What's Coming

Regulatory updates and enhancements are frequently needed between releases, the most important of which are highlighted here.

Contents of this Topic

Use the following links to navigate to sections of this topic:

Federal Updates

- 2020 1099 Updates

- 2020 W-2 Updates - Add 2019 USERRA Make-Up Options to the Box 12 Lookup List

- 2020 W-2 - Reporting COVID-19 Sick Leave and Family Leave

- 2020 W-2 Allow for Truncation of Social Security Numbers on W-2s Furnished to Employees

- 2020 Affordable Care Act (ACA) - Add Age and Zip Code to 1095-C Report 2020

- 2020 Affordable Care Act (ACA) - Electronic Filing Updates

- 2020 Affordable Care Act (ACA) - Form 1095-C and Form 1094-C Alignment Updates

- 2020 Affordable Care Act (ACA) - Add New 1095-C Print Options

- 2021 401(K) Compensation Limit Update

- 2021 Federal Nonresident Alien Updates

- 2021 Federal Tax Table Updates

- 2021 Repayment of Deferred Social Security Withholding

- 2021 Safe Harbor Affordability Percentage

- 2021 Social Security Wage Limit Update

- 2021 W-4 Deductions Worksheet

- 2021 Reissued W-4 Deductions Worksheet (Final)

State-Specific Updates

- Alaska 2021 SUTA Wage Base Update

- Arizona 2020 W-2 Electronic Filing Updates

- Arkansas 2021 SUTA Wage Base Update

- Arkansas 2021 Tax Table Update

- Delaware 2020 W-2 Electronic Filing Updates

- Colorado 2020 Tax Table Update (Retroactive to 01/01/2020)

- Guam 2021 Tax Table Update

- Hawaii 2021 SUTA Wage Base Update

- Hawaii 2020 W-2 Electronic Filing Updates

- Idaho 2021 SUTA Wage Base Update

- Illinois 2021 SUTA Wage Base Update

- Illinois 2021 Tax Table Update

- Iowa 2021 SUTA Wage Base Updates

- Iowa 2021 Tax Withholding Updates

- Kentucky 2021 SUTA Wage Base Update

- Kentucky 2021 Tax Withholding Updates

- Maine 2021 Tax Withholding Updates

- Michigan 2021 Tax Table Update

- Minnesota 2021 Tax Table Update

- Mississippi 2021 Tax Table Update

- Missouri 2021 SUTA Wage Base Update

- Missouri 2021 Tax Withholding Updates

- Montana 2021 SUTA Wage Base Updates

- Nevada 2021 SUTA Wage Base Updates

- New Mexico 2021 SUTA Wage Base Update

- New Mexico 2021 Tax Table Update

- New York State and Yonkers, NY 2021 Tax Withholding Update

- North Carolina 2021 SUTA Wage Base Updates

- North Dakota 2021 SUTA Wage Base Update

- North Dakota State Tax Withholding Update

- Oklahoma 2021 SUTA Wage Base Update

- Oregon 2021 SUTA Wage Base Update

- Oregon 2021 Tax Table Update

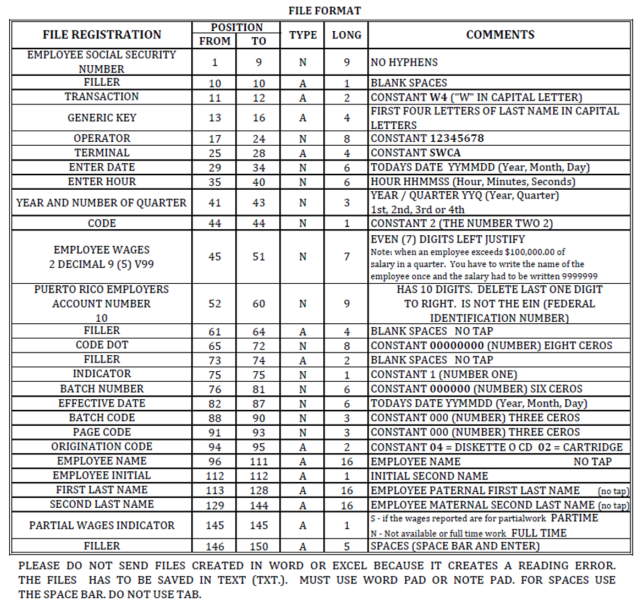

- Puerto Rico Q4 2020 SUTA Electronic Filing

- Rhode Island 2021 SUTA Wage Base Update

- Rhode Island 2021 Tax Table Update

- South Carolina 2021 Tax Withholding Updates

- Utah 2021 SUTA Wage Base Update

- Vermont 2021 SUTA Wage Base Update

- Vermont 2021 Tax Table Update

- Virgin Islands 2020 FUTA Credit Reduction

- Virgin Islands 2021 SUTA Wage Base Update

- Virgin Islands 2021 Tax Table Update

- Washington 2021 SUTA Wage Base Updates

- Wyoming 2021 SUTA Wage Base Update

2020 1099 Updates

The following updates have been made to for 2020 1099 reporting:

-

The IRS released the 2020 Form 1099-NEC, Nonemployee Compensation, which replaces Box 7 in Form 1099-MISC for reporting nonemployee compensation. This shifts the role of the 1099-MISC for reporting all other types of compensation.

- The 1099 mag media file format was updated to accommodate the new form and its contents

- The Print/Create 1099s and Magnetic Media (APR1099) screen was updated to select the appropriate forms for printing

- The contents of 1099-MISC was reformatted to match the government-required output.

Target Dates

The following target dates are subject to change:

- ■ 7.1.1 (on-premise) : MR 7.1.13 (December 4, 2020)

- ■ 8.0 (on-premise) : MR 8.0.4 (December 11. 2020)

- ■ 7.1.7 Hot Fix (on-premise) : Hot Fix 7.1.7.5 (December 23, 2020)

2020 W-2 Updates - Add 2019 USERRA Make-Up Options to the Box 12 Lookup List

The following options will be added to the lookup list for Box 12 in the Manage W-2s (PRMW2) screen:

- D 19 (USERRA 2019 make up elective deferrals to a section 401(k) cash or deferred arrangement)

- E 19 (USERRA 2019 make up elective deferrals to a section 403(b) salary reduction agreement)

- F 19 (USERRA 2019 make up elective deferrals to a section 408(k)(6) salary reduction agreement)

- G 19 (USERRA 2019 make up elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred comp plan)

- H 19 (USERRA 2019 make up elective deferrals under a section 501(c)(18)(D) tax-exempt organization plan)

- S 19 (USERRA 2019 make up employee salary reduction contributions under a section 408(p) SIMPLE)

- Y 19 (USERRA 2019 make up deferrals under section 409A nonqualified deferred compensation plan)

- AA 19 (USERRA 2019 make up designated Roth contributions to a section 401(k) plan)

- BB 19 (USERRA 2019 make up designated Roth contributions under a section 403(b) salary reduction agreement)

- EE 19 (USERRA 2019 make up designated Roth contributions under a section 457(b) plan)

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

2020 W-2 - Reporting COVID-19 Sick Leave and Family Leave Wages

IRS Notice 2020-54 (Guidance on Reporting Qualified Sick Leave Wages and Qualified Family Leave Wages Paid Pursuant to the Families First Coronavirus Response Act)

Source: https://www.irs.gov/pub/irs-drop/n-20-54.pdf

Reporting Qualified Sick Leave Wages

In addition to including qualified sick leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the social security wage base), and 5 of Form W-2, employers must report to the employee the following type and amount of the wages that were paid, with each amount separately reported either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified sick leave wages paid to the quarantined employee under the EPSLA; in labeling this amount, the employer must use the following, or similar, language: "sick leave wages subject to the $511 per day limit."

- the total amount of qualified sick leave wages paid to the employee caring for quarantined individuals and others under the EPSLA; in labeling this amount, the employer must use the following or similar language: "sick leave wages subject to the $200 per day limit."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 provided to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Reporting Qualified Family Leave Wages

In addition to including qualified family leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the Social Security wage base), and 5 of Form W-2, employers must separately report to the employee the following type and amount of the wages that were paid in either in Box 14 of Form W-2 or on a separate statement:

- the total amount of qualified family leave wages paid to the employee under the EFMLEA; in labeling this amount, the employer must use the following, or similar, language: "emergency family leave wages."

If a separate statement is provided and the employee receives a paper Form W-2, then the statement must be included with the Form W-2 sent to the employee, and if the employee receives an electronic Form W-2, then the statement shall be provided in the same manner and at the same time as the Form W-2.

Model Language for Employee Instructions

As part of the Instructions for Employee, under the instructions for Box 14, for the Forms W-2, or in a separate statement sent to the employee, the employer may provide additional information about qualified sick leave wages and qualified family leave wages and explain that these wages may limit the amount of the qualified sick leave equivalent or qualified family leave equivalent credits to which the employee may be entitled with 9 respect to any self-employment income. The following model language (modified as necessary) may be used:

"Included in Box 14, if applicable, are amounts paid to you as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act. Specifically, up to three types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:

- Sick leave wages subject to the $511 per day limit because of care you required;

- Sick leave wages subject to the $200 per day limit because of care you provided to another; and

- Emergency family leave wages.

If you have self-employment income in addition to wages paid by your employer, and you intend to claim any qualified sick leave or qualified family leave equivalent credits, you must report the qualified sick leave or qualified family leave wages on Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, included with your income tax return and reduce (but not below zero) any qualified sick leave or qualified family leave equivalent credits by the amount of these qualified leave wages. If you have self employment income, you should refer to the instructions for your individual income tax return for more information."

Costpoint Solution

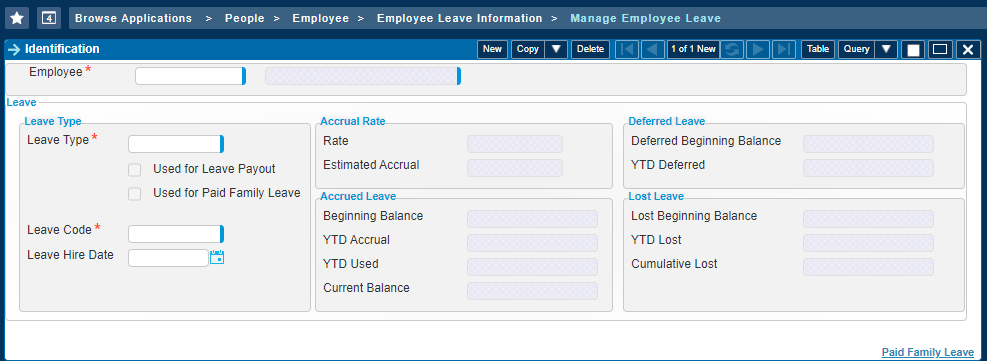

Manage Employee Leave (LDMELV)

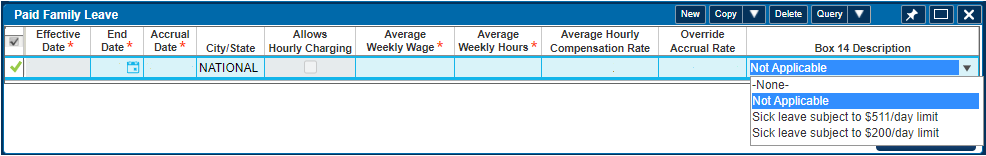

When you report the COVID-19 sick leave wages in Box 14 of Form W-2, the sick leave wages must be reported based on the daily limit that was applied:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

A new drop-down box titled Box 14 Description will be added to the Paid Family Leave subtask in the Manage Employee Leave screen so you can specify which daily limit was utilized. This will allow the Create W-2 Table application to appropriately allocate wages to the correct category. The Box 14 Description drop-down box will only be enabled and required if the City/State is "NATIONAL PAID SICK LEAVE COVID19."

A new value "EMERGENCY FAMILY MEDICAL LEAVE COVID19" will also be added in City/State for the FFCRA's EFMLEA provision. The purpose of adding this value is to distinguish it from the existing value "NATIONAL PAID SICK LEAVE COVID19," which is for the FFCRA's EPSLA provision.

¶

¶

Create W-2 Table (PRPCW2)

The application will be updated to generate Box 14 records for any employees with the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Before generating W-2s for an employee with COVID-19 sick leave wages, you must specify the Box 14 Description in the Manage Employee Leave screen.

When you print W-2s, any COVID-19 Box 14 information is printed on a separate W-2 for the employee, due to the lengthy descriptions required by the IRS.

Manage W-2s (PRMW2)

A new subtask titled COVID-19 Box 14 will be added to the screen, allowing you to view and edit Box 14 information for the following types of COVID-19 leave wages:

- Sick leave wages subject to the $511 per day limit

- Sick leave wages subject to the $200 per day limit

- Emergency family leave wages

Print W-2s (PRRW2)

If an employee has COVID-19 sick leave of family leave wages in 2020, the information will print in Box 14 on a separate W-2 for the employee.

PRRW2: Print W-2s

W-2 Box 14 COVID-19 sick and family leave wages will be added to the report.

ESS W-2s (ESMELECW2)

In order to accommodate the Box 14 COVID-19 reporting, the existing Box 14 (Other) fields on the main screen have been replaced with a Box 14 subtask.

Export Payroll Taxes (PRPEXTAX)

The application will be updated to include the three types of COVID-19 leave wages in the W-2 File.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

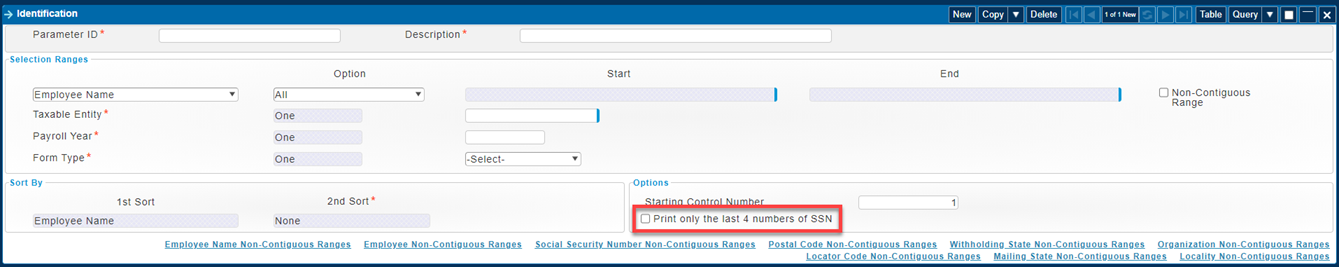

2020 W-2 - Allow for Truncation of Social Security Numbers on W-2s Furnished to Employees

To aid employer efforts to protect employees from identity theft, recent IRS regulations permit employers to voluntarily truncate employee social security numbers (SSN) on the employee copy of the W-2. According to IRS guidelines, when truncating, the first five digits of the employee's nine-digit SSN can be replaced by an asterisk (*) or X.

Costpoint's Print W-2s application was updated to allow for truncation of the employee SSNs when printing W-2s. If opting to truncate, the first five digits of the SSN will be replaced with X. Example: XXX-XX-1234.

Please see the following IRS site for additional information: https://www.federalregister.gov/documents/2019/07/03/2019-11500/use-of-truncated-taxpayer-%20identification-numbers-on-forms-w-2-wage-and-tax-statement-furnished-to

Release RDates

- 7.1.1 (on-premise): MR 7.1.10 (September 20, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12. 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

2020 Affordable Care Act (ACA) - Add Age and Zip Code to 1095-C Report

The IRS released a draft of Form 1095-C, which included the following updates:

- "Employee's Age on January 1" has been added in Part II

- "Zip Code" has been added in Part II, #17

- Line 17 is for reporting the applicable ZIP code that the employer used for determining affordability if the employee was offered an individual coverage health-reimbursement arrangement.

- If Code 1L, 1M, or 1N were used on Line 14, this will be the employee's primary residence location.

- If Code 1O, 1P, or 1Q were used on Line 14, this will be the employee's primary work location.

- Part III (Covered Individuals) now starts at #18 (instead of #17 in 2019)

- Part III (Covered Individuals) now ends at #30 (instead of #34 in 2019)

- "Name of employee (first name, middle initial, last name)" has been removed from Part III

- "Social Security Number" has been removed from Part III

- New codes related to Health Reimbursement Arrangements (HRA) have been added for use in Line 14 (1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S).

These updates will be implemented into Costpoint and we will update as the IRS provides the finalized 1095-C and 1094-C requirements and instructions.

Important

As of mid-October, the IRS has not yet provided guidance on the spacing in the 1095-C and 1094-C forms. Until that is provided, Deltek will not be able to update the Costpoint 1095-C and 1094-C reports. When the IRS publishes the final spacing of these forms, we will update the Costpoint reports accordingly. Please continue to check this site for announcements to changes in the report spacing.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

2020 Affordable Care Act (ACA) - Electronic Filing Updates

The IRS released their E-file instructions for ACA electronic filing, which included the following updates:

- Update 'ty19' to 'ty20' in the namespaces of both manifest and data files

- Update Software ID for 2020 to '20A0010933'

- Add element AgeNum

- Add elements for the ZIP Code, Line 17

- AnnualICHRAZipCd

- MonthlyICHRAZipCdGrp

- JanICHRAZipCd

- FebICHRAZipCd

- MarICHRAZipCd

- AprICHRAZipCd

- MayICHRAZipCd

- JunICHRAZipCd

- JulICHRAZipCd

- AugICHRAZipCd

- SepICHRAZipCd

- OctICHRAZipCd

- NovICHRAZipCd

- DecICHRAZipCd

These updates will be implemented into Costpoint's Create 1094-C and 1095-C Electronic File application.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 16, 2020)

2020 Affordable Care Act (ACA) – Form 1095-C and Form 1094-C Alignment Updates

The IRS released their layout instructions for the ACA 1095-C and 1094-C forms.

Costpoint Solution

Costpoint will be updated to accommodate the layout changes.

Important

You should not print the 1095-C forms for employees and 1094-C forms for the IRS until after you receive these updates.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (December 27, 2021)

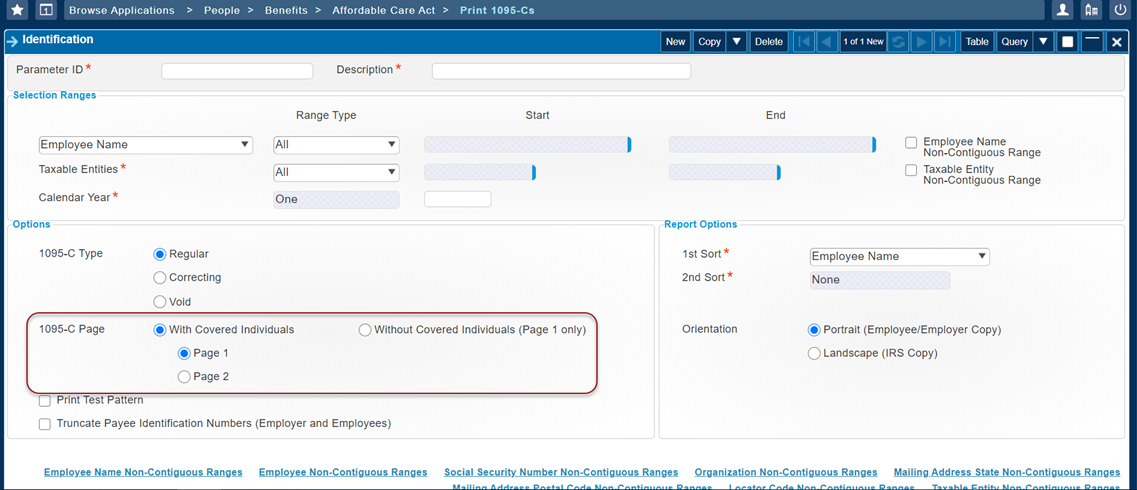

2020 Affordable Care Act (ACA) – Add New 1095-C Print Options

The IRS released their layout instructions for the ACA 1095-C forms. This included the following changes:

- “Name of employee (first name, middle initial, last name)” has been removed from Part III (Page 2)

- “Social Security Number” has been removed from Part III (Page 2)

This change had a large impact on the printing of the 1095-C forms. Prior to this, you could print Page 2 separately, then use the "Name of employee" at the top of the page to match it up with the employee's Page 1. With the removal of the employee name and social security number from Page 2, there may be no way to match Page 2 with Page 1 as the IRS did not retain or provide a field to match the two pages. In cases where the covered individuals have the same surname as the employee, this would not be an issue, but there may be cases where the covered individuals do not have the same surname or you have multiple employees with the same surname. This can be problematic in matching up the pages correctly.

Costpoint Solution

In order to address this issue, Costpoint has been updated with new print options. There will be a four-step approach to printing 1095-Cs:

- Print 1095-C Page 1 for employees with covered individuals.

- Print 1095-C Page 2 for employees with covered individuals. You must use the same 1st Sort and 2nd Sort settings when printing Page 2.

- After printing Page 2, carefully collate the Page 1 forms with the Page 2 forms.

- Print 1095-C Page 1 for employees without covered individuals.

Important

You should not print the 1095-C forms for employees and 1094-C forms for the IRS until after you receive these updates.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

2020 401(K) Compensation Limit Update

The IRS increased the 401(K) compensation limit from $285,000 in 2020 to $290,000 in 2021. Costpoint will be updated to support this new limit with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

2021 Federal Nonresident Alien Updates

The IRS increased the amount to be added to the wages for nonresident alien employees for taxability purposes.

- The amount added to the wages of a nonresident alien employee, who was first paid wages before 2020 and has not submitted a Form W-4 for 2020 or later, has increased to $8,250 (from $8,100 in 2020).

- The amount added to the wages of a nonresident alien employee, who was first paid wages in 2020 or later or has submitted a Form W-4 for 2020 or later, has increased to $12,550 (from $12,400 in 2020).

Costpoint Solution

Costpoint will be updated to support the 2021 Manage Federal Taxes Nonresident Alien Additional Amount of $12,550 for Payroll Year 2021.

The Compute Payroll application will be updated as follows:

- If the employee's Form W-4 is set to 2019 in the Manage Employee Taxes screen and the check date is within 2021, an additional nonresident alien amount of $8,250 will be used.

- If the employee's Form W-4 is set to 2019 in the Manage Employee Taxes screen and the check date is within 2020, an additional nonresident alien amount of $8,100 will be used.

- If the preceding two scenarios do not apply, the Nonresident Alien Additional Amount from the Manage Federal Taxes screen will be used.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

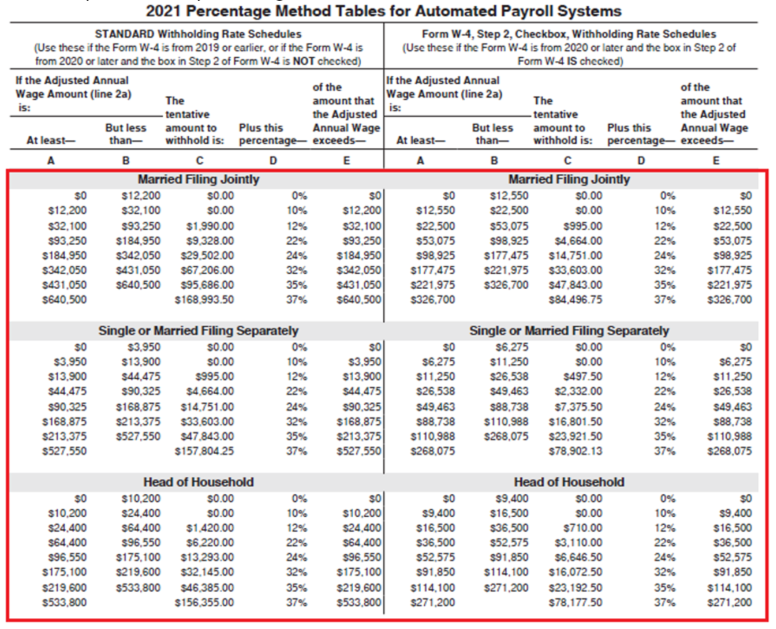

2021 Federal Tax Table Updates

The IRS updated their percentage method tables for 2021.

Please see the following for additional information: https://www.irs.gov/pub/irs-pdf/p15t.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5(January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

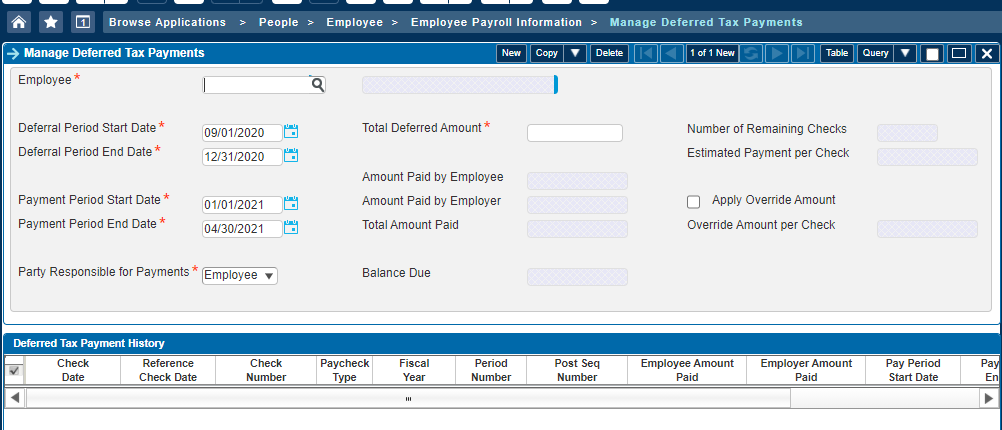

2021 Repayment of Deferred Social Security Withholding

On August 8, 2020, the President signed an executive order which allowed employers to defer Social Security tax withholding for certain employees from September 1, 2020 through December 31, 2020. In late August, the Internal Revenue Service (IRS) announced that employers that opted to defer the withholding must pay the money back by April 2021.

Costpoint Solution

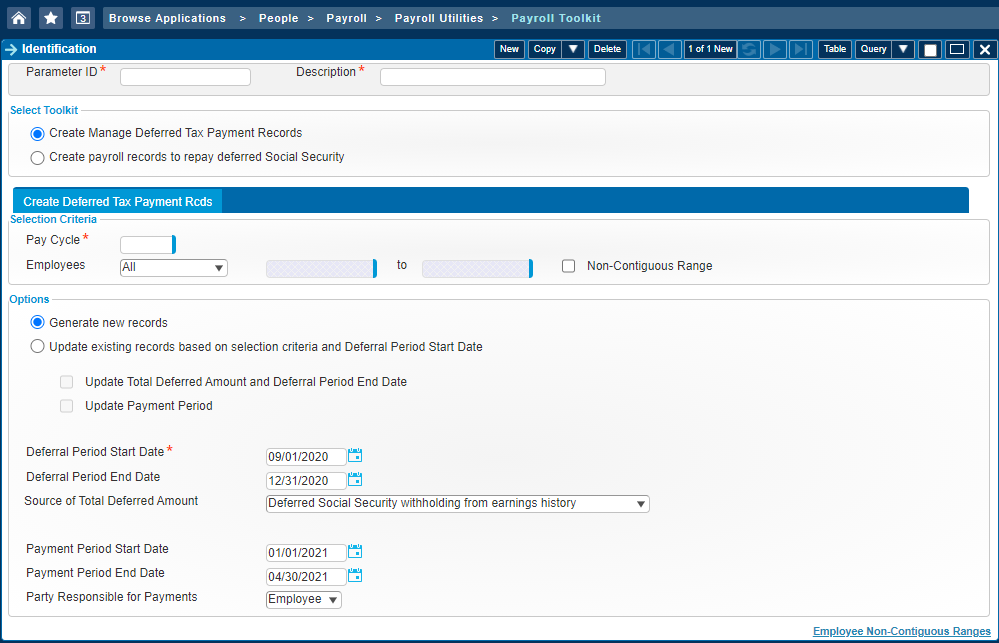

For those employers that opted to defer employee Social Security tax withholding in 2020, Costpoint has provided the following new functionality to track and process the repayments.

A. The ability to establish the total deferred amount and the rules for repayment

A new screen, titled Manage Deferred Tax Payments (EMMDFRDTAXPAY), will be added to Costpoint. This new screen will allow you to manage an employee's deferred Social Security amount and set up the rules for repayment of the deferral.

In this screen, you will be able to specify the deferral dates, the repayment date range, whether the employee or the employer is responsible for repaying the deferred amount, and, if necessary, an override amount to be withheld for any upcoming paychecks. Once the repayments have started, you will also be able to view the check detail for each repayment in the Deferred Tax Payment History subtask. The subtask will be populated with any pertinent data when an existing record is queried.

There are two ways of populating this new screen:

- If you used Deltek's recommended method of deferring the employee Social Security withholding (see " 2020 Employee Social Security Tax Withholding Deferred from 9/1 to 12/31" in the

Regulatory - Latest News section), you may populate this screen using the new

Create Manage Deferred Tax Payment Records toolkit in the Payroll Toolkits application. To determine the

Total Deferred Amount, the toolkit will sum the

Deferred Employee Withholding amounts from Manage Employee Earnings History, where the check date is between the specified deferral dates.

Timing: If this is the method that you choose to create the Deferred Tax Payment records, you should run this toolkit after your final paycheck of 2020 and before computing payroll for the first paycheck in 2021.

- If you did not use Deltek's recommended method of deferring the employee Social Security withholding, you may manually enter the data in the Manage Deferred Tax Payments (EMMDFRDTAXPAY) screen. You will need to determine each affected employee's total deferred withholding and specify the amount in the Total Deferred Amount field.

Timing: If this is the method you choose to create the Deferred Tax Payment records, you should enter and save the records after your final paycheck of 2020 and before computing payroll for the first paycheck in 2021.

B. The ability to process the repayment

Whether you use the new Create Manage Deferred Tax Payment records toolkit to generate the Manage Deferred Tax Payments (EMMDFRDTAXPAY) or manually enter the records, you may use either one of the following methods to process the deferred Social Security withholding repayments:

- A new toolkit, titled Create payroll records to repay deferred Social Security, has been added to the Payroll Toolkits screen. This toolkit can be used to generate X or Y type records to repay the deferral. In order to determine the repayment amount, the toolkit will prorate the employee's balance due over the remaining number of checks within the repayment period or, if you specified an Override Amount per Check, the toolkit will use that value as the repayment amount. The X or Y records generated by this toolkit cannot be edited and will only include the repayment amount. If the Manage Deferred Tax Payments (EMMDFRDTAXPAY) record specifies the employee as the party responsible for the repayments, the amount will be withheld from the employee. Otherwise, if the employer is the responsible party, the repayment amount will be recorded as the employer's Social Security liability.

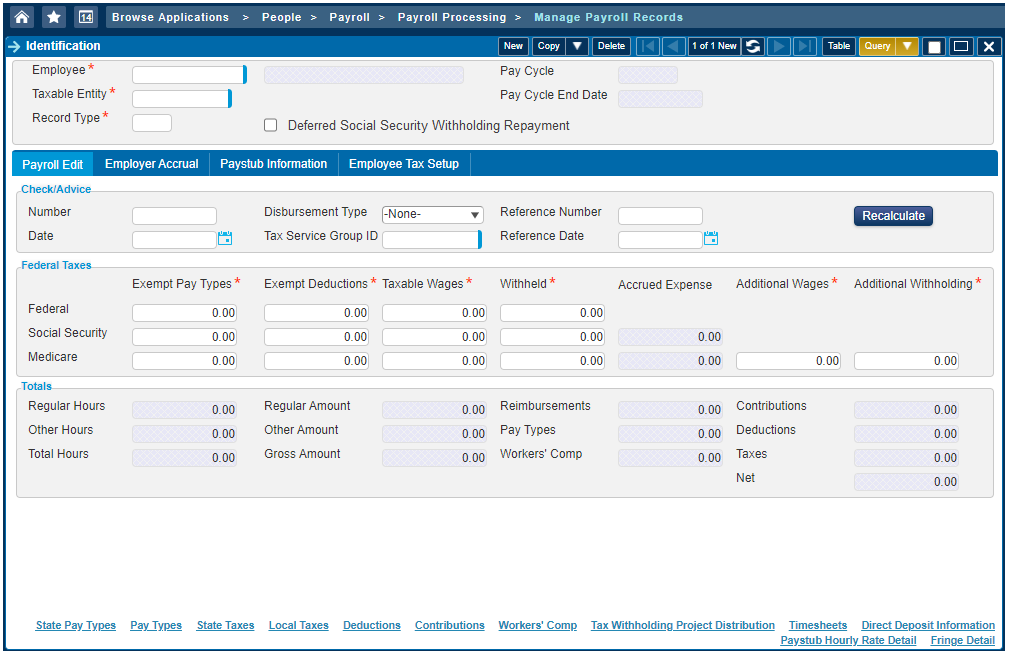

- You can manually enter an X or Y record in the Manage Payroll Records screen. In order to identify the record as a deferred Social Security repayment record, you must select the Deferred Social Security Withholding Repayment check box. By selecting this box, you will have limited access to fields in the screen and you will only be able to either enter an employee Social Security withholding amount or an employer Social Security accrual amount. You must also have at least one row in the Pay Types subtask or the State Pay Types subtask (for multi-state users) with zero hours and amounts.

Timing: It is important to perform the correct steps in order to process the repayment correctly:

- If you are using the new Create payroll records to repay deferred Social Security toolkit to generate the repayment records, ensure you have Check Dates assigned to your pay periods in the Manage Pay Periods screen. Each pay period with a check dated within the deferred Social Security withholding repayment period must have a Check Date assigned to it in order for the repayment amounts to be calculated correctly.

- If the employee is responsible for repaying the deferred Social Security withholding, compute a Regular or Bonus payroll for the affected employee in the Compute Payroll screen. If the employer (not the employee) is responsible for repayment of the deferral, this step is not necessary.

- Run the Create payroll records to repay deferred Social Security toolkit or manually enter the repayment record in the Manage Payroll Records screen.

- Print paychecks or payment advices.

- Post payroll.

C. The ability to export the deferred Social Security repayment amounts to a third party tax-reporting software

Costpoint's Export Payroll Taxes application will be updated to include the following:

- Add CHECK Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 70)

- Add QTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 71)

- Add YTD Deferred Social Security Withholding Paid Back by Employee field to the Employee Social Security (SSEE) records (Field 72)

- Add CHECK Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 76)

- Add QTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 77)

- Add YTD Deferred Social Security Withholding Paid Back by Employer field to the Employer Social Security (SSER) records (Field 78)

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

2021 Safe Harbor Affordability Percentage

The affordability of employer-sponsored health coverage will increase to 9.83% of an employee's household income for the 2021 plan year.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

2021 Social Security Wage Limit Update

The affordability of employer-sponsored health coverage will increase to 9.83% of an employee's household income for the 2021 plan year. The IRS has released its Social Security taxable wage base limit for 2021 from $137,700 to $142,800. Costpoint will be updated to support this new limit with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

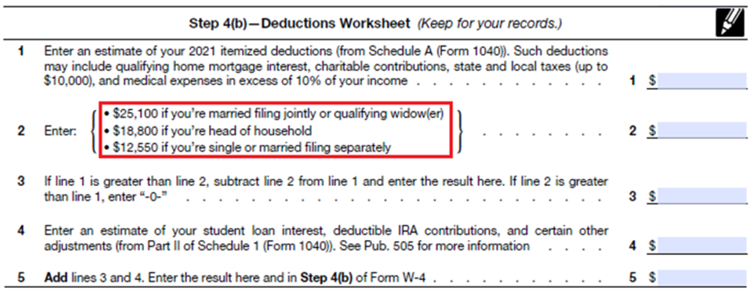

2021 W-4 Deductions Worksheet

The Internal Revenue Service (IRS) supplied the final version of the 2021 W-4 and introduced changes to Step 4(b)-Deductions Worksheet.

2021 Form W-4

Costpoint will update the following screens to comply with the final version of the worksheet:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

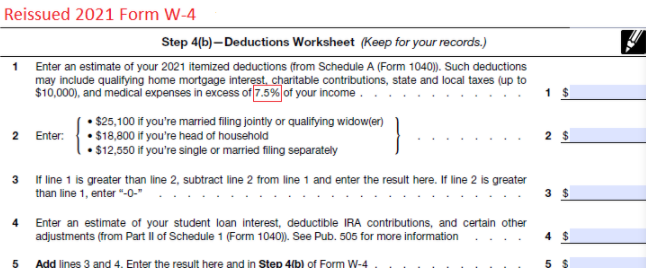

2021 Reissued W-4 Deductions Worksheet (Final)

The Internal Revenue Service (IRS) reissued the final version of the 2021 W-4 and introduced changes to Step 4(b)–Deductions Worksheet. In #line 1, the percentage was changed from 10% to 7.5%.

2021 Form W-4

Costpoint will update the following screens to comply with the reissued version of the worksheet:

- Costpoint Employee Self Service (ESS) Federal Withholding - Multiple Jobs/Deductions Worksheet tab

- Costpoint Employee Self Service (ESS) Life Events/New Hires - Federal Withholding screen - Deductions Worksheet tab

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Alaska 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Alaska SUTA taxable wage base limit of $43,600 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

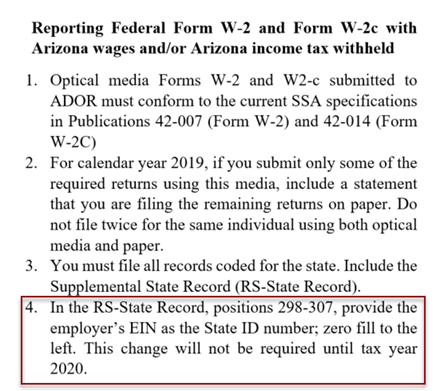

Arizona 2020 W-2 Electronic Filing Updates

The Arizona Department of Revenue has updated their W-2 electronic reporting requirements with the following changes:

- Beginning with the 2020 tax year (due January 31, 2021), all W-2s and 1099s must be submitted electronically.

- In the RS-State Record, positions 298-307, provide the employer’s EIN as the State ID number; zero fill to the left.

Costpoint Solution

Costpoint will be updated to support the file format updates for Arizona W-2 electronic reporting.

Please see the following Arizona Department of Revenue site for additional information: https://azdor.gov/sites/default/files/media/PUBLICATION_701.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Arkansas 2021 SUTA Wage Base Update

The state of Arkansas released their SUTA taxable wage base limit for 2021.

Costpoint Solution

Costpoint will be updated to support the new Arkansas SUTA taxable wage base limit of $10,000 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

Arkansas 2021 Tax Table Update

The state of Arkansas Department of Finance has released their withholding formula with an effective date of January 1, 2021.

- The threshold for adjusting the net taxable income at the $50 range (midrange of 100) increased to 88,001 (from 87,001).

- The value of a state withholding allowance increased to $29, up from $26.

- The tax rates used in the formula decreased to zero to 5.9%, down from zero to 6.6%, and the income tax brackets were adjusted.

Costpoint Solution

Costpoint will be updated to support the new Arkansas state withholding allowance and tax tables with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Colorado 2020 Tax Table Update (Retroactive to 01/01/2020)

Costpoint will support the following 2021 updates for Colorado:

- Colorado’s flat income tax rate, used for regular and supplemental wages, decreases to 4.55%, from 4.63%.

(The decrease was approved by voters at the November 3, 2020 election, and is effective retroactive to January 1, 2020.)

- All employers must calculate the required Colorado wage withholding using the formula (worksheet) and must be used with all Forms W-4.

(Previously, Colorado allowed its 2019 percentage method, which included withholding allowances, to be used with Forms W-4 from 2019 or earlier.)

For more information, refer to: https://tax.colorado.gov/sites/tax/files/DR1098_12-2020.pdf

Delaware 2020 W-2 Electronic Filing Updates

The Delaware Division of Revenue updated their W-2 electronic reporting requirements with the following changes:

- EFW2 “RW” records should be included in W-2 submissions

- Do not truncate the employee SSN on W-2 “Copy 1—For State, City, or Local Tax Department” or in the EFW2 “RS” record. All nine digits must be present.

Costpoint Solution

Costpoint will be updated to support the file format updates for Delaware W-2 electronic reporting.

Please see the following Delaware Division of Revenue site for additional information: https://revenue.delaware.gov/frequently-asked-questions/w-2-and-1099-form-faqs/

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Guam 2021 Tax Table Update

The Guam tax tables will be updated to reflect the 2021 U.S. federal updates.

State Requirements

For more information, refer to: https://www.irs.gov/pub/irs-pdf/p15t.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Hawaii 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Hawaii SUTA taxable wage base limit of $47,400 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

Hawaii 2020 W-2 Electronic Filing Updates

If you are an employer or payroll provider who is required by the federal government to electronically file Form W‐2, Wage and Tax Statements, or Form W‐2C during the year, you must also electronically transmit these informational returns to the Hawaii Department of Taxation. For Hawaii employees and withholding, use the Social Security Administration’s EFW2 format.

Costpoint Solution

Costpoint will be updated to support the EFW2 file for Hawaii W-2 electronic reporting.

State Requirements

Please see the following State of Hawaii Department of Taxation site for additional information: https://files.hawaii.gov/tax/eservices/ebiz/20pubef10-HI_EFW2SpecsGuide-v1rev102020.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

Idaho 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Idaho SUTA taxable wage base limit of $43,000 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

Illinois 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Illinois SUTA taxable wage base limit of $12,960 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

Illinois 2021 Tax Table Update

Costpoint will support the 2021 tax update for Illinois. The value of a state withholding allowance in the withholding formula increased to $2,375, from $2,325 in 2020.

State Requirements

For more information, refer to: https://www2.illinois.gov/rev/forms/withholding/Documents/2020/2021%20IL-700-T.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Iowa 2021 SUTA Wage Base Updates

Costpoint will be updated to support the new Iowa SUTA taxable wage base limit of $32,400 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

Iowa 2021 Tax Withholding Updates

The state of Iowa released their state tax withholding updates for 2021.

- The annual tax bracket thresholds were adjusted.

- The standard deduction increased to $2,130 a year, from $1,880, for employees who claim one or zero allowances, and to $5,240 a year, from $4,630, for employees who claim more than one allowance.

Costpoint Solution

Costpoint will be updated to support the new Iowa state tax withholding standard deduction and tax tables with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change.

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Kentucky 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Kentucky SUTA taxable wage base limit of $11,100 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change.

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Kentucky 2021 Tax Withholding Updates

The standard deduction amount for Kentucky increases to $2,690 (from 2,650 in 2020).

State Requirements

Please see the following for additional information: https://revenue.ky.gov/Forms/2021%2042A003(TCF)(12-2020).pdf

Target Dates

The following target dates are subject to change.

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Maine 2021 Tax Withholding Updates

The state of Maine released their state tax withholding updates for 2021.

- The standard deduction amounts have been updated.

-

The annual withholding tax tables for Married and Single have been updated

Costpoint Solution

Costpoint will be updated to support the new Maine state tax withholding standard deduction and tax tables with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change.

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Michigan 2021 Tax Table Update

Costpoint will support the 2021 tax update for Michigan. The personal exemption amount increases to $4,900, from 4,750 in 2020.

State Requirements

For more information, refer to: https://www.michigan.gov/documents/taxes/446_711611_7.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Minnesota 2021 Tax Table Update

Costpoint will support the following 2021 updates for Minnesota:

- The amount of one withholding allowance increases to 4,350 (from 4,300 in 2020).

- The withholding tables for Single and Married have been updated.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Mississippi 2021 Tax Table Update

Costpoint will support the 2021 tax update for Mississippi. The annual withholding percentage table has been updated.

State Requirements

For more information, refer to: https://www.dor.ms.gov/Documents/Computer%20Payroll%20Flowchart%209-9-20.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Missouri 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Missouri SUTA taxable wage base limit of $11,000 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

Missouri 2021 Tax Withholding Updates

The state of Missouri released their state tax withholding updates for 2021.

- The standard deduction amounts have increased.

- The tax bracket thresholds used in the formula were adjusted.

State Requirements

Please see the following for additional information: https://dor.mo.gov/forms/4282_2021.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15. 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Montana 2021 SUTA Wage Base Updates

Costpoint will be updated to support the new Montana SUTA taxable wage base limit of $35,300 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.2 (October 12, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

Nevada 2021 SUTA Wage Base Updates

Costpoint will be updated to support the new Nevada SUTA taxable wage base limit of $33,400 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

New Mexico 2021 SUTA Wage Base Update

Costpoint will be updated to support the 2021 New Mexico SUTA taxable wage base limit of $27,000 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

New Mexico 2021 Tax Table Update

Costpoint will support the following 2021 updates for New Mexico:

- A new 5.9% income tax bracket has been added to the percentage method withholding.

- The supplemental tax rate increased to 5.9% (from 4.9% in 2020).

State Requirements

For more information, refer to: https://home.deltek.com/sites/EPMO/PP/Integration/Regulatory/PRDs%20and%20Government%20Publications/Payroll_Taxes/State%20Publications/New%20Mexico/FYI-104%20-%20New%20Mexico%20Withholding%20Tax%202021.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

New York State and Yonkers, NY 2021 Tax Withholding Update

The 2021 New York State personal income tax rate schedules have been revised to reflect certain income tax rate reductions enacted under Chapter 60 of the Laws of 2016 (Part TT).

- The annual withholding tax tables for Married and Single have been updated.

- The amount of the adjustment for the difference between federal and New York State withholding allowances increased to $3,300, from $3,200.

State Requirements

Please see the following for additional information:

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

North Carolina 2021 SUTA Wage Base Updates

Costpoint will be updated to support the 2021 North Carolina SUTA taxable wage base limit of $26,000 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

North Dakota 2021 SUTA Wage Base Update

Costpoint will be updated to support the 2021 North Dakota SUTA taxable wage base limit of $38,500 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

North Dakota State Tax Withholding Update

North Dakota released their 2021 state tax withholding requirements for 2021 and introduced the following changes:

- The tax brackets used in the withholding method for Forms W-4 before 2020 have been adjusted.

- The tax brackets used in the withholding method for Forms W-4 for 2020 and after have been adjusted.

State Requirements

Please see the following for additional information: https://www.nd.gov/tax/data/upfiles/media/income-tax-withholding-rates-and-instructions-booklet-2021.pdf%20

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Oklahoma 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Oklahoma SUTA taxable wage base limit of $24,000 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

Oregon 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Oregon SUTA taxable wage base limit of $43,800 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Oregon 2021 Tax Table Update

Costpoint will support the following updates for Oregon:

- The federal tax adjustment amount increased to 7,050 (from 6,950 in 2020) for an employee with annual wages up to $50,000.

- The federal tax adjustment phase out amounts for an employee with annual wages 50,000 or greater changed in 2020.

- The tax table changed for an employee with annual wages up to $50,000.

- The tax table changed for an employee with annual wages $50,000 or greater.

- The allowance amount increased to 213 (from 210 in 2020).

- The standard deduction amount increased to 2,350 (from 2,315 in 2020) for an employee filing “Single” with fewer than 3 allowances.

- The standard deduction amount increased to 4,700 (from 4,630 in 2020) for an employee filing “Single” with 3 or more allowances.

- The standard deduction amount increased to 4,700 (from 4,630 in 2020) for an employee filing “Married”.

State Requirements

For more information, refer to: https://www.oregon.gov/dor/forms/FormsPubs/withholding-tax-formulas_206-436_2021.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Puerto Rico Q4 2020 SUTA Electronic Filing

Costpoint was updated to support electronic filing for Puerto Rico SUTA reporting, using the following format:

State Requirements

Please see the following Maryland Department of Labor site for additional information: https://patronos.trabajo.pr.gov/patronos/Help/Help_EN/default.htm?turl=aboutus.htm

Release Dates

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

Rhode Island 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Rhode Island SUTA taxable wage base limit of $24,600 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Rhode Island 2021 Tax Table Update

Costpoint will support the following 2021 updates for Rhode Island:

- The withholding tables have been updated, effective 01/01/2021.

- The threshold for 0.00 allowance amount increases to $234,750 (from $231,500 in 2020).

State Requirements

For more information, refer to: http://www.tax.ri.gov/forms/2021/Withholding/2021%20Withholding%20Tax%20Booklet.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

South Carolina 2021 Tax Withholding Updates

Costpoint will be updated to support the following 2021 South Carolina state tax withholding updates:

- Reduce the lowest tax rate used from 0.8% in 2020 to 0.5% in 2021.

- Increase the value of a state allowance from $2,590 in 2020 to $2,670 in 2021.

- Increase the maximum state standard deduction from $3,820 in 2020 to $4,200 in 2021.

- Adjust the income brackets.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Utah 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Utah SUTA taxable wage base limit of $38,900 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2020)

- 8.0 (on-premise): MR 8.0.4 (December 11, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.5 (December 23, 2020)

Vermont 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Vermont SUTA taxable wage base limit of $14,100 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.12 (December 4, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

Vermont 2021 Tax Table Update

Costpoint will support the following 2021 updates for Vermont:

- The annual percentage method withholding tables for Married and Single have been updated.

- The value of a withholding allowance increased to $4,400 annually, up from $4,350 in 2020.

State Requirements

For more information, refer to: https://tax.vermont.gov/sites/tax/files/documents/WithholdingInstructions.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Virgin Islands 2020 FUTA Credit Reduction

For 2020, the U.S. Virgin Islands (USVI) is the only credit reduction state. The credit reduction rate is 0.03 (3.0%).

State Requirements

For more information, refer to: https://www.irs.gov/pub/irs-pdf/f940sa.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 7, 2021)

Virgin Islands 2021 SUTA Wage Base Update

The Virgin Islands increased their SUTA taxable wage base limit from 28,900 in 2020 to 32,500 in 2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

- 8.0 (on-premise): MR 8.0.7 (February 26, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.7 (February 23, 2021)

Virgin Islands 2021 Tax Table Update

The Virgin Islands tax tables will be updated to reflect the 2021 U.S. federal updates.

State Requirements

For more information, refer to: https://www.irs.gov/pub/irs-pdf/p15t.pdf

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Washington 2021 SUTA Wage Base Updates

Costpoint will be updated to support the new Washington SUTA taxable wage base limit of $56,500 with an effective date of 01/01/2021.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

Wyoming 2021 SUTA Wage Base Update

Costpoint will be updated to support the new Wyoming SUTA taxable wage base limit of $27,300 with an effective date of 01/01/2021.

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.3 (October 23, 2020)

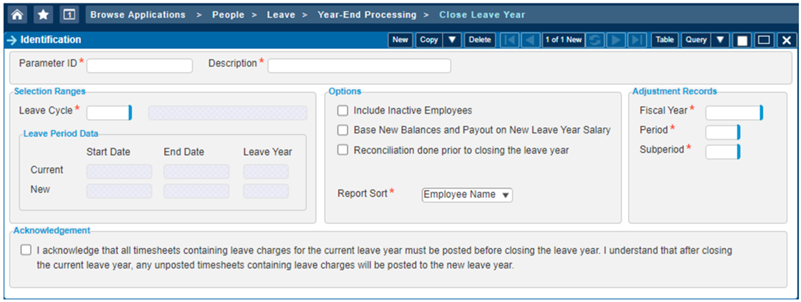

Require Acknowledgement of Used Leave Posting Prior to Closing the Leave Year

In the past few years, there have been cases where Costpoint users have posted used leave from the prior leave year after that leave year has already been closed. When this occurs, the used leave is posted to the incorrect leave year, resulting in incorrect leave balances and often requiring Costpoint users to work with Deltek Support to reverse the leave year closing.

Costpoint Solution

To help prevent this issue and encourage the Leave Administrator to verify that all used leave for the current year has already been posted, Costpoint will be updated to require users to acknowledge that timesheets with leave charges have been posted prior to closing the leave year. The Close Leave Year screen will be updated with a new Acknowledgement group box:

Release Dates

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 19, 2020)