Intercompany Accounts Workspace

Use this workspace to specify the accounts to be used for intercompany balancing between two companies in the Company dimension.

You can define a set of intercompany accounts for each transaction type that can cause an intercompany balancing. You specify the posting reference to the individual intercompany account by using a dimension combination. The dimension combination also specifies the account number and any other dimension values needed in connection with the intercompany transaction type in question.

An intercompany balancing is an extra entry that Maconomy creates at the posting of entries that concern two different companies. Maconomy performs the balancing to ensure that equal amounts are debited and credited in both companies. The entries can be based on an invoice; the entry, reallocation, or allocation of a vendor invoice; item movements; hours entered in the Job Cost module; or entries in a general journal. Note, however, that if you do not select the Create intercompany entries for companies with same parent company system parameter, Maconomy only creates intercompany entries if the two companies that are involved are not both assigned to the same parent company.

Two designations are used for the companies that are involved in an intercompany balancing: Responsible company and Intercompany company. The responsible company is the company that you specified in the Company island in the tab in which you entered the transaction (for example: for jobs, the tab in the Jobs workspace; for vendor invoices, the tab in the Invoice Allocation workspace). Therefore, this is usually the company who employs the user who created the transaction.

The intercompany company is the company whose accounts are affected by the transactions. The field that determines the intercompany company depends on the type of transaction that you are posting. You identify the field that determines the intercompany company in the field description of each type of intercompany balancing.

When posting, Maconomy creates intercompany entries for the relevant amounts. On the account and any other dimension values that are listed in the dimension combination that you entered in the Posting Reference, Responsible Company field for the intercompany transaction type in question, Maconomy creates an entry that has the responsible company as the company dimension. On the account and any other dimension values that are listed in the dimension combination that you entered in the Posting Reference, Intercompany Company field for the intercompany transaction type in question, Maconomy creates an offset entry that has the intercompany company as the company dimension. Maconomy transfers the remaining dimension values from the line that causes the intercompany balancing. If there is no value for a dimension in the dimension combination, the value that you specified on the entry line that results in the intercompany posting is used.

If you select the Create Intercompany Invoicing Basis system parameter, the creation of intercompany balancing also results in the creation of intercompany entries. This is described in "Settling Intercompany Balances." However, because intercompany entries are only used as a basis for easy intercompany invoicing and are not, as such, related to the G/L accounts of the companies that are involved, intercompany entries are not included in the following descriptions of intercompany balancing.

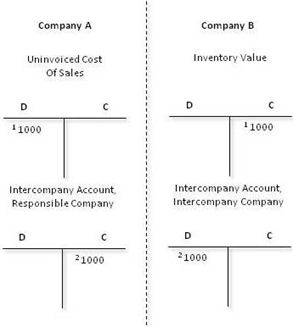

The following figure shows an example of an intercompany balancing in a situation where company A sells a chair at the price of $1,000 from a warehouse that belongs to company B. Tax is not considered in this example.

In the Company Number field in the tab of the Sales Orders workspace, company A has been specified, and is thus the responsible company. The warehouse specified on the sales order line is assigned to company B, making company B the intercompany company.

- A normal sales situation causes a debit entry for the cost of the item on company A's account for uninvoiced cost of sales and an offset entry on company B's account for inventory value. Viewed separately, the accounts of the two companies are missing a credit entry in company A and a debit entry in company B. To make the accounts of both companies balance separately, an intercompany balancing must be performed.

- In the preceding example, Maconomy creates a credit entry for the cost of the item on an intercompany account for the responsible company. The company dimension value on this entry is company A. In addition, Maconomy creates a debit entry for the same amount on the intercompany account for the intercompany company. The company dimension value on this entry is company B. The accounts of both companies now balance, because equal amounts have been debited and credited in both companies.

Deselecting the Create intercompany entries for companies with same parent company system parameter means that Maconomy does not create intercompany balancings between two companies that have the same parent company. In this example, this would mean that the entries to the two intercompany accounts would be skipped if the parameter was not selected and companies A and B were assigned to the same parent company. As a result, the accounts of the two individual companies do not balance. However, because the same amount has been debited in one company and credited in the other, the accounts of the parent company balance.