| Select one of four values, “Average,” “Last,” “Standard,” and “FIFO,” to be used for determining the inventory value of items in the group. This selection is also used in the calculation of sales prices on order lines if the item is not priced in a price list and if costs are not calculated from sales prices.

You can change the costing method for an existing item group, but it will not affect items already assigned to the group.

Changes will only affect new items assigned to the group after the change. You cannot change costing method for an existing item.

Use the “Standard” costing method if you leave the “Inventory Control” field unmarked. Since Maconomy does not keep track of item batches for items without inventory control, the average cost always corresponds to the cost of the last item purchase. This makes the Average and Last costing methods irrelevant for an item without inventory control. If an item is under inventory control, both the average and last costs will be updated when there are inventory changes, regardless of the costing method you have applied.

Only if the field “Inventory Control” has been marked are you allowed to create an item group with the FIFO costing method. By the FIFO method (First In First Out) is meant that items are shipped from the inventory at the same price as at their receipt. The stock of any given item in a given warehouse is therefore divided into a number of item batches corresponding with the item receipts which form the stock of the warehouse. Each item batch is described by a quantity of items which is equivalent to their part of the total stock, a date of receipt, and the cost. Items are shipped from stock at the price of the oldest item batch in the warehouse in question. Each warehouse has its own FIFO queue. Thus, each item batch is identified by an item number, a warehouse, and an item batch number. Item batches are numbered consecutively for each combination of item and warehouse. For items with FIFO control, it is not sufficient to calculate the inventory value on the basis of stock times cost. It is thus necessary to calculate it on the basis of the total value of the individual batches. For each batch, this value is calculated from the batch’s cost times the stock on hand at the warehouse in question.

The control of the FIFO queue involves the cost of the items only and thus not physical item numbers. At shipment, the inventory value account will be credited the cost of the oldest receipt. However, there is no verification that the serial numbers shipped are the exact same numbers which were once entered at the particular cost.

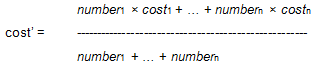

For items under inventory control, shipment from a single item line on an item with FIFO control can take place from different batches and thus at more than one cost at the same time. The value of the cost of sales is thus a total of the value of the batches, and it is this value which is credited the inventory value account. The cost of sales is calculated as follows:

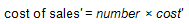

However, in the invoicing procedure, it is more beneficial to operate with only one cost per packing slip line.

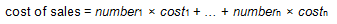

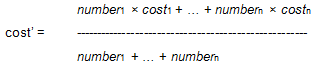

Therefore, an average cost of the items shipped from a given warehouse is calculated to be used on the item entry and for further invoicing. The average cost is calculated as follows:

As the amount calculated has been rounded to the nearest currency unit, a difference may occur between the cost of sales posted and the value registered on the packing slip line.

The difference between cost of sales - cost of sales’, is posted to:

- The inventory account for automatic write-ups and write-downs in connection with sales and the creation of packing slips,

- The inventory account for automatic write-ups and write-downs in connection with the production of bills of materials, or

- The inventory’s manual offset accounts for receipts and shipments in connection with item carry-over.

For items with FIFO control, it thus applies that the cost cannot be determined until at the time of shipment. In certain functions in Maconomy, the cost of an item is used without a concomitant shipment (for instance in the case of order lines in which the cost at the warehouse in question is used to calculate the sales price if no sales price list is used and if no sales price costing is used). These functions therefore require a selection as to a suitable cost. If the cost is used in connection with an expected shipment, the cost of the oldest item batch in the warehouse in question is used. If the cost is to be used in connection with an expected receipt, the last cost should be used.

|