Client Invoice window

Percent of Construction Cost tab

Main window

|

Button |

Description |

||

|---|---|---|---|

|

Entries |

This button opens different windows depending on the billing type of the phase. For fee-based

For time and expense phases, this button opens the Noninvoiced Time and Expense Entries window, which by default displays held and deferred entries. You can view nonbillable and written-off entries by clicking the Change View button. |

|

Field |

Description |

|---|---|

|

Status |

The current

status of the invoice status of the invoice

|

|

Cutoff date |

All transactions later than the cutoff date are given a status of Defer and automatically included on the next invoice if within the new cutoff date. Any Defer transactions earlier than the new cutoff date are changed to billable and attached to the invoice. |

|

Invoice date |

The date of the invoice. You cannot change it if the status is Final or Write-off. |

|

Invoice number |

The invoice number. You cannot change it if the status is Final or Write-off. |

|

View only - The prepayments available for the invoice group |

|

|

Invoice amount |

The total amount of the invoice |

Labor tab

|

Field |

Description |

|---|---|

|

Status |

The

status of the transaction status of the transaction |

|

Date |

Transaction date. If you change it to be later than the invoice cutoff date, Ajera removes the transaction from the invoice and assigns it a status of Defer. |

|

Phase |

The phase of the project associated with the transaction |

|

Activity |

The activity of the transaction |

|

Employee |

View only - Employee who worked the time entered |

|

Hours |

The hours for the transaction that are billed. If you change it, the change does not affect the hours worked. |

|

Billing rate |

The rate at which hours are billed. If you change a rate based on markups, it becomes a flat rate. |

|

Billing amount |

The amount billed on the invoice for the transaction. If you change an amount based on markups, it becomes a flat rate. See Changing the billed amount when printing markups as part of totals. |

|

Optional columns: |

|

|

Project |

The project associated with the invoice |

| Can bill |

View only - If a check mark appears in this column, you can print this client invoice as Final and bill the client. If this column is not visible, click If your billing rate tables are based on effective cost, you can invoice salaried time only after running payroll because this is when Ajera calculates the effective cost rates. |

|

Employee type |

The employee type used for billing |

|

Hours worked |

The hours for the transaction that were worked |

|

Hours type |

View only - Indicates if hours worked were regular or premium time, such as overtime |

|

Cost rate |

View only - The cost rate |

|

Cost amount |

View only - The cost amount |

|

Markup rate 1,2,3,4,5 |

View only - The markup |

|

Write-off date |

The date a transaction is written off |

|

Sale tax amount |

The amount of sales tax |

|

Notes |

Any notes for the transaction |

Expense & Consultant tab

|

Field |

Description |

|---|---|

|

Status |

The

status of the transaction status of the transaction |

|

Date |

View only - The transaction date |

|

Phase |

The phase of the project associated with the transaction |

|

Activity |

The activity for the transaction |

|

Vendor |

View only - The vendor associated with the transaction |

|

Units |

The units billed on the invoice |

|

Billing rate |

The rate at which unit are billed. If you change a rate based on markups, it becomes a flat rate. |

|

Billing amount |

The amount billed on this invoice for this transaction. If you change an amount based on markups, it becomes a flat rate. See Changing the billed amount when printing markups as part of totals. |

|

Optional columns: |

|

|

Activity type |

View only - The activity of the transaction |

|

Project |

The project of the transaction |

|

Cost units |

The cost of the units. If you change the cost units, Ajera updates the billed units. |

|

Unit description |

View only - A description of the units |

|

Cost rate |

View only - The cost rate |

|

Cost amount |

View only - The cost amount |

|

Markup rate 1,2,3 |

View only - The markup |

|

Write-off date |

View only - The date a transaction was written off |

|

Sales tax amount |

The amount of sales tax on the transaction |

|

Notes |

Any notes for the transaction |

Fixed Fee tab

|

Column |

Description |

|---|---|

|

Phase |

View only - The phase of the project associated with the transaction |

|

Contract amount |

View only - The contract amount for the transaction |

|

Billing amount |

The amount billed on the invoice for the transaction |

|

Optional columns: |

|

|

Activity type |

View only - The activity of the transaction |

|

Prior billed amount |

View only - The previously billed total for the phase and activity |

|

Total billed amount |

The billing amount plus the prior billed amount |

|

Sales tax amount |

The amount of sales tax on the transaction |

|

Contract remaining amount |

The amount of the contract available to bill |

|

Billable WIP |

The amount of billable work-in-progress associated with the invoice. Any WIP with a status of Hold or Defer is not included. |

|

Notes |

Any notes for the transaction |

Percent Complete tab

|

Column |

Description |

|---|---|

|

Phase |

View only - The phase of the project associated with the transaction |

|

Contract amount |

View only - The contract amount for this transaction |

|

Percent to bill |

The percent of the contract amount billed on this invoice for the transaction |

|

Billing amount |

The amount billed on the invoice for the transaction |

|

Optional columns: |

|

|

Activity type |

View only - The activity of the transaction |

|

Prior percent billed |

View only - The percent of the contract amount that has already been billed |

|

Prior billed amount |

View only - The previously billed total for the phase and activity |

|

Total percent billed |

The percent of the contract amount that has been billed for this phase and activity |

|

Total billed amount |

The billing amount plus the prior billed amount |

|

Sales tax amount |

The amount of sales tax on the transaction |

|

Contract remaining amount |

The amount of the contract available to bill |

|

Billable WIP |

The amount of billable work-in-progress associated with the invoice. Any WIP with a status of Hold or Defer is not included. |

|

Notes |

Any notes for the transaction |

Unit Price tab

|

Column |

Description |

|---|---|

|

Phase |

View only - The phase of the project |

|

Contract units |

View only - The number of units for the transaction |

|

Unit rate |

View only - The rate at which units are billed |

|

Contract amount |

View only - The contract amount for the transaction |

|

Billing units |

The number of units billed on the invoice for the transaction |

|

Billing amount |

The amount billed on the invoice for the transaction |

|

Optional columns: |

|

|

Activity type |

View only - The activity for the transaction |

|

Unit description |

View only - A description of the units |

|

Prior billed units |

View only - The number of units already billed for the phase and activity |

|

Prior billed amount |

View only - The previously billed total for the phase and activity |

|

Total billed units |

The billing units plus the prior billed units |

|

Total billed amount |

The billing amount plus the prior billed amount |

|

Sales tax amount |

The sales tax on the transaction |

|

Units remaining |

The number of units available to bill |

|

Contract remaining amount |

The amount of the contract available to bill |

|

Billable WIP |

The amount of billable work-in-progress associated with the invoice. Any WIP with a status of Hold or Defer is not included. |

|

Notes |

Any notes for the transaction |

Percent of Construction Cost tab

|

Column |

Description |

|---|---|

|

Phase |

View only - The phase of the project |

|

Contract amount |

Viewonly - The contract amount for the transaction |

|

Percent to bill |

The percent of the contract amount billed for the transaction |

|

Billing amount |

The amount billed on the invoice for the transaction |

|

Optional columns: |

|

|

Activity type |

View only - The activity type for the transaction |

|

Prior percent billed |

View only - The percent of the contract amount that has already been billed |

|

Prior billed amount |

View only - The previously billed total for the phase and activity |

|

Total percent billed |

The percent of the contract amount for this phase and activity that has already been billed |

|

Total billed amount |

The billing amount plus the prior billed amount |

|

Sales tax amount |

The sales tax on the transaction |

|

Contract remaining amount |

The amount of the contract available to bill |

|

Billable WIP |

The amount of billable work-in-progress associated with the invoice. Any WIP with a status of Hold or Defer is not included. |

|

Notes |

Any notes for the transaction |

Invoice Adjustments tab

|

Column |

Description |

|---|---|

|

Adjustment |

The name of the adjustment. It cannot be changed. |

|

Activity type |

The activity type of the adjustment. It cannot be changed. |

|

Adjustment amount |

If you entered an amount, the field contains the amount of the adjustment you entered. If you entered a percent, Ajera calculates it and enters the amount for you. If you then change the amount, Ajera displays a message to let you know that it can no longer automatically calculate the amount as the billed amount changes for the project. Ajera displays (m) in the heading of the Adjustment Amount column to indicate that you must now manually change the amounts for all percent-based adjustments listed on this tab. |

|

Optional columns: |

|

|

Adjustment type |

View only - Indicates if the adjustment is a flat amount or based on a percent |

|

Contract amount |

View only - The contract amount of the adjustment |

|

Prior billed amount

|

View only - The previously billed total for the phase and activity |

|

Total billed amount

|

The billing amount plus the prior billed amount |

|

Sales tax amount |

The sales tax on the adjustment |

|

Contract remaining amount

|

View only - The amount of the contract available to bill |

|

Notes

|

The text in this field prints on the invoice as a description for adjustments. If this field is empty for all the adjustments, Ajera prints Invoice adjustment on the invoice. Otherwise, it prints the text you enter in this field for each adjustment. |

Text & Amounts tab

|

Column |

Description |

||

|---|---|---|---|

|

Invoice text: |

|||

|

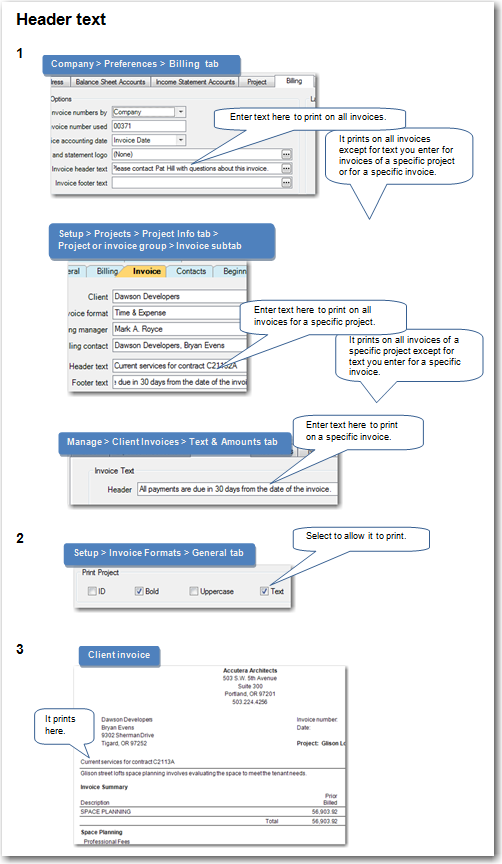

Header |

Enter text that you want to print on the invoice below the client mailing address. If you entered header text in the Company > Preferences > Billing tab > Invoice Header Text field, that text appears in this field and prints on client invoices for all projects, unless you change it here for this invoice. (If you use multi-company, the header text is on the Billing/Payroll tab of the Company > Companies window.) If you entered header text in the You can reenter header text from the Project window by right-clicking and selecting Refresh header text. Either type the text or click

|

||

|

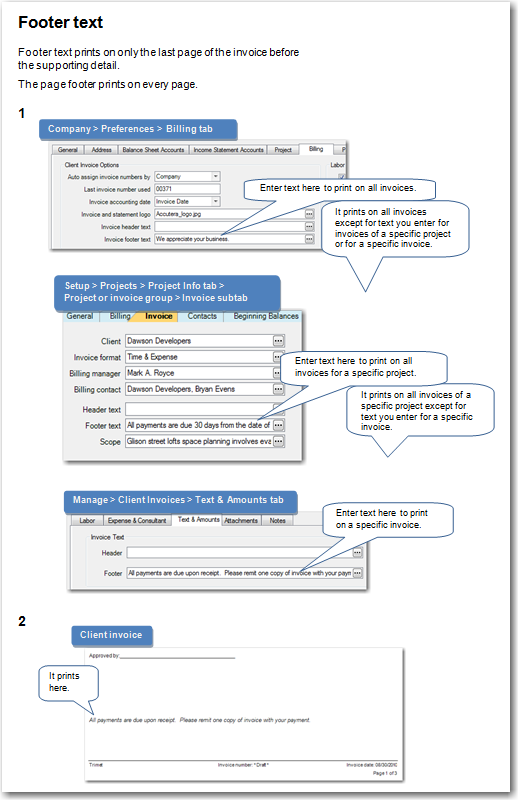

Footer |

Enter text that prints on only the last page of the invoice. You may choose to use it to print a holiday greeting or contract information. There is no length limit. If you entered footer text in the Company > Preferences > Billing tab > Invoice Footer Text field, that text appears in this field and prints on client invoices for all projects, unless you change it here for this invoice. (If you use multi-company, the footer text is on the Billing/Payroll tab of the Company > Companies window.) If you entered footer text in the You can reenter footer text from the Project window by right-clicking and selecting Refresh footer text.

|

||

|

Invoice amounts: |

|||

|

Prepayment |

Enter the prepayment amount you want to apply to the invoice. The prepayment amount available appears in the Prepayments Available field in the main window of the client invoice. You cannot apply more than the available amount.

|

||

|

Adjustment amount |

Any change you want to make to the final amount on the invoice, such as a discount. Type a minus sign (-) to indicate a negative adjustment. |

||

|

Adjustment description |

A description for the adjustment |

||

|

Sales tax |

The amount of sales tax on the invoice |

||

Attachments tab

|

Field |

Description |

|---|---|

|

The category of the attachment An attachment category is a group of files with similar characteristics (for example, RFPs). You can set up categories if your security settings give you access to them. |

|

|

Description |

The name of the attachment |

|

Added |

The date and time when the attachment was made |

Notes tab

This tab contains any notes about the client invoice.

(Change View).

(Change View). (Customize) and select the Can final bill check box.

(Customize) and select the Can final bill check box.  . If you do not want the text to wrap to the second

line on the invoice, press the Enter

key where you want the first line to end.

. If you do not want the text to wrap to the second

line on the invoice, press the Enter

key where you want the first line to end.