module.

- Use Imported Budget Line Resource Allocation - Enable this parameter attribute to use the Update Job Budget Resource Allocations workspace.

When this attribute is enabled, you cannot add a budget by employee or employee category in the planning budget.

If you select a job parameter where this attribute is enabled on a job with a planning budget, Maconomy checks whether the budget has no lines on time or amount activities with an employee or employee category.

Pricing Principle

- Fixed-Price Basis — For this attribute, you can specify whether the fixed price of a job should be transferred from the latest approved job budget of the type specified in the parameter attribute “Fixed-Price Budget Type,” or whether it should be transferred from the quote of the job. The attribute can thus have one of the values “Budget” or “Quote.” The attribute can be used for both fixed- price jobs and time and material jobs. The “fixed price” of a time and material job is hence either the total budgeted billing price of the latest approved budget of the job or the approved quote price of the job.

- Fixed-Price Budget Type — For this attribute, you can specify which budget type to apply, if you have selected the value “Budget” for the attribute “Fixed-Price Basis.” This attribute can only be given a value corresponding to one of the user-defined job budget types created in the window “Popup Fields” in the Set-Up module.

- Fixed-Price Inclusion Setup — For this attribute, you can specify what is included in the fixed price for a job. You can select any of the following values:

- Exclude Outlays — If you select this value, Maconomy excludes outlays (cost type defined on activity) from the fixed price.

- By Job Allocation Combination — If you select this value, a job allocation combination on the job controls what is included in the fixed price.

- By Task — If you select this value, the value of the

Included in Fixed Price field in the task controls what is included in the fixed price.

- Include All — If you select this value, Maconomy includes all registrations in the fixed price.

- Invoicing Method — For this attribute, you can specify whether a job should be a time and material job or a fixed-price job.

If you specify the option “Time and Material” for this attribute, Maconomy invoices the billing price of the actual costs entered in the windows Job Journal, Time Sheets, Expense Sheets, and so on, on jobs assigned this attribute.

If you select the option “Fixed-Price,” you should note that fixed-price jobs are invoiced according to two principles, which depend on whether the attribute “Allow Invoicing On account Only” in the job parameter type “Fixed-Price Job Set-Up” has been given the value “Yes” or “No.” If that attribute is given the value “No,” the customer on the assigned job is invoiced up to the agreed quote price, which is specified in the windows “Jobs,” “Job Price Information,” or “Job Budgets.” In the window “Invoice Selection” you can select the action “Transfer Fixed Price.” This will write the invoice selection up or down to match the quote price, less previously invoiced job entries.

If the attribute “Create Invoice Upon Job Closing” is assigned the value “Yes,” Maconomy will print a zero invoice upon the closing of a job. This invoice reconciles the printed invoices on account with the quote price. Any difference between the actual billing price and the quote price of the job is posted on the activity specified in the attribute “Activity for Job Closing” in the job parameter type “Fixed-Price Job Set-Up.” With the “actual billing price” of the job is understood the billing price of the activities entered on the job in the windows “Job Journal,” “Time Sheets,” “Expense Sheets,” and so on.

The difference between these invoicing principles is reflected in several windows in Maconomy: “Invoice Selection,” “Itemize Invoice Selection,” and “Approve Invoice Selection” in the Job Cost module, and the window “Sales Orders” in the Sales Order module. In the latter window it is required that fixed-price jobs be invoiced in the Job Cost module. For more information about fixed-price jobs, please see the description of the windows mentioned and the description of the action “Close Job” in the window “Jobs.”

Progress Evaluation

- Billing Price Based on Actuals and ETC - Enable this attribute to update the billing price in the planning budget based on revenue recognized when you perform progress evaluation. For time activities and for amount activities where the

Progress by Quantity check box is selected, the total billing price is calculated as the sum of the registered billing price plus any write up/down and the estimated time to completion multiplied by the Progress Unit Billing Price. For amount activities where the

Progress by Quantity check box is deselected, the total billing price is calculated as the sum of the registered billing price plus any write up/down and the estimated cost to completion marked up with the Progress Markup Percentage. This attribute is disabled by default.

Registration

- Automatically approve employee control lines at creation — For this attribute, you can specify whether employees added to employee control lists in the window “Employee Control” should be approved automatically. If you specify “No,” the employee added must be approved in the windows “Employee Control” or “Employee Control Lines.”

- Automatically Approve Project Manager’s Expense Sheet Lines — For this attribute, you can specify whether expense sheet lines belonging to the employee who is the project manager of the job specified on the line should automatically be approved. This way, the project manager does not have to manually approve his or her own expense sheet lines. Specify “Yes” if the lines should automatically be approved and “No” if the lines should be approved manually.

- Automatically Approve Project Manager's Time Sheet Lines — For this attribute, you can specify whether time sheet lines belonging to the employee who is the project manager of the job specified on the line should automatically be approved. This way, the project manager does not have to manually approve his or her own time sheet lines. Specify “Yes” if the lines should automatically be approved and “No” if the lines should be approved manually.

- Block Time and Expense Registrations Before Job Start Date — If this job parameter is set to yes, then employee will receive an error message if they try to register time or expenses before the job start date.

- Notify Employee if listed in Employee Control — If this attribute is set to "Yes", employees are notified via a To-Do when they are listed in the Employee Control workspace.

- Project Manager Can Register Time and Expenses Outside Allowed Period — If this job parameter is set to yes, then the project manager may register time and expenses before the job starting date.

- Standard invoicing action for job entries on time and material jobs — For this attribute, you can specify a standard action to be applied to job entries on time and material jobs in connection with invoice selection. In the window Invoice Selection, the field “Action” in the table part allows you to specify whether to carry forward, invoice, or write off each entry. The value specified in this parameter attribute will be suggested in the field “Action” in the table part of the window “Invoice Selection” if the job in question is a time and material job.

- Time Registration Rounding To Multiple Of Unit — This attribute allows you to specify how Maconomy should handle an attempt to enter time that is not a multiple of the chosen unit. You can choose one of the following options:

- Round to the nearest multiple of the unit.

- Round up to the nearest multiple of the unit.

- Round down to the nearest multiple of the unit.

- Leave the field blank if there should be no rounding. This option means you will get an error message if you try to enter time which is not a multiple of the specified unit.

- Time Registration Unit In Days — This number decides the rounding of registration in days. For example, if this value is set to 0.5 then time sheet registrations are rounded to half or full days.

- Time Registration Unit In Minutes — If a positive number of minutes (non-zero) is entered as a unit, every time registration on the jobs with the given parameter must be a multiple of this number. When the unit is zero, this restriction is disabled.

- Use Daily Description as Description Text on Job Entries — If this attribute is set to “Yes,” you specify that the Description (text) field on the Job Entry should be set to Daily Description instead of Entry Text, and the Daily Description field is not empty.

Revenue Recognition

- Capitalization Method — For this attribute, you can specify whether a job assigned this job parameter should be capitalized at cost or at billing price. You can thus choose among the two options “At Cost” and “At Billing Price.” A job will only be capitalized if it belongs to a job group that is marked in the field “Capitalize Expenses” in the window Job Groups.

- Activity for Job Revenue Adjustment — For this attribute, you can specify an invoiceable amount activity to be used for entering revenue adjustments in connection with jobs using overrun handling or jobs using revenue recognition by completion percentage. However, if you are performing detailed revenue recognition by activity or task, the activity specified in this field will not be used for the posting of adjustment entries, if account references can be derived from the field “Open Billing Price, Adjustment” on the relevant activities. Please see the description of the action “Approve Revenue Recognition” in the window “Job Revenue Recognition Details” for a detailed description of how Maconomy determines where adjustment entries should be posted when performing detailed revenue recognition.

- Limit Revenue — For this attribute, you can specify whether the revenue to be recognized on time and material jobs using revenue recognition by completion percentage should be limited by the “fixed price” specified for the jobs. If you enter the value “Yes” in this attribute, you can specify the desired maximum completion percentage limit to apply to the relevant jobs in the attribute “Compl. % Limit” in this job parameter.

If the revenue to be recognized on a time and material job is not limited, the completion percentage of a time and material job being revenue recognized can be larger than 100% meaning that more than the “fixed price” of the job can actually be recognized as revenue. However, as a fixed-price job can never be revenue-recognized for more than 100% of the job’s fixed price, the revenue to be recognized on such jobs will always be limited.

- Calculate Completion Percentage From — In this attribute, you can specify the basis for the calculation of completion percentages calculated on jobs using revenue recognition by completion percentage. The calculation can be based on one of the two options “Cost Price” and “Billing Price.”

If you select the option “Cost Price” in this attribute, the completion percentage of a given job will be calculated on the basis of the budgeted cost price from the latest approved revision of the budget type specified in either the attribute “Completion Percentage, Budget Type” or the job attribute “Fixed Price Budget Type.”

If you select the option “Billing Price” in this attribute, the completion percentage of a given job will be calculated on the basis of the budgeted billing price of the latest approved revision of the budget type specified in either the attribute “Completion Percentage, Budget Type” or the job attribute “Fixed Price Budget Type.” See the introduction to the window “Revenue Recognition” for a thorough description of how Maconomy calculates the completion percentage and the amounts to be revenue recognized when you have selected one of the options in this attribute.

- Detail by — In this attribute, you can specify whether revenue recognition by completion percentage should be calculated on a more detailed level than the job level for jobs assigned this job parameter. You can enter one of the following values in this attribute: “Activity,” “Task,” “Location,” “Entity,” “Project,” “Purpose,” “Specification 1-3,” or “Local Specification 1-3.” If the value of this attribute is, for example, set to “Task,” the revenue recognition of the job will be based on completion percentages calculated for each individual task specified on the job. See the introduction to the window “Job Revenue Recognition Details” for more information about how to use detailed revenue recognition on jobs.

Note that you can only specify a value in this field if you have specified “Yes” for the attribute “Revenue Recognition By Completion Percentage” in this job parameter. Moreover, if you want a job to use detailed revenue recognition, the job must also be assigned a job parameter of the type “Pricing Principle” in which it is specified that the “fixed price” of the job is determined by the job’s budget, rather than the quote price of the job. If you leave this field blank, revenue recognition by completion percentage will be calculated at the job level, insofar as you have specified the value “Yes” in the attribute “Revenue Recognition By Completion Percentage.”

- Detail by — The functionality of this attribute is similar to that of the above attribute also called “Detail By.” If you enter values in both of these attributes, revenue recognition of a job assigned this job parameter will be based on completion calculations of both of the values specified in the two attributes. This means that if you have entered “Task” in the other attribute and “Activity” in this attribute, revenue recognition on a job will be based on the completion percentage of each combination of task and activity registered on the job. An example of this combination is illustrated in the introduction to the window “Job Revenue Recognition Details.”

If you have entered a value in the other “Detail By” attribute, the value in this field must be different from the value entered in the other attribute. Also note that there is no ordering or priority between the two attributes. This means that specifying, for example, “Task” and “Purpose” will generate the same results as if you specify “Purpose” and “Task.”

See the introduction to the window “Job Revenue Recognition Details” for information about how to use detailed revenue recognition on jobs.

- Evaluation of Work in Progress — Copy to come.

- Completion % Limit — For this attribute, you can specify a completion percentage limit to apply to the jobs assigned to this job parameter. The value in this field will only have effect, if you have specified the value “Yes” in the attribute “Limit Revenue.”

On fixed-price jobs, the completion percentage limit can have a value between 0% and 100%, whereas the value can be anything from 0% and up on time and material jobs. If, for example, you enter the value “120%” in this attribute, the completion percentage limit for fixed-price jobs assigned to this attribute will be 100%, whereas the limit will be 120% for time and material jobs. This is because it is not possible to recognize more revenue than the fixed price on a fixed-price job. If you enter the value “85%,” the revenue recognized on both fixed-price jobs and time and material jobs will not exceed 85% of the fixed price of the jobs. If you specify the value “0” in this attribute, you cannot recognize any revenue by completion percentage on fixed-price jobs and time and material jobs assigned to this job parameter.

If the revenue to be recognized on a time and material job is not limited, the completion percentage of a time and material job being revenue recognized can be larger than 100%, meaning that more than the “fixed price” of the job can actually be recognized as revenue. However, a fixed-price job can never be revenue-recognized for more than 100% of the job’s fixed price.

The value specified in this attribute only applies as the default value for the jobs assigned this parameter. This means that the percentage entered in this attribute can be manually changed by the user in the windows “Job Revenue Recognition” and “Job Revenue Recognition Details.”

- Completion Percentage, Budget Type — In this attribute, you can specify a budget type to be used when calculating the completion percentage of a job. The functionality of this attribute is useful if you need to let one particular job budget type determine the fixed price of a job, while another job budget type is used for calculating the completion percentage of a job. Specifying a budget type in this attribute thus allows you to separate the fixed-price budget of a job from the ongoing budget of a job. If you do not enter a value in this attribute, the completion percentage of a job will be based on the budget specified in the attribute “Fixed Price Budget Type.” See the introduction to the window “Job Revenue Recognition” for further information about the use of this attribute.

- Revenue Recognition By Completion Percentage — For this attribute, you can choose whether revenue on a job should be recognized according to completion percentage. Revenue recognition means that the entries of the job are registered as revenue in the G/L module.

You can only specify the value “Yes” for this attribute if you have chosen the value “At Billing Price” for the attribute “Capitalization Method.”

If you specify the value “No” for this attribute, and you have selected capitalization at billing price, Maconomy revenue recognizes the value of all registered entries on the job at their billing price, for example, employees’ registrations on the job in the window “Time Sheets.” The display of the value of a job thus created is only correct if the registrations actually reflect how far the job processing is.

If you specify the value “Yes” for this attribute, any revenue can be recognized on a job according to the degree of completion of the job. The completion percentage is calculated or specified on a current basis for each job in the two windows “Job Revenue Recognition” and “Job Revenue Recognition Details.”

However, as the revenue to be recognized on a time and material job should not necessarily be limited to the “fixed price” of the job, you can specify whether revenue should be limited in the attribute “Limit Revenue.” If you want to specify a limit to the completion percentage for the revenue to be recognized on jobs, this limit can be defined in the attribute “Compl. % Limit” in this job parameter. See the descriptions of these two attributes for more information about the possibilities for limiting the revenue to be recognized on both fixed-price jobs and time and material jobs.

As you can recognize revenue by completion percentage on both fixed-price jobs and time and material jobs, you should see the introduction to the window “Job Revenue Recognition” for information about the setting up and handling of revenue recognition by completion percentage on these two types of jobs.

- Handling of Overruns — For this attribute, you can specify whether a job assigned this job parameter should handle overruns. An overrun occurs when the costs registered on a job exceed the agreed fixed price of the job. The “fixed price” of a time and material job can either be the budgeted billing price of the latest approved job budget or the approved quote price of the time and material job.

To handle overruns, Maconomy must be set up to capitalize jobs at billing price. This is done in the attribute Capitalization Method.

If the value “Yes” is specified for this attribute, the capitalization of a given job’s billing price is limited to the effective fixed price of the job. The basis of the effective fixed price of both time and material jobs and fixed-price jobs is specified in the job parameter type “Pricing Method” for the attribute “Fixed Price Basis.” Any adjustments are automatically made when posting is carried out as described below. The amount activity on which overrun adjustments are to be registered is specified in the attribute “Activity for Job Revenue Adjustments” in this job parameter. If the fixed price of a job is changed, Maconomy also adjusts (that is, creates, increases, or reduces) any overruns on the job. This means that the job is written up or down according to the agreed fixed price.

The following paragraphs describe the entries made by Maconomy when you register entries giving rise to overruns on a fixed-price job. As this procedure is identical to the procedure applying to time and material jobs, special considerations applying to time and material jobs are described after the following example.

Assume that a fixed-price job is created with a quote price of USD 6,000. As the job progresses, you enter registrations on the job using the job journal, time sheets, and so on. These entries are posted as usual to the account for work in progress. You register work and expenses for a total of USD 7,000 on the job, thus creating an overrun. The USD 1,000 by which the WIP account exceeds the fixed price is credited on the account for adjustment of work in progress (which is specified by means of a dimension combination in the window “Job Groups”), while the same amount is debited on the account for open sales price adjustment. The account for open sales price adjustment is specified by means of a dimension combination in the window “Activities” for the activity specified in the attribute “Activity for Job Revenue Adjustment” in the job parameter type “Revenue Recognition” if you use posting by activity, while it is specified in the window “Posting References” in the G/L module if you do not use posting by activity.

At the same time, Maconomy writes down the job, creating the necessary job entries.

Next, assume that the quote price is increased, for instance to USD 8,000. This means that there is no longer an overrun, as you have still only registered entries for USD 7,000 on the account for work in progress. Maconomy will then automatically debit the account for WIP adjustment for the USD 1,000, while the account for open sales price adjustment is credited the same amount. This way, the overrun is cancelled until the registrations on the job cause the WIP account to exceed the fixed price.

If the same G/L account is used for the registration of work in progress and WIP adjustment, the balance on this account will never exceed the fixed price. The same applies to the open sales price if the same G/L account is used both for registration of open sales price and for adjusting the open sales price.

Maconomy automatically creates any necessary entries caused by overruns. You can view these entries along with all the regular job entries in the window “Job Card.”

For time and material jobs it applies that the invoice basis of the job should always be the basis for the invoicing on the job. Therefore, as revenue adjustment entries should not adjust the invoice basis of the job, any revenue adjustment entries created will be closed immediately after creation and hence they will not have any effect on the invoice basis of the job. If changes on the job result in overruns being cancelled, the automatic creation of reversing journals ensures that the relevant entries are adjusted in the same way as it applies to fixed price jobs.

When closing a time and material job with handling of overruns, Maconomy automatically creates a job revenue recognition journal which when posted ensures that the revenue recognized on the job is equal to the amount invoiced on the job.

- Recognize Revenue by Completion Percentage — This attribute recognizes revenue of a fixed price job by the completion percentage. This parameter requires job capitalization at billing price.

- Revenue Adjustment at Missing Budget — For this attribute, you can specify whether a registration on a detail level should be considered at approval of a revenue recognition, if the detail level in question is not assigned a budget line that contains an amount which is included in the fixed price of the relevant job. If this attribute is assigned the value “No,” Maconomy will not make a revenue adjustment journal when selecting the action “Approve Revenue Recognition” in the window “Job Revenue Recognition Details,” if no budget line assigned to the job contains a specification of a corresponding detail level which is to be included in the fixed price of the job. This means that if detailed revenue recognition is to be carried out on the basis of, for example, activities, and you have made a registration on an activity for which there is no corresponding budget line, Maconomy will ignore the registration in question and hence not create an adjustment journal for the detail level in question when the action “Approve Revenue Recognition” is selected.

If you specify the value “Yes” in this attribute, Maconomy will make a revenue adjustment at every detail level, even though no corresponding budget line has been created for the job in question. This means that if you have, for example, registered GBP 100 on a given detail level for which no corresponding budget line has been created, the fixed price on the line in the window “Job Revenue Recognition Details” will be zero. When approving the revenue recognition in the window, the amount registered will be compared to the amount budgeted hence resulting in a removal of the revenue and a resetting to zero of the line.

- Evaluate Work in Progress — For this attribute, you can specify if it should be possible to evaluate the WIP of a job in the window “Evaluation of Work in Progress.” The attribute can have one of two values: “Yes” or “No.” You cannot select “Yes” if the job parameters “Handling of Overrun” or “Recognize Revenue by Completion Percentage” of the job parameter type “Revenue Recognition” are set, or if the job parameter attribute “Fixed-Price” of the “Invoicing Method” job parameter of the job parameter type “Pricing Method” is set to “Yes.” Also, the job must be capitalized at billing price.

For jobs where this attribute is set to “Yes,” it is possible to revenue-recognize an amount or a percentage of the open entries of jobs without a job budget. For instance, you can choose to recognize 85% of the registered entries on a job (the open billing price) as revenue. When the job is closed, a revenue adjustment journal is created which ensures that the revenue recognized on the job is equal to the amount actually invoiced on the job.

Jobs where this attribute is set to “No” will not be displayed in the window “Evaluation of Work in Progress.”

For more information, please see the description of the window “Evaluation of Work in Progress.”

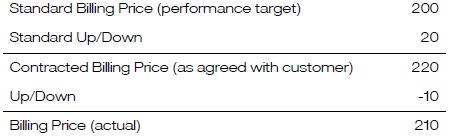

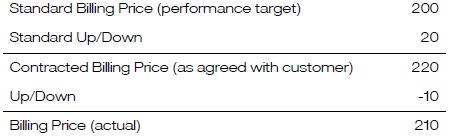

- Posting of Contract Deviation and Posting of Invoice Deviation — For these attributes, you can specify a posting method for job cost entries in the general ledger. In the Job Cost module, there is a distinction between three types of billing prices: The Billing Price is the price which is actually invoiced to a customer. The Contracted Billing Price is the price which was agreed with the customer, usually reflected in a job price list. The Standard Billing Price is an estimated target price which can be used as a standard of measure when analyzing job performance (see also the section “Price Types” in “Appendix A”). Using these attributes, you can have deviations between these billing prices reflected in the General Ledger, for example, for use in G/L reports.

Note that it is only possible to select the attribute “Posting of Contract Deviation” if one or both of the system parameters “Use standard billing price for amount activities” or “Use standard billing price for time activities” has been marked in the Set-Up module.

Even though these two attributes are described together, they are independent of each other. The attribute “Posting of Contract Deviation” has influence on the postings at the time of registration of the job entries, and the attribute “Posting of Invoice Deviation” has influence on the postings at the time of invoicing of the job entries. However, it is easier to describe the effect of the attributes when they are combined in the examples below, as each example shows both registration and invoicing for completeness.

The effect of the posting method depends on whether the job group to which the job belongs is capitalized and, if it is, on the capitalization principle of the current job. The posting principle of each attribute is described below using the same example: Consider a job on which time has been registered, and which is now ready to be invoiced. Let the following facts apply:

In the example, the cost factor is omitted for clarity, as the posting of costs is not affected by these job parameter attributes. Furthermore, the affected posting references are emphasized.

Note that the relevant posting references can both be defined in the window “Posting References” in the G/L module and per activity in the table part of the window “Activities.” If the field “Post by Activity” is marked in the window “System Information” in the Set-Up module, the references in the window” Activities” are used. If the field is not marked, the references in the window “Posting References” are used.

Posting of Contract Deviation = “No”; Posting of Invoice Deviation = “No” — On jobs for which both these attributes have the value “No,” the following postings take place when a job is invoiced:

| Capitalization Method: At Billing Price

|

| Event

|

Accounts

|

Debit

|

Credit

|

| Registration

|

Open Billing Price

|

|

220

|

| Work in Progress

|

220

|

|

| Invoice

|

Open Billing Price

|

220

|

|

| Work in Progress

|

|

220

|

| Item Sales

|

|

210

|

| A/R Control Account

|

210

|

|

| Capitalization Method: At Cost Price

|

| Event

|

Accounts

|

Debit

|

Credit

|

| Invoice

|

Item Sales

|

|

210

|

| A/R Control Account

|

210

|

|

- Posting of Contract Deviation = “No”; Posting of Invoice Deviation = “Yes” — On jobs for which the attribute “Posting of Contract Deviation” is set to “No” and “Posting of Invoice Deviation” is “Yes,” the following postings take place when a job is invoiced:

| Capitalization Method: At Billing Price

|

| Events

|

Accounts

|

Debit

|

Credit

|

| Registration

|

Open Billing Price

|

|

220

|

| Work in Progress

|

220

|

|

| Invoice

|

Open Billing Price

|

220

|

|

| Work in Progress

|

|

220

|

| Item Sales

|

|

220

|

| Invoice Deviation

|

10

|

|

| A/R Control

|

210

|

|

|

| Capitalization Method: At Cost Price

Or without capitalization

|

| Event

|

Account

|

Debit

|

Credit

|

|

|

Item Sales

|

|

220

|

| Invoice Deviation

|

10

|

|

| A/R Control Account

|

210

|

|

|

|

- Posting of Contract Deviation = “Yes”; Posting of Invoice Deviation = “No” — On jobs for which the attribute “Posting of Contract Deviation” is set to “Yes” and “Posting of Invoice Deviation” is “No,” the following postings take place when a job is invoiced:

| Capitalization Method: At Billing Price

|

| Event

|

Accounts

|

Debit

|

Credit

|

| Registration

|

Open Billing Price

|

|

220

|

| Work in Progress

|

220

|

|

| Invoice

|

Open Billing Price

|

220

|

|

| Work in Progress

|

|

220

|

| Item Sales

|

|

210

|

| A/R Control Account

|

210

|

|

| Capitalization Method: At Cost Price

|

| Event

|

Account

|

Debit

|

Credit

|

| Invoice

|

Item Sales

|

|

210

|

| A/R Control Account

|

210

|

|

- Posting of Contract Deviation = “Yes”; Posting of Invoice Deviation = “Yes” — On jobs for which both the attribute “Posting of Contract Deviation” and “Posting of Invoice Deviation” are “Yes,” the following postings take place when a job is invoiced:

| Capitalization Method: At Billing Price

|

| Event

|

Accounts

|

Debit

|

Credit

|

| Registration

|

Open Billing Price

|

|

220

|

| Work in Progress

|

220

|

|

| Contract Deviation

|

|

20

|

| Contract Deviation Offset

|

20

|

|

| Invoice

|

Open Billing Price

|

220

|

|

| Work in Progress

|

|

220

|

| Item Sales

|

|

210

|

| Invoice Deviation

|

10

|

|

| A/R Control Account

|

210

|

|

|

| Capitalization Method: At Cost Price

Or without capitalization

|

| Event

|

Accounts

|

Debit

|

Credit

|

|

|

Item Sales

|

|

210

|

| Invoice Deviation

|

10

|

|

| A/R Control Account

|

210

|

|

- Posting of Standard Billing Price — A standard billing price can be used as a measuring point for performance analyses in which you compare the actual, registered billing price with the standard billing price. In this way, the standard billing price acts as a target price which should be achieved for this activity. The standard billing price is derived in the same way as the regular billing price, except that the item price list system is not used.

- Set this parameter to

No to track this target price for items or services outside of the company.

- Set this parameter to

Yes to post this price for items or services for the job.

- Posting References Based on Job Balance — Select this attribute to enable the job balance to determine the posting reference. When you post a job entry or an invoice/credit memo on account and capitalize at billing price, Maconomy reflects the amount posted either in an Asset account (Accrued Revenue) or in a Liability account (Deferred Revenue). You must combine these two accounts to view the job balance between work in progress and invoiced on account.

If you post an entry that shifts the job balance from negative to positive, the amount you posted is split such that Deferred Revenue is reflected as zero, with the remaining amount reflected as an increase in Accrued Revenue. The opposite happens when the job balance is shifted from positive to negative. The amount you posted is split such that Accrued Revenue is reflected as zero, with the remaining amount reflected as an increase in Deferred Revenue. In effect, it is the current job balance that determines the posting reference.

- Revenue Recognize According to Approved Budget — For this attribute, you can specify if it should be possible to perform revenue recognition by completion percentage on the basis of the latest approved revision of the job budget or on the basis of the latest revision (whether approved or not). If the latest approved revision is used as the basis, the budget must be approved whenever the budget is changed and you wish to perform revenue recognition. Consequently, a great number of job budget revisions are generated if you perform revenue recognition often. By setting the value of this attribute to “No,” you can revenue-recognize a job without having to approve the job budget first. The attribute can have one of two values: “Yes” or “No.”

Charges

- Add Charges to Invoice On Account — This attribute specifies whether charges should be added to invoices on account.

- Calculate Charges after On Account Reduction — This attribute specifies whether the calculation on time-and-material invoices should be based on the invoice amount after on-account reduction.

- Charges on Credit Memos — This attribute specifies whether charges should be applied to credit memos, and if they are, whether those charges should be debited or credited.

Job Text Option Lists

- Text 1 Option List — In this attribute, you can specify an option list to be applied to the field “Text 1” in the island Extra Text in the window “Jobs.” If such an option list is specified in this field and the job parameter is assigned to a given job, the field “Text 1” on the job may only contain values from the option list specified in this attribute. By using options lists, you can hence restrict the contents of the text fields entered on a current job. If you do not specify an option list in this field, you can enter any text you like in the corresponding field in the window Jobs.

- Text 2-20 Option List — The functionality of these attributes is similar to that described for the attribute “Text 1 Option List” above.

- Revision Code Option List — In this attribute, you can specify an option list to be applied to the field “Revision Code” in the island Revision in the window “Job Budget Revisions.” If such an option list is specified in this field, and the job parameter is assigned to a given job, the field “Revision Code” may only contain values from the option list specified in this attribute. By using options lists, you can hence restrict the contents of this field. If you do not specify an option list in this field, you can enter any text you like in the corresponding field in the window “Job Budget Revisions.”

Write-Up/Down

- Activity for Write-Up/Down — In this attribute, you can specify an activity to be used on the new invoice line created when writing a job up or down in the Invoice Selection window. For more information, please see the description of the Transfer Write-Up/Down to Fixed Allocation Combination attribute above.

- Activity for Write-Up/Down, Job Inv. Alloc. — In this attribute, you can specify an activity to be used when writing a job up or down in the Job Invoice Allocation window. For more information, please see the description of the Transfer Write-Up/Down to Fixed Allocation Combination attribute.

- Allow only Write-Up/Down at Close All, Job Inv. Alloc. — With this attribute set to Yes you can only write a job up or down in the window Job Invoice Allocation by selecting the Close All option on the allocation lines. This makes it impossible to write the job up or down by adjusting the quantities or billing prices on the allocation lines.

- Allow Write-Up/Down at Transfer of Billing Price Only — If this attribute is selected (value is “Yes”), you can only write a job up or down in the Invoice Selection window by selecting the Transfer Desired Sales Price action or Transfer Fixed Price action. This makes it impossible to write the job up or down by adjusting the quantities or billing prices on the invoice lines directly in the Invoice Selection window or Itemize Invoice Selection window. Furthermore, it will not be possible to select the action Transfer Budget action in the Invoice Selection window.

You can only select this attribute if the Transfer Write-Up/Down to Fixed Allocation Combination action is selected.

- Entity for Write-Up/Down — The functionality of this field is similar to that of the Activity for Write-Up/Down field above.

- Entity for Write-Up/Down, Job Inv. Alloc. — In this attribute, you can specify an entity to be used when writing a job up or down in the Job Invoice Allocation window. For more information, please see the description of the Transfer Write-Up/Down to Fixed Allocation Combination attribute.

- Local Spec. 1-3 for Write-Up/Down — The functionality of these fields is similar to that of the field “Activity for Write-Up/Down” above.