Payroll variance

|

Why is it important? You need to manage it if you want accurate information about job costs. |

Payroll variance is important to understand and manage because it provides:

- Access to real-time, job-cost data

- Consistent and fair job costing

- Job costs that easily reconcile to general ledger direct costs

- Ability to assess the optimal utilization of salaried employees

- A fluctuating number of hours across pay periods without a lot of extra effort for firms using monthly or semimonthly payroll cycles

- Conformity to government contracting requirements

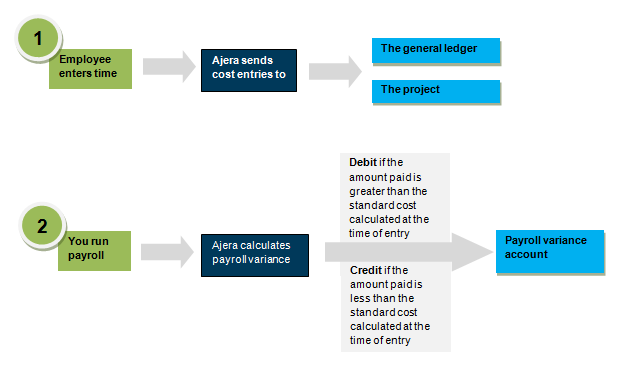

Payroll variance is calculated when the actual amount paid to a salaried employee is greater than or less than the standard cost calculated at the time of entry. Payroll variance allows you to report actual cost to your general ledger while using a standard cost rate for salaried employees on project reports.

Payroll variance affects salaried employees, as hourly employees are paid based on the hours that they work. Salaried employees receive their salary amount no matter how many hours they work. However, payroll variance can occur for hourly employees when there are rounding situations, such as in outsourced payroll. This type of variance is typically less than $1.00.

When Ajera calculates it

How Ajera calculates it

Ajera automatically calculates payroll variance for you using information from the following fields in Setup > Employees > Pay Information tab:

- The Pay Period field - The pay period (weekly, biweekly, semimonthly, or monthly) for the employee

- The Salary field - The salary amount for that pay period

Ajera calculates the standard cost of a salaried employee as follows:

Salary amount per pay period/Normal or standard number of hours in a pay period

Normal hours in the period are set up in Company > Preferences > Payroll tab.

For example, if an employee is paid $1,000.00 every 2 weeks (80 hours), the standard cost rate is calculated as $1,000.00/80= $12.50.

To calculate payroll variance, Ajera determines if the cost rate for the time entered is different from the standard cost rate.

Example

A salaried employee is paid $1,000.00 every two weeks (80 hours) with a standard rate of $12.50 per hour.

| When the employee works | Standard cost is | Actual cost is | Payroll variance is |

|---|---|---|---|

| 80 hours in the two-week period | $1,000.00 ($12.50 x 80 hours) | $1,000.00 (employee's salary) |

Zero ($1,000.00 - $1,000.00) No payroll variance is calculated. |

| 90 hours in the two-week period | $1,125.00 ($12.50 x 90 hours) | $1,000.00 (employee's salary) |

$125.00 ($1,125.00 - $1,000.00) It is a credit to the payroll variance account. |

| Only works 75 hours in the two-week period | $937.50 ($12.50 x 75 hours) | $1,000.00 (employee's salary) |

-$62.50 ($937.50 - $1,000.00) It is a debit to the payroll variance account. |

Next