Lesson 2: Accounting - Where and how it happens

|

Start here! |

|

What you do and what Ajera does

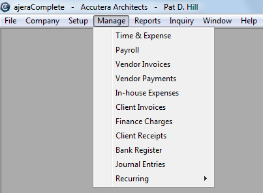

After you set up Ajera and go live, you perform much of your typical day-to-day work by opening options from theManage menu.

Here's a quick look at some of your main tasks:

|

Menu option |

What you do |

What Ajera does |

||

|---|---|---|---|---|

|

Time & Expense |

With time

With expenses

With tasks (unavailable in ajeraCore)

|

With timeAs you enter billable time and expense transactions for a project, Ajera automatically attaches them to the draft client invoice it creates when you set up the project. When the employee closes or saves the timesheet, Ajera saves the time entered and updates the client invoice and project information. Ajera automatically adjusts the general ledger. With expensesIf you are requiring approvals, after the supervisor/accounting manager approves the expense report, Ajera processes it as follows:

With tasks (unavailable in ajeraCore)Updates the project information. |

||

|

Payroll |

For in-house payroll, run payroll. For outsourced payroll, produce the payroll file to send to your payroll service. |

For in-house payroll, Ajera does the following:

For outsourced payroll, Ajera does the following:

|

||

|

Vendor Invoices |

Perform these Accounts Payable tasks:

|

Ajera does the following:

|

||

|

Vendor Payments |

Perform these Accounts Payable tasks:

|

After you pay vendor invoices, Ajera does the following:

|

||

|

In-house Expenses |

Enter and track in-house costs (such as copies and telephone calls) that you can include in the cost of a specific project and bill. |

Ajera does the following:

|

||

|

Client Invoices |

Perform these billing tasks: You change client invoices and prepare them for final billing.

|

After you set up and save a project, Ajera automatically creates a draft client invoice. It automatically adds transactions to the draft invoice when you:

When you print a final version of the invoice, Ajera automatically creates a new draft invoice for the project if the project is not yet complete. In this way, the billing process for the project continues without interruption. Ajera automatically adjusts the general ledger. Note that there are many general ledger transactions involved with the billing process in Ajera, including invoices, WIP adjustments, and write-offs. |

||

|

Client Receipts |

Perform these Accounts Receivable tasks:

|

After you print a client invoice as Final, Ajera makes it available to pay in Manage > Client Receipts. Ajera records client receipts to a pending deposits account. When you create a deposit, Ajera credits that account and records the deposit in the bank register. Ajera automatically adjusts the general ledger. |

||

|

Bank Register |

Perform these tasks:

|

After you pay client and vendor invoices, Ajera enters these payments and receipts in your bank register for you to verify and reconcile. After you run payroll for in-house payroll or produce the payroll file to send to a payroll service provider, Ajera updates the bank register. Ajera automatically adjusts the general ledger. |

||

|

Journal Entries |

Create entries that affect financial reporting for your firm but have no effect on project reporting.

|

Audit trail and error correction

Session journals are reports that show you entries created, changed, and deleted in a session. They also show a recap of the general ledger accounts affected by the entries. Click Reports > Session Journals.

Reconciliation

Developing precise procedures for reconciliation should be a top priority for every company. It is a guarantee that your reports are accurate and that your data is in balance.

As a best practice, Axium recommends that you reconcile monthly. You first determine if your Trial Balance report is in balance and then balance each of the control accounts to the Trial Balance report.

Through normal workflow, Ajera keeps the subsidiary ledgers and control accounts in balance. For example, when you print vendor checks, Ajera makes an entry to the Accounts Payable control account to reduce the balance by the total of the check.

However, if you entered the amount of the check as a debit to the Accounts Payable account in Manage > Journal Entries, then your Accounts Payable subsidiary ledger (Vendor Invoice Aging report) would no longer be in balance with your Accounts Payable account on your Trial Balance report.

For step-by-step instructions on how to perform reconciliation, see Reconciliation in help .

Next