Price Adjustment Principles Single Dialog Workspace

Use this workspace to set up price adjustment principles that are used to adjust the prices of subscriptions.

Calculation Method in Price Adjustments

A price adjustment principle is a set of rules that determine how prices should be updated on subscriptions to which the price adjustment principle in question is assigned. Each price adjustment principle can refer to a price index table in which you can maintain price increments, for instance, in accordance with consumer price indexes. In addition, you can define a minimum and maximum adjustment percentage, enabling you to set up adjustment principles that match your subscription contracts. If you do not assign a given principle to a price index table, Maconomy always performs price adjustments that use that principle according to the minimum adjustment percentage.

The adjustment of subscription prices occurs automatically when you prepare subscription invoicing. For each subscription included in the preparation, Maconomy takes into account the previous date on which the subscription price was updated and makes the necessary price adjustment. This can include multiple adjustment steps, for instance, if a subscription has run for a number of years before you perform the price adjustment.

You can assign adjustment principles to customers, subscription orders, and individual subscription order lines. A price adjustment principle that you specify on a customer information card is inherited by the main tab of any new subscription orders for the customer in question, and from the subscription order to the individual subscription order lines. By assigning an adjustment principle to a customer, you indicate a given price adjustment method that you agreed to with the customer. However, you can change the adjustment principle on the subscription orders and the individual order lines.

Price adjustments occur when you run subscription invoice preparations in the Prepare Subscription Invoicing workspace. You perform price adjustments for one subscription order line at a time, and only for subscription lines on which a price adjustment principle has been specified. Each adjustment occurs as follows:

- Maconomy checks whether the line is eligible for price adjustment. If no price adjustment has occurred for the line before, the line is eligible if the value in the Date of Initial Adjustment field is earlier than the starting date of the period for which you are preparing invoicing. The line is eligible if the date in the Date for Next Adjustment field is equal to or earlier than the starting date of the period. If the line is eligible, Maconomy continues with step 2; if not, no price adjustment occurs for the subscription line.

- Maconomy calculates the price adjustment from the basis price up to the current period. This means that instead of running an adjustment based on the latest adjusted price, Maconomy recalculates the price all the way back from the base price. This happens through a number of iterations where each iteration is based on the adjusted price and adjustments/index dates that Maconomy calculated in the previous iteration. The procedure of each iteration is as follows:

Maconomy calculates an index increase percentage and determines whether this percentage is between the minimum and maximum adjustment percentages specified on the adjustment principle. If no price index table is assigned to the adjustment principle in question, the increase percentage is set to zero.

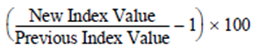

The formula used for calculating the index increase percentage is:

In this formula, the index values depend on whether this is the initial iteration of the calculation. If it is, the New Index Value is the index value that was valid on the date that you entered in the Index Date, Initial Adjustment field on the subscription line, and the Previous Index Value is the index value that was valid on the date that you entered in the Index Date, Base field. If it is not the first iteration, the New Index Value is the index value that was valid 1, 2, 3, and so on, years after the date in the Index Date, Initial Adjustment field, depending on the iteration. This means that in the second iteration, the New Index Value is the index value that was valid one year after the initial index date, and in each subsequent iteration, the Maconomy increases the date by one year. In addition, if it is not the first iteration, the Previous Index Value is the New Index Value that was used in the previous iteration.

The calculation results in a percentage that is compared to the minimum and maximum percentages that you entered for the price adjustment principle. If the calculated percentage is between the minimum and maximum percentages, Maconomy selects the calculated percentage. If it is higher than the maximum percentage, Maconomy selects the maximum percentage. If it is lower than the minimum percentage, Maconomy selects the minimum percentage.

- Maconomy increases the adjusted unit price in the Adjusted Unit Price field on the line by the percentage that it selected in the previous step.

- Maconomy updates the Date of Last Adjustment field to the value that was previously in the Date for Next Adjustment field and increases the date in the Date for Next Adjustment field by a year.

- Maconomy checks whether the new value in the Date for Next Adjustment field is earlier than or equal to the start of the period for which you are preparing invoicing. If it is, Maconomy repeats this process, thus adjusting the (adjusted) unit price again, until it is in line with the index level of the period to be invoiced.

Assume that you have set up Adjustment Principle A for a minimum adjustment percentage of 3.

In addition, a subscription contains a subscription line that uses Adjustment Principle A and has the following information:

| Unit Price | Index Date, Base | Index Date, Initial Adj. | Date of Initial Adjustment | Adjusted Unit Price | Date of Latest Adjustment | Date of Next Adjustment |

|

10,000 |

5 May 2015 |

1 Jan 2017 |

1 Apr 2017 |

10,000 |

1 April 2017 |

Adjustment Principle A is assigned to a price index table that looks like the following:

| Index Number | From Date | To Date |

|

110 |

1 May 2015 |

31 May 2015 |

|

… |

||

|

120 |

1 Jan 2017 |

31 Jan 2017 |

|

… |

||

|

122 |

1 Jan 2018 |

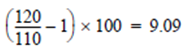

On 1 April 2018, you enter the Prepare Subscription Invoicing workspace to prepare invoicing for Q2. You enter an invoicing period of 1 April to 30 June. This period starts after the next adjustment date of the subscription line, causing Maconomy to calculate an adjustment. In the first iteration of the price adjustment calculation, Maconomy takes the unit price and adjusts it from the index value on the base index date (5 May 2015) to the index value on the index date for first adjustment (1 Jan 2017).

Since this percentage is between the minimum and maximum percentages specified on the adjustment principle, Maconomy adjusts the unit price using the calculated percentage:

Adjusted Unit Price = 10, 000 × 1.0909= 10,909

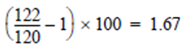

After adjusting the unit price, Maconomy increases the date for next adjustment by a year (which was 1 April 2017-the date of initial adjustment). The result is 1 April 2018, which is also before the period for which you are preparing invoicing. Maconomy runs another adjustment of the already adjusted unit price of 10.909.

Because this percentage is below the minimum percentage of 3, Maconomy increases the adjusted unit price by 3%.

Adjusted Unit Price = 10,909 × 1.03= 11,236.36

Once again, Maconomy increases the date for next adjustment by a year (the previous value was 1 April 2018). The result is 1 April 2019. Because this date is after the starting date of the period for which you are preparing invoicing, Maconomy does not perform any additional adjustments. As a result, the information on the subscription order line is as follows:

| Unit Price | Index Date, Base | Index Date, Initial Adj. | Date of Initial Adjustment | Adjusted Unit Price | Date of Latest Adjustment | Date of Next Adjustment |

|

10,000 |

5 May 2015 |

1 Jan 2017 |

1 Apr 2017 |

11,236 |

1 Apr 2018 |

1 April 2019 |