Deltek Time & Expense with ESS supports per diems for lodging and for meals and incidental expenses (M&IE). Per diems are policy guidelines for reimbursing these types of travel expenses. These guidelines typically vary by location and time of the year. Per diem guidelines break down these expenses into the following components:

Lodging - Includes expenses for overnight sleeping facilities, baths, personal use of the room during daytime, telephone access fee, and service charges for fans, air conditioners, heaters, and fires furnished in the room when such charges are not included in the room rate. (For CONUS, lodging taxes are excluded.)

Meals - Expenses for breakfast, lunch, dinner and related tips and taxes. (Specifically excluded are alcoholic beverage and entertainment expenses, and any expenses incurred for other persons).

Incidental - Miscellaneous fees such as the following:

Fees and tips given to porters, baggage carriers, bellhops, hotel maids, stewards, stewardesses, and so on

Transportation fees between lodging, places where meals are taken, and place of business

Mailing costs associated with filing expense reports and mailing payments to personal credit cards

Time & Expense with ESS supports two types of per diem methods: per diem as a ceiling and per diem as an allowance. When per diem amounts function as ceilings, the system compares actual incurred amounts to the per diem rates listed in a schedule to determine if they exceed the ceiling, but reimbursement is for the incurred amounts. When per diem amounts function as allowances, the system reimburses the traveller for the per diem amounts regardless of the actual incurred amounts.

Per diem schedules provide meal and lodging ceilings or allowances that are location driven. The system supports multiple per diem schedules, with each schedule handling multiple locations. Typically, per diem schedules use the US government schedules. These per diem schedules are the shared responsibility of the Department of State (DOS), the General Services Administration (GSA), and the DOD Per Diem, Travel and Transportation Allowance Committee (Per Diem Committee).

General Services Administration (GSA) — Provides rates for the continental US locations (CONUS). GSA updates the schedule once a year, usually in October, or as necessary.

Department of State (DOS) — Provides rates for non-US overseas locations. DOS updates these rates monthly.

Per Diem Committee — Provides rates for non-continental US and overseas non-foreign areas. This includes Alaska, Hawaii, Guam, and so on. The Per Diem Committee updates these rates monthly.

The Per Diem Committee simplifies the process by adding DOD military installations to the rate information from DOS and GSA. At the end of the month, the Per Diem Committee provides a new Outside Continental US (OCONUS) per diem schedule, which consists of DOS (non-U.S. overseas) and the Per Diem Committee (overseas US areas) per diem rates. Once a year or as necessary, the Per Diem Committee posts the Continental US (CONUS) per diem schedule, which includes the GSA per diem rates plus rates for military installations. They publish .pdf, text, and ASCII versions of these schedules on their Web site, http://www.defensetravel.dod.mil/perdiem/perdiemrates.html. Deltek Time & Expense with ESS accepts these files for import into per diem schedules.

Effective October 2009, the U.S. Government changed the names of locations contained in the Per Diem files, which Deltek Expense uses to determine meal and lodging rates by location.

To continue using these files, you should do the following:

Download the updated files (CONUS or OCONUS) from the DOD Web site, available from http://www.defensetravel.dod.mil/perdiem/perdiemrates.html.

In Time & Expense with ESS, open the Per Diem Preprocessor (Utilities » Per Diem Preprocessor) and import the new files.

Terminate the old locations that no longer match the new locations. To do this en mass, select the check box in the top-left corner of the results screen and then click Terminate Location.

For further information on importing per diem schedule information, see Per Diem Preprocessor and the Deltek Time & Expense with ESS Technical Guide.

Time & Expense with ESS supports multiple per diem schedules. You can define an expense report type as per diem or not. If you define an expense report type as per diem, you also specify which per diem schedule applies to the expense report type. (See Expense Report Types for further information.) Also, if you create an expense type for lodging or meals, you can indicate whether the expense type is per diem or not and, if so, whether it functions as an allowance or as a ceiling. (See Expense Types for further information.)

When creating a schedule, you have the following options:

Source — The source of the information in the per diem schedule. The valid options are as follows:

USER — The schedule is based on user-provided per diem information.

CONUS — The schedule contains per diem information for continental US locations. (Imported information will include Hawaii, Alaska, and U.S. territories.)

OCONUS — The schedule contains per diem information for locations outside of the continental US (OCONUS) plus the overseas non-foreign locations.

CONUS/OCONUS — The schedule includes both the CONUS and OCONUS locations.

Contents — The type of locations you want in the schedule. The valid options are as follows:

Civilian — Civilian locations only

Military — Military locations only

Both — Both civilian and military locations

CONNOW-0X.TXT — CONUS (Civilian & Military)

CONUSNM-0X.TXT — CONUS (Civilian)

CONUSMIL-0X.TXT — CONUS (Military)

OCONUS.TXT — OCONUS (Civilian & Military)

OCONUSNM.TXT — OCONUS (Civilian)

Input Options — The location fields the user can provide. The four location fields are as follows:

Country

State/Province

City

County

Each schedule record is location, date, and season sensitive. The attributes of these detail records are as follows:

Source — Where the schedule record came from. The valid values are CONUS, OCONUS, and User.

Location Type — The type of location the record represents. The valid values are Civilian, Military, Both, and User.

Country — The location's country. For CONUS records, this is UNITED STATES.

State — The location's state. For OCONUS records, this is N/A.

City — The location's city.

County — The location's county. Mainly used for CONUS records; for OCONUS records, this is N/A.

Effective Date — The effective date for the record. The system uses this date to determine which rate is in effect for a certain date.

Season Start — The beginning date of the season to which the per diem applies. Some locations have seasonal rates. For example, rates may be higher during the summer months for some locations while at other times of the year, lower rates are applicable.

Season End — The end date for a season.

Termination Date – The date after which the per diem location will no longer be valid. After the termination date, employees filling out expense reports or expense authorizations can no longer select the location when entering per diem information.

Lodging Amount — The amount for lodging, without taxes.

Meals and Incidental Amounts — The amount for meals and incidental expenses. The amount is further classified as CONUS and OCONUS, and broken down into amounts for breakfast, lunch, dinner, and incidentals. If you need an additional amount or an amount where the breakfast, lunch, dinner, and incidental amounts are different, you can add a record to this table.

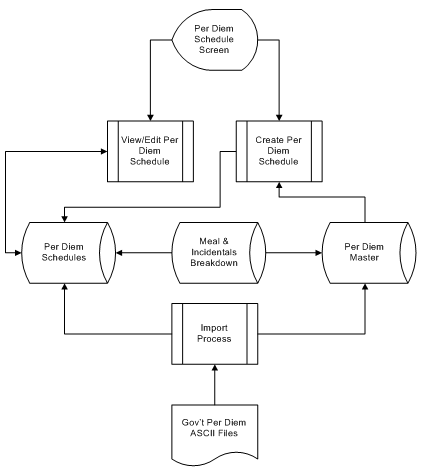

The following diagram illustrates how per diem schedules are maintained.

Government-provided per diem files can change monthly. These files can contain a few thousand locations. Thus, it is important to update your schedules regularly.

The major steps are the following:

Create Per Diem Schedule — In the Per Diem Schedules screen, create the schedule and set its options. When you finish, the system searches the Per Diem Master table for records that meet the source and contents criteria. If it finds any records, it copies them into the newly created per diem schedule. If it finds no records, as would be the case when you are setting up a new system, it creates the per diem schedule without records. In that case, you populate the schedule by downloading the government per diem files and either posting them to the schedule using the Per Diem Preprocessor utility or importing them using the Import Console.

Post Per Diem Information from Per Diem Preprocessor or Import Directly from Import Files — Once you have used the Per Diem Schedules screen to create a per diem schedule that uses government per diem amounts, it is recommended that you use the Per Diem Preprocessor utility to import, review, and post the per diem amounts to the per diem schedule. Using the utility has several advantages over importing data directly into your schedules. For more, see Per Diem Preprocessor.

If you instead decide to import information directly from import files into your per diem schedules, first make sure the files you downloaded from the government Web site are named correctly and located in the correct import folder. When you run the import process using the Import Console, the system reads those files and updates the Per Diem Master and any per diem schedules that, based on the import file name, have the correct source and location type.

Edit Per Diem Schedule — At any point, you can enter manual records into any per diem schedule. Manual entries take precedence over any imported record.

As the schedule maintenance diagram illustrates, the system has three sets of per diem data:

Per Diem Master — This data represents the master list of all per diem locations for each source and location type. When Time & Expense with ESS ships, the Per Diem Master is empty. When you post from the Per Diem Preprocessor utility or import directly from the government files, the records are kept in this master table. Later postings or imports append new records. When you create a new per diem schedule, the system populates the schedule using the records it finds in the master that have the appropriate source and location type.

Per Diem Schedule — The per diem schedules you create are stored here. New schedules are populated from the Per Diem Master and, once a schedule is populated, you can make override entries to the schedule. When you later post or import updated government per diem information, both the Per Diem Master and the appropriate per diem schedules are updated with the new information.

Meals & Incidentals Breakdown — This table contains the breakdown of meals and incidental expenses by source, total amount, breakfast, lunch, and dinner. This table is pre-populated with all CONUS and OCONUS meal amounts. To maintain this table, click Expense Setup » M&IE Breakdown on the main menu to open the M&IE Breakdown screen.

You can use combined per diem when setting up expense types if you reimburse both lodging and meals using per diem rates and you want the employee to enter one expense for both instead of a separate expense for each. This simplifies the entry of the expense for the employee. The per diem method must be "Allowance." It cannot be "Ceiling."

Once you have used the Per Diem Schedules screen to create a per diem schedule that uses government per diem amounts, use the Per Diem Preprocessor utility to import government per diem information into temporary tables, review and edit that information, and then post it to your actual per diem schedules. And when the government publishes new per diem information, use the utility to post the updated information to your existing schedules.

While you can use Time & Expense with ESS import processing to import per diem information directly into your schedule, it is recommended that you instead use the Per Diem Preprocessor utility. Using the utility has several advantages over importing data directly into your schedules:

You are not required to locate the import files in a particular system location. You can import them from any location accessible to the computer on which you are running the utility.

The utility checks for error conditions (missing M&IE information, for example) and highlights the affected location lines so you can identify and correct the problem.

The utility checks for locations in the actual per diem schedule that do not exist in the government file being imported and highlights those locations. You can then decide if you want them to remain active or, if they are no longer valid, to be marked as terminated and removed from the lookup lists of valid per diem locations.

You can delete location lines imported from the government files that you do not want in your per diem schedule.

To open the Per Diem Preprocessor screen, click Utilities » Per Diem Preprocessor on the Time & Expense with ESS main menu.

For details on how to use the utility, refer to Per Diem Preprocessor.

This is the general process for implementing per diems:

Download the appropriate government per diem files.

Visit the Per Diem Committee Web site, https://secureapp2.hqda.pentagon.mil/ perdiem, and download the appropriate files.

Set up your per diem schedules (Expense Setup » Per Diem Schedules).

Set up the schedules by defining the source, contents, and input options.

Use the Per Diem Preprocessor utility (Utilities » Per Diem Preprocessor) to import, review (and edit, if necessary), and post the location per diem information to your per diem schedules.

Create per diem lodging and meal expense types (Expense Setup » Expense Types).

Check Per Diem and select either Reimbursement or Ceiling.

Create per diem expense report types (Expense Setup » Expense Report Types).

Check Per Diem and associate the appropriate expense types with the expense report type. Also set the first and last day meal percentage, along with any adjustment percentage.