Latest News

Regulatory updates and enhancements are frequently needed between releases, the most important recent releases are highlighted here.

Reminder: Costpoint 7.0.1 Support Policy Update

Costpoint 7.0.1 is currently in Maintenance Support. Maintenance Support is a period where you will continue to receive hot fixes for severity 1 issues, and tax, legal, and regulatory updates.

Contents of this Topic

Use the following links to navigate to sections of this topic:

Federal Updates

- 2020 Q3 Form 941 Instructions - Worksheet 1 Updates

- Quarterly Federal Payroll Tax Report

- Employee Social Security Tax Withholding Deferred from 9/1 to 12/31

- VETS-4212 Report

- 2020 H.R. 6201: Families First Coronavirus Response Act - Payroll Tax Credits

- COVID-CARES Act Paycheck Protection Program

- COVID-CARES Act Deferral of Employment Tax Deposits and Payments

- COVID-Export of Leave Data to Shop Floor Time to Include Paid Family Leave Dates for COVID-19 H.R. 6201

- COVID-2020 H.R. 6201: Families First Coronavirus Response Act - National Paid Sick Leave and FMLA Expansion

- Emergency Paid Sick Leave and Emergency FMLA Expansion

2020 Q3 Form 941 Instructions - Worksheet 1 Updates

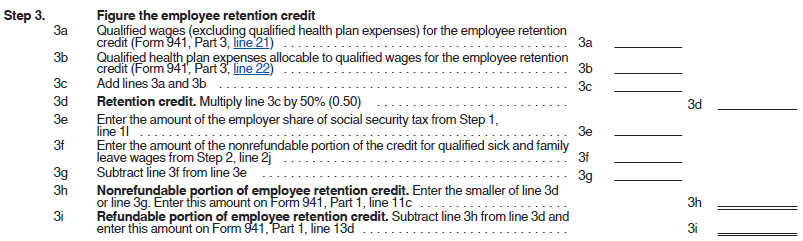

The Internal Revenue Service (IRS) released revised instructions for Form 941, which include changes to Step 3 of Worksheet 1 (Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit). Employers will need to use the new worksheet to complete their 2020 third quarter 941 reporting.

Worksheet 1. Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit (July 2020 Revision) https://www.irs.gov/pub/irs-prior/i941--2020.pdf

Costpoint Solution

Print Quarter Federal Payroll Tax Report

To comply with the revised Form 941, Costpoint will update the numbering and text in the Employee Retention Credit section of the Federal 941 Data and Tax Credit Report in MR 7.1.7.4, MR 7.1.11 and MR 8.0.3. The following chart provides a mapping of the new IRS worksheet to Costpoint's updated report.

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

|---|---|

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3cq2 on the updated report.) | 3cq2 Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below. In order to continue supporting Q2 2020 reporting, we will show this as 3dq2 on the updated report) | 3dq2 Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3c Total qualified wages for employee retention credit (3a + 3b + 3cq2 + 3dq2): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3d Retention credit (3c x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3g Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3h Nonrefundable portion of employee retention credit (the smaller of 3d or 3g): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3i Refundable portion of employee retention credit (3d - 3h): |

Target Dates

The following target dates are subject to change:

- 7.1.1 (on-premise): MR 7.1.11 (October 29, 2020)

- 8.0 (on-premise): MR 8.0.3 (November 10. 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.4 (November 20, 2020)

Important Information

If you do not download the Costpoint updates in MR 7.1.11, MR 8.0.3, or MR 7.1.7.4 before completing your 941 for Q3 2020 and are therefore using an old version of Costpoint's Federal 941 Data and Tax Credit Report, please use the following mapping to help you complete your report:

| IRS Form 941, Worksheet 1 - Step 3 (July 2020 Revision) | Costpoint's Federal 941 Data and Tax Credit Report (Pre-MR 7.1.7.4, MR 7.1.11 and MR 8.0.3) |

|---|---|

| 3a Qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) | 3a Qualified wages for the employee retention credit: |

| 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22) | 3b Qualified health plan expenses allocable to qualified wages for the employee retention credit: |

| (The existing line 3c has been repurposed in the new IRS worksheet. See below.) | 3c Qualified wages paid March 13, 2020 through March 31, 2020 for the employee retention credit (Q2 report only); (Amount should be zero) |

| (The existing line 3d has been repurposed in the new IRS worksheet. See below.) | 3d Qualified health plan expenses allocable to qualified wages paid March 13, 2020 through March 31, 2020 (Q2 report only); (Amount should be zero) |

| 3c Add lines 3a and 3b | 3e Total qualified wages for employee retention credit (3a + 3b + 3c + 3d): |

| 3d Retention credit. Multiply line 3c by 50% (0.50) | 3f Retention credit (3e x 50%): |

| 3e Enter the amount of the employer share of social security tax from Step 1, line 1l | 1l (from the 'Credit for Sick and Family Leave Wages' section of the report) Employer share of social security tax remaining: |

| 3f Enter the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j | 2j (from the 'Credit for Sick and Family Leave Wages' section of the report) Nonrefundable portion of credit for qualified sick and family leave wages (the smaller of 1l or 2i): |

| 3g Subtract line 3f from line 3e | 3i Subtract nonrefundable portion of credit for qualified sick and family leave wages from employer share of social security tax (1l - 2j): |

| 3h Nonrefundable portion of employee retention credit. Enter the smaller of line 3d or line 3g. Enter this amount on Form 941, Part 1, line 11c | 3j Nonrefundable portion of employee retention credit (the smaller of 3f or 3i): |

| 3i Refundable portion of employee retention credit. Subtract line 3h from line 3d and enter this amount on Form 941, Part 1, line 13d | 3k Refundable portion of employee retention credit (3f - 3j): |

2020 Quarterly Federal Payroll Tax Report

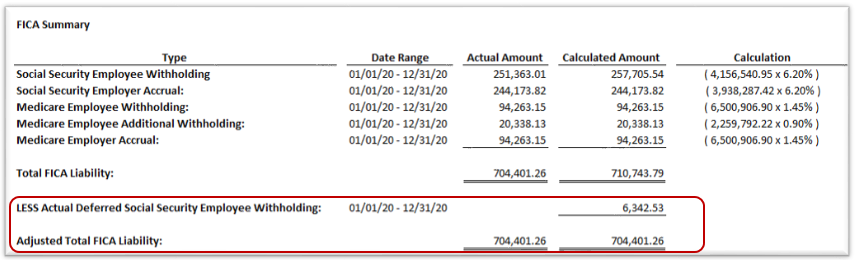

The U.S. Department of Treasury has not yet announced how the recent Social Security withholding deferral (CARES Act Memorandum) will affect the federal quarterly reporting. However, to help provide critical information, the Quarterly Federal Payroll Tax Report will be updated to provide the following information:

- Since it currently reports the expected Social Security Employee Withholding without adjusting for the amount of employee Social Security withholding that was deferred from September 1, 2020 to December 31, 2020, a new Actual Deferred Social Security Employee Withholding row has been added to the FICA Summary section of the Quarterly Federal Payroll Tax Report. This value is a sum of the Social Security employee withholding that was deferred during the reporting period. This amount will only be included on the report if at least one employee’s Social Security withholding was deferred. An Adjusted Total FICA Liability row was added to show the difference between the calculated amount and the deferred Social Security withholding.

- To provide additional information, a new Deferred Employee Social Security Withholding section was added to the Quarterly Federal Payroll Tax Report. This report will provide a detailed list of the employees whose Social Security withholding was deferred during the reporting period as a result of the CARES Act memorandum.

The 941 section of the Quarterly Federal Payroll Tax Report will be updated when an updated 941 form is provided by the U.S. government.

Release Dates

- 7.1.1 (on-premise): MR 7.1.10 (September 30, 2020)

- 7.1.7 Hot Fix (on-premise): MR 7.1.7.2 (September 22. 2020)

- 8.0.1 (on-premise): MR 8.0.2 (October 12, 2020)

2020 Employee Social Security Tax Withholding Deferred from 9/1 to 12/31

Source: Bloomberg Tax

Employee Social Security Tax Deferred from Sept. 1 to Dec. 31

- The relief is in addition to the deferral of the employer portion of Social Security tax with respect to March 27 to Dec. 31

- Employees generally must have biweekly pay of less than $4,000 to be eligible for the new deferral

Withholding, deposits, and payments of the employee portion of Social Security tax are to be deferred with respect to the period from Sept. 1 to Dec. 31, 2020, under a presidential memorandum signed August 8 by President Donald Trump.

This relief for employees is separate from, and in addition to, the deferral of deposits and payments of the employer portion of Social Security tax with respect to the period from March 27 to Dec. 31, 2020, which was authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The deferral provisions pertaining to the employee portion of Social Security tax are to apply only to compensation paid to employees whose biweekly pretax compensation generally is less than $4,000. The employee portion of Medicare tax is not affected by the memorandum, as the memorandum specifies its applicability to the employee portion of Social Security tax imposed by Internal Revenue Code Section 3101(a) without also identifying applicability to the employee portion of Medicare tax imposed by IRC Section 3101(b).

Although the memorandum indicates that deferrals of the employee portion of Social Security tax are available with regard to compensation paid during the period from Sept. 1 to Dec. 31, the memorandum does not indicate that the employee relief would extend to deposit deadlines from Sept. 1 to Dec. 31 for assessments on compensation paid before that period. By contrast, deferrals of the employer portion of Social Security tax are available both with respect to deposit deadlines that occur within the period from March 27 to Dec. 31, even if those deposit deadlines are for assessments on compensation paid before that period, and deposit deadlines after that period but that are based on compensation paid during that period.

While the CARES Act did not require employers to defer their portion of Social Security tax and instead merely provided them with the option to do so, Sections 1 and 2 of the memorandum appear to have the combined effect of requiring the deferral of the employee portion of Social Security tax for eligible employees. It is likely that Treasury Department guidance issued pursuant to Section 3 of the memorandum will clarify whether deferral of the employee portion of Social Security tax indeed is required.

Although the CARES Act specified that half of the deferred employer portion of Social Security tax would be due Dec. 31, 2021, with the other half due Dec. 31, 2022, the memorandum does not specify when the deferred employee portion of Social Security tax would be due. Instead, Section 3 of the memorandum authorizes the Treasury Department to issue guidance that would clarify when the deferred employee portion would be due.

However, the memorandum identified that there is a possibility that the deferral of the employee portion of Social Security tax with respect to the period from Sept. 1 to Dec. 31 will be transformed into an elimination of the liability to pay that amount. Section 4 of the memorandum specifies in this regard that the Treasury Department "shall explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum."

As it is uncertain whether the liability to pay the deferred amounts of the employee portion of Social Security is to eventually be eliminated, the deferrals of the employee portion of Social Security tax are for now, like the deferrals of the employer portion of Social Security tax, not to be treated as deferrals of liability.

Therefore, for now, the employee portion of Social Security tax, even with deferrals, that normally would be due with respect to the period from Sept. 1 to Dec. 31 would need to continue to be included in Lines 12 and 16 of Form 941, Employer's Quarterly Federal Tax Return, and in applicable boxes for Form 941's Schedule B for semiweekly depositors, with respect to the returns reporting data for the period from Sept. 1 to Dec. 31. Amounts of the employee portion of Social Security tax, regardless of deferral, also would continue to be factored into determinations during the period from Sept. 1 to Dec. 31 of whether an employer must perform a next-day deposit because it accumulated employment tax liability of at least $100,000.

In light of the new line 13b that was added to Form 941, upon the release of its finalized revision June 19, to report deferrals of the employer portion of Social Security tax, it remains to be seen whether Form 941 will be further modified to accommodate reporting of deferrals of the employee portion of Social Security tax.

Presidential Memorandum: https://www.whitehouse.gov/presidential-actions/memorandum-deferring-payroll-tax-obligations-light-ongoing-covid-19-disaster/?fbclid=IwAR19mUMFDE3Sr62xogkuwOM9kHtg17Rw3vaancO78WBacuDqlrO445uof3w

Costpoint Solution

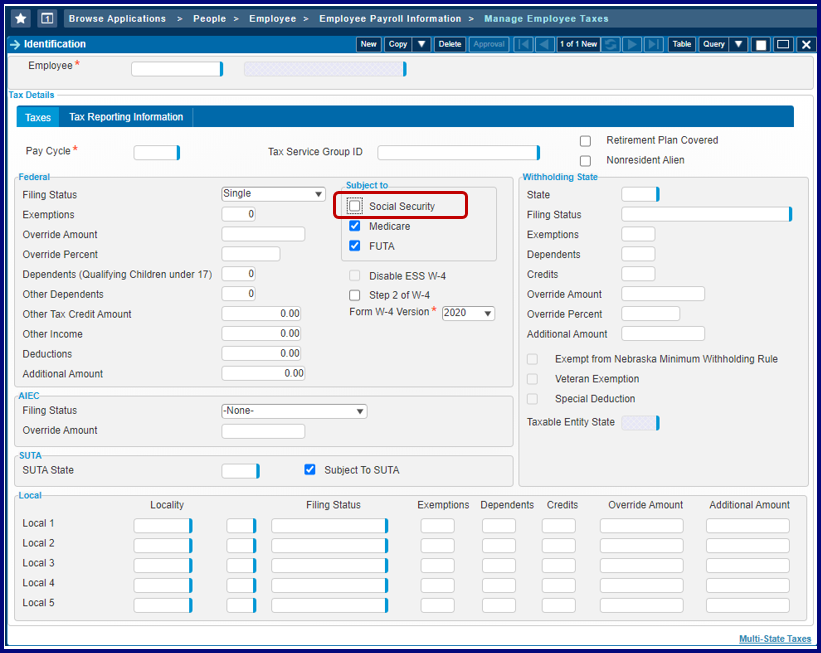

Based on the information provided in the memorandum, here are the required steps you will need to take to be compliant with this federal requirement:

Caution: Before computing payroll for your first paycheck in September 2020, you must complete the steps in the first two bullets below, even if you have not yet downloaded Costpoint MR 7.1.9 or MR 8.0.1.

- Identify the employees that are eligible for deferral from their portion of Social Security taxes by identifying employees that generally have biweekly pay of less than $4,000.

- Clear the Subject to Social Security check box in the Manage Payroll Taxes screen for the identified employees. This will impede the calculation of both the employee's portion of Social Security taxes and the employer's portion of Social Security taxes when Compute Payroll is processed. You must complete this step before the first paycheck with a date that falls within the 9/1/2020 to 12/31/2020 period of deferral.

- The presidential memorandum states that only the employee's portion of Social Security taxes will be deferred. Therefore, after you post payroll and before you generate the Quarterly Federal Tax Report for 941 reporting, you will need to download MR 7.1.9, MR 8.0.1, or a higher version in order to obtain the updates that will allow you to calculate the employer portion of the Social Security tax and the employee's Social Security taxable wages.

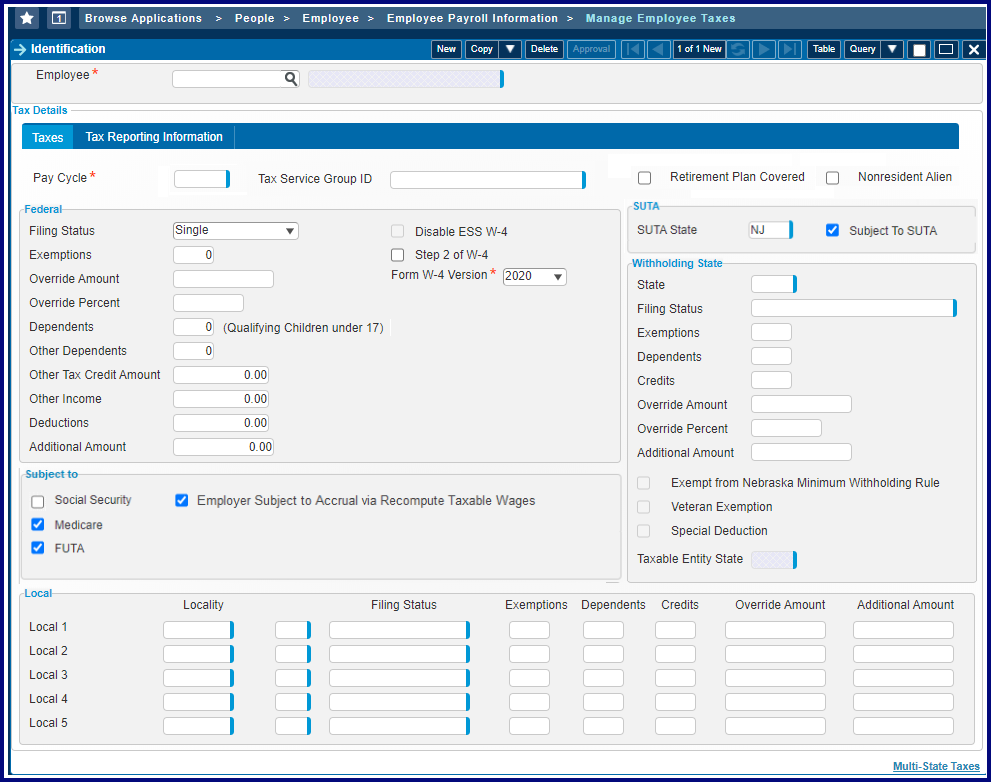

- Once MR 7.1.9 or MR 8.0.1 is loaded, query the employees that were identified for deferral from the employee portion of Social Security taxes and select the new Employer Subject to Accrual via Recompute Taxable Wages check box for each of the employees. Selecting this check box indicates that the employer is still liable for their portion of the Social Security taxes while the employee's Social Security Withholding is in a deferred status from 09/01/2020 through 12/31/2020.

- In order to update the employer's Social Security tax liability and the employee's Social Security taxable wages, you will need to run the Recompute Taxable Wages application. If an employee's

Employer Subject to Accrual via Recompute Taxable Wages check box is selected in the Manage Employee Taxes screen and the check date falls within the 9/1/2020 to 12/31/2020 deferral period, the Recompute Taxable Wages application will do the following:

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security taxable wages.

- Calculate and populate the Manage Employee Earning History record with the employer's Social Security tax accrual amount.

- Calculate and populate the Manage Employee Earnings History record with the employee's Social Security taxable wages.

Release Dates

- 7.1.1 (on-premise): MR 7.1.9 (September 8, 2020)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.2 (September 22. 2020)

- 8.0 (on-premise): MR 8.0.1 (September 14, 2020)

VETS-4212 Report

Costpoint MR 7.1.6 updates the Print VETS-4212 Report (HARV100) screen and changes the existing single date parameter on the screen into a range of dates. You will now be able to enter a pay period date range which represents the pay period used as the basis for filing the VETS-4212 report. Costpoint now uses the pay period date range for reporting the following:

- Number of employees: The application will use the pay period start and end dates as the basis for the employment figure.

- Number of new-hires for the 12 month reporting period: The application will use the pay period end date as the end date for the twelve-month reporting period.

The VETS-4212 Report will be based on a pay period that has an end date between July 1 and August 31. Any Federal contractor or subcontractor that has written approval from the Equal Employment Opportunity Commission to use December 31 as the ending date for the EEO-1 Report may also use that date as the ending date for the payroll period selected for the VETS-4212 Report.

The following are the updates to the Print VETS-4212 Report screen:

- The "Period End Date" label in the Selection Range group box changed to "Pay Period Date."

- The value in the Option field for Pay Period Date changed to Range.

- The screen now requires a start and end date for the reporting period in the following fields:

- Pay Period Date - Start field: Enter, or use the calendar lookup, the pay period start date to determine the number of employees.

- Pay Period Date - End field: Enter, or use the calendar lookup, the pay period end date to determine the number of employees and the number of new-hires in the previous 12-month period.

Release Date

- 7.1.1 (on-premise): Released with MR 7.1.6 (May 2020)

2020 H.R. 6201: Families First Coronavirus Response Act - Payroll Tax Credits

The U.S. government recently signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new tax credit legislation:

Employers covered by the Families First Coronavirus Response Act may take advantage of special tax credits designed to reimburse them for providing coronavirus-related paid sick and family medical leave to their employees.

- Paid Sick Leave Credit: As per the IRS, for an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days. For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

- Child Care Leave Credit: As per the IRS, in addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Costpoint Solution

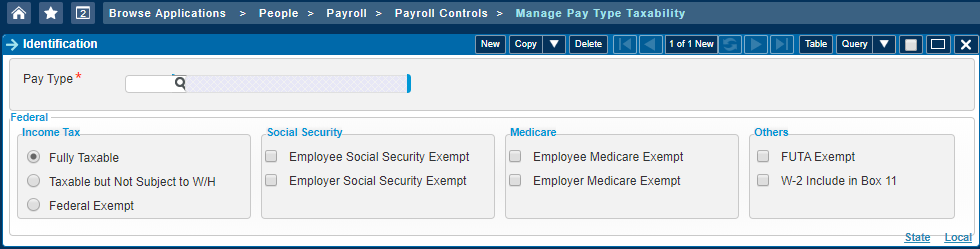

Costpoint currently allows for pay types to be flagged as exempt from both employer and employee Social Security and Medicare (FICA) taxes in the Manage Pay Type Taxability screen. However, the Families First Coronavirus Response Act allows for coronavirus-related sick and family medical leave to be exempt from only the employer's FICA tax. In order to comply with this requirement, we will update the Manage Pay Type Taxability application so you can specify a pay type's employer Social Security and Medicare taxability separately from the employee Social Security and Medicare taxability. This will allow you to set up your Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act pay types as employer-FICA-exempt, but not exempt for employee FICA tax.

Accordingly, Costpoint will compute and track the employee and employer FICA exempt pay type amounts, exempt deduction amounts, and taxable wages separately from the employee FICA information throughout the payroll process.

Release Dates

- 7.1.1 (on-premise): MR 7.1.7 (June 30, 2020)

- 7.0.1: System Jar 061 (June 30, 2020)

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) will be updated with data setup instructions in the coming weeks.

COVID-CARES Act Paycheck Protection Program

The Paycheck Protection Program, established by the Coronavirus, Aid, Relief and Economic Security Act (CARES Act), is implemented by the Small Business Administration with support from the Department of the Treasury. This program provides small businesses with funds to pay up to eight weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities.

The program allows qualifying employers with up to 500 employees to apply for a forgivable loan to cover payroll costs over an eight-week period from Feb. 15 to June 30, 2020.

Employers will need the following data to apply for the loan:

- Employee gross pay (capped at $100,000 on an annualized basis for each employee)

- Employer-paid benefits contributions

- Employer-paid retirement contributions

- Employer-paid state and local taxes

Costpoint Solution

To help employers report accurate data for any loan applications, a new report was added in the Payroll module to calculate employer payroll expenses. The new report, which is available in the Payroll Toolkits screen, will provide a 12-month breakdown of total employee earnings, Employer paid state and local taxes, Employer benefits, Earnings in excess of $100,000, Total payroll costs and the Number of employees. The report will also display the yearly average for the total payroll costs and number of employees. Only U.S. based employees will be included in the report.

Release Dates

- 7.1.1 (on-premise): MR 7.1.6 (May 25, 2020)

- 7.0.1: PRPTOOLKIT application was deployed to DSM on 6/2/2020 (Requires System Jar 060, which was deployed on May 11, 2020)

COVID-CARES Act Deferral of Employment Tax Deposits and Payments

Source: IRS website

The Coronavirus, Aid, Relief and Economic Security Act (CARES Act) allows employers to defer the deposit and payment of the employer's share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes.

- What deposits and payments of employment taxes are employers entitled to defer?

Section 2302 of the CARES Act provides that employers may defer the deposit and payment of the employer's portion of Social Security taxes and certain railroad retirement taxes. These are the taxes imposed under section 3111(a) of the Internal Revenue Code (the "Code") and, for Railroad employers, so much of the taxes imposed under section 3221(a) of the Code as are attributable to the rate in effect under section 3111(a) of the Code (collectively referred to as the "employer's share of Social Security tax"). Employers that received a Paycheck Protection Program loan may not defer the deposit and payment of the employer's share of Social Security tax that is otherwise due after the employer receives a decision from the lender that the loan was forgiven. (See FAQ 4).

- When can employers begin deferring deposit and payment of the employer's share of Social Security tax without incurring failure to deposit and failure to pay penalties?

The deferral applies to deposits and payments of the employer's share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020. (Section 2302 of the CARES Act calls this period the "payroll tax deferral period.")

The Form 941, Employer's QUARTERLY Federal Tax Return, will be revised for the second calendar quarter of 2020 (April - June, 2020). Information will be provided in the near future to instruct employers how to reflect the deferred deposits and payments otherwise due on or after March 27, 2020 for the first quarter of 2020 (January - March 2020). In no case will Employers be required to make a special election to be able to defer deposits and payments of these employment taxes.

Costpoint Solution

Costpoint's existing A/P Voucher functionality already allows for partial liability payments as part of standard functionality. In the Edit Voucher Payment Status screen, the Amount to Pay is automatically calculated by the system (based on discounts, etc.) but you may override this value in order to do a partial payment. You may enter an override amount, for example the 50% of the employer portion of Social Security tax, but there is also retainage options that limit how much to pay.

COVID-Export of Leave Data to Shop Floor Time to Include Paid Family Leave Dates for COVID-19 H.R. 6201

The recent H.R. 6201: Families First Coronavirus Response Act regulations for COVID-19 allows employees to receive paid sick leave and Paid Family Medical Leave for certain COVID-19-related situations. The regulations, however, state that employees must use the leave between 04/01/2020 and 12/31/2020.

To allow Costpoint Shop Floor Time users comply to with the regulations, Costpoint MR 7.1.6 updates the way the Export Project Manufacturing Data (LDPEXPM) process handles the export of leave data. The application will now use the start and end dates on the Paid Family Leave subtask of the Manage Employee Leave (LDMELV) screen as the basis of the leave start and end dates exported to Shop Floor Time. This update will prevent employees from charging the COVID-19-related leave outside of the dates allowed by the government regulation.

Release Date

- 7.1.1 (on-premise): MR 7.1.6 (May 25, 2020)

COVID-2020 H.R. 6201: Families First Coronavirus Response Act - National Paid Sick Leave and FMLA Expansion

The U.S. government recently signed the H.R. 6201: Families First Coronavirus Response Act into law. Here is a summary of the new legislation:

- Emergency Paid Sick Leave: This legislation mandates covered employers to provide paid leave for employees affected by the coronavirus if those employees are unable to work or telework. An eligible employee is allowed two weeks (80 hours) of paid sick time at the employee's full regular rate of pay, subject to dollar caps; this is reduced to two-thirds pay if the leave is due to caring for others (for example, a sick or quarantined family member or a child whose school is closed or whose childcare provider is unavailable due to the coronavirus).

- Emergency Family and Medical Leave Expansion: An employee is eligible for ten additional weeks of FMLA leave, but only for those who must stay at home to care for a child whose school is closed. These 10 weeks will be paid at two-thirds the employee's regular rate of pay, subject to a $200 maximum payable amount per day and a $10,000 maximum total amount payable to an employee for public health emergency leave.

Emergency Paid Sick Leave and Emergency FMLA Expansion

Costpoint's existing Paid Family Leave functionality already supports the ability to accrue and track paid leave and adjust a salaried employee's timesheet so that the total labor cost for Paid Sick Leave is based on an average hourly compensation rate. However, the Families First Coronavirus Response Act imposes a daily dollar cap that will require Costpoint users to manually adjust the average hourly compensation rate if it would cause the daily labor cost for an employee's paid sick leave or paid FMLA to exceed the cap. The Average Hourly Compensation Rate field already exists in the Paid Family Leave subtask of the Manage Employee Leave screen, but it is not currently editable. An enhancement will enable the Average Hourly Compensation Rate field, allowing you to edit the rate, if necessary. To ensure compliance by April 2, 2020, all Deltek Costpoint, on-premise customers with fewer than 500 employees will need to apply the update to their environment with the following file requirements:

| Scenario | Action |

|---|---|

| Due to rules established in H.R. 6201 Families First Coronavirus Response Act, you have an employee that requires paid sick leave or paid FMLA and... | |

| You're a 7.1.1 client using System Jar 060 or older and you're not ready to put MR 7.1.4 into production. |

Download cp711_ldmelv_003.zip from the DSM 7.1.1 folder and then apply the file. The minimum file requirements for this enhancement are as follows:

Release Date 7.1.1 (on-premise) file cp711_ldmelv_003.zip: Deployed to DSM on 03/27/2020 |

| You're a 7.1.1 client using MR 7.1.2 or MR 7.1.3. | Upgrade to

7.1.4 or higher.

Release Date 7.1.1 (on-premise) MR 7.1.4:: Deployed to DSM on 03/31/2020 |

| You're a 7.1.1 client that's already applied MR 7.1.4 or a higher version. | No further action necessary. |

| You're a 7.0.1 client using System Jar 059 (or lower) and not ready to put System Jar 060 or a higher version into production. |

The minimum file requirements for this enhancement are as follows:

Release Date 7.0.1 cp701_patch5132_001.zip: Deployed to DSM 03/27/2020 |

| You're a 7.0.1 client that is ready to put 7.0.1 System Jar 060 or a higher version into production. | Implement the System Jar.

Release Date 7.0.1 System Jar 060: 05/06/2020 |

| You're a 7.0.1 client that's already applied System Jar 060 or a higher version. | No further action necessary. |

Additional Information

KB article 100864 (H.R. 6201 Families First Coronavirus Response Act-Data Setup and Processing Instructions for Paid Sick Leave and Paid Family and Medical Leave) has been created with instructions on the following:

- Pay type setup

- Leave type setup

- Leave code setup

- How to set up the employee Paid Family Leave information in relation to the Families First Coronavirus Response Act

- Examples of timesheet entry

- Instruction and examples of Paid Family Leave adjustment processing