About Revenue Recognition

Ajera's revenue recognition functionality enables you to calculate and commit current project revenue, based on the revenue methods your company uses for labor, expenses, and consulting. Ajera gives you complete flexibility and control to determine how to calculate your revenue, using the following revenue methods:

- Billed: Ajera creates revenue entries when you print final invoices. Use this method if you bill work during the same accounting period in which the work is performed.

- Billed + WIP (default): In addition to the entries made by the Billed calculation method, Ajera creates revenue entries for the billable amount of WIP entries. Use this method if you bill for time and material.

- Formula: Ajera creates revenue entries when you print final invoices and then adjusts the entries with your formula's calculation. Use this method if your firm wants to specify a unique way to calculate revenue. For example, when you bill in advance or after incurring costs. Go to step 2 to select a specific formula.

- Formula + WIP: Ajera creates revenue entries and any billable WIP entries when you print final invoices and then adjusts the entries with your formula's calculation. Use this method if your firm wants to specify a unique way to calculate revenue and include work-in-progress (WIP). Go to step 2 to select a specific formula.

- None: Use this method for those nonbillable project phases on which you do not intend to recognize revenue, such as business development or administrative efforts.

- Percent of contract: Ajera creates revenue entries when you print final invoices and then adjusts the entries by multiplying your revenue percent completed with the contract amount. Use this method if you use progress type billing, where the amount that you bill may not correspond with the actual percent of work completed.

You determine the most appropriate time to calculate revenue entries. Ajera calculates estimated revenue based on the revenue methods you assign to a project, phase, or activity on the Project Command Center > Revenue tab. Employees who are authorized to recognize revenue for your company use revenue sessions on the Revenue Recognition tabs to review, edit, and commit estimated revenue.

Once you commit revenue, Ajera creates corresponding over- and under-billed entries to the General Ledger and creates billed entries when you post to Accounts Receivable accounts. These entries enable you to recognize revenue in the form of unbilled work-in-progress (WIP) and unbilled revenue.

Note: Use revenue recognition if your company uses the accrual accounting method. Revenue recognition cannot be used with the cash accounting method.

Ajera uses the browser spell check so you can verify the spelling while recognizing revenue.

Video: Take a tour of Revenue Recognition(8:07 min)

Capping WIP at contract amount

You can also assign the following Cap WIP at contract methods on the ![]() > Manage > Project Command Center > Revenue tab:

> Manage > Project Command Center > Revenue tab:

- None: If you use this method, Ajera does not cap WIP at the contract amount on the General Ledger or the transaction.

- Adjustment: If your revenue method writes WIP General Ledger entries, Ajera writes WIP transactions and entries to the General Ledger whenever employees enter time and expenses. Then, during billing, Ajera automatically creates a lump sum negative adjustment for any amount over the contract.

For example if you have a labor contract of $10,000 and $13,000 in WIP, Ajera creates a negative $3,000 adjustment to make the invoice amount $10,000. Ajera then self-calculates an adjustment amount as entries are created beyond the contract amount. During billing, Ajera creates a lump sum negative adjustment for any amount over the contract.

- Write-Off: If your revenue method writes WIP General Ledger entries, Ajera writes WIP transactions and entries to the General Ledger whenever employees enter.time and expenses. Then, Ajera automatically writes off all entries above the contract cap.

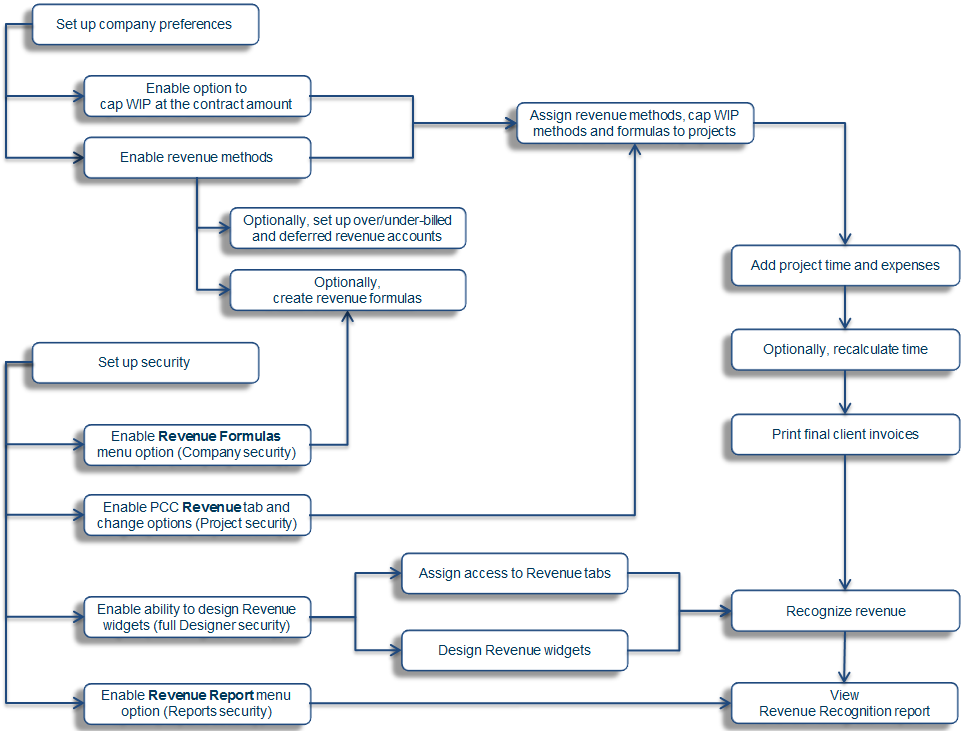

How it works in Ajera

Learn more about each step in the revenue workflow, illustrated below. Click on each task for step-by-step instructions.