The AR and DSO tab displays days sales outstanding (DSO) values. The default formula for calculating DSO is the following:

AR / (Billing for prior 3 periods / 90)

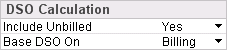

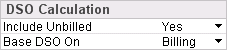

However, you can use the first two options under DSO Calculation to override the default:

You can base the calculation on revenue rather than billing: AR / (Revenue for prior 3 periods / 90).

You can include unbilled in the numerator along with AR: (AR + Unbilled) / (Billing for prior 3 periods / 90) or (AR + Unbilled) / (Revenue for prior 3 periods / 90)

If your firm's current accounts receivable balance is 1,000,000 and total billing for the prior three periods is 2,250,000, DSO is 40:

1,000,000 / (2,250,000 / 90) = 40

If you base the DSO calculation on billing, Costpoint Analytics uses the sum of billing amounts for invoices with a posting date in the prior three fiscal periods.

Revenue amounts used in Costpoint Analytics can be calculated using either actual or target rates. During the configuration process for Costpoint Analytics, you select the option your firm will use. That selection applies to all analytics that either display revenue amounts or use them to derive other values.

For the AR and DSO Analytics, that option affects the DSO calculation if you include revenue or unbilled in the calculation.

If you include unbilled in DSO, Costpoint Analytics calculates unbilled using inception-to-date (ITD) revenue and billing:

Unbilled = ITD revenue – ITD billing

The DSO calculation assumes that three periods of billing or revenue exist. As a result, if you display DSO values in the analytics for the first two periods of data that you have loaded from Costpoint, those DSO values will not be accurate because the required data is incomplete.

No revenue amounts are loaded into the data model for fiscal periods later than the period selected in Current Period. As a result, if the analysis period for the AR and DSO Analytics includes periods later than the period in Current Period, Costpoint Analytics cannot calculate meaningful unbilled amounts for those later periods because that calculation depends on having current revenue amounts. Instead, Costpoint Analytics displays a dash (–) in tables in place of unbilled amounts for those periods.

This also affects DSO calculations for those later periods if revenue or unbilled are included in the DSO calculations:

If you calculate DSO using billing rather than revenue and you do not include unbilled, DSO values for those later periods are accurate.

If you calculate DSO using billing rather than revenue and you do include unbilled, DSO values for those periods are calculated but may not be accurate because no unbilled amounts are available for those periods.

If you calculate DSO using revenue rather than billing, Costpoint Analytics cannot calculate meaningful DSO values for those periods because of the missing revenue amounts. In that case, Costpoint Analytics displays a dash (–) in the tables in place of the DSO values for those periods.

For the initial configuration, do the following:

If you want to include unbilled in the DSO calculation, select Yes in Include Unbilled.

Select Billing or Revenue in Base DSO On to indicate whether you want to base DSO calculation on billing amounts or revenue amounts.

Normally, you do not change these settings after the initial configuration. However, you can change them at any time.

.