Set Up the Colorado FAMLI on the Manage Local Taxes Screen in 2023

Configure the Colorado Paid Family and Medical Leave Insurance (FAMLI) on the Manage Local Taxes screen.

To set up the Colorado FAMLI deduction, you will need to configure the employee-paid and employer-paid local tax on the Manage Local Taxes screen

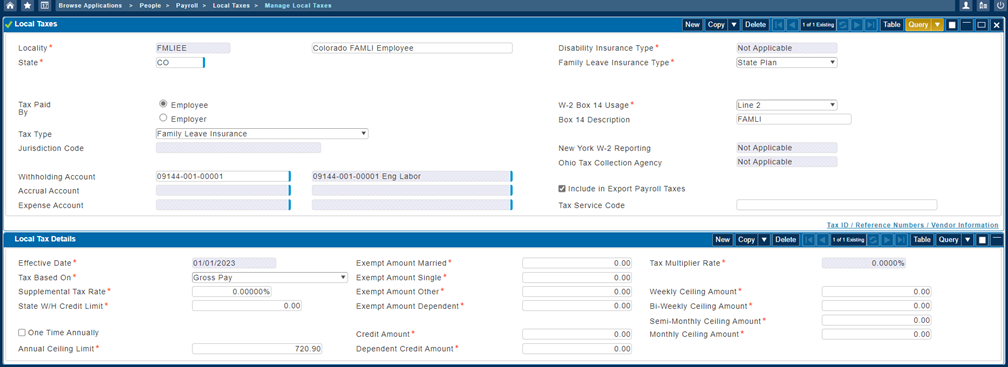

Employee-Paid Local Tax

To setup the employee-paid local tax:

-

On the

Manage Local Taxes screen, add a

Local Tax code to represent the employee-paid Colorado FAMLI tax and enter the following, and then set other local values as needed:

- State: CO

- Tax Paid By: Employee

- Tax Type: Family Leave Insurance

- Family Leave Insurance Type State Plan

-

W-2 Box 14 Usage: Selected which line number to print FAMLI premiums

This should be the same line number as the employee-paid Colorado FAMLI local tax.

- Box 14 Description: FAMLI

- In the Local Tax Details, set the following:

- Effective Date: 01/01/2023

-

Tax Based On: Gross Pay

Since the wages subject to Paid Family Leave premiums will be the same wages subject to Unemployment Insurance (UI), you may also opt to use the newly added method of "SUTA Subject Wages".

-

Annual Ceiling Limit: 720.90

Colorado regulations state the amount of wages subject to a premium assessment is capped at the maximum wages subject to social security tax. In 2023, the social security wage limit is 160,200.00. The Annual Ceiling Amount must be manually calculated and entered each year, based on the following formula: SS Wage Limit x Employee Premium Rate %. In 2023, this is 160,200.00 x 0.45%, which results in an Annual Ceiling Amount of 720.90.

-

In Manage Local Tax Tables screen, add a record for the employee-paid FAMLI local tax code and enter the following for each filing status:

- Effective Date: 01/01/2023

- For Taxable Income Over: 0.00

- Base Tax Plus: 0.00

-

Percent of Excess: 0.45%

You may choose to cover any amount of the employee's portion of the premium. The most an employer can deduct from an employee is 0.45% of their wages, but the employer can choose to only deduct 0.1% or 0.2% or deduct nothing at all.

- On the Manage Local Standard Deductions screen, add a record for the employee-paid FAMLI local tax code for 01/01/2023 and set all values to 0.00.

-

Assign the employee-paid local tax code to employees on the Manage Employee Taxes screen.

Here is an example of the employee-paid local tax setup on the Manage Local Taxes screen:

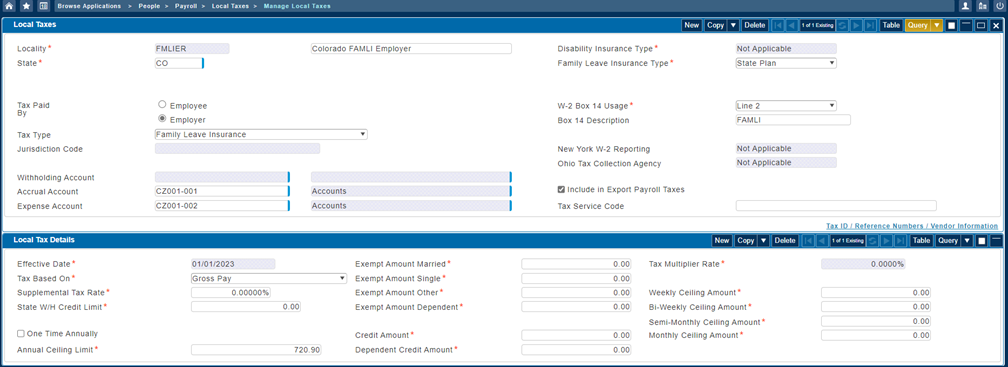

Employer-Paid Local Tax

To set up the employer-paid local tax:

-

In Manage Local Taxes screen, add a

Local Tax code to represent the employer-paid Colorado FAMLI tax and enter the following, and then set other local values as needed:

- State: CO

- Tax Paid By: Employer

- Tax Type: Family Leave Insurance

- Family Leave Insurance Type: State Plan

-

W-2 Box 14 Usage

: <selected which line number to print FAMLI premiums>

This should be the same line number as the employee-paid Colorado FAMLI local tax.

- Box 14 Description: FAMLI

- In the Local Tax Details, set the following:

- Effective Date: 01/01/2023

-

Tax Based On: Gross Pay

Since the wages subject to Paid Family Leave premiums will be the same wages subject to Unemployment Insurance (UI), you may also opt to use the newly added method of "SUTA Subject Wages"

-

Annual Ceiling Limit: 720.90

Colorado regulations state the amount of wages subject to a premium assessment is capped at the maximum wages subject to social security tax. In 2023, the social security wage limit is 160,200.00. The Annual Ceiling Amount must be manually calculated and entered each year, based on the following formula: SS Wage Limit x Employee Premium Rate %. In 2023, this is 160,200.00 x 0.45%, which results in an Annual Ceiling Amount of 720.90.

-

On the Manage Local Tax Tables screen, add a record for the employer-paid FAMLI local tax code and enter the following for each filing status:

- Effective Date: 01/01/2023

- For Taxable Income Over: 0.00

- Base Tax Plus: 0.00

-

Percent of Excess: 0.45%

You may choose to cover any amount of the employee's portion of the premium. The most an employer can deduct from an employee is 0.45% of their wages, but the employer can choose to only deduct 0.1% or 0.2% or deduct nothing at all.

- On the Manage Local Standard Deductions screen, add a record for the employer-paid FAMLI local tax code for 01/01/2023 and set all values to 0.00.

-

Assign the employer-paid

Local Tax code to employees on the Manage Employee Taxes screen.

Here is an example of the employer-paid local tax setup on the Manage Local Taxes screen:

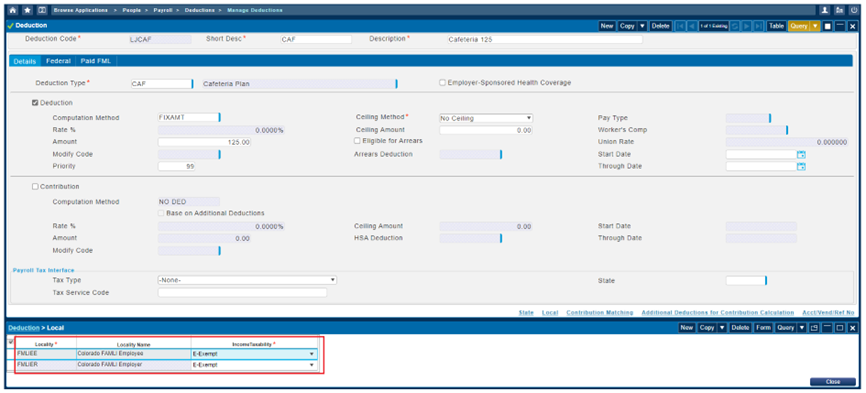

-

If there are deductions that need to be excluded from FAMLI wages, then you must add the

Local Tax codes representing the employee and employer-paid Colorado FAMLI tax in the Local subtask of the Manage Deductions screen and the

Income Taxability must be set to

E-Exempt.

For example, if deduction code LJCAF is exempt from FAMLI premiums, then the following is an example of the setup on the Manage Deductions screen.