Work-in-progress (WIP)

|

Why is it important? You need to monitor it to keep billing accurate and timely. |

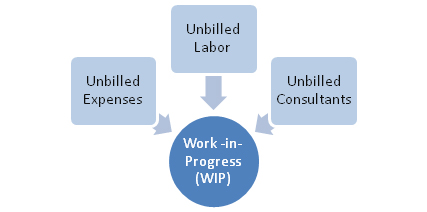

Work-in-progress (WIP) is billable time and expenses that have not yet been included on a final client invoice. Although the work was already completed or the expenses were already incurred, it is called work-in-progress because it is in progress of being billed.

As you work in Ajera, you create WIP when you enter:

- Timesheets

- Expense reports

- Vendor invoices

- In-house expenses

- Beginning balance unbilled work-in-progress

In addition, you make adjustments to WIP when you:

- Change time, expense reports, or vendor invoices

- Adjust, move, or split WIP in Manage > Client Invoices

- Change billing rates after WIP is created

For example, an employee entered time, and Ajera calculated WIP based on a billing rate table. You raise your rates and change the rate table. You want to bill the previously entered time at the new, higher rate. In Manage > Client Invoices, you right-click the WIP item, and select Recalculate Billing Rate.

WIP and the general ledger

With the accrual accounting basis, WIP affects the general ledger as follows.

These examples illustrate WIP that is labor, but the process is similar for consultants and expenses.

Invoicing as Time & Expense

In this example:

- You invoice the client as Time & Expense.

- A drafter at your firm performs one hour of work.

- The spent amount of that work is based on the billing rate table for that project. The billing rate table specifies a billing rate of $80 an hour for a drafter.

| Ajera makes entries to these accounts | When you do this | ||

|---|---|---|---|

| Enter time | Print a final invoice | (billed amount) | |

|

WIP |

$80 debit |

$80 credit |

|

|

Unbilled Revenue |

$80 credit |

$80 debit |

|

|

Accounts Receivable |

$80 debit |

||

|

Billed Revenue |

$80 credit |

||

Invoicing as a fee

In this example:

- You invoice the client as a fee.

- A drafter at your firm performs one hour of work.

- The spent amount of that work is based on the billing rate table for that project. The billing rate table specifies a billing rate of $80 an hour for a drafter.

- You invoice the client a fee of $100.

| Ajera makes entries to these accounts | When you do this | ||

|---|---|---|---|

| Enter time | Print a final invoice | (billed amount) | |

|

WIP |

$80 debit |

$80 credit |

|

|

Unbilled Revenue |

$80 credit |

$80 debit |

|

|

Accounts Receivable |

$100 debit |

||

|

Billed Revenue |

$100 credit |

||

Writing off WIP

In this example, you write off the WIP.

| Ajera makes entries to these accounts | When you write off WIP |

|---|---|

|

WIP |

$80 credit |

|

Write-off* |

$80 debit |

* Ajera uses the write-off account you specified in Company > Preferences> Income Statement Accounts tab.

WIP and the cash accounting basis

With the cash accounting basis, revenue is not reported until you receive payment from the client for the work performed. When you enter the cash receipt, entries are made to the Cash and Revenue accounts. No accounting entries are made to the WIP, Unbilled Revenue, or Accounts Receivable account.

WIP and financial reporting

In a standard setup in Ajera, WIP is recognized as an asset on the balance sheet.

The change to WIP in the period is shown as revenue (unbilled) on the profit and loss statement (also called the income statement), and, if applicable, write-offs.

There are options for alternative ways to recognize WIP on your accrual financial statements. Talk to your consultant or Support for more information.

WIP and managing projects

WIP provides an additional piece of information for evaluating the progress of projects. To effectively manage a project’s budget, project managers must know what was billed and what is available to bill (WIP). Project managers can utilize this information to proactively manage a project’s budget, help guide billing, and help identify any potential overruns.

Firms often review the aging of their WIP (the amount of time that it requires to bill the WIP) by using the Work-in-Progress Aging report. Projects with WIP that is 90 days or older can prompt the question of: Why has this WIP not been billed?

It is important to understand that the WIP amount may not coincide with the intended value of the next billing to be done on a fee-type job. For fee-type jobs, the best understanding of a project’s budget status will be in relating the cumulative spent value to the contract and billed values.

Next