Lesson 5: Audit reporting

An important part of financial software is auditing and financial reconciliation. With Ajera, you can use the following to accomplish those tasks:

- Session journal reports

- Session inquiries

- Other inquires

- Reconciliation reports

Session journal reports

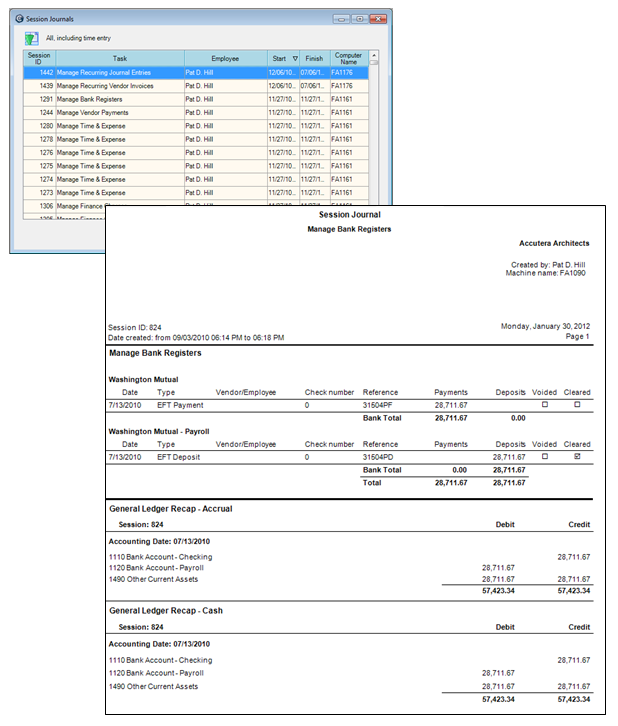

Session journal reports show entries created, changed, and deleted in a session. They also show a recap of accounts affected by the entries.

You begin by viewing a list of session journals. You can select to see only sessions for a specific time frame if the list is too long. Next, you select the session journal you want to view.

To view session journal reports, from the Reports menu, click Session Journals.

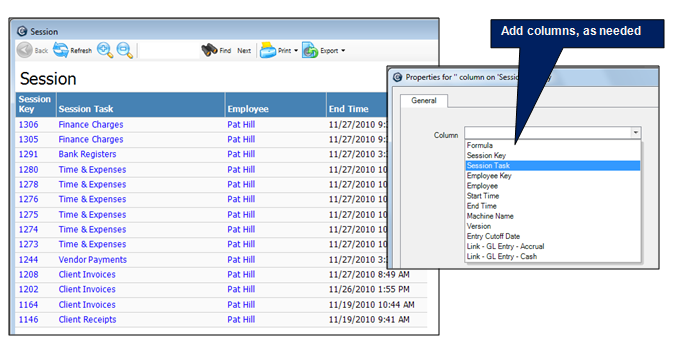

Session inquiries

A session inquiry differs from a report in that you can more easily focus on the information you want. If you don't readily see what you need in the report, the inquiry provides a good way for you to research and investigate specific issues. For example, you can add columns for information you need to review.

To view session inquiries, from

Other inquiries

In addition to session inquires, other types of inquires are also available to help you monitor your accounts and transactions, and to research a specific issue in detail. For example, when viewing the Timesheet inquiry, you can click a link to view the Transaction Labor inquiry, or when viewing the GL Account inquiry, you can click a link to view the GL Entry Accrual inquiry.

Be sure to review the inquires that are available to you. From the main menu,

Financial reconciliation

Developing precise procedures for reconciliation should be a top priority for every company. It is a guarantee your reports are accurate and your data is in balance.

As a best practice, we recommend that you reconcile monthly. You first determine if your Trial Balance report is in balance and then balance each of the control accounts to your Trial Balance report.

Through normal workflow, Ajera keeps the subsidiary ledgers and control accounts in balance. For example, when you print vendor checks, an entry is made to the Accounts Payable control account to reduce the balance by the total of the check. However, if you entered the amount of the check as a debit to the Accounts Payable account in Manage Journal Entries, then your Accounts Payable subsidiary ledger (Vendor Invoice Aging) would no longer be in balance with your Accounts Payable account on your Trial Balance report.

Learn the details

This link goes to help. To return to this course, click the Back button.

Test your knowledge

Next